10 Best Automated Crypto Trading Platforms in 2024

An increasing number of traders are turning to automated crypto strategies and looking for the best automated crypto trading platforms. Auto trading strategies can help reduce the need to perform analysis or trade manually while allowing trades to occur 24/7. But what are the best automated crypto trading platforms for 2024?

This guide reveals 10 popular crypto platforms that support automated trading. I cover the intricacies of automated crypto trading and the different options available, including fully autonomous systems, copy trading, and custom bots.

The Top 10 Crypto Auto Trading Platforms

The 10 best automated crypto trading platforms are listed below:

- Dash 2 Trade – The overall best automated crypto trading platform

- Cryptohopper – A great option for building custom trading strategies

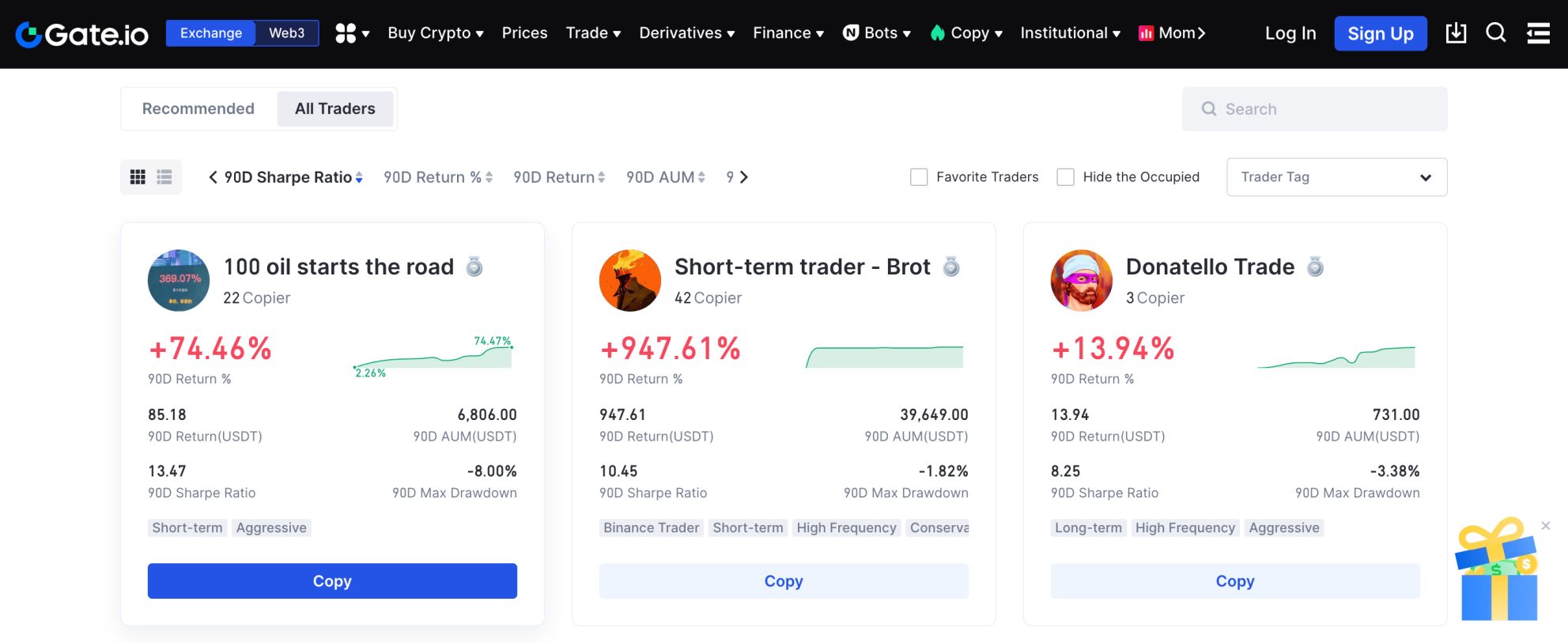

- Gate.io – Tier-one crypto exchange offering automated copy trading tools

- TradeSanta – Popular bot marketplace with a native mobile app

- Bitsgap – Automatically deploy advanced dollar-cost averaging strategies

- KuCoin – Invest in smart rebalancing portfolios that track crypto niches

- OKX – Top auto trade cryptocurrency platform for leveraged futures

- 3Commas – Deploy grid trading bots to capitalize on sideways markets

- MQL5 – Lists thousands of crypto expert advisors for the MetaTrader series

- Coinrule – Create rule-based instructions for an automated crypto bot

Best Automated Crypto Trading Platforms Reviews

I’ll now review the auto crypto trader platforms listed above. Read on to get started with the right automated system for your crypto trading goals.

1. Dash 2 Trade – The Overall Best Automated Crypto Trading Platform with Fully Automated Service

My top pick is Dash 2 Trade. It offers a fully automated service, allowing investors to buy and sell crypto passively, and is ideal for both beginners and experienced traders. First, users must choose their preferred exchange.

Dash 2 Trade supports the best Bitcoin exchanges, including Binance and Kraken. Next, users can choose which crypto tokens they want to auto-trade. There are no limitations here, but it’s best to stick with liquid pairs like BTC/USD and ETH/USD. After that, you can select your preferred trading strategy. The most popular options include dollar-cost averaging and grid trading. Dash 2 Trade also enables you to choose your exposure levels. For instance, you might only want to risk $10 per trade.

You can then deploy your trading bot via the demo platform. Once the bot is ready to trade with real money, it can be activated. Like most automated platforms, Dash 2 Trade charges a monthly subscription. This starts from $10 per month on flexible plans, but discounts are available when paying in crypto. While there’s also a free plan, this doesn’t support auto trading.

