This Margex review is going to cover one of the top crypto derivatives trading platforms that offers its users up to 100x leverage. It supports 36 perpetual futures, allowing traders to go long or short at rock-bottom fees.

Learn how Margex compares with other exchanges, including fees, customer support, margin requirements, security, and available markets. My review is based on independent testing processes that aim to be impartial and without bias. This Margex review covers everything you need to know about the platform—let’s get into it.

Key Takeaways From My Margex Review

Here are five key takeaways from my Margex review:

- 36 Perpetual Futures: Margex offers 36 perpetual futures markets, including BTC, DOGE, XRP, and BNB. Perpetuals enable Margex users to go long or short 24 hours per day.

- Low Margin Requirements: Margex is ideal for traders on a budget, and those looking to amplify their existing bankroll. The minimum margin requirement is 1%, meaning up to 100x leverage.

- Competitive Trading Commissions: Margex users pay just 0.019% per slide when entering limit orders. A slightly higher fee of 0.06% is levied when placing a market order. Either way, these fees compare well with other derivative platforms.

- KYC is Optional: My Margex review found that accounts only require an email address. This means KYC documents aren’t required. However, accounts without KYC can only be funded with crypto.

- Copy Trading: One of the best Margex features is its copy trading tool. Put simply, users can copy an experienced derivative trader at their preferred stake. Any future positions will be replicated like-for-like.

Get a 20% Deposit Bonus with Margex

Use promo code 99BITCOINS when making a deposit to get a 20% deposit bonus for deposits above $100 in any currency. The bonuses can be used to offset trading commissions.

Visit MargexPros & Cons of Margex

Here are all the pros and cons I discovered during my Margex review process.

The main advantages of using Margex are access to high-leverage limits, short-selling facilities, and rock-bottom commissions. Not to mention copy trading features, advanced analysis tools, and the ability to trade anonymously.

However, some disadvantages should also be considered. Withdrawal requests are only processed once per day, and U.S. clients aren’t allowed to use the platform. Moreover, Margex doesn’t currently offer spot trading markets (coming soon), so you can’t own crypto coins directly—rather just bet on the price of crypto going up or down.

Let’s summarize Margex’s pros and cons:

Pros

- Go long or short on 36 perpetual futures markets

- One of the best no-KYC crypto exchanges

- Trade with a minimum margin requirement of 1%

- Trading commissions start from 0.019% per slide

- Users can copy experienced derivative traders like-for-like

- Great charting tools with technical indicators

Cons

- Doesn’t accept traders from the US

- Debit/credit card payments will trigger ID verification

- Lack of tier-one licensing is a risk

- Withdrawals are only processed once per day

- Users can’t own coins directly - derivatives only

What Is Margex?

Established in 2019, Margex is a crypto derivative platform located in the Seychelles. It offers 36 perpetual futures markets, including some of the best cryptocurrencies to buy. Bitcoin, Solana, Bitcoin Cash, XRP, Ethereum, Cardano, and SushiSwap are just some of the available markets. Perpetuals can be traded long or short 24/7.

Leverage of 20x and 100x is available, depending on the market. There are currently no spot trading pairs available at Margex, meaning you can’t directly own coins or tokens. On the contrary, Margex allows users to speculate on futures prices, just like any other derivatives exchange. This results in a cost-effective trading experience.

For example, commissions of just 0.019% per slide are paid when placing limit orders, and a commission of 0.06% is charged when placing market orders. The Margex crypto trading dashboard is ideal for technical analysts; it supports a full suite of drawing tools and indicators, and the chart can be customized to your liking.

Margex also supports copy trading. Users can pick an experienced derivatives trader, select an investment size, and automatically replicate their positions. This feature will appeal to time-staved traders as well as beginners. Staking yields are also available, with APYs of up to 5% on flexible terms. Customer support is available 24/7 via live chat and email.

My Methodology for Reviewing Margex

My most important criteria when reviewing Margex were impartiality, accuracy, and honesty. This ensures my Margex review is valid and credible, allowing you to make an informed decision on whether it’s a suitable trading platform. The only way to achieve these goals was to personally register an account and test every aspect.

This included depositing crypto and fiat money, allowing me to test the overall payment experience. I also tested the Margex trading dashboard, covering both demo and real-money funds. This included using drawing tools and technical indicators and placing market and limit orders. Market depth and prices were compared with other perpetual platforms.

