The day has finally arrived – Mt. Gox officially began making repayments to its customers after a decade of uncertainty. The notorious Mt. Gox hack happened in February 2014 and subsequently sent the exchange into bankruptcy.

Mt. Gox Repayments Adding To Bitcoin’s Ongoing Sell-Off

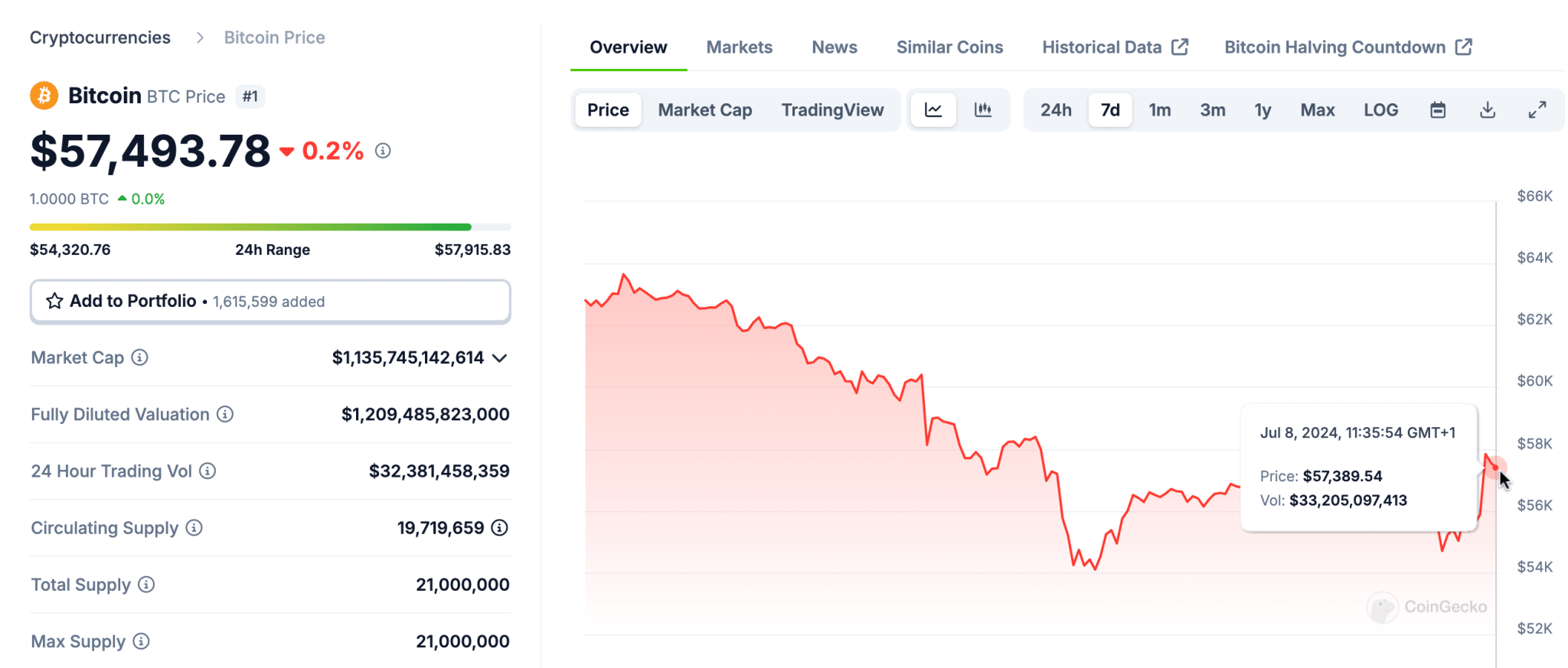

The company confirmed late last week that repayments had begun. This has been a key factor behind the recent downturn in the crypto market which saw Bitcoin sink to its lowest level in nearly 6 months. On Friday, 5 July 2024, BTC dropped just below $54,000, with many across social media predicting sub-$50,000 was next. The drop led to over $580 million in leveraged positions being liquidated.

RELATED Mt. Gox To Return $9 Billion In Bitcoin: Should Market Brace For Potential Volatility?

This past weekend saw BTC rallying as it hit $58,350 on Sunday, before plunging back to $54,700 in the early hours of Monday morning in European timezones.

The crypto market turning red is especially hard to digest since Bitcoin began the month of July trading at $63,000.

There are two main factors behind the current downturn in the market and the volatility that has followed – the Mt. Gox repayments being one and the German government continuing to sell BTC the other.

Fear In Market As German Government Still Holds Over $2 Billion In BTC

The German government has now sold over $390 million worth of Bitcoin in less than a month and reportedly still holds over 40,000 BTC (currently worth $2.3 billion) in reserve. The sell-pressure for Bitcoin continues, now that Mt. Gox have begun repayments. Although the ex-CEO of Mt.Gox, Mark Karpeles, told CoinDesk that customers may have to wait between 60-90 days to receive their payouts.

The German Government has been reducing their #Bitcoin balance at a rapid pace.

It's now down close to $1B in value from the ~$3.3B it started with.

Partially because of price reductions, and ofc because of their stack shrinking.

The impact should slowly diminish with time. pic.twitter.com/rQPgBR2ZF4

— Daan Crypto Trades (@DaanCrypto) July 8, 2024

In a direct-message correspondence between Mt. Gox’s former CEO and CoinDesk, Karpeles said “Those are deadlines linked to the number of transfers to process, each exchange might have a slightly different internal policy and decide to credit everyone later than sooner or sooner than later.”

Read more: Germany’s $2.2B Bitcoin Holdings Continues To Spook The Crypto Market

The trustee overseeing the Mt. Gox repayment case is working with a number of exchanges to handle the process of repayments to its customers. The exchanges include Bitbank, BitGo, Bistamp, Kraken and Japanese platform, SBI VC Trade.

From 2011-2014, Mt. Gox was the leading crypto exchange, long before the days of Coinbase and Binance. It once handled over 70% of all Bitcoin transactions and the 2014 hack resulted in the loss of 740,000 Bitcoin.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.