Uniswap, the top DEX in Ethereum, is the most dominant. It commands a bigger market share, and UNI might be extremely undervalued according to crypto analysts – but is it true? Let’s dig in.

Successful innovators like Hayden Adams of Uniswap can choose to “retire” early. If their innovations solve real-world problems, that’s the jackpot.

Amazon did, and so did Microsoft, Nvidia, Alibaba, and multiple other tech companies. In the crypto world, Bitcoin remains the most valuable because it created what we have today.

Uniswap DEX Is Pivotal In Ethereum Trading

Ethereum is dominant because it led the way with smart contracts.

Uniswap, on the other hand, is a gem in the ecosystem and has been ever since Hayden Adams built a way for users to trustlessly swap tokens.

Roughly five years after launching in late 2018, the DEX has helped founders save billions they would otherwise have to pay to list their tokens on, say, Binance.

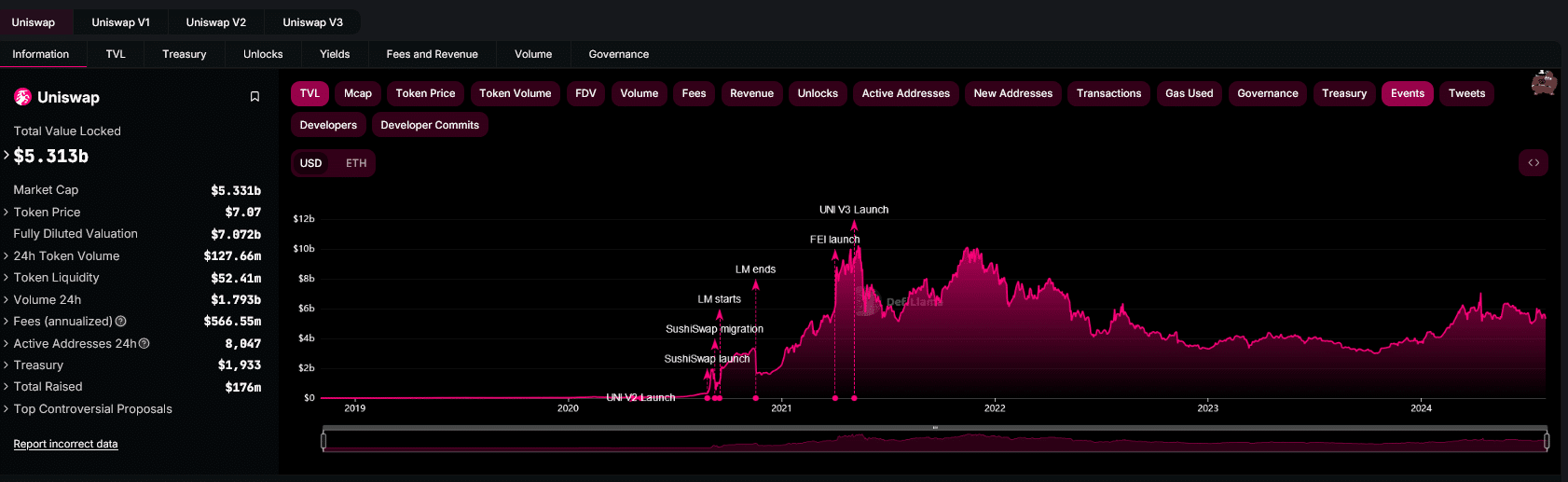

Looking at DeFiLlama data, Uniswap might not be the leader ranked by assets under management, but every user knows the DEX is king.

The problem is that UNI, the native governance token, continues to underperform.

After rallying to as high as $45 in the last bull cycle from 2020 through 2021, pumped by DeFi and NFTs, UNI plunged throughout 2022.

Bears are still in control, but traders are hopeful.

In a post on X, one analyst is convinced Uniswap is undervalued, considering its pivotal role in the Ethereum ecosystem and the broader crypto landscape.

Putting in the numbers, the analyst noted that Uniswap controls roughly 70% of all the DEX market share.

It has nearly half a million monthly active users and impressively retains most of them, regardless of market conditions.

For this reason, the DEX’s contribution to the Ethereum network is undeniable.

As of early August, Uniswap accounted for roughly 71% of all Ethereum gas fees in the last month alone, generating over $1 billion in fees over the last year.

All these fees were distributed to liquidity providers who enable the protocol to operate trustlessly.

The dominance of Uniswap highlights how significant the network is, especially as a fee-generating powerhouse across Ethereum.

