Crypto prices, including Bitcoin and Solana, are down today after the Fed held interest rates steady at 5.5% – but why is crypto down?

Yet, this is nothing new – cypto prices often see-saw. At one time, they can fly to new highs, while in some cases, crashes can force speculators to the exits.

$BTC March Crash vs Today's Crash. pic.twitter.com/JYCRIEA5Nk

— Daan Crypto Trades (@DaanCrypto) April 18, 2021

Crypto Prices Dump: But Why Is Crypto Down Today?

Just like it happened yesterday.

After a strong July, which started on a weaker foot, prices rebounded sharply, lifting the world’s most valuable coin to nearly $70,000.

However, by the end of July 31, Bitcoin and most cryptocurrencies were down.

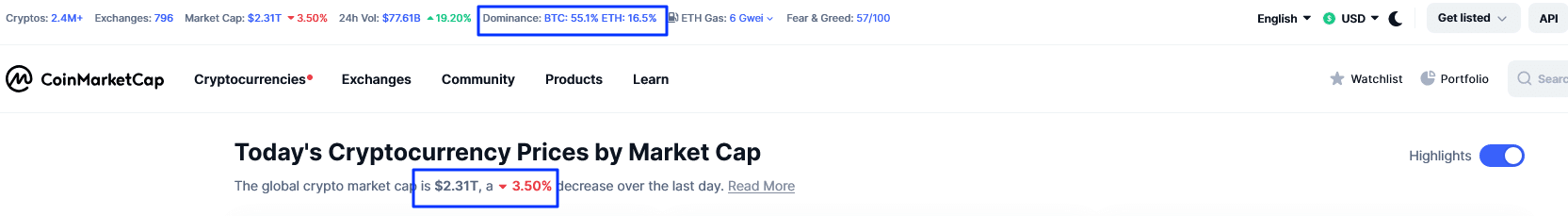

To put the numbers in perspective, CoinMarketCap data shows that the broader crypto scene is down nearly 3.5% to $2.31 trillion.

Bitcoin still maintains the lead, but losses mean it is below $1.3 trillion to $1.2 trillion, commanding a market share of 55.1%.

Contracting BTC prices also negatively impacted top altcoins, especially Solana, which flash crashed by nearly 10%; the biggest drop in the top 30. XRP and Ethereum, which shed around 5%, are other notable losses.

(SOLUSDT)

While Ethereum was expected to surge immediately after the approval of spot ETFs, bulls are struggling.

Meanwhile, with the United States retracting its claim that some altcoins, including SOL and ADA, were unregistered securities in its lawsuit versus Binance, there were decent gains mid-this week.

However, all these have been reversed, and bears are pressing on when writing.

DISCOVER: The Best Solana Meme Coins to Accumulate During The Dip

United States Fed Holds Interest Rates Steady

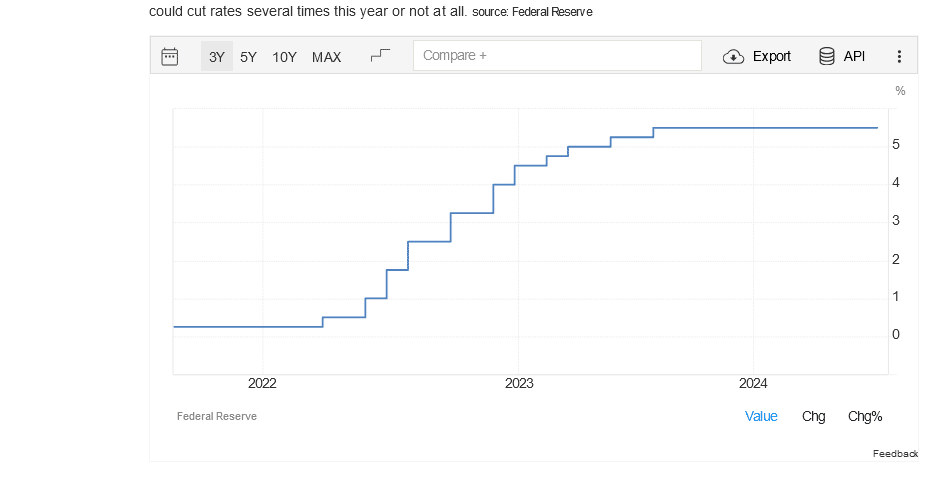

Crypto is falling primarily because the Federal Reserve held interest rates steady at 5.5% yesterday.

While Jerome Powell, in a statement, said a rate cut would be on the table in September, the decision was received negatively, especially by crypto investors.

Some analysts interpreted the move as a lack of commitment by the United States central bank when inflation is cooling off.

Earlier, Powell said the central bank would be data-driven, relying on economic data, especially inflation, to determine whether to slash rates.

Interest rates have been steady at 5.5% since July 2023 – yet September is widely anticipated across TradFi as the potential rate cut date.

Rate Cut Expectations, Politics, and Spot ETFs To Drive Demand?

When the Federal Reserve eased throughout 2020 and 2021, Bitcoin and crypto prices rose sharply.

Of note, top altcoins, including ETH, rallied to $4,900 while Polkadot broke $50. However, prices fell sharply in the months after 2022. Then, the central bank began aggressively hiking rates to curb runaway inflation.

(Source)

Even so, the crypto community remains upbeat about what lies ahead.

With spot Bitcoin and Ethereum ETFs available, institutions now have legal channels for exposure to top cryptocurrencies.

At the same time, improving crypto regulation and political endorsement in the United States could help change the tides. In turn, this will propel valuation to record highs by the end of the year.

EXPLORE: 17 Best Crypto ICOs To Buy in 2024 – Top New & Upcoming ICOs

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.