How do “independent thinkers” and internet gurus completely ignore that to get rich in 2025 or any day in age you need to know:

- Real wages have not increased since the 1970s

- The banking system has been straight robbing everyone for 50 years and only makes it possible to get rich one way. (More on that below)

These two mathematically certain factors represent a crisis larger than any previous war, any terrorist attack, or any natural disaster.

Society must devote crisis-level resources and energy to dealing with these problems; we’re sleepwalking.

This is to say the window for generational wealth is closing. So, I want to give you four easy things to do to get rich in 2025:

1. We’re All Debt Slaves

2008 changed everything. By 2008, every major country had more debt than their GDP.

Normal people like you and me were in the same boat. Households: record high debts. Corporations: record high debts.

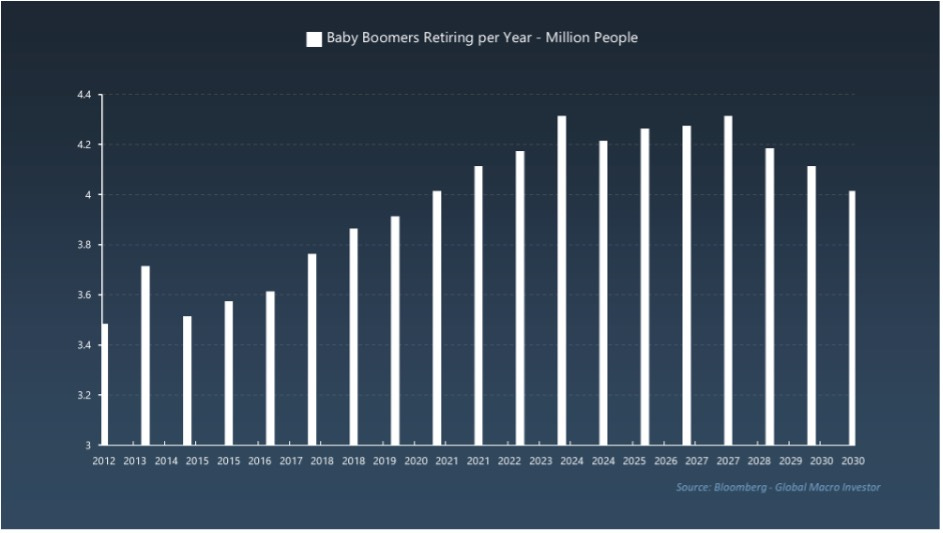

Raoul Pal, the CEO of Real Vision Finance, has a theory about this on YouTube that you need to watch. The upshot is Baby Boomers entering the workforce in the 1970s was the largest demand shock the world had ever seen. Because of this, people had to start taking on more debt to feel richer.

Now, we’re in a perpetual boom-and-bust debt cycle. If one market fails—say real estate or retirement pensions, for example—it takes down everything because there is so much debt in the plumbing. The only way for the Fed to prevent this is to continually print money and pump assets.

