Ethereum’s price might rally in the days to come following BlackRock’s and Nasdaq’s filing regarding options trading of spot ETH ETFs.

Crypto prices fell sharply early this week, but the big boys held on.

Solid data shows that Ethereum and Bitcoin whales did not sell despite prices plunging, but some bought more, taking advantage of the dip.

What’s there to see is that the crypto landscape is fast changing, and there are institutions in the picture.

Nasdaq and BlackRock Wants To Roll Out Options Trading For ETHA

To highlight their presence and interest, especially in Ethereum, yesterday, Nasdaq, one of the largest tech bourses in the world, and BlackRock, another heavyweight in asset management, jointly filed a proposal to introduce options trading for the ETHA.

The filing with the United States Securities and Exchange Commission (SEC) will see the complex derivative for BlackRock’s spot Ethereum ETF product, ETHA, available for institutional traders.

In their filing, BlackRock and Nasdaq explained why options on this spot Ethereum ETF is necessary for investors to trade cheaply and hedge efficiently.

Options are usually used to hedge against market risks.

For example, a hedge fund could be short on the Ethereum spot but long on ETH options.

All the fund traders have to do is pay a premium to place “call” options. This makes trading safe, regardless of how price action pans out.

It will take time before the fund is approved.

However, this would clearly significantly open up more opportunities for the big boys to invest in ETH with a broader understanding of how to manage risks and generate returns.

How the United States SEC comments on this filing will be key, especially now the approval of spot Ethereum ETFs was accelerated from May through July when they began trading.

DISCOVER: How to Buy Ethereum During August Dip (The Tactical Way)

Will Ethereum Break $2,800? Jump Trading Selling

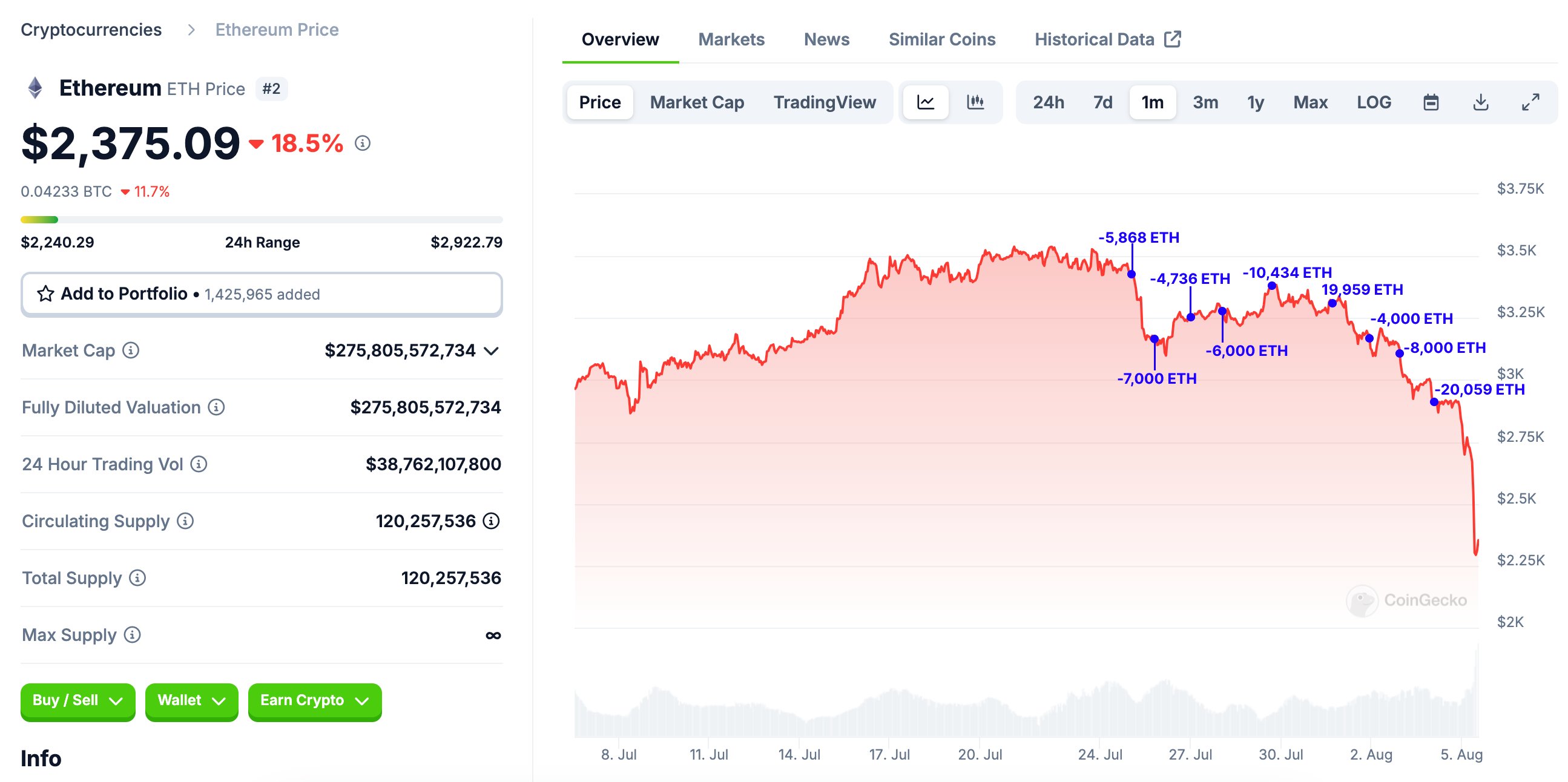

For now, ETH is down, but traders are upbeat. They expect prices to bounce higher, clearing the immediate resistance at $2,800.

