In late May, the United States Securities and Exchange Commission (SEC) surprised everyone after accelerating their decision to approve the 194-b forms submitted by spot Ethereum ETF applicants. Following this, Ethereum prices soared on May 20, breaking above $3,000. Still, Grayscale Investments has said it will not change its high management fee on its Ethereum Trust (ETHE) ahead of the launch of spot ETFs.

The hopes of this derivative product hitting the market has spurred demand for ETH.

It has never been the same again.

Fast-forward a few weeks later, the regulator is expected to finally greenlight the launch and trading of several spot Ethereum ETFs.

Most analysts think this product will go live on July 23.

Ahead of this, Ethereum prices are firm above $3,300, with analysts expecting even more gains above 2024 highs weeks after spot Ethereum ETF launches.

Grayscale To Maintain High ETHE Fees

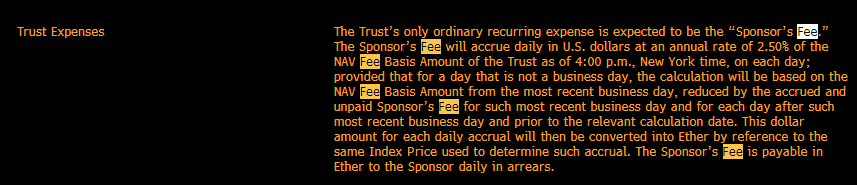

Before this derivative goes live and ETH prices explode, Grayscale Investments, one of the world’s largest crypto asset managers, will not change its high management fee on its Ethereum Trust (ETHE). Investors are currently paying a 2.5% fee.

Interestingly, they decided not to budge despite planning to launch a new mini-trust with a significantly low management fee of 0.25% and an introductory fee of 0.12% in the first year.

Grayscale is now being criticized, especially after they divested 10% of ETHE shares into ETH days ahead of their mini-trust launch.

Investors complain that the 2.5% fee is hefty and remains a sore spot.

The management fee is also markedly higher than what Grayscale competitors are offering for the upcoming spot Ethereum ETFs.

For now, opinions vary on what could have made Grayscale stick with the higher fee.

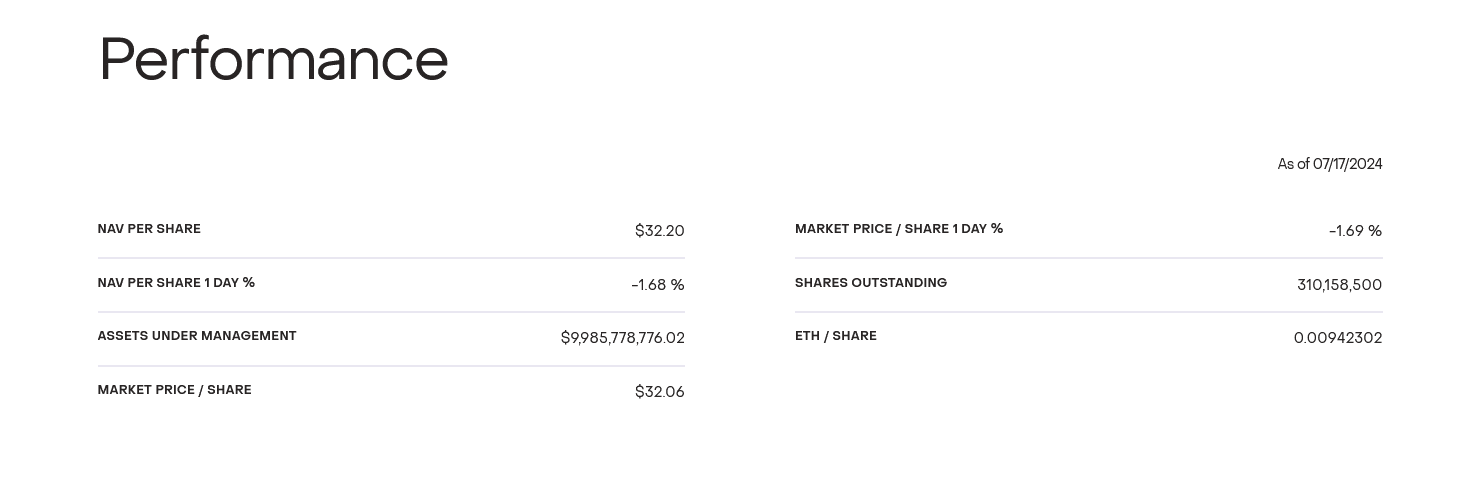

Some analysts think they are capitalizing on the higher ETHE AUM, which stands at nearly $10 billion. Launching the mini trust would be a strategy to funnel new investors eager to get exposure to ETH.

