When will Ethereum ETF be approved? Will the ETH ETF approval decision meet Reuter’s July 4th deadline – or is the SEC sitting on their hands?

The Fourth of July might be more than fireworks and Coors Light this year; it could mark the debut of spot ETH ETFs.

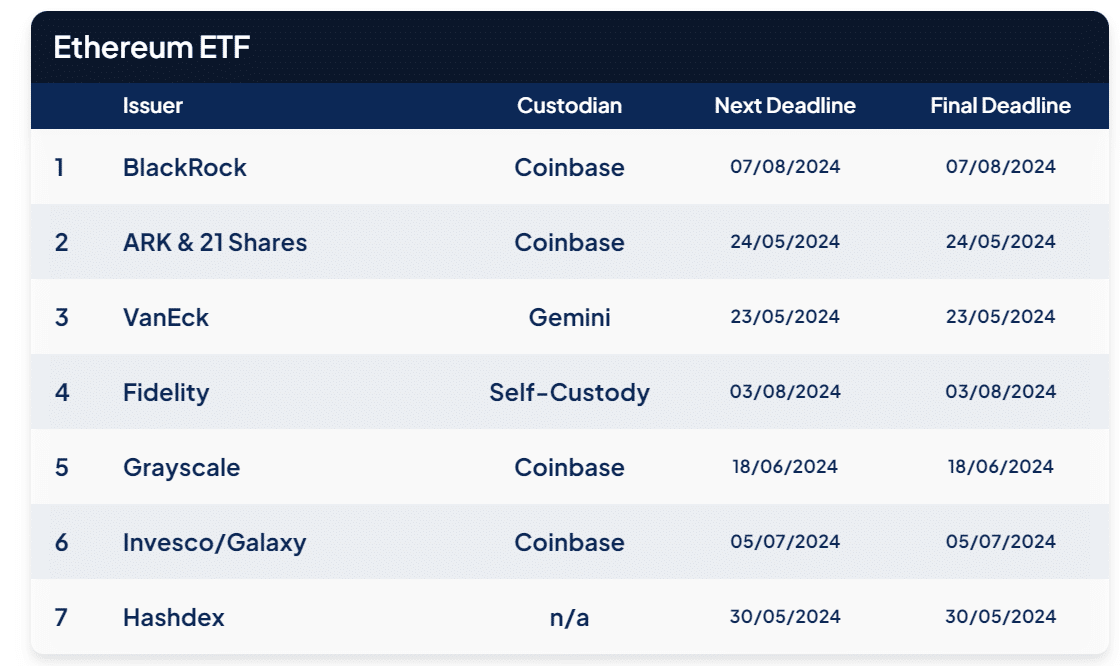

Eight major asset managers, including BlackRock, Grayscale, and VanEck, are pushing to introduce ETH exchange-traded funds to the market as soon as possible.

On Polymarket, bets on these ETFs trading by July 4 shot from 28% to 76% based on a Reuters report – and many believe if this were to happen, Ethereum could break its $4,800 all-time high from 2021.

Meanwhile, JPMorgan analysts predict spot Ethereum ETFs could hit the market around July or August, just in time for crypto to become a hot-button election issue.

So when, realistically, will we see this product out?

The SEC is Finalizing Regulatory Approvals (Apparently)

Regarding “what’s next” for the ETH ETFs, the SEC has already approved rule changes for NYSE, Nasdaq, and Cboe. Once SEC staff give the thumbs-up, trading could start within a day.

According to Gemini, net inflows into spot Ethereum ETFs might hit $5 billion in six months. With Grayscale’s existing assets, U.S. spot ETH ETFs could boast $13 billion to $15 billion in AUM in the first half-year.

A lawyer involved in the case, remaining anonymous, says the approval process is nearly done.

“It’s down to the finishing touches,” the lawyer stated, adding that approval is “probably not more than a week or two away.”

Moreover, SEC Chair Gary Gensler said in a meeting with Congress last week, “I would envision sometime over the course of this summer” regarding the launch of the ETFs.

DISCOVER: How to Buy Ethereum in July 2024 – Beginner’s Guide

Ethereum ETFs: A Different Ball Game To January

While Bitcoin ETFs singlehandedly moved the markets in March, some analysts think spot Ether ETFs won’t cause the same stir.

James Butterfill of Coinshares points out what he thinks is the gap.

“Ethereum is not the same size in terms of market cap, nor does it have the same volumes,” Butterfill noted.

So far, Ethereum has taken a dive this month, down over -11%, while Bitcoin dropped -9.8%. The market is becoming wrought with pessimism.

The market is proper horse shit but I don’t think we go as low as everyone is anticipating.

All I see is bear doom on the timeline. The sentiment is suicidal. $ETH ETF to go live soon. Institutions balance sheets keep growing.

I’d be looking to buy dips, not sell

— cousin crypto (@cousincrypt0) July 3, 2024

Still, some insiders see promise. OKX’s Lennix Lai predicts up to $500 million in the first week. “ETH ETF volumes could rival BTC,” Lai told DL News.

Ethereum has also been marred in this market, down 13.29% over the last month, and is in dire need of some good news.

The Bottom Line: Don’t Sleep on ETH ETF Approval Decision

The asset management world is on edge, waiting for the SEC’s nod for new spot Bitcoin and Ethereum ETFs. This could be a game-changer for crypto investments.

While Ether ETFs might not spark the same frenzy as Bitcoin, their ceiling is anyone’s guess, and they’ll also set a precedent for any altcoin to get one. Doge ETF soon? (kidding)

EXPLORE: Robinhood Review and Comparison

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.