It was dreadful to HODL Bitcoin and, quite literally, crypto assets in the first half of July. After the sharp drop on July 4 and 5, Bitcoin was heading back to $50,000. Then, in the past week, things changed, and the price of BTC has been boosted by an endorsement from Larry Fink, the CEO of Blackrock, as Germany runs out of BTC to sell. However, concerns over Mt. Gox bankruptcy repayments are growing.

Some analysts even predicted the world’s most valuable coin to break $45,000 earlier this month. Only then, they said, would BTC bulls find strength and resume the Q1 2024 uptrend.

However, events of last week, following the rejection of July 4 and 5 losses, sparked demand, lifting sentiment.

Bitcoin Rising: Germany Runs Out Of Coins To Sell

At spot rates, Bitcoin is not only trading above $60,000, completely reversing the climatic dip of early July, but bulls have pushed prices above $62,000, a region of interest for short-term holders (STHs).

From a technical perspective, Bitcoin is also trending above the middle BB for the first time in over four weeks. This uptick represents a bullish breakout that might further reinvigorate buyers targeting $66,000–the local resistance level.

There are various factors behind the expansion.

From the look of things, the confluence of these supportive tailwinds helped push prices higher, improving sentiment.

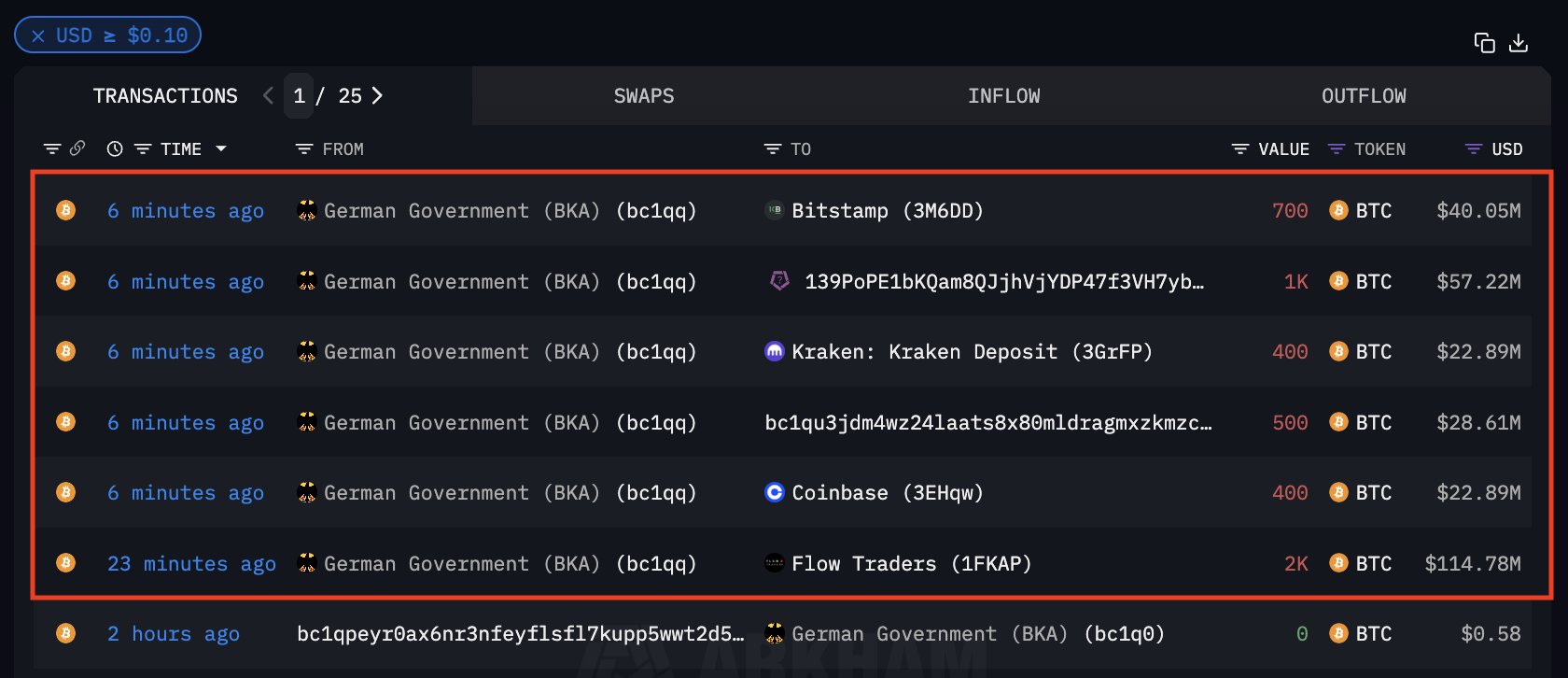

One massive development was that in Germany, the government eventually ran out of BTC to sell as of July 12.