(ETHUSDT)

Though optimism remains high, there are headwinds.

Today, Jump Trading, a high-frequency trading firm, began unloading ETH derivatives and resumed activity after a day.

The trading firm, which the United States CFTC is investigating, sold 120,695 wrapped ETH (wETH) worth $481 million on August 5 alone, according to Lookonchain data.

Combined with other market factors, ETH prices crashed by over -35% from July highs on August 5.

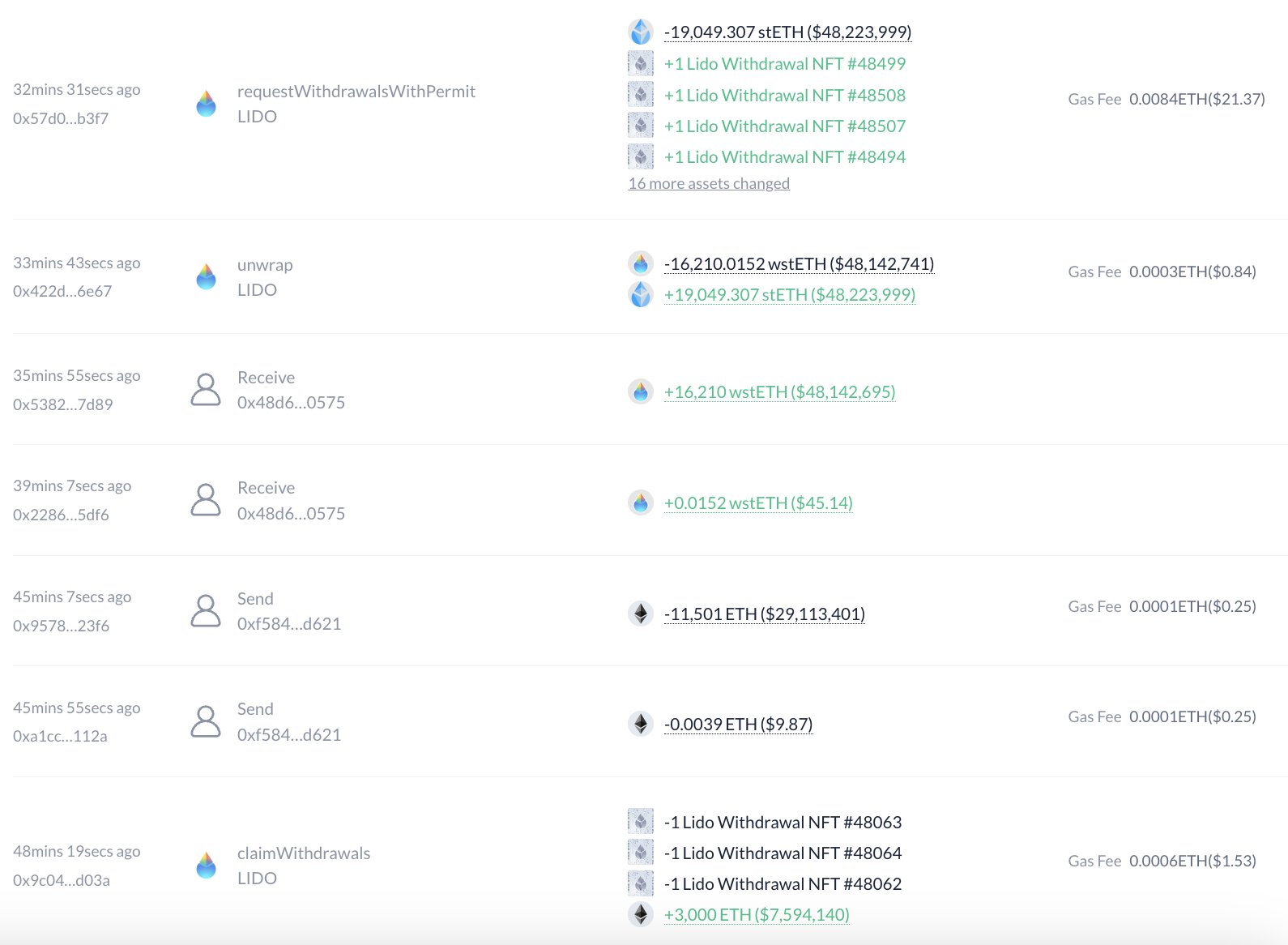

Today, Jump Trading moved 11,501 ETH from Lido and moved them out for sale.

At the same time, they applied to redeem 19,049 ETH in readiness for liquidation.

So far, the firm owns 21,394 wstETH that they plan to sell in the coming days.

As Jump Trading unwinds, whether the market will comfortably soak up the supply remains to be seen.

The immediate support lies at $2,000.

EXPLORE: Mark Cuban’s Bitcoin Theory: Decoding Silicon Valley’s Support For Trump

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.