Pros

- The overall best crypto auto trader

- Fully automated service that runs 24/7

- Many trading strategies to choose from

- Offers demo trading facilities

- Great customer support

Cons

- Credit cards cost more than crypto payments

- Doesn’t provide past performance metrics

2. Cryptohopper – A Great Option for Building Custom Trading Strategies

Cryptohopper is one of the best automated crypto trading platforms for building custom strategies. First, you’ll need to spend some time building your strategy parameters. No coding knowledge is required, but you’ll need a basic understanding of trading indicators. After all, the Cryptohopper bot needs to know when and what to trade.

A simple bot strategy could be to buy Bitcoin whenever the RSI drops below 30 or to sell Bitcoin when it surpasses 70. You could also add some additional metrics, such as only executing positions between Monday and Friday and when daily trading volumes are above $20 billion. The possibilities are endless.

Most importantly, Cryptohopper enables you to test automated trading strategies in demo mode. You can also backtest the strategy for additional insights. Adjustments can be made when needed. Cryptohopper is compatible with most exchanges – you simply need your unique API key. Prices range from $0 to $129 per month.

Pros

- The best option for creating custom strategies

- An automated bot will follow your requirements 24/7

- Simple strategy builder without code

- Backtesting and demo platforms are supported

- Compatible with the leading crypto exchanges

Cons

- VAT isn’t included in advertised prices

- The free trial only lasts for three days

3. Gate.io – Tier-One Crypto Exchange Offering Automated Copy Trading Tools

Gate.io is a tier-one crypto exchange with over 14 million registered users. I found that it’s one of the best options for automated copy trading. This means you’ll be copying Gate.io traders like-for-like. First, you’ll need to choose from a spot or futures trader. The latter offers more sophisticated strategies, including short-selling and leverage.

Either way, you can narrow down the search by the 90-day return, win percentage, assets under management, and other filters. Clicking on a trader reveals additional information, including a full breakdown of trading positions. You can make a decision accordingly. Copy trading comes with a profit-sharing agreement.

So you only pay commissions if the trader generates a return. This means you won’t need to sign up for a monthly subscription. In addition to copy trading, Gate.io also offers automated bots. There are many strategies and indicators to choose from. Bots can be customized to ensure they align with your crypto auto trading goals.

Pros

- Trade passively via copy trading tools

- Thousands of traders to choose from

- Works for spot trading and leveraged futures

- Also offers automated crypto trading bots

- No monthly subscription is required

Cons

- Many traders adopt high-risk strategies

- Fiat withdrawals aren’t supported

4. TradeSanta – Popular Bot Marketplace With a Native Mobile App for 24/7 Tracking

TradeSanta is a great option if you’re looking to buy pre-made trading strategies. Once deployed, you can monitor the bot’s performance on the TradeSanta app. That said, you won’t need to purchase individual strategies, as TradeSanta offers a cost-effective subscription model.

The basic plan, which costs $25 per month, supports 49 different bots. You’ll get an unlimited number of bot strategies for just $90 per month. The prices for these plans are reduced to $18 and $45 per month respectively when paying annually. TradeSanta has been designed with beginners in mind.

The setup process is fast and hassle-free. Most major exchanges are supported via an API connection. All connected accounts can be imported to the same trading dashboard. For instance, you might have one bot trading on Binance and another on Kraken. I also like that bots can be test-driven with demo funds.

Pros

- Access dozens of automated strategies from one subscription

- Prices start from just $25 per month

- Get a huge discount when paying annually

- Compatible with most tier-one exchanges

- Offers an automated crypto trading app for Android and iOS

Cons

- Doesn’t accept e-wallet payments

- The free trial expires after three days

5. Bitsgap – Automatically Deploy Advanced Dollar-Cost Averaging Strategies

Bitsgap is one of the best automated crypto trading platforms for dollar-cost averaging (DCA). It enables investors to create bespoke DCA strategies. The Bitsgap dashboard offers a solid user experience, meaning it appeals to beginners and seasoned pros alike. The first step is to decide which cryptocurrencies you want to DCA.

Bitsgap supports some of the best cryptocurrencies to buy, including Bitcoin and Ethereum. It also supports popular exchanges like Binance, Bitfinex, Gemini, Gate.io, and Kraken. After that, you can set your DCA parameters. For example, you can buy crypto based on technical indicator readings, which could mean buying Ethereum based on Fibonacci retracement levels.

Alternatively, you can keep things simple by setting specific DCA intervals. For instance, you could buy $50 worth of XRP every Wednesday. Bitsgap also supports backtesting, pump and dump protections, multiplier strategies, and take-profit orders. Pricing plans cost $29, $69, and $149 per month. Each plan comes with different levels of functionality.

