What is the best RWA Crypto to buy in June 2024? RWA tokenization is still in the early stages, but amid a return to the much-anticipated RWA narrative – analysts have identified Ondo Finance, Landshare, and Polymesh as market leaders.

It is clear as the day that Real-World Asset (RWA) tokenization is here to stay and rapidly gaining momentum.

They may not be as “fun” as speculating on meme coins, but they are crucial.

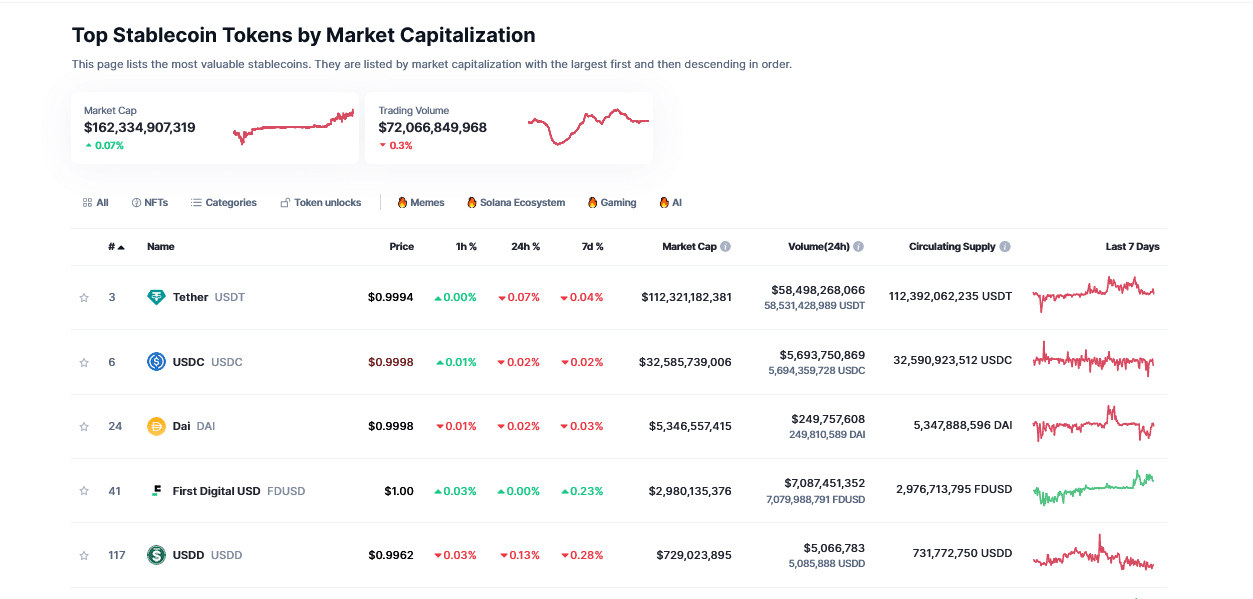

If anything, without Tether Holdings or Circle tokenizing the USD and bringing it onchain, the industry would be struggling with liquidity.

The success of stablecoins has inspired developers to unleash even more products on-chain, easing accessibility and turbo-boosting liquidity.

Investors are thirsty for more real-world assets to be tokenized on Ethereum or Solana and brought on chain.

The recent congressional hearing in the United States serves as the evidence we all need.

On June 5, the Financial Services Committee held a hearing titled “Next Generation Infrastructure: How Tokenization of Real-World Assets Will Facilitate Efficient Markets.”

There in, policymakers focused on the blockchain’s potential to tokenize real-world assets, which could, among other things, increase transparency in traditionally opaque markets.

Proponents of tokenization truly argue that technology can revolutionize various industries, from streamlining supply chains in agriculture and healthcare to lowering costs for financial institutions.

Top 3 RWA Tokens to Watch

While the regulatory landscape surrounding RWA tokenization remains in flux (for now), several projects are already making waves.

After extensive research, 99Bitcoins analysts are confident these top three RWA tokens can extend gains in the second half of 2024.

1. Ondo Finance (ONDO):

Ondo Finance is the leader of RWA tokens, boasting a market cap of nearly $2 billion. At spot rates, ONDO commands over 20% of the $9.3 billion RWA sector.

Since May 2024, its TVL has skyrocketed by over 43%, pointing to investor interest. The sharp expansion is primarily because of the rising demand for tokenization from global banks, investors, and more.

Ondo Finance is proud to share that we have surpassed $500M in TVL across our yield-bearing products!

🔹 $OUSG TVL: $221M

🔹 $USDY TVL: $286MWe are the leading yieldcoin provider in this $1.5B growing market, alongside BlackRock & Franklin Templeton.

Our yield-bearing,… pic.twitter.com/EbgtqyHNN8

— Ondo Finance (@OndoFinance) June 5, 2024

Their yield-bearing, composable products like USDY and OUSDG are fast gaining traction, fanning the demand for ONDO.

(ONDOUSDT)

2. Landshare (LAND):

LAND is the native token for Landshare, a portal where users can invest in real estate assets. LAND holders can also participate in governance and earn rewards. They can also purchase the platform’s RWA token and co-own a pool of real estate assets.

We applied for the #Binance listing program, which supports small and medium-sized projects with strong fundamentals. Show your support by liking and retweeting this tweet, and tag @Binance in the comments to demonstrate the strength of our community.

Details:…

— Landshare (@Landshareio) May 23, 2024

Since May, LAND has skyrocketed by over 60% but will only rally if their application for Binance listing is approved.

(LANDUSDT)

3. Polymesh (POLYX):

Polymesh offers a compliant platform where users and institutions can issue and manage tokenized assets. This feature allows users to diversify their portfolios. POLYX is trending higher and is one of the top RWA tokens. It is up by over 40% from May 2024 lows and is set for more gains following its partnership with REtokens.

ICYMI

From @JuricaDujmovic on @WeissRatings

REtokens has recently announced an initiative to tokenize $30 million in real estate assets using the Polymesh blockchain.

Polymesh, a blockchain designed specifically for regulated assets, offers features aimed at compliance and…

— Polymesh 🅿️ (@PolymeshNetwork) June 4, 2024

The platform will tokenize $30 million in real estate in this deal.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.