Why is Crypto crashing today? Bitcoin is under pressure as the crypto crash ruins price consolidation, yet traders remain upbeat despite the drop.

Crypto prices have been see-sawing this week, with Bitcoin retracing from last week’s high, a deflating development. The horizontal chop is being felt across the board.

Bitcoin And Crypto Choppy And Under Pressure

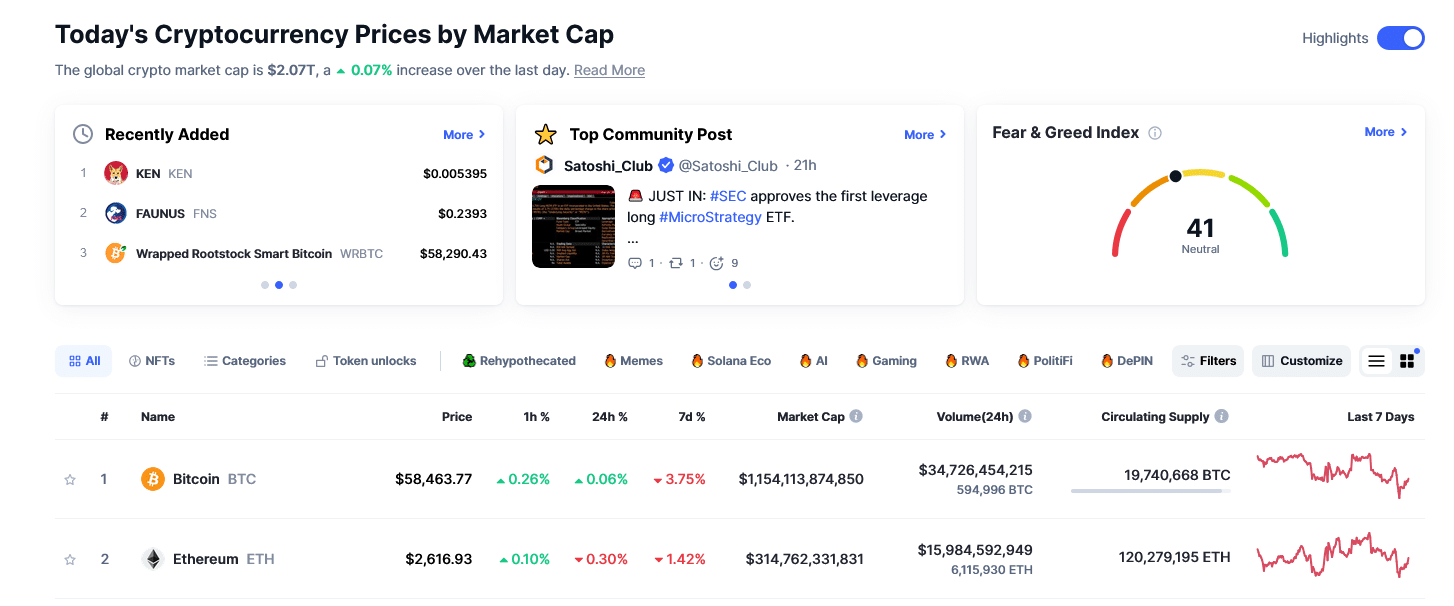

According to CoinMarketCap, the total crypto market cap is at $2 trillion, down from roughly $2.3 trillion in July and June.

The drop is mainly attributed to the contraction of Bitcoin prices, a digital asset commanding 55.8% of the market share.

(Source)

For now, Bitcoin is shaky, and though prices are up 20% from August 2024 lows, the failure of bulls to press on is a concern. BTCUSDT prices are still inside the bullish bar of August 8.

This is bullish, and with prices still inside a bull flag, more is needed to confirm the uptrend.

(BTCUSDT)

Analysts note that if BTC cracks $63,000, there could be more room for growth, even lifting the coin towards $66,000 and the all-important resistance at $72,000.

The downturn in June and July was mainly due to miner liquidation and the apprehension that the Mt. Gox distribution would impact sentiment, pushing prices lower.

The German government also found it best to unload its stash in July, further heaping pressure on BTC. However, the last leg down was the impact of the Bank of Japan’s rate hike.

It led to a sharp sell-off in early August, but prices rebounded strongly afterward.

The uptrend on August 8 was a major relief for traders.

Though there needs to be a push higher, BTC and crypto prices are struggling even as the stock market posts impressive gains.