Pros

- Create bespoke DCA strategies

- DCA bots run 24/7

- Buy crypto based on predetermined triggers

- The free trial doesn’t require a credit card

- Used by over 500,000 traders globally

Cons

- Annual purchases only offer a 20% discount

- Higher fees than other automated platforms

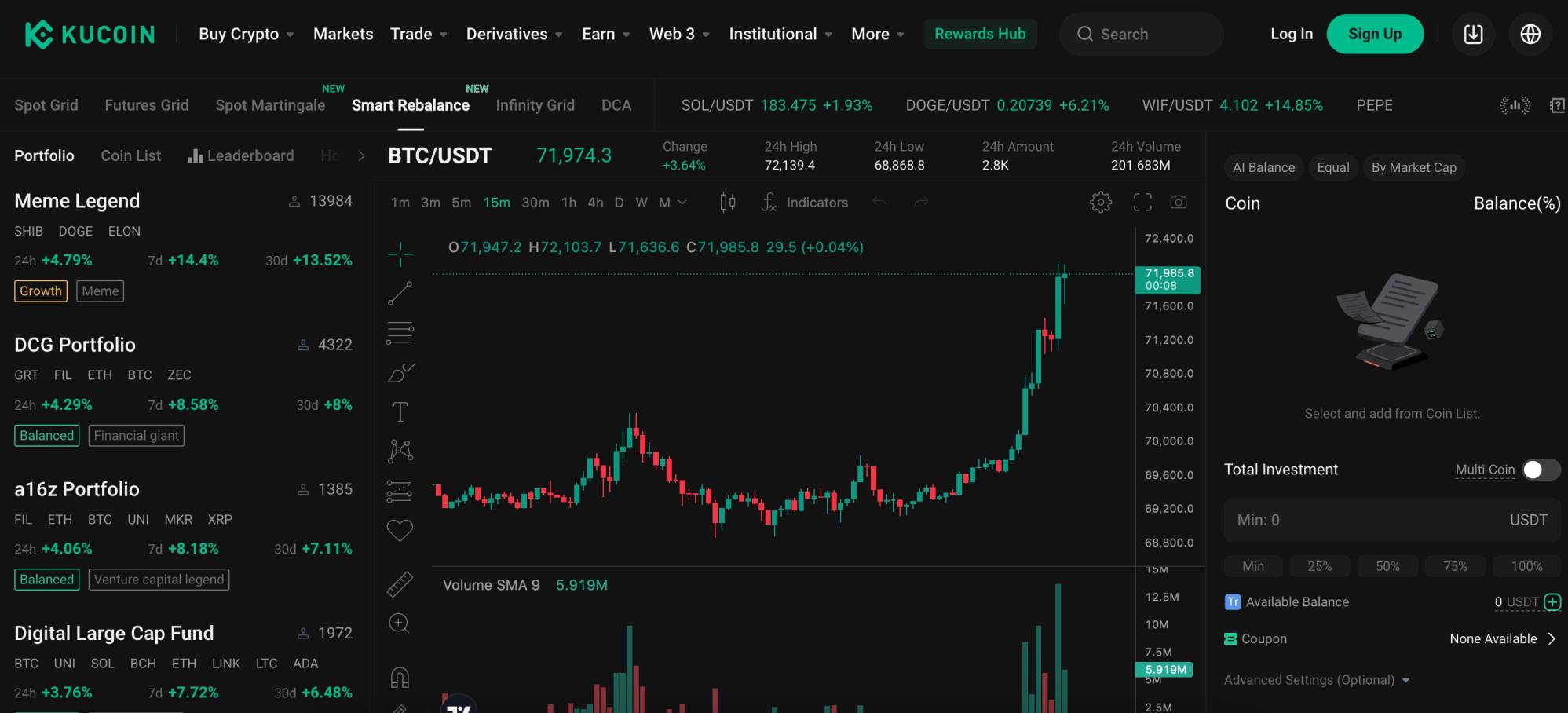

6. KuCoin – Invest in Smart Rebalancing Portfolios That Track Popular Crypto Niches

KuCoin is one of the best automated crypto trading platforms for long-term investing. It offers smart rebalancing portfolios that track popular crypto niches. This enables investors to gain exposure to multiple coins from a particular narrative. The bot automatically rebalances the portfolio based on broader market conditions and risk.

One option is the Defi Leaders portfolio, which contains Aave, Uniswap, Chainlink, and Avalanche at various weights. The Digital Large Cap Fund is also popular. It tracks the largest coins by market capitalization, including Bitcoin, Ethereum, Solana, and Bitcoin Cash.

There are thousands of other portfolios to choose from. No minimum investment requirements are in place, so you can easily diversify across multiple niches—even with a small account balance. Best of all, there are no fees when using KuCoin bots. Investors simply need to cover standard commissions. KuCoin charges 0.1% per slide.