Trade execution speeds and latency times were analyzed across various sessions. I also verified trading commissions, average spreads, and supported markets. Not to mention leverage limits for each futures contract. Withdrawal times, customer service, and bonuses were also analyzed in great depth.

Which Cryptos Does Margex Offer?

My Margex review found that 36 crypto pairs are supported. Each is traded against USD, which aligns with the market standard. All 36 trading pairs are traded as perpetual futures, allowing users to enter long or short positions.

Although the most popular cryptocurrencies are supported, 36 markets are on the low side—especially when compared with other derivative platforms. For example, as per CoinMarketCap data, Binance, Bybit, and OKX list 346, 370, and 218 derivatives markets respectively.

What’s more, these platforms not only offer perpetuals but also delivery futures, options, and spot trading.

Nevertheless, here are the 36 crypto trading pairs available on Margex:

- BTC/USD

- ETH/USD

- BNB/USD

- XRP/USD

- LTC/USD

- EOS/USD

- ADA/USD

- SOL/USD

- UNI/USD

- MATIC/USD

- LINK/USD

- BCH/USD

- APT/USD

- DOT/USD

- AVAX/USD

- APE/USD

- ETC/USD

- SUI/USD

- ATOM/USD

- MANA/USD

- XMR/USD

- SUSHI/USD

- LINA/USD

- OP/USD

- ARB/USD

- MTL/USD

- CFX/USD

- DOGE/USD

- 100KPEPE/USD

- 1KSHIB/USD

- COMP/USD

- FIL/USD

- CRV/USD

- AAVE/USD

- NEAR/USD

- AUDIO/USD

Margex’s Top Features

Having tested the Margex exchange extensively, I’ll now discuss its top features.

Perpetual Futures

Perpetual futures are the primary financial instrument available on the Margex exchange. Therefore, understanding how perpetuals work will help you assess whether Margex is suitable.

- In simple terms, perpetuals are similar to delivery futures, as they allow you to speculate on crypto prices without owning the underlying asset.

- Moreover, perpetuals allow you to enter buy or sell orders.

- Placing a buy order means you believe the price will increase.

- Placing a sell order means you believe the price will decline.

However, perpetuals don’t come with an expiry date like delivery futures. This offers traders more flexibility, as the trade won’t be closed until you’re ready.

Low Margin Requirements

Margex has some of the lowest margin requirements. This is, in percentage terms, the amount of capital that needs to be put up as collateral.

- For example, the margin requirement when trading Ethereum is 1%.

- So, let’s say you want to trade $5,000 worth of Ethereum.

- A 1% margin requirement means you’d only need $50 in your account.

Similarly, you now want to trade Cardano. You're super-bullish so you want to enter a large buy order. The minimum margin requirement on Cardano is 2%. You enter a $50,000 order. At 2%, you only need an account balance of $1,000.

Each supported market has a minimum margin requirement, which, depending on the pair, can range from 1% to 5%.

Be careful not to trade with too much leverage as a beginner. Like any crypto futures trading platform, Margex will send you a margin call if the position approaches liquidation.

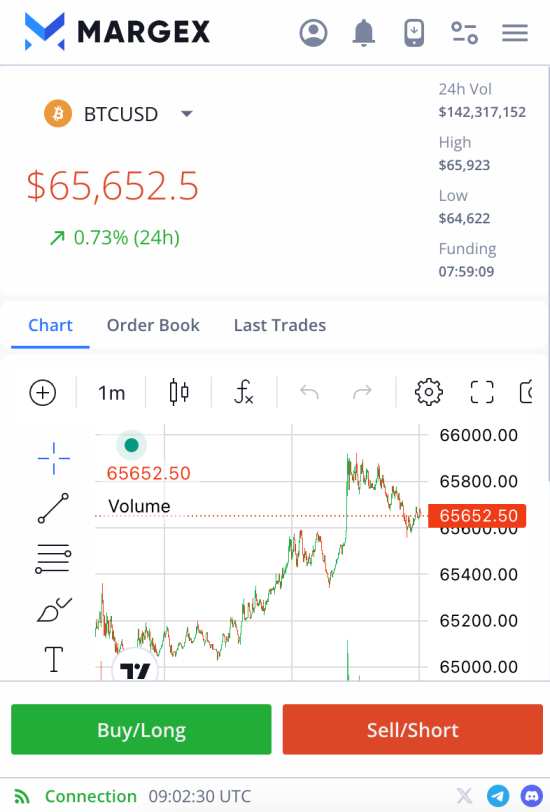

Trading Dashboard

While Margex offers a user-friendly trading dashboard, it's also suitable for advanced traders. Orders are set up to the left of the pricing chart. Traders can choose between cross and isolated margins, their required leverage multiple, and the order size. There's a slider to streamline investment sizes.