Will ETHE’s AUM Shrink After Spot Ethereum ETF Launch?

Though some investors might switch from ETHE to the Grayscale mini trust with lower fees, analysts think most ETHE investors will redeem their shares and opt for competitors.

For example, BlackRock plans to charge a management fee of 0.25%, with an even lower introductory rate.

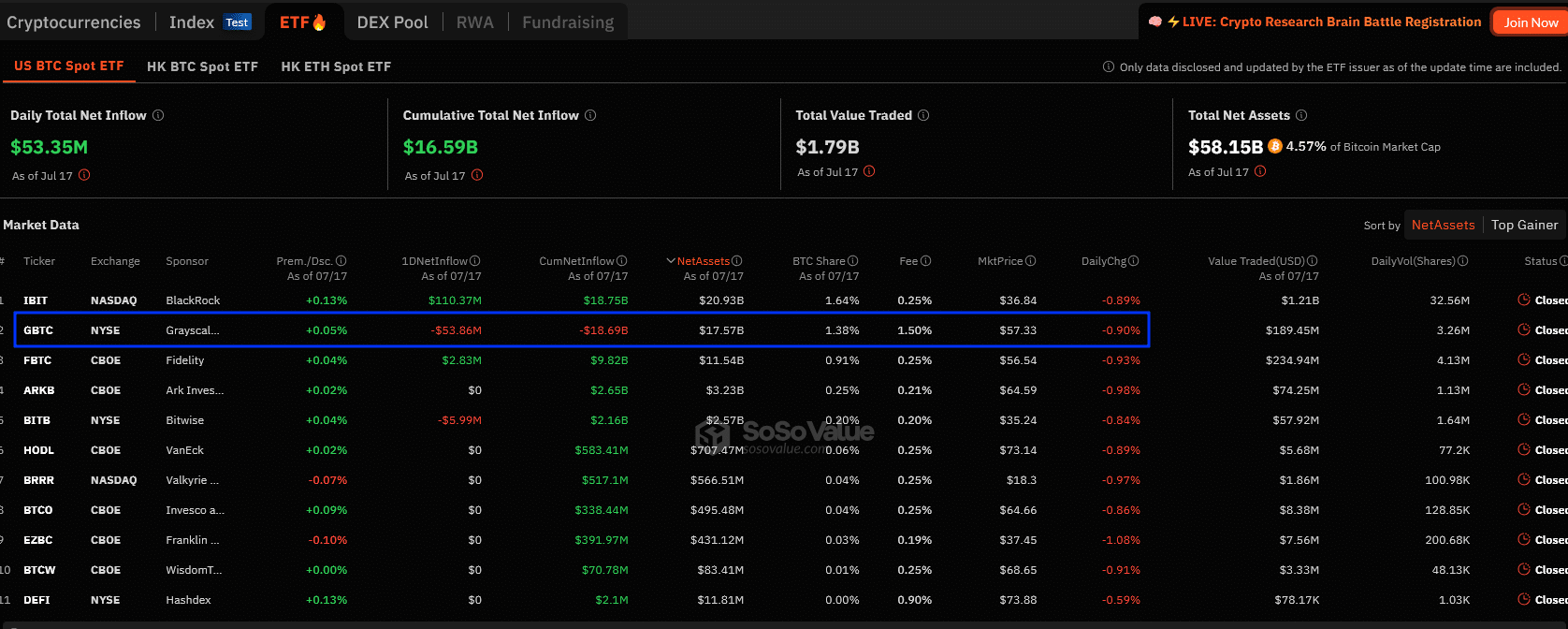

Ahead of the spot Ethereum ETF launch, massive outflows from ETHE are highly likely, just like what the Bitcoin community saw with GBTC.

Investors chose to redeem their GBTC shares and choose alternatives like Bitwise and Fidelity spot Bitcoin ETF primarily because of the higher fees charged by Grayscale.

EXPLORE: Top 5 Portfolio Trackers To Supercharge Your Returns in 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.