DISCOVER: The Best Cryptocurrency Exchanges For Streamlined Trading in 2024

Is UNI Price Extremely Undervalued?

Even as Uniswap continues to power most of Ethereum and its layer-2 swapping operations, there is a glaring disconnect regarding its valuation.

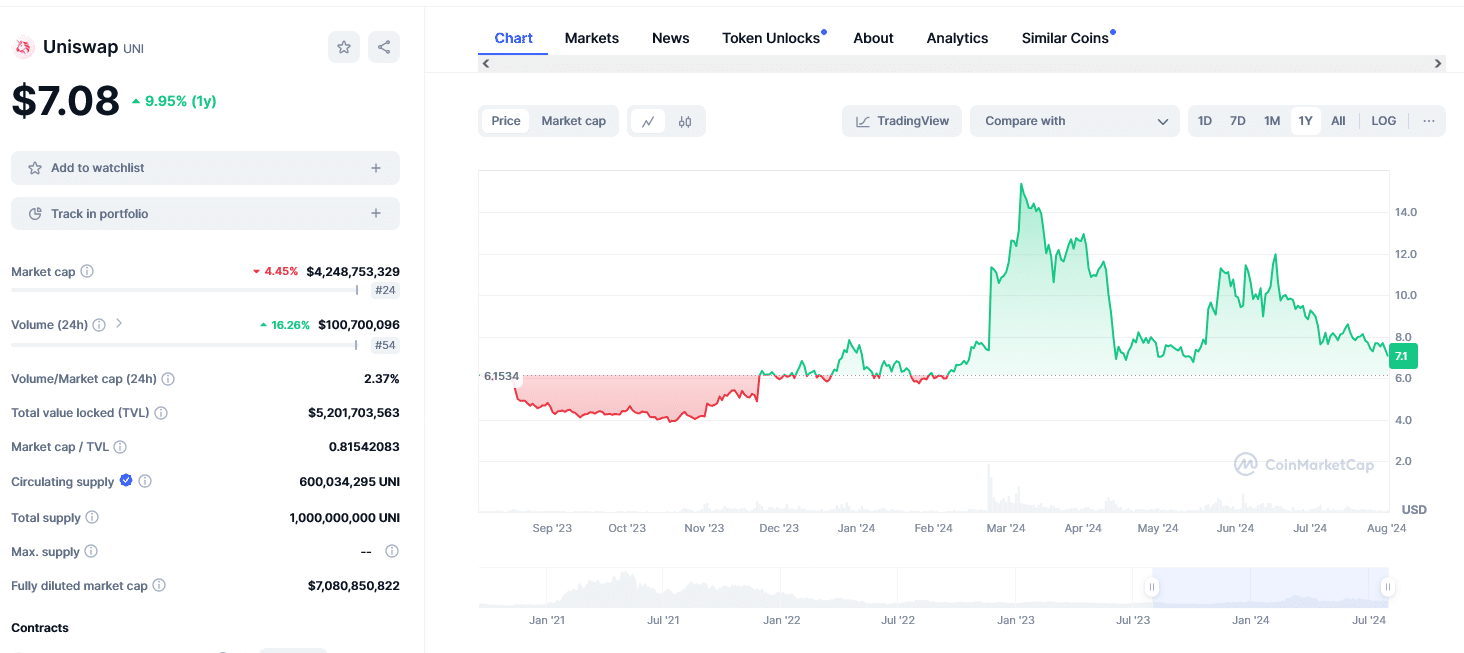

According to CoinMarketCap, UNI’s market cap is just $4.2 billion, or 2% of Ethereum’s.

The analyst is convinced that this should be much higher now that Uniswap is available. This is because, without Uniswap, most of Ethereum’s tokens would be illiquid.

As a result, the valuation discrepancy now raises hard questions about UNI’s true value and whether the token could expand in the coming years, given its role in the crypto scene.

For now, the approval of spot Ethereum ETFs would likely benefit UNI as there is regulatory clarity.

Moreover, it plans to launch Uniswap v4, which introduces unique features like Hooks. This tool makes the DEX more customizable, further increasing its market share.

(UNIUSDT)

From the daily chart, the UNI’s price has support at around $6.6 – although it is currently falling away from 20DMA support – highlighting the risk of further downside in the short-time frame.

If bulls push to reclaim this moving average, it could send the token above $8.5, a sign that it could be on its way even higher- long-term targeting 2021 highs.

EXPLORE: How To Earn Interest On Crypto In August 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.