Pros

- One of the best automated crypto bots for long-term investing

- Choose from thousands of pre-made portfolios

- Diversify into niches like DeFi, AI, and meme coins

- Portfolios are automatically rebalanced by the bot

- No fees – just cover the standard trading commission

Cons

- The bot dashboard could be more user-friendly

- KuCoin was fined by US regulators for money laundering failures

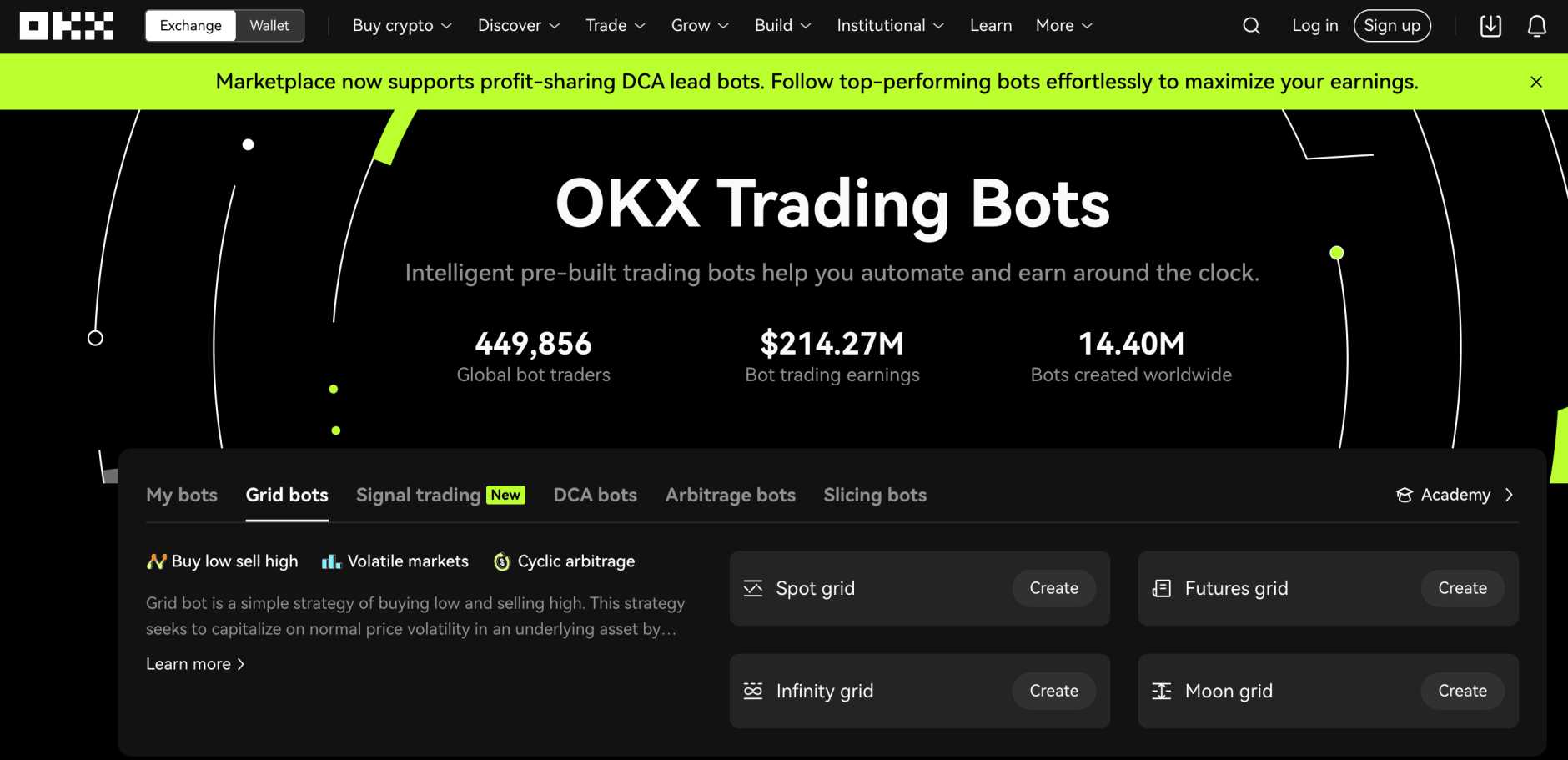

7. OKX – Top Auto Trade Cryptocurrency Platform for Leveraged Futures

OKX is a popular crypto exchange that lists more than 14 million bot creations. There are many different strategies to choose from. The main bot categories are arbitrage, slicing, grid, and DCA trading. Some OKX bots specialize in leveraged futures, which will appeal to high-risk investors.

You can find a suitable bot from the available filters. For instance, you might wish to sort bots by the highest backtested APY. Some trading bots have more than 10,000 followers, highlighting how popular this field is becoming. Each bot comes with a profit-sharing fee, which averages 20%. You also need to cover OKX commissions, which are minimal.

For example, futures commissions amount to just 0.05% of the position size. Lower commissions are offered when trading larger amounts. In terms of markets, OKX supports the best altcoins to trade. This includes small and large-cap markets. OKX can be accessed on the browser-based platform or mobile app.