For the better part of last week, authorities in Germany have been on a fire sale, dumping roughly 50,000 BTC into the secondary market and heaping more pressure on a fragile coin.

Their action was undoubtedly a headwind, preventing prices from reversing losses and breaking $60,000.

Interestingly, as they sold, spot Bitcoin ETFs and exchanges, likely Binance, were buying the dip. Their intervention propped up the market, preventing more dumps.

The endorsement from Blackrock CEO Larry Fink, who called Bitcoin “digital gold,” has also helped the market recovery. Larry Fink has been a long-term skeptic, so this reversal has stirred up interest from traditional financial institutions.

Still, there are concerns.

Mt. Gox will be distributing BTC to hack victims this week. Creditors plan to transfer roughly $9 billion of Bitcoin.

Analysts worry that this transfer from Mt. Gox would sharply increase supply, forcing prices lower. Nonetheless, with the odds of Donald Trump winning the November elections rising, their full market impact remains uncertain.

Eyes On 99Bitcoins: Analysts Predict 99BTC To 100X On Launch

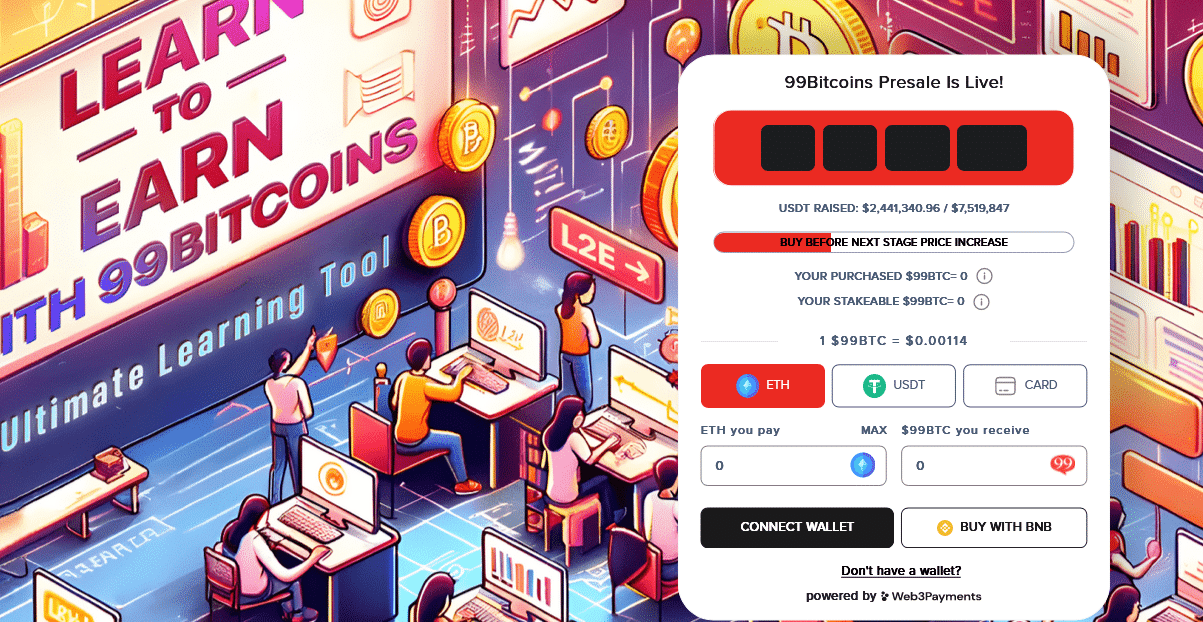

As Bitcoin turns the corner, investors are convinced that 99Bitcoins, a learn-to-earn project whose 99BTC presale is ongoing, can offer entries for smart investors.

It is a low-market-cap project that will capitalize on Bitcoin’s strengths, allowing users to learn more about crypto while concurrently earning 99BTC rewards.

The 99Bitcoin presale has raised a whopping $2.4 million in the ongoing fundraiser.

What’s cool is that every 99BTC available at this stage sells for just $0.00114.