The gap will keep widening. There is no middle class anymore. So buy this…

2. Get Rich in 2025, The Number One Asset to Buy

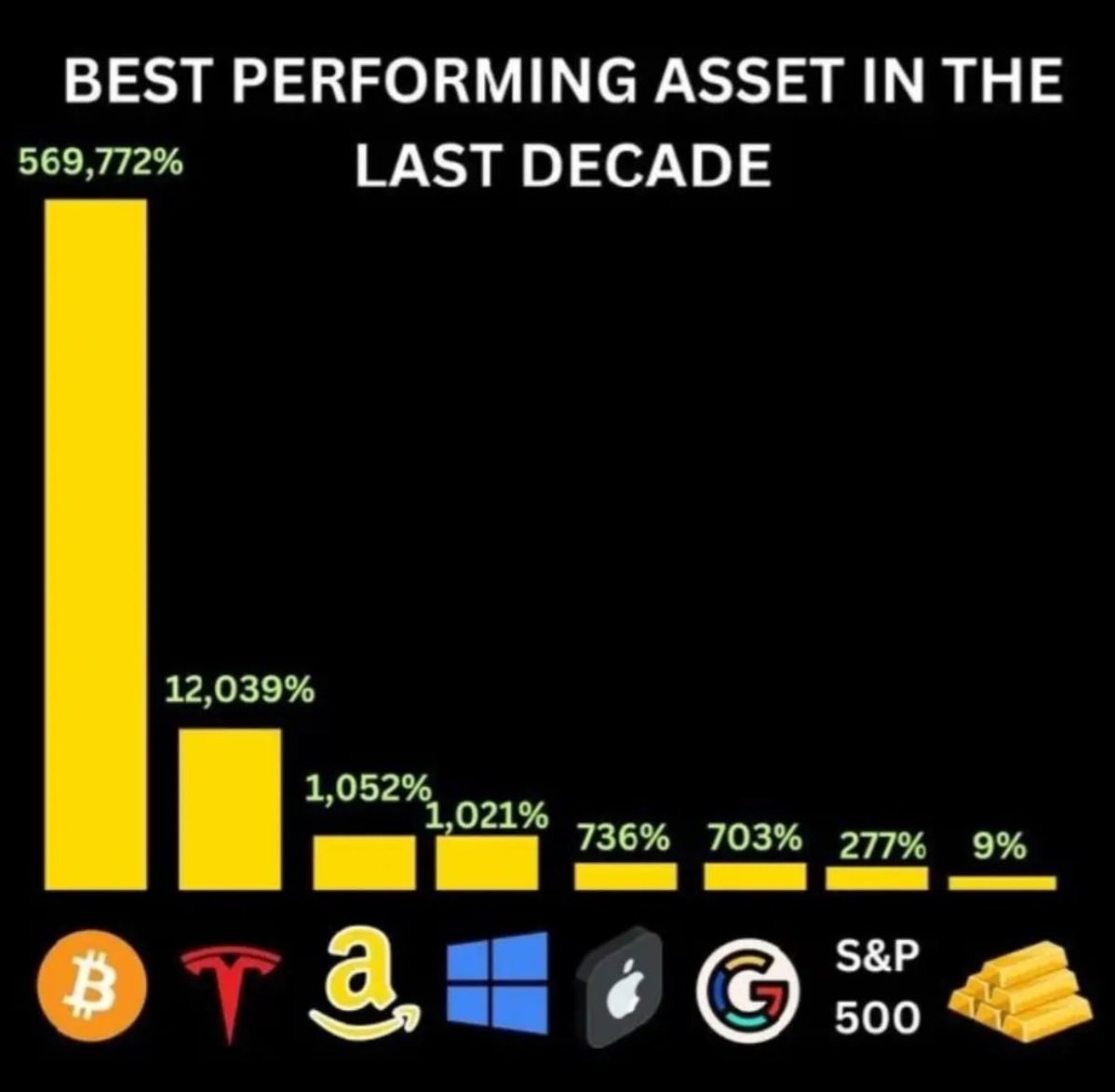

Technology and crypto.

Here is a chart:

Wealth inequality has risen exponentially in the exact same time frame that wages haven’t risen. This means the rich will become super rich.

The poor will become super poor.

The exponential riches that will be doled out between now and 2030 only make sense because 1) Tech is everything, 2) Debt is also everything.

They can’t let the system fail. We’ll keep going up.

3. In The Long Run Markets are Weighing Machines

“Inflation is always and everywhere a monetary phenomenon.”

— Milton Friedman, Godfather of libertarian economics

Just because tech has a good long-term horizon doesn’t mean it won’t have pullbacks. Particularly with giants like Nvidia and Bitcoin leading the charge, there’s a sense that it may be overextended.

Overall, since the November Fed meeting, the US stock and bond markets have added a historic $13.5 trillion.

For comparison, the value of the US economy (GDP) is ~$27 trillion. This means that the US stock and bond markets surged by more than 50% of the value of the US economy in just five months.

If you have a long-term investment horizon, volatility is part of the game but shouldn’t matter much to you unless you’re buying more.

DISCOVER: 1000X Potential Cryptocurrencies in August 2024

4. It’s the Economy, Stupid

Bill Clinton once said, “It’s the economy, stupid.”

