Crypto users, like in any other sector, are sensitive to fees. But fees are not always bad. In trustless systems like public ledgers, users must send fees to process their transactions.

The same fee is distributed to the lucky node as a reward for committing resources to process the same transaction and ensure the network remains secure, reliable, and censorship-resistant.

It is the price all crypto users pay, a nice trade-off if they want to transact at any time of the day without worrying that someone might hijack their transaction or censor them.

Depending on the network, the cost of transacting varies.

Ethereum was once the most expensive platform on which to transact, and it remains so. For this reason, the network rewards its validators with millions every week.

However, this is fast changing. Ethereum is still up the rankings, but alternative blockchains and top protocols are increasingly taking over as the leaders in fee generation.

Tron Flips Ethereum, On Course Of Being The Most Valuable Network In The World?

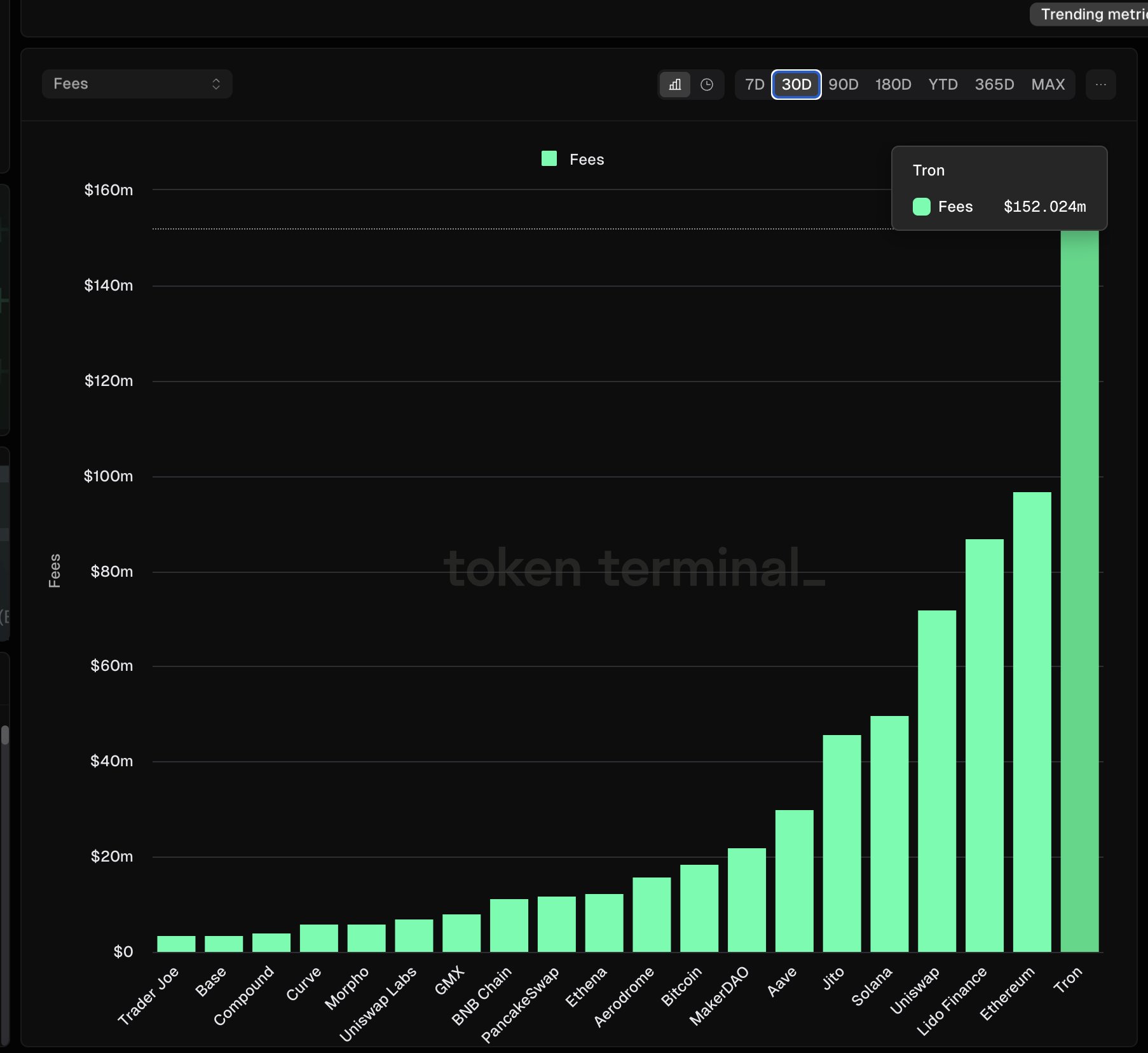

Taking to X on August 15, Justin Sun, the controversial co-founder of Tron, a low-fee and scalable network, said the platform has overtaken Ethereum in the fee it generates.