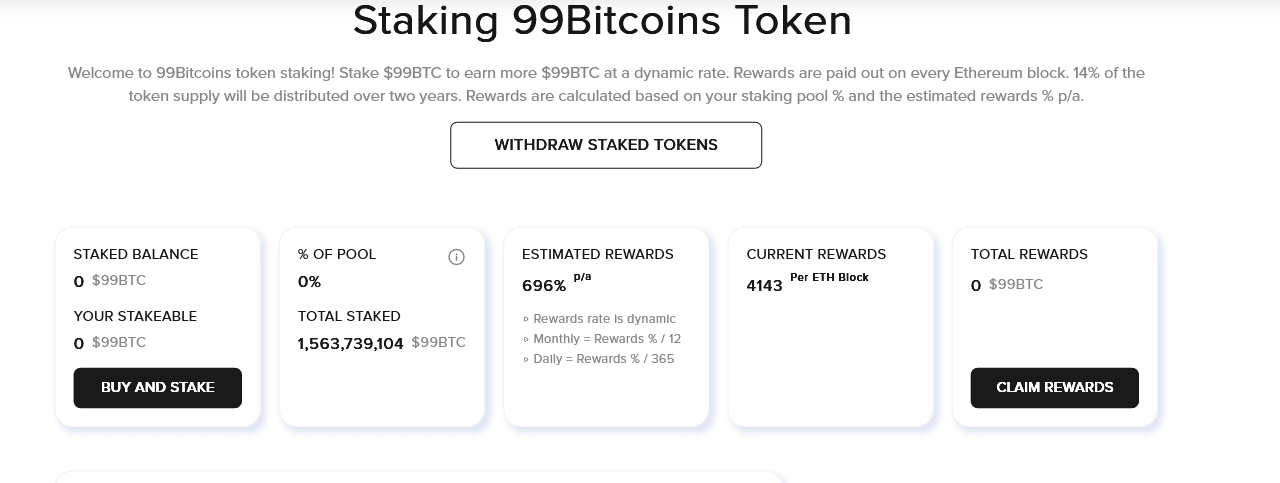

Investors can choose to stake and receive a 696% APY.

Over 1.5 billion 99BTC have been locked up by investors seeking to earn more tokens.

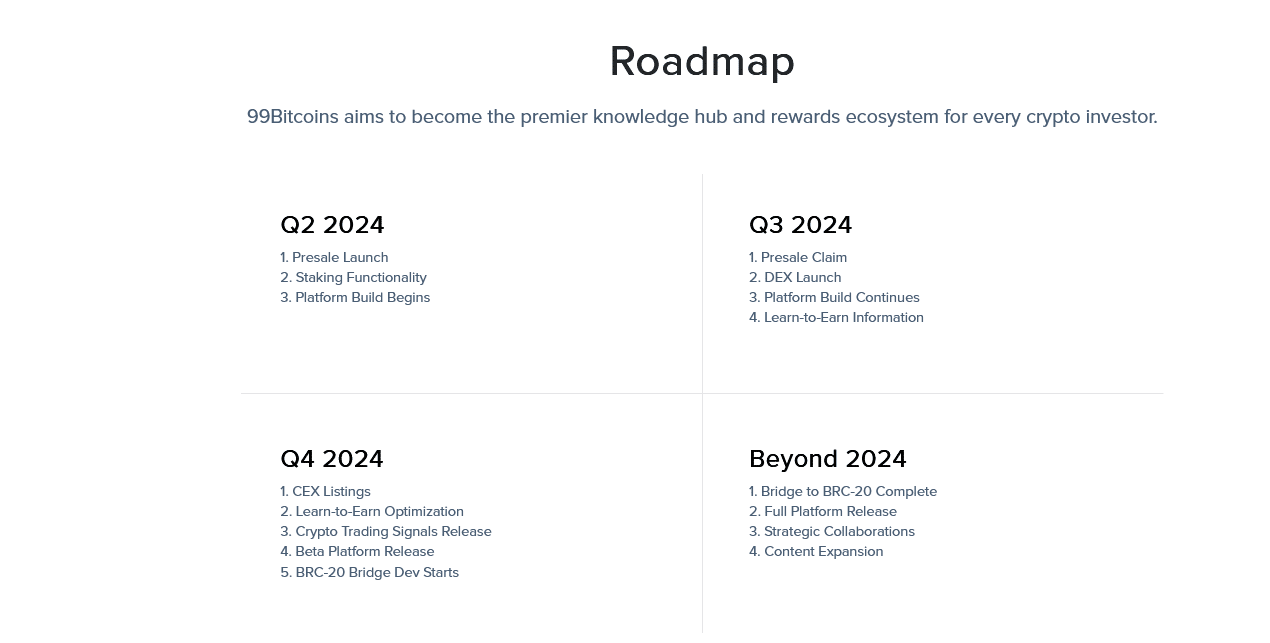

As part of the 99Bitcoins roadmap, the plan is to list 99BTC on leading exchanges like Binance and launch a DEX.

In the coming months, 99BTC will be converted to a BRC-20 token, riding on the secure Bitcoin network.

For these reasons, analysts expect 99BTC to outperform BTC, possibly rallying 100X after listing.

Explore: Visa And WireX Join Forces To Drive Crypto Adoption In Europe And The UK

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.