This phrase has persisted because no one wants to re-elect a politician during a recession.

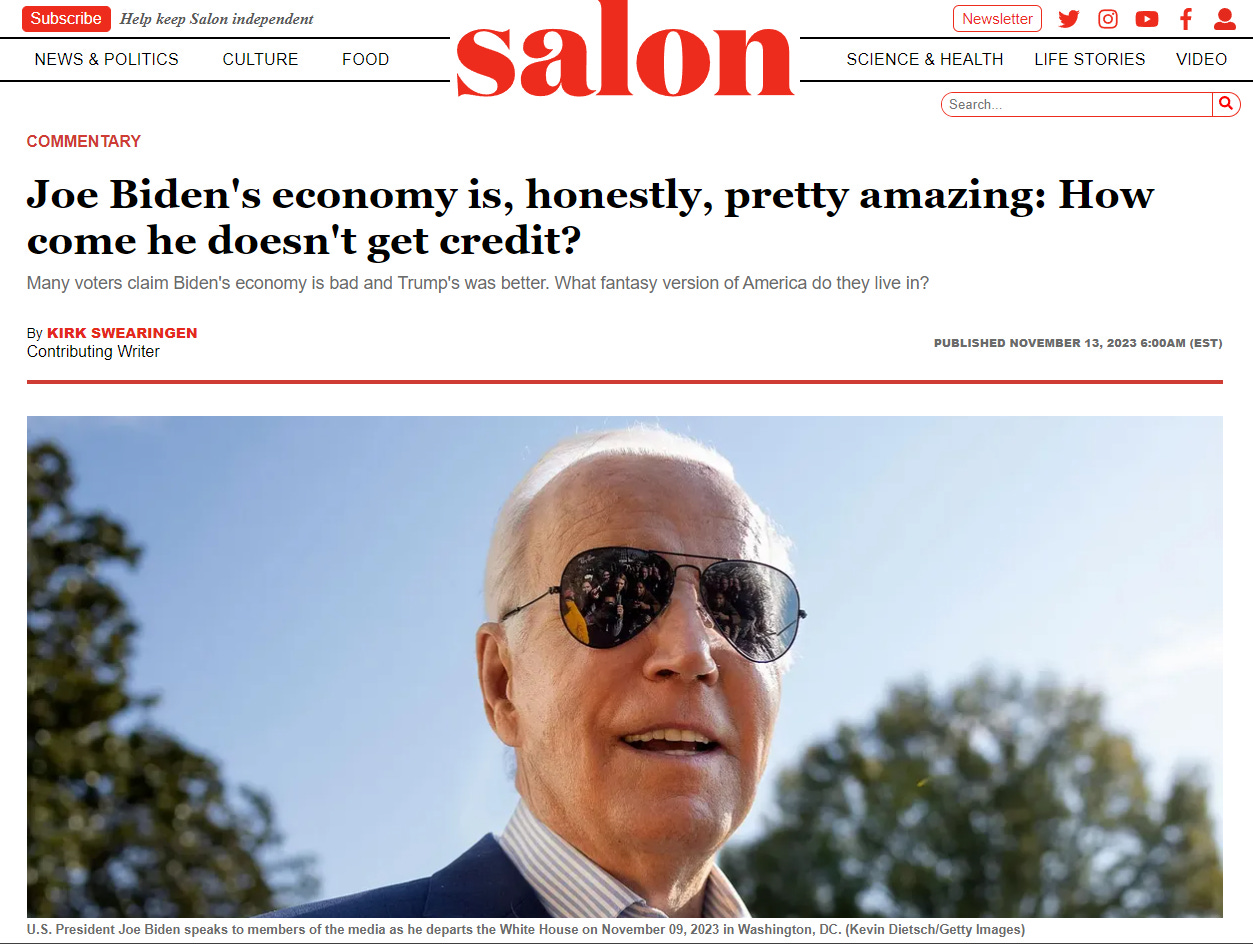

The US Presidential elections are coming up later this year, and Kamala/Biden (and the Fed) will do everything to get the economy right. Even fake articles will do…

READ MORE: 16 Best Crypto ICOs in 2024 for 50x Returns