Crypto markets have exploded into life amid Bitcoin hysteria, as excitement around spot Bitcoin ETFs and the upcoming halving event in April trigger a surge to a new all-time high (ATH), but could retail concerns of a sell-off by US Bitcoin mining companies materialize?

Despite bullish price action in recent months, the crypto community is seething with fear, uncertainty, and doubt (FUD) surrounding the possibility that US Bitcoin mining companies could sell into strength ahead of the halving following the first-ever pre-halving ATH.

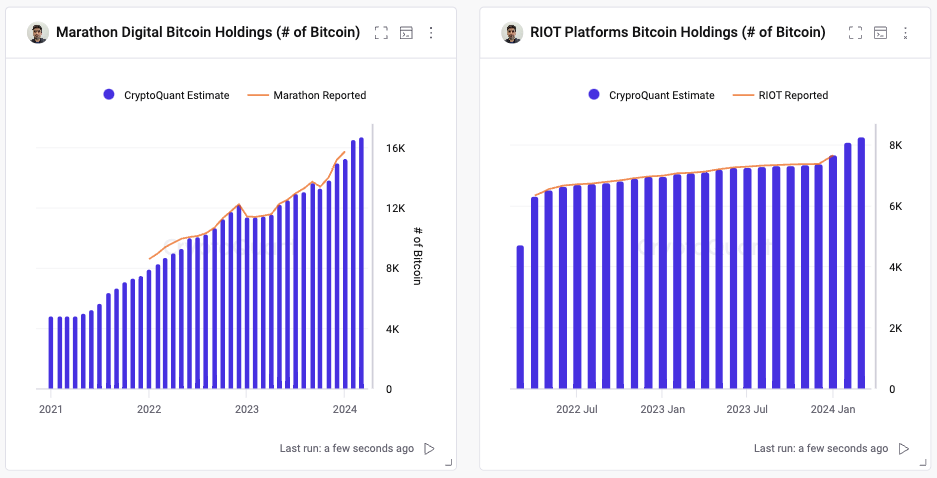

However, contrary to concerns about US Bitcoin miners offloading coins before the April 2024 halving event, Ki Young Ju (co-founder of CryptoQuant) has explained how on-chain data paints a different picture.

U.S. mining companies aren't major #Bitcoin sellers; the sellers are likely offshore or older miners. pic.twitter.com/H6lffwviAR

— Ki Young Ju (@ki_young_ju) March 14, 2024

Taking to X (formerly Twitter), Ju provides compelling evidence that Riot Blockchain and Marathon Digital, two of the largest mining farms by hash rate, are, if anything, accumulating and HODLing their Bitcoin.

A Glance On-Chain: Miners Are HODLing Bitcoin

Riot Blockchain and Marathon Digital were the only US Bitcoin mining companies to make their BTC holdings public, but it could suggest that most miners in the country are holding and steadily growing their respective stashes – as major players like Riot and Marathon represent leaders within the space.

When Yu shared the on-chain data, Marathon Digital held over 16,000 BTC ($1.15bn USD), while Riot Blockchain controlled the private keys of more than 8,000 BTC ($578m).

By comparison, Michael Saylor’s MicroStrategy holds 205,000 – highlighting the growing significance of corporate entities as holders in the Bitcoin market.

Interestingly, both companies have significantly increased their holdings over the past few years, with Marathon nearly quadrupling its stash, suggesting that both firms believe Bitcoin will undergo major price growth post-halving event.

Historically, Bitcoin miners have been known to sell portions of their mined coins before halvings, because of their secondary market activities, sometimes via platforms like Coinbase or even Binance, selling pressure fuels increased supply on exchanges – decreasing Bitcoin price.

There was a noticeable increase in miner selling activity during the last halving event in 2020, by selling and taking advantage of pre-halving rallies, miners tend to lock in profits.

By widening their financial base, they accumulate enough cases to manage the expected price volatility and, in some instances, diversify.

However, most of the time, considering the expected -50% drop in revenue from block rewards post-halving, most miners reinvest in mining infrastructure – for example in 2021 Marathon Digital invested $879m in new ASICs.

The Bottom Line: Billions Flowing To Bitcoin

As we approach the 2024 Halving Event in Late April, it’s possible that some miners might be gently selling into strength.

However, it’s challenging to identify which miners are accelerating their liquidation of holdings due to the unpublished and private nature of this sensitive data.

While their actions could potentially increase supply and sell-pressure, it’s important to note that the current market dynamic is unique – with Bitcoin reaching new all-time highs pre-Halving for the first time in its history due to institutional inflows, adding a layer of complexity to the situation.

Bitcoin ETF inflows last week were 2.2 billion.

That equals about 33,000 Bitcoin.

Bitcoin miners produced 6300 BTC last week

42 weeks left this year.

Bitcoin halving in 6 weeks.

Once in a market liquidity event.

Do you see it?

— Lark Davis (@TheCryptoLark) March 10, 2024

The Bitcoin uptrend will likely remain even if miners increase their selling activity.

After all, billions of dollars are being channeled to spot Bitcoin exchange-traded funds (ETFs), soaking in any liquidation of assets by US Bitcoin mining companies.

As BlackRock, Fidelity, and 9 other spot Bitcoin ETF issuers continue to fan demand ahead of the halving event; it seems Bitcoin is on a crash course with a major supply shock by Summer.

And with Bitcoin presently trading at near all-time highs, with BTC prices temporarily spiking to over $73,880 earlier this morning – there is clearly no sell-off yet.

EXPLORE: How to Buy Spot Bitcoin ETF – For Beginners

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.