For example, you can move the slide to 25%, meaning you want to use 25% of your existing balance. Once an order is placed, it's neatly displayed beneath the pricing chart. Margex's dashboard can be customized, and drawing tools, text, and lines are supported.

Short-term time frame frequencies range from 1 minute to 30 minutes. Long-term time frames, on the other hand, range from 1 hour to 1 month. The pricing chart can be enlarged for an even smoother analysis experience. The live order book data is displayed to the right of the chart.

Demo Trading

I was impressed to see that Margex has launched a demo trading facility. No account is required—which is certainly a smart move. After all, new customers can test Margex’s charting area without needing to complete any registration forms.

The demo account offers a realistic digital asset trading experience. This means all metrics—such as order books, prices, market depth, and volatility—mirror live market conditions. The demo account also offers unfettered access to the charting screen, including technical indicators.

Copy Trading

While it can be tempting to dive straight in and trade perpetuals with high leverage, it's often best to leave things to the experts. This is where the Margex copy trading tool can help. It enables users to trade perpetual futures on autopilot.

This is because you'll be copying an experienced perpetual trader. Any buy or sell orders placed will be mirrored in your own Margex account. You can choose your investment stake, ensuring that budgets of all sizes are catered for.

For example:

- You have chosen a trader and decided to invest $2,000.

- The trader places a short-selling order on BCH/USD. They put up an initial margin of 5%.

- You replicate the same position, with the only difference being the stake. You risk 5% of your $2,000 investment, so your BCH/USD short order is worth $100.

- The trader closes the position and makes 60%.

- You also made 60% but on a $100 trade. Therefore, you passively made a profit of $60.

Traders taking part in the copy trading program earn a revenue share on profitable positions. It’s up to the trader how much they charge. But you can check this before you start following them. Some traders charge just 20% while others 50%.

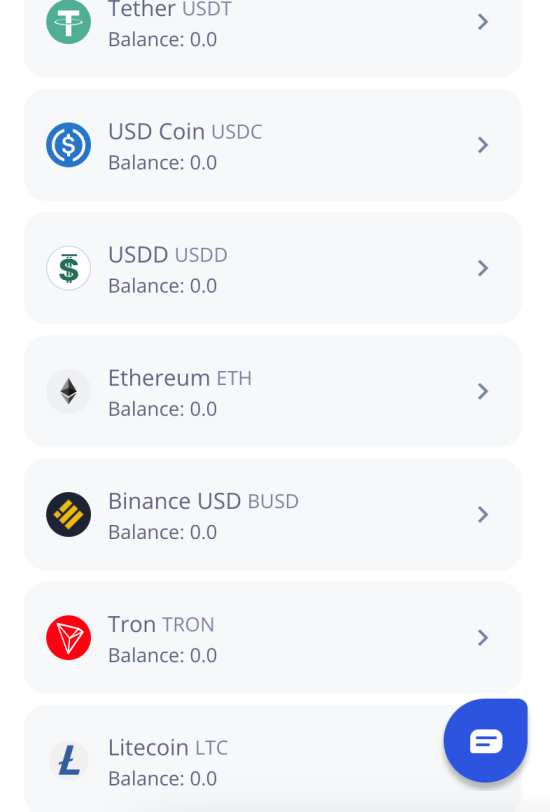

Flexible Staking

Margex offers flexible staking pools for five cryptocurrencies. This enables users to earn daily rewards without locking the coins away. APYs on USDT and USDC are 5%.

Ethereum staking pays 4.7%, while Bitcoin and Chainlink have APYs of 3% Moreover, the coins being staked are still available in the equity balance. This means they can be used as an initial margin when placing trading orders.

For example, suppose you’ve staked $2,000 worth of Bitcoin. You can use that $2,000 to trade while earning APYs of 3%.

Margex Fees & Commissions

My Margex review found that trading fees are competitive. Commissions have been simplified - there are just two rates to consider.

- Limit Orders: 0.019%

- Market Orders: 0.06%

Limit orders offer the lowest commission rate of just 0.019%. This is because limit orders provide the Margex exchange with liquidity. This means you’re a market maker, so favorable pricing is more favorable.

Seasoned traders prefer limit orders anyway, as they enable you to choose the execution price. The commission is multiplied by the total trade amount.