Pros

- Lists more than 14 million auto trading bots, including AI trading bots

- One of the best options for trading leveraged futures

- Supports hundreds of crypto pairs

- Easily find a suitable bot through filters

- Enables users to buy Bitcoin with a credit card

Cons

- Average profit-sharing commission of 20%

- Past performance is sometimes based on backtesting

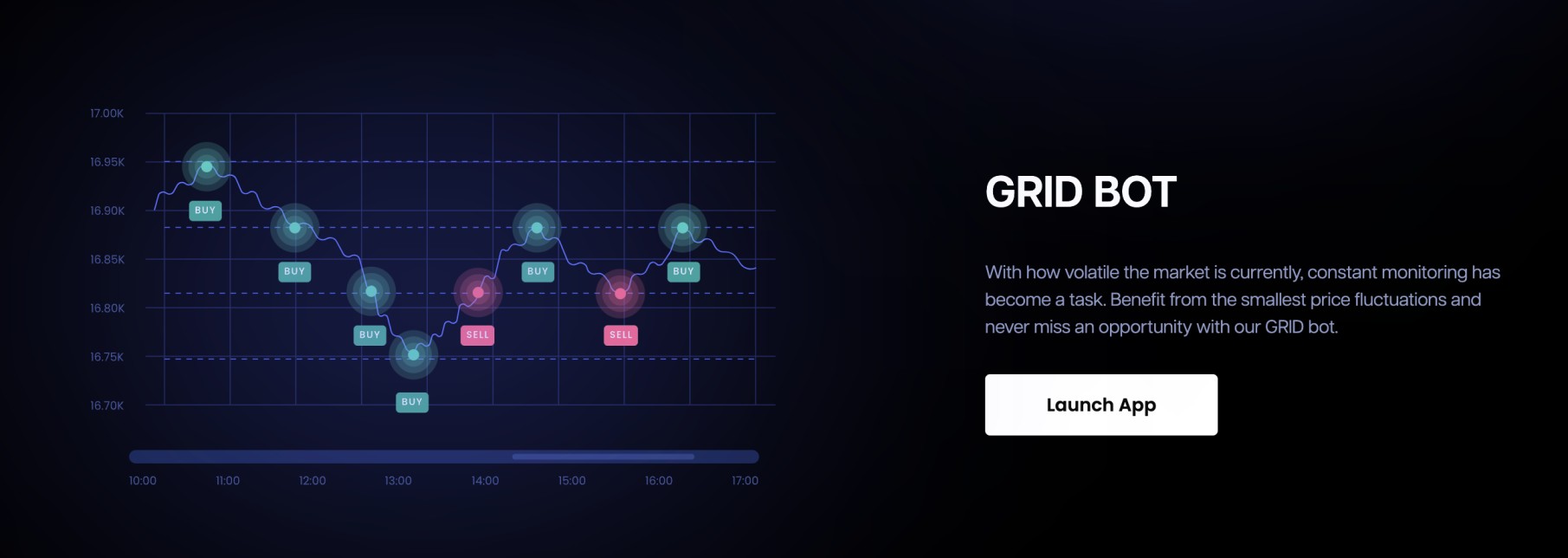

8. 3Commas – Deploy Grid Trading Bots to Capitalize on Sideways Markets

Another top-rated option to consider is 3Commas. This is an established automated trading platform that offers many strategies. All are executed by automated bots that buy and sell crypto 24/7. That said, one of the best strategies is the grid trading bot. This trades in sideways markets, also known as consolidation periods.

Put otherwise, the bot capitalizes when trading pairs witness low volatility levels. It automatically identifies key support and resistance zones. And then enters smart buy and sell positions. Crucially, this strategy is considered low-risk, as stop-loss orders are placed at potential breakout areas.

3Commas works with most crypto exchanges, including Binance, Bitstamp, Gate.io, and Coinbase. Prices are on the high side, with 3Commas plans starting from $49 per month. This enables you to deploy up to 10 active grid trading bots. Pay $79 per month to increase this to 50. All plans include TradingView integration, demo accounts, and backtesting.

Pros

- Deploy automated bots to trade sideways markets

- Automatically finds key support and resistance zones

- Stop-losses are entered near breakout areas to reduce risk

- Considered one of the lowest-risk trading strategies

- Supported by most crypto exchanges

Cons

- Prices start at $49 per month

- Past performance metrics are not provided

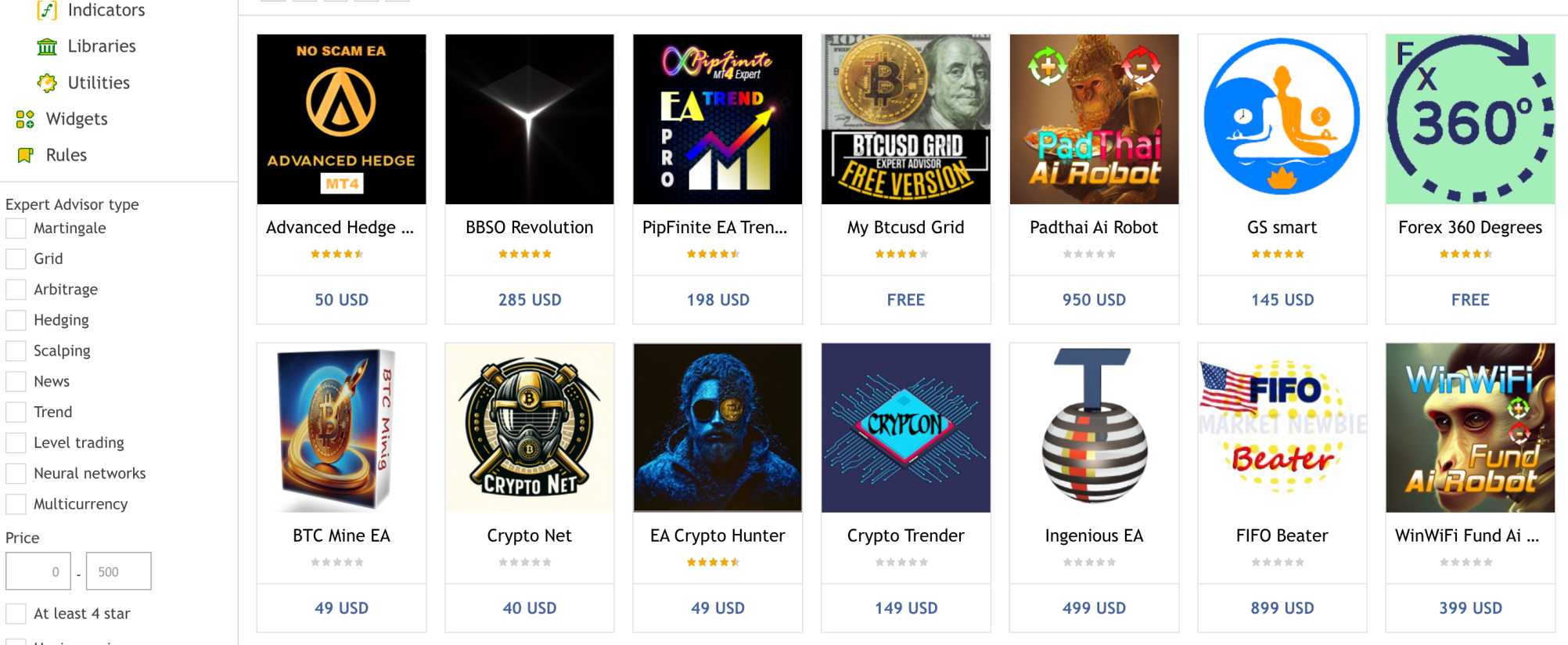

9. MQL5 – Lists Thousands of Crypto Expert Advisors for the MetaTrader Series

MQL5 should also be considered when exploring the best crypto auto trading platforms. This is an online marketplace for the MetaTrader platforms, which covers MT4 and MT5. These popular platforms connect with hundreds of online brokers. MQL5 lists thousands of automated strategies known as ‘expert advisors.’

In simple terms, they are trading bots that buy and sell crypto 24/7. Although expert advisors are created by third-party developers, MQL5 offers all the information you need to choose wisely. This includes a full description of the strategy and target growth, alongside historical orders and past performance.