Citing Token Terminal data, Sun said Tron’s revenue exceeded Ethereum’s by over 50% in the past 30 days.

(Source)

At this pace, he continued, Tron would generate and distribute a whopping $2 billion by the end of the year–that is, in the next four months.

Over the last 30 days, Token Terminal has revealed that Tron has generated $152.7 million in revenue, mainly from gas fees.

During this period, Ethereum created just $40 million in revenue.

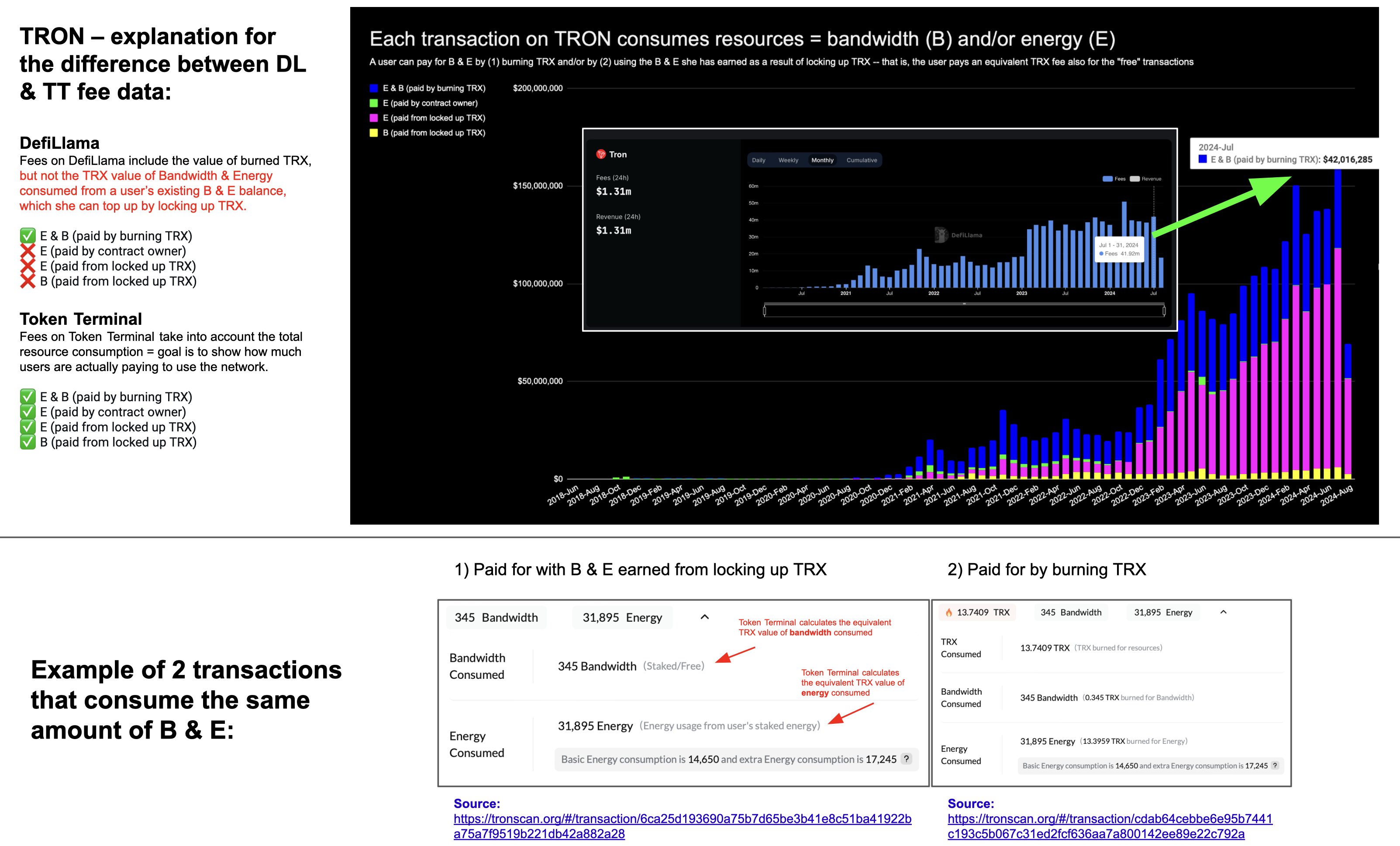

Though some trackers show that Tron generated far less revenue than Sun pointed out, the reason could be how Token Terminal calculates revenue.

Token Terminal said their method factors in the total resource consumption. As such, this approach takes into account the actual cost users must incur to, say, transfer or deploy smart contracts.