- For example, let’s say you risk $1,000 on an XRP/USD long order.

- You apply leverage of 50x, meaning the total crypto trading value is $50,000.

- The 0.019% commission on $50,000 is just $9.50.

- You close the trade when it’s valued at $60,000.

- A 0.019% commission is charged on that $60,000, so that’s $11.40.

If you want to buy or sell perpetual futures instantly, a market order is more appropriate. The trade will be executed at the next best available price.

This means you’re using liquidity from existing limit orders. The commission on market orders is also charged at both ends of the trade. However, the commission is higher at 0.06%.

Margin Trading Fees

It’s not possible to trade on Margex without margin and leverage. The minimum leverage multiplier is 5x, so every position requires borrowed funds. This will incur margin trading fees, like paying interest on a loan.

The specific fees are based on the perpetual contracts being traded, the crypto trading value, and current market conditions. Different fees are charged based on whether you’re long or short. Fees are displayed when creating an order to ensure full transparency.

Moreover, margin trading fees are charged every 8 hours at fixed intervals. There are three intervals per day: 8 am, 4 pm, and 12 am.

- For example, suppose you enter a trade at 10 am.

- This means you pay financing fees for the first session (8 am to 4 pm).

- If the trade remains open past 4 pm, you pay the next interval fee (4 pm to 12 am).

- As such, it can make sense to close a position before the next interval kicks in.

User Experience on Margex

Having tested every aspect of the Margex crypto exchange, I found the overall user experience to be positive. It took me less than a minute to register an account. I was only asked for an email address and a password. Margex sent me an email with a unique code. This was required to verify my email address. My account was then open and ready for funding.

I also found it seamless to deposit funds. Clicking on the 'Wallet' button offers two options; accounts can be funded with crypto or fiat money. Clicking the 'Trade' button reveals the Margex trading dashboard. Traders can choose the coin they want to trade from the left-hand portal. Customizing and analyzing pricing charts was also straightforward.

All aspects of the pricing chart are clearly marked, so it’s a great option for beginners who want to learn technical analysis. While I focused mainly on the desktop dashboard, I also tested the Margex mobile app. This also offers a great user experience. Although optimized for smaller screens, I had no issues navigating the platform.