You can also read reviews from existing users. This gives you solid insights into real customer experiences. MQL5 sellers set their own prices. This is always a one-off fee. The drawback here is that, unlike monthly subscriptions, developers aren’t as motivated to make regular improvements. Nonetheless, expert advisors can be run in demo mode via MT4/5.

Pros

- Thousands of crypto expert advisors to choose from

- Compatible with MT4 and/or MT5

- Past performance, win ratios, and other important data provided

- Test strategies with demo funds in live market conditions

- Full set-up instructions are included

Cons

- Some strategies cost hundreds of dollars

- One-off fee demotivates developers from making regular adjustments

10. Coinrule – Create Rule-Based Instructions for an Automated Crypto Bot

Coinrule is another platform that supports custom bot strategies. It leverages a rule-based system that requires zero coding knowledge. Users can build their strategy from the ground up by selecting their preferred trigger points. A simple example is buying Litecoin whenever the 24-hour price declines by 3% or more.

However, more sophisticated strategies have the best chance of success. For example, you can incorporate technical indicators into the strategy. This includes the MACD, moving averages, and Fibonacci retracement levels. Once deployed, the Coinrule bot will scan the markets 24 hours per day, 7 days per week.

It will enter buy or sell orders when a rule is triggered. Supported crypto exchanges include OKX, Binance, Kraken, and KuCoin. Coinrule also supports Uniswap. This means your bot can trade on the world’s most popular decentralized exchange. Depending on your requirements, you’ll pay between $29.99 and $449.99 per month.

Pros

- Create rule-based strategies

- Zero coding knowledge is required

- Supports the most popular technical indicators

- Compatible with leading exchanges

- Also supports Uniwap integration

Cons

- Expensive pricing structure

- Only works if you already have a trading strategy

What is Automated Cryptocurrency Trading?

Automated crypto trading offers a passive investing experience. This means you can invest in the crypto markets without any experience. Most platforms in this space offer automated bots. They place buy and sell orders based on pre-set conditions.

For example, consider a Dollar Cost Averaging (DCA) automated bot that targets Bitcoin. This bot will automatically buy or sell Bitcoin at specific intervals or in response to certain price movements.

It might buy Bitcoin whenever the price declines by 2%. Or, it might place a buy order when a technical indicator has been triggered. This could be anything from the Fibonacci retracement levels to the 50-day moving average. Either way, bots operate autonomously 24/7, so they never miss a trading session.

Another way to automate your crypto investments is copy trading. This also offers a passive experience, but you’ll be copying a human trader. Whenever the selected trader enters a position, the same trade is replicated in your account. It’s also possible to create custom strategies from the ground up.

Most auto cryptocurrency trading sites are aimed at beginners, so you won’t need any programming experience. You can select which triggers the bot should follow, and it will execute your instructions like-for-like. Just remember that no auto trading strategy guarantees profits. This is why starting off with a demo account is a wise option.

How do Crypto Auto Trading Platforms Work?

There are two different ways to access crypto auto trading platforms.

First, some of the best providers are third-party platforms that connect with exchanges. You’ll pay a monthly subscription fee and connect to your exchange accounts via an API. Alternatively, you can also access auto-trading strategies directly from selected exchanges. This means the bot must trade on that particular exchange, which can be a drawback.

In both scenarios, you’ll need to invest capital into the respective strategy. Orders will then be automated on your behalf via an automated bot or a copy trading tool. You’ll benefit from a passive trading experience, as you won’t need to perform any market research.

What’s more, you won’t need to place orders with an exchange. However, not all automated trading strategies make a profit. Diversification can reduce the risk of financial loss, meaning you invest in multiple strategies.

Let’s look at a quick example of how an automated trading strategy works:

- Let’s say you opt for Dash 2 Trade, which offers automated trading bots. You open an account and choose a subscription plan.

- You select your preferred strategy, trading pairs, and risk parameters.

- Dash 2 Trade then requires an API key from your preferred exchange. This enables the trading bot to place buy and sell orders on your behalf.

- You also need to ensure your exchange account has sufficient funds. Once activated, the Dash 2 Trade bot will begin trading.

- The bot can be switched off at any time. What’s more, you can make withdrawals from your account as normal.

Types of Automated Crypto Trading Software

I mentioned there are many different options when researching crypto automated trading platforms.

Let’s explore some of the most common.

Copy Trading

Copy trading is a great option if you don’t trust automated bots. Put simply, you’ll allocate capital to copying the portfolio of an experienced crypto trader. Anything they buy or sell will be replicated in your account. This means you can leverage the analysis skills of a proven investor from the comforts of home.

Here’s an example of how automated copy trading works:

- First, you research the best trader to copy and decide how much to invest, say $1,000. All future trades will now be copied automatically and proportionately.

- The trader uses 10% of their account balance to buy LTC/USD. $100 worth of LTC/USD is added to your account, as that’s 10% of your $1,000 investment.

- The LTC/USD position is closed at a 50% profit. You make 50% on a $100 position, so that’s $50.

Most copy trading providers utilize a profit-sharing commission. This means a percentage of profits are distributed to the trader. For example, suppose the commission is 10%. On a $50 profit, you’d keep $45, while $5 goes to the trader. This keeps the trader motivated and ensures they perform to the best of their abilities.

Trading Bots

The most popular automated trading tools are bots. These are software-based and offer many benefits over human traders. For a start, bots can trade crypto all day, every day. They can usually monitor an unlimited number of trading pairs around the clock. This means bots never miss a trading opportunity.