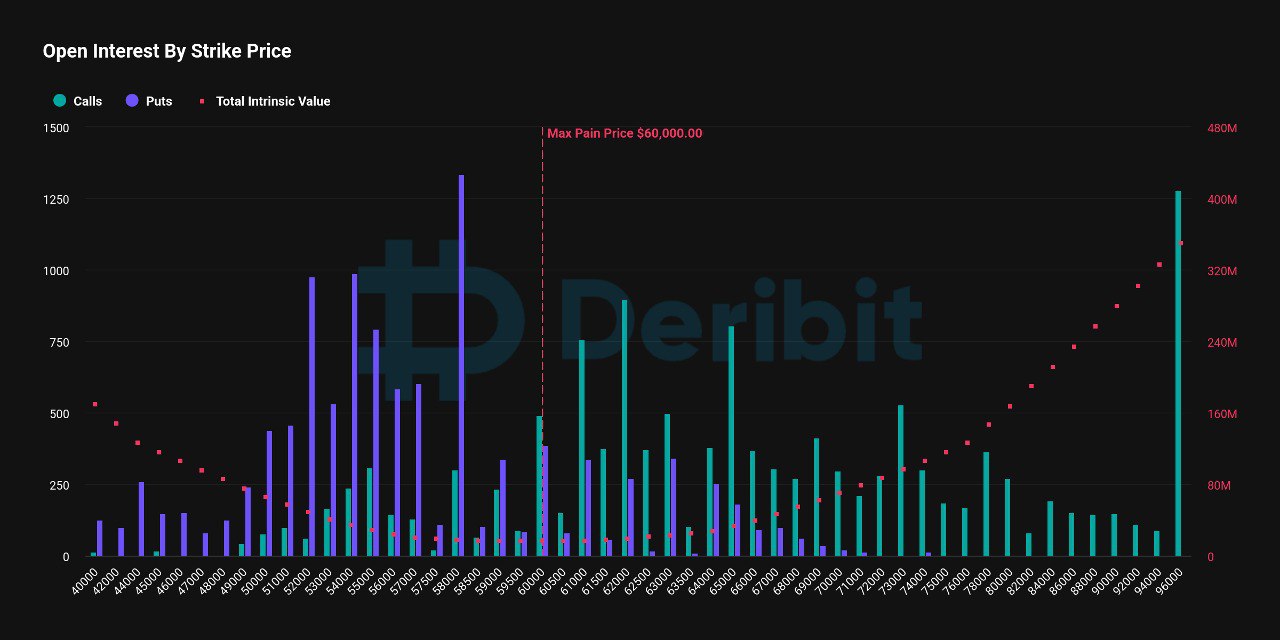

Today, traders expect the expiry of the $1.4 billion of Bitcoin options to push prices lower toward a key support zone between $50,000 and $56,000.

(Source)

This will be negative for crypto as a whole, especially now that the sentiment is bearish following the unexpected transfer of 10,000 BTC by the United States government.

Positive Macro Factors To Prop Up Bulls

Beyond the headwinds, traders and investors are closely monitoring the following news.

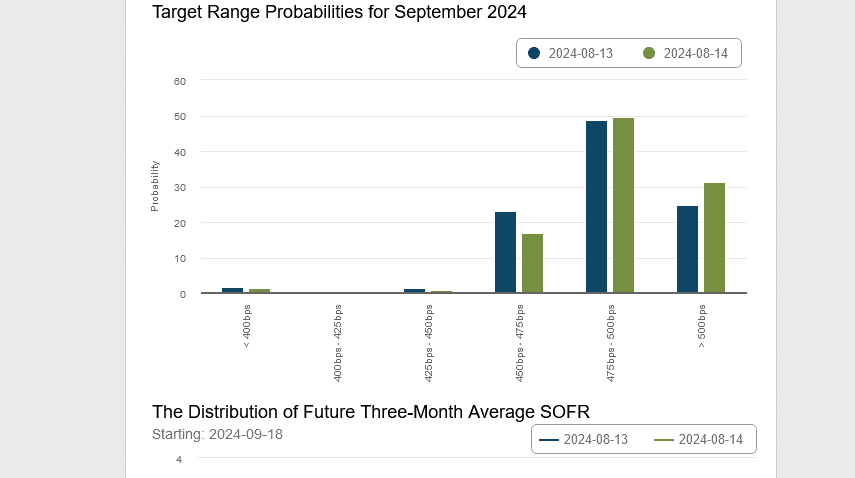

Inflation is falling in the United States, meaning the probability of the Federal Reserve slashing rates in September is high.

(Source)

This expectation boosts investor sentiment since an accommodative monetary policy often benefits crypto assets, as seen in the last bull cycle of 2020 through 2021.

Ahead of this, interest in spot Bitcoin ETFs remains lukewarm, though miner liquidation has decreased.

If anything, most miners are looking to HODL, as seen with Marathon Digital. The public miner recently raised $300 million and plans to buy more BTC.

Semler Scientific is also looking to follow MicroStrategy’s example of raising $150 million and splashing it all on BTC.

DISCOVER: Next 1000x Crypto – 17 Coins That Could 1000x in 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.