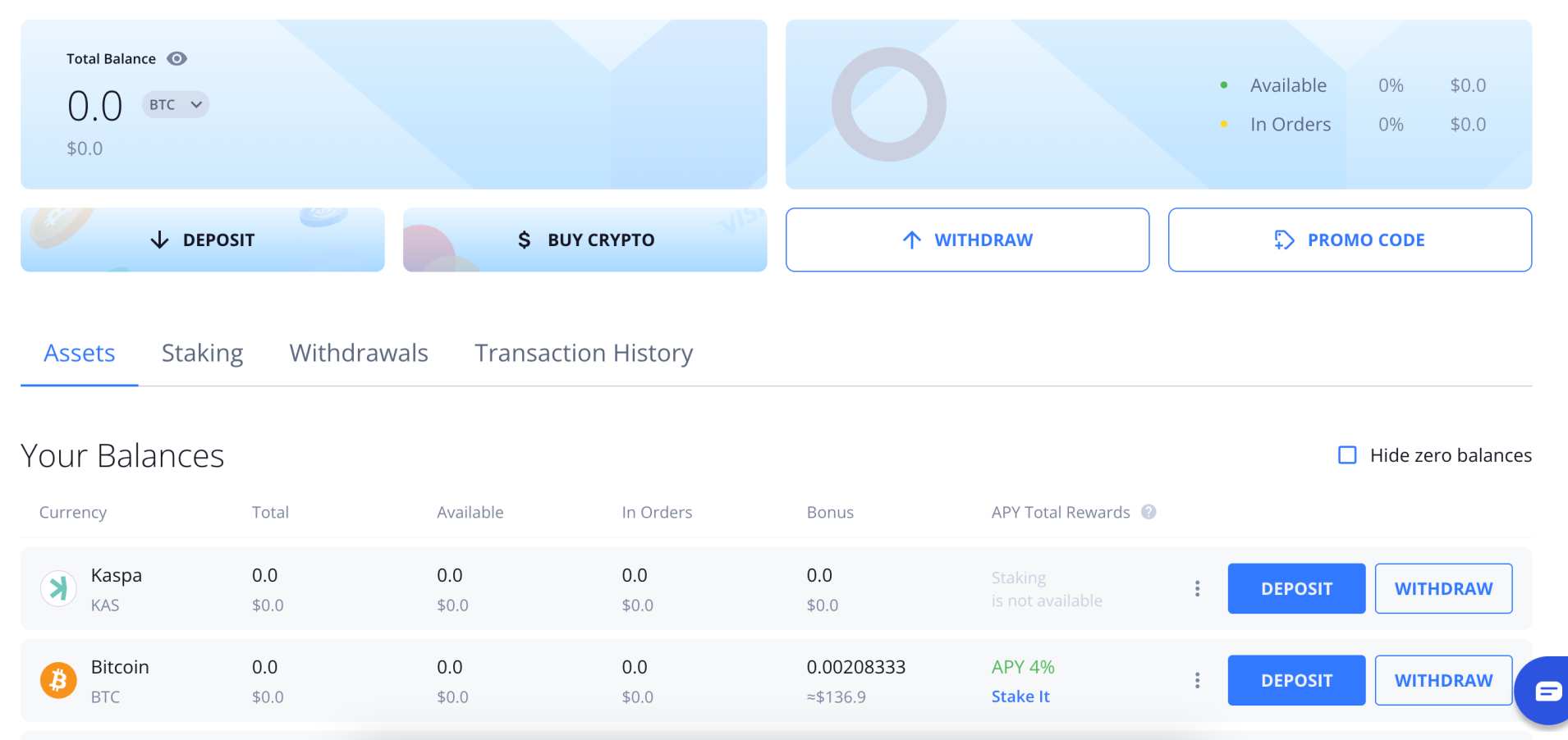

Margex Wallet

All Margex users have access to a custodial wallet. This means Margex is responsible for its contents, and that users don't have access to the private keys. Crucially, Margex keeps 100% of wallet funds in cold storage—so it's considered safe.

The Margex wallet displays each supported crypto asset. Clicking the 'Deposit' button next to the chosen coin reveals a unique wallet address. Transfer coins to this address to fund the Margex wallet.

The wallet also enables users to choose their preferred network. For example, suppose you want to deposit USDT. Available USDT networks include Ethereum, TRON, BNB Chain, Avalanche, Solana, and Polygon.

Wallet balances are updated after 1-3 blockchain confirmations. This means Bitcoin deposits take at least 10 minutes. Ethereum deposits are much faster—often taking less than 60 seconds. The deposit will remain pending until the required confirmations.

Users can also withdraw coins from the Margex wallet by clicking the 'Withdraw' button next to the respective coin. They can choose the network and amount and paste the receiving wallet address. Users can also stake coins from within Margex’s wallet by clicking the ‘Stake It’ button.

Does Margex Have a Mobile App?

Margex offers a mobile trading app for Android and iOS. The process is simple: Download the app from Google Play or the App Store and log in with your Margex credentials. You'll then see your account balance, and you can begin trading.

I found no issues with execution or latency speeds when placing orders. What's more, navigating between markets and analyzing pricing charts was seamless—even on smaller smartphone models.

One drawback is that the copy trading service has a separate Margex app, which is also available on Android and iOS. This means you’ll need to open the trading app to place orders manually.

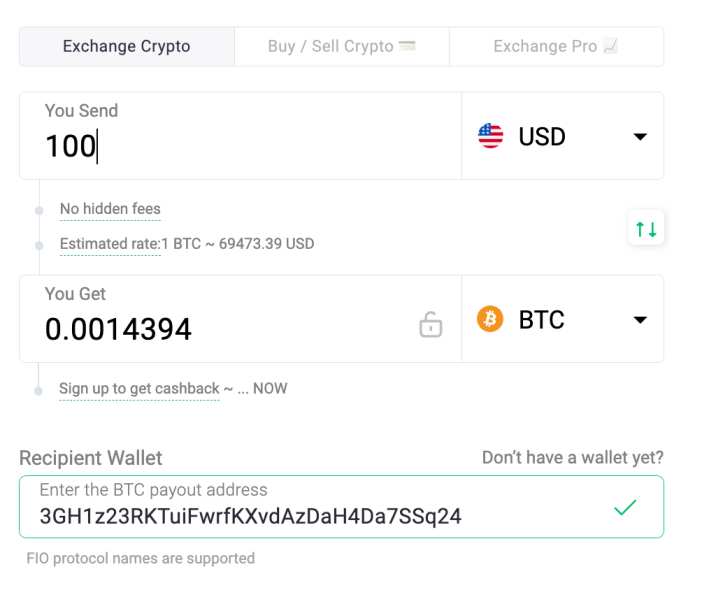

Margex’s Accepted Payment Methods

The best way to deposit funds at Margex is via crypto. As mentioned, users simply need to click the 'Deposit' button next to their preferred coin. Margex will generate a unique wallet address, which you'll need to transfer the coins to. No fees or minimums apply when depositing crypto.

