Self-appointed “Microstrategy of Japan” investment firm Metaplanet announced on Tuesday (16 July) that it has bought another $1.2 million (200 million Japanese Yen) worth of Bitcoin (BTC).

Asia’s Microstrategy Makes Its 4th Bitcoin Purchase In 6 Weeks

.@Metaplanet_JP has purchased an additional ~21.88 #bitcoin for ¥200 million at an average price of ¥9,142,021 per $BTC.

As of July 16, Metaplanet holds ~225.61 bitcoin acquired for ¥2.25 billion at an average price of ¥9,972,933 per $BTC. #TSE3350 https://t.co/oI3OoJiOTB

— Dylan LeClair 🟠 (@DylanLeClair_) July 16, 2024

The Japanese asset manager disclosed its latest Bitcoin purchase in a press release on July 16 and follows the company’s June 24, announcement regarding a 1 billion yen BTC investment. This most recent purchase was the firm’s third in July after previously acquiring 42.46 Bitcoin for 400 million Yen on July 7 and 20.195 Bitcoin for 200 million Yen on July 1.

According to today’s statement, Metaplanet has acquired 21.877 BTC at an average price of 9,142,021 Yen per BTC. This brings the company’s total holdings to 225.611 BTC, with an average purchase price of 9,972,933 yen per BTC.

Market Reacts Positively To Metaplanet’s Latest BTC Purchase, Soaring 10%

Metaplanet’s share price has been positively impacted by the news, climbing 10% to trade for 102.00 YEN, per Google Finance. The investment firm trades on the Tokyo Stock Exchange under the ‘3550’ ticker. At the beginning of 2024, Metaplanet announced its intention to start accumulating Bitcoin in its corporate treasury and, as a result, has been named the Microstrategy of Japan.

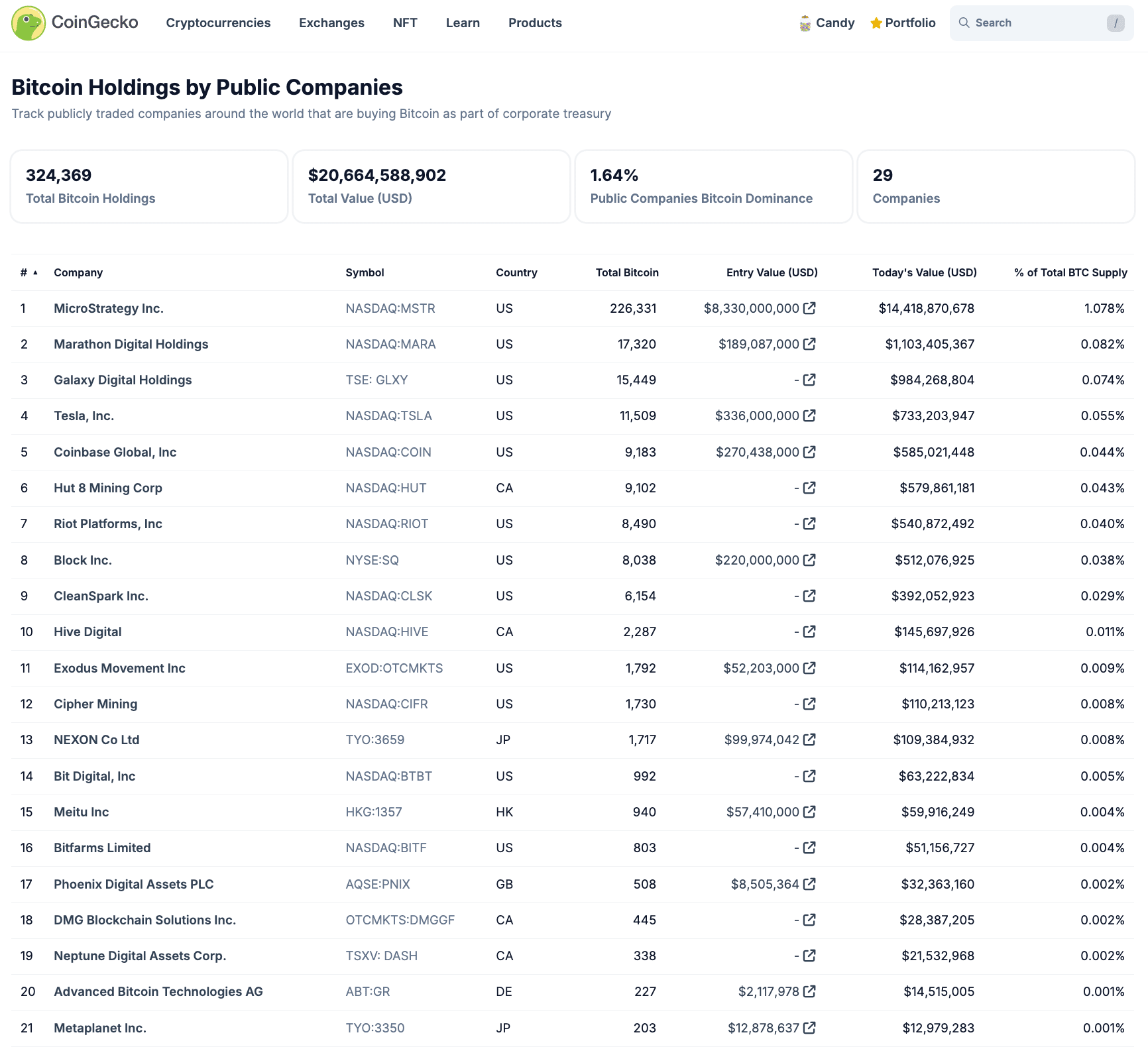

With this most recent BTC purchase, Metaplanet has moved above Cypherpunk Holdings of Canada as the 21st largest corporate holder of BTC globally, according to data from CoinGecko.

Even with the Japanese investment firm’s nickname, it is unlikely that Metaplanet will ever actually compete with Microstrategy. Michael Saylor’s asset management company is the largest corporate holder of BTC in the world, with 226,331. The value of Microstrategy’s BTC holdings is currently over $14 billion.

EXPLORE: PEPE Price Analysis: As Pepe Volume Triples This Other Project Could Repeat Pepecoin Skyrocket

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.