(Source)

Ethereum remains one of the most active smart contracts platforms, looking at DeFi activity and NFT minting.

However, even with Ethereum playing a key role, Tron has carved its share in stablecoin transfers and has remained dominant since 2018.

Stablecoin Activity Blossoms: Tron Facing Stiff Competition From Ethereum Layer-2 Solutions

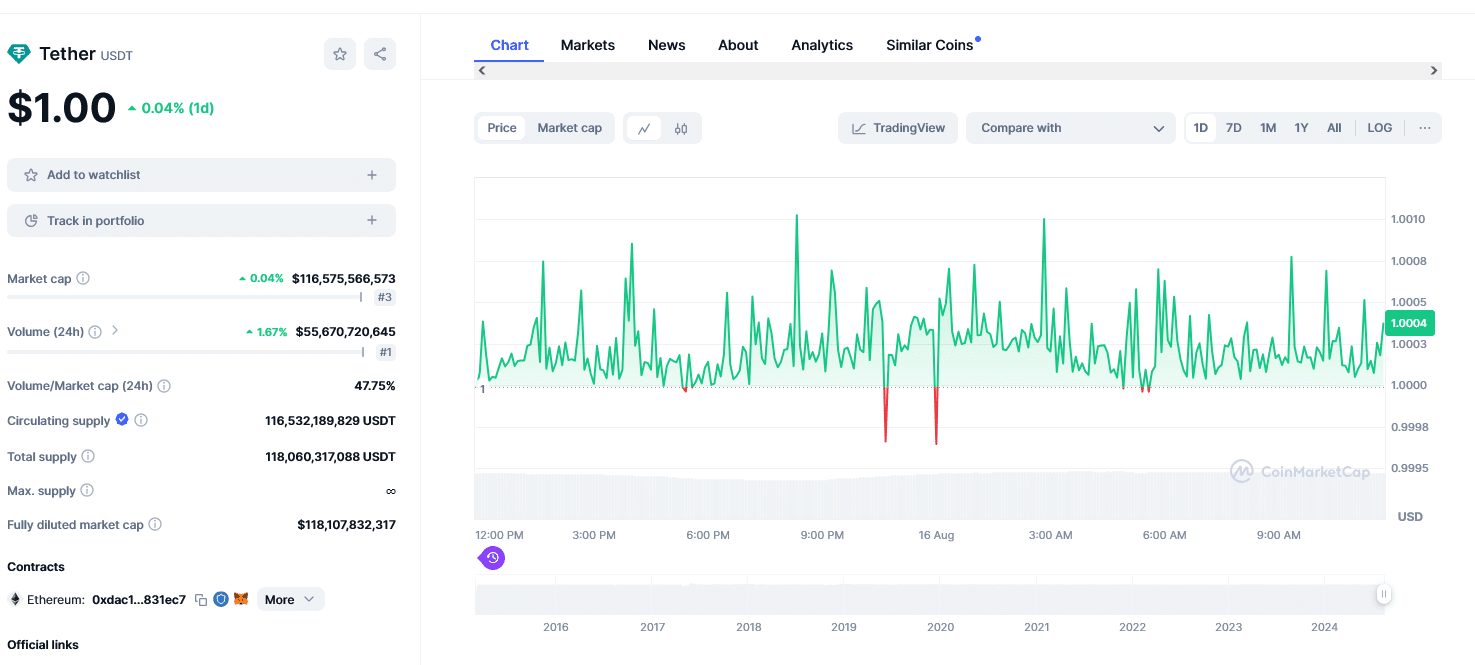

Over the years, users have preferred sending USDT via Tron, primarily because of the low fees associated with these transfers.

For this reason, over 50% of the over $116 billion of USDT tied to various blockchains are on Tron.

(Source)

With Ethereum prone to congestion, Tron emerged as an effective and reliable low-cost channel for users to send USDT just like they would in Ethereum.

The affordability of Tron transfers, coupled with its higher efficiency, makes Tron the go-to platform as Ethereum continues to lose market share.

Parallel Token Terminal data shows rampant stablecoin activity picking up steam on Ethereum layer-2 solutions like Base and Arbitrum.

The tracker notes that the USDC supply on Base is at nearly $3 billion, with over 1 million USDC holders.

(Source)

Over the last month, over $80 billion in USDC transfer volume has been generated by nearly 500,000 USDC senders.

It remains to be seen how USDC and stablecoin uptake will be on layer-2 platforms like Base and Arbitrum.

However, provided USDT remains dominant over alternatives, Tron will likely continue to generate millions in monthly revenue, pushing its valuation even higher.

EXPLORE: Cardano Users Loyal: On-Chain Data Shows ADA Is Surprisingly Undervalued

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.