Although Margex accounts can't be funded with fiat money, you can purchase coins with a debit/credit card. Only Visa and MasterCard are supported. The deposit is processed by ChangeNOW, Changelly, or Uniramp. The coins will be added to your Margex wallet after you complete the payment.

However, a quick KYC process is required when using fiat money. The minimum debit/credit card purchase is just $10, which will appeal to beginners. Fees are included in the exchange rate and determined by the on-ramp provider.

Withdrawal Speeds

Margex approves withdrawal requests once daily, between 12 p.m. and 2 p.m. (UTC). This will be a drawback for some users, as exchanges typically process withdrawals near-instantly.

Withdrawal Limits

Margex doesn't state any withdrawal limits, which is a huge advantage - especially for professional traders. However, there are withdrawal minimums. These vary widely depending on the coin being withdrawn.

For example, the minimum Solana withdrawal is just 0.1 SOL, which is approximately $14 based on current prices. However, the minimum Bitcoin withdrawal is much higher, at 0.002 BTC, which is about $130.

Margex Account Types

Margex offers only one account type: standard accounts, which are offered to all registered users. Corporate accounts aren't supported at the moment.

Margex Bonuses & Promos

My Margex review found that new users can claim a $50 sign-up bonus. This bonus is offered for every collateral currency. For instance, suppose you have USDT, Bitcoin, and Ethereum in your collateral accounts.

That's three $50 bonuses for each coin. No Margex promo code is needed - the bonus is automatically applied after making a deposit. The first deposit also triggers another $100 bonus for each coin. Do note that bonus funds are used to pay commission fees.

What's more, only the first 50% of each trading commission is eligible. So, suppose you've got $50 in your Ethereum bonus account. You open a trade and pay a $30 commission. 50%, or $15, will be deducted from your bonus account.

Is Margex Safe?

Safety should be your main priority when choosing the best Bitcoin exchange. In this section of my Margex review, I'll assess whether Margex is safe.

Licensing

Margex is an unregulated exchange, meaning it doesn't hold any licenses and isn't accountable to any government bodies. While I prefer regulated platforms, this does offer some advantages.

For instance, accounts can be opened without KYC, and high leverage levels are available to all users. This typically isn't possible when using a regulated exchange, especially at 100x leverage.

Security

While Margex falls short in the licensing department - it offers institutional-grade security features.

This includes:

- Cold Storage: All coins and tokens held in the Margex Wallet are kept safely in cold storage. This protects your balance from hacking attempts. Digital assets are only transferred to hot wallets between 12 pm and 2 pm. This is to cover client withdrawals.

- 2FA: Margex supports two-factor authentication (2FA) via Google Authenticator. This means your account is safe even if your login credentials are compromised. After all, your credentials are worthless without the 2FA code—which can only be accessed from your smartphone.

- Email Confirmations: Withdrawal requests not only require a 2FA code but also an email confirmation. You can also set up email notifications for other account functions, such as sign-ins and deposits.

- SSL Encryption: Another important safeguard is Secure Sockets Layer (SSL) encryption. This ensures data is encrypted between your device and Margex's servers. This keeps your data private. : Wi

- Delayed Withdrawals: We mentioned earlier that Margex withdrawals are processed once per day, which could be a drawback for some. However, this is also an additional security feature. If the unlikely happens and your account is compromised, you might still have time to flag this to the Margex security team. This could be the difference between saving or losing the account balance.

Fund Protection

Margex is an unregulated platform, so there are no client fund protection schemes in place. This is why it's crucial to activate 2FA immediately.

Margex Customer Support & Service

I couldn't finalize my Margex review without testing its customer support system. Margex offers customer support 24 hours per day, 7 days a week. While email support is also available, the best support method is live chat.

Just click the chat icon on the Margex website or app. You'll initially be connected with a bot—so you must select the account query (e.g. deposits or trading conditions). You will then be added to the live chat queue. I was told waiting times would take 3 minutes. However, I was connected within 60 seconds.

Responses were prompt and professional. That said, I also found that most account queries can be found in the help section. This covers everything from deposit and withdrawal time frames to bonus terms and available margin rates.

How to Open a Margex Account

Here's a quick overview of how