For example, the bot might trade BTC/USD in the early morning and then ETH/USD during the night based on market changes, while a human might have been asleep by then. Bots are systematic, meaning they can only follow pre-programmed conditions. For instance, suppose the bot is programmed to trade Bitcoin based on the 200-day moving average. Irrespective of broader market conditions, it can only enter positions based on this indicator.

Although bots have been known to malfunction, the risks are vastly reduced when using risk management orders. For example, Dash 2 Trade supports stop-loss positions. This means the bot can only lose a certain amount on each trade. So, if a trade doesn’t go to plan, your bankroll won’t be depleted.

Crypto auto bots can usually be deployed on the most popular exchanges, such as Kraken, Coinbase, and KuCoin. Bots are often compatible with the spot trading and futures markets. Although most traders opt for a pre-made strategy, you can also build one from scratch. This ensures the bot aligns with your risk appetite.

Signals

Trading signals are another popular way to automate your crypto investments. However, they’re not fully automated, as you’re still required to place orders manually.

Here’s how it works:

- You sign up with a crypto signals service and pay a monthly fee.

- Trading signals are distributed in real time, usually via Telegram

- The signal tells you what crypto pair to trade, plus the suggested entry and exit prices

- You the place the suggested orders at your preferred exchange

Signals come with benefits and drawbacks. The main advantage is that you can pre-vet trading suggestions rather than always following them blindly. You might find some signals unsuitable for your risk appetite, so you can simply ignore them.

However, you must be active to make the most of signals. Time delays can reduce the signal effectiveness, as some require immediate action.

How I Ranked Automated Crypto Trading Platforms

I’ve established that there are many different types of automated crypto trading platforms. But how did I rank the top providers for this guide? I’ll now explain my research methods so that you can make an informed decision.

Level of Automation

First, I explored how much automation the trading platform offers. For instance, some investors prefer a ‘plug-and-play’ solution, meaning the trading process is fully automated. Put otherwise, the bot will research the markets and place trading orders on your behalf. No manual input is required, so you can sit back and hopefully enjoy passive returns.

I also included automated crypto trading platforms that support custom strategies. This means you’ll need to spend time training the bot. This enables you to automate a proven strategy. For instance, you might be a scalping trader who leverages support and resistance levels, alongside the MACD and Bollinger Bands. A custom bot will automatically mirror your strategy.

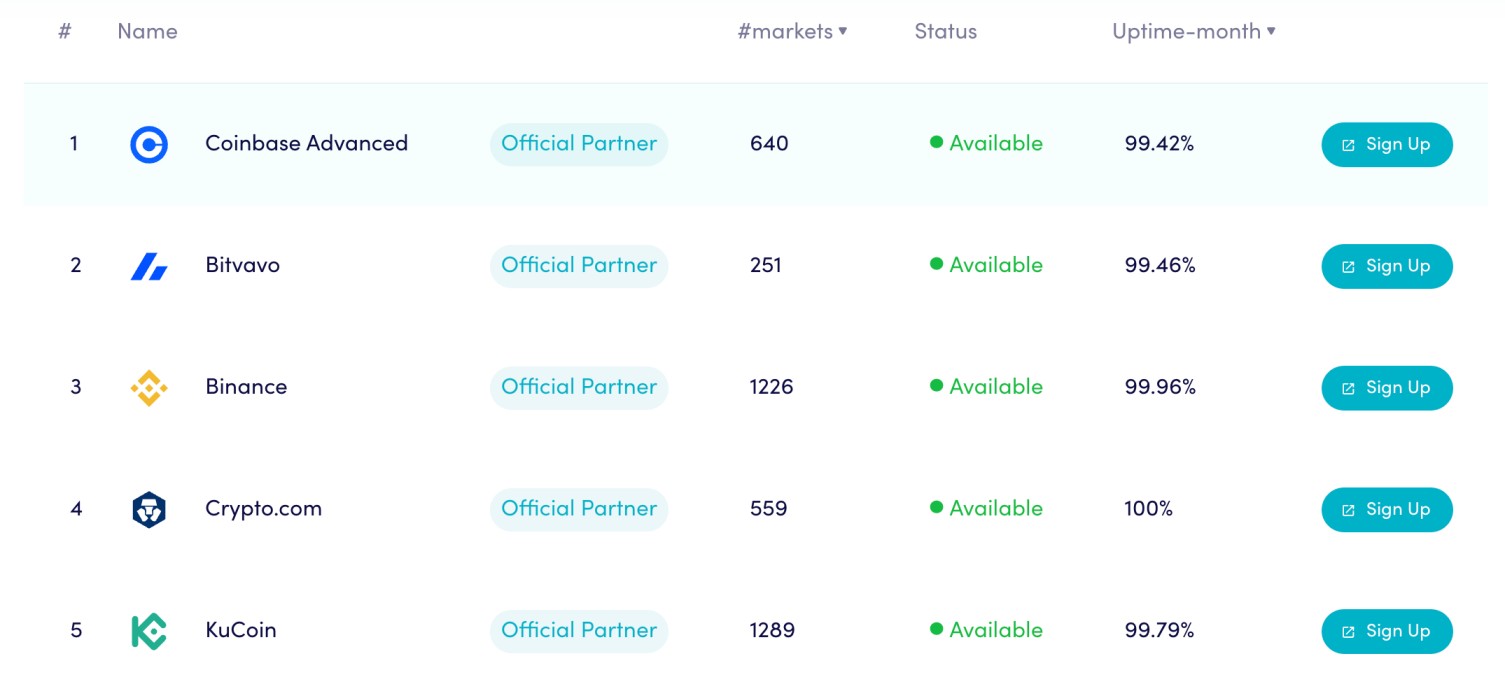

Supported Exchanges and Markets

It’s also important to assess what exchanges the automated trading platform integrates with. I found that the best providers connect with leading exchanges like Binance, MEXC, KuCoin, Kraken, and Coinbase. You can connect your exchange account via an API key, which takes seconds to set up.

Additionally, evaluate which crypto markets the platform supports. For example, while a platform might support MEXC, this doesn’t mean it supports all 2,000+ markets. Instead, it might only support a selection of pairs. You should also assess whether you want to trade the crypto spot markets or derivatives like perpetual swaps and futures.

In-Depth Data Covering Performance

Some of the best automated crypto trading platforms support thousands of strategies. While having lots of choices is a plus point, choosing a strategy should be straightforward. I prefer platforms with a range of filters, allowing you to select the most suitable strategy for your goals.

I expect to see the following data points when reviewing strategies:

- Past performance and/or win percentage rate

- Number of days the strategy has been active

- Backtesting results over several years

- Average trade duration

- Historical trading orders

- Maximum drawdown percentage

- Preferred crypto markets (e.g., futures or spot trading)

Having access to ample data points allows you to make an informed decision.

Backtesting and Demo Trading

Past performance doesn’t guarantee future results. So you’ll want to choose an automated trading platform that enables you to test strategies before going live.

First, I prioritized platforms offering backtesting facilities. This enables you to test how strategies would have performed in past market conditions. You can often backtest several years’ worth of data in minutes, and amendments to the strategy can be made accordingly.

Second, I also prefer platforms offering demo trading facilities. This enables you to deploy a strategy in the live crypto markets with virtual funds. You’d want to run the strategy in demo mode for extended periods. This will yield the most effective data and results.

Fee Structure

Fees will vary widely depending on the auto trading platform and the chosen strategy.

For example, if you opt for a crypto auto trading bot like Dash 2 Trade, you’ll pay a monthly subscription. You’re then free to connect the bot to any exchange. Alternatively, if you opt for an automated copy trading platform like Gate.io, no subscription fees are charged. However, you’ll need to enter a profit-sharing agreement with the trader.

This means you only pay fees on profitable trades. Expect to pay around 10-20% of the generated returns. Some platforms offer fee-free access to their automated strategies. The only requirement is that you cover standard trading commissions, which are often minute.

I also encountered platforms that charge a one-off fee. This fee gets you lifetime access to a bot, with no further charges required. However, it can also mean that the strategy developer has no motivation to make improvements.

Mobile Compatibility

Investors should also explore whether the platform offers a native mobile app. This enables you to keep tabs on the automated strategy without needing desktop access.

You can simply open the app and see how the bot or copy trader is performing. Most importantly, you should be able to activate or deactivate the strategy at the click of a button.

Are Auto Crypto Trading Bots Safe?

Safety should be considered when exploring automated crypto trading bots. For a start, the bot will require access to your trading capital. Otherwise, it won’t be able to enter positions on your behalf. If you’re using a third-party platform, you’ll need to obtain an API key from your crypto exchange.

This will be unique to your account. In general, this is a safe process. This is because the API key does not permit account withdrawals. On the contrary, it simply enables the bot to trade from your balance. However, just make sure you’re using a legitimate platform; fraudsters have been known to use crypto bots to drain account balances.

There might also be a fear that the bot malfunctions and trades the account to zero. Fortunately, platforms like Dash 2 Trade offer in-built risk management tools. For example, the bot can automatically close a position if it declines by 2%. This protects your capital over time. You can set the stop-loss percentage based on your risk appetite.

Is Automated Crypto Trading Profitable?

The objective when auto-trading crypto is simple: generate long-term profits without actively researching the market. However, if it were this simple, we’d all have accounts with automated trading platforms. The reality is that while some automated strategies make money, others don’t.

This is why researching the best strategies is so important. For example, you might come across a strategy that has made 30-day gains of 200%. However, upon closer inspection, you might find that the bot has only been operating for 45 days. This isn’t enough data to make an informed decision.

Instead, it’s best to focus on strategies that have a proven track record over extended periods. The longer, the better. And don’t forget about backtesting and demo trading. These tools will enable you to test an automated strategy without risking any funds. Even if your strategy is profitable, you should still monitor its performance regularly.

Another mistake made by beginners is going ‘all in’ on one trading strategy. If you’re interested in copy trading, ensure you’re copying multiple traders. The same goes for automated trading bots and signals. Ultimately, ensure you’ve considered the risks before proceeding; there’s no guarantee you’ll make money.

Conclusion

In summary, I’ve revealed the best automated crypto trading platforms for 2024. The best option for beginners is Dash 2 Trade, which offers a plug-and-play trading bot that connects with the most popular crypto exchanges.

There are multiple strategies to choose from, each comes with in-built risk management tools. Most importantly, Dash 2 Trade offers demo trading facilities, so you can test strategies without risking any capital.

See also: 10 Best Crypto Leverage Trading Platforms in 2024

FAQs

Can you automate crypto trading?

Is it legal to automate crypto trading?

Is auto crypto trading worth it?

What is the success rate of crypto trading bots?

What is the best automated crypto trading platform?

References

“U.S. Charges KuCoin Crypto Exchange with Anti-Money Laundering Failures.” Reuters, 26 Mar. 2024, www.reuters.com/technology/us-charges-kucoin-crypto-exchange-with-anti-money-laundering-failures-2024-03-26/

“Technical Analysis.” CFA Institute, www.cfainstitute.org/en/membership/professional-development/refresher-readings/technical-analysis

“When and Why to Use API Keys.” Google Cloud, Why and when to use API keys | Cloud Endpoints with OpenAPI | Google Cloud

“Crypto Fraudsters Use Robocalls to Drain Accounts.” CNBC, 15 Feb. 2022, www.cnbc.com/2022/02/15/crypto-fraudsters-use-robocalls-to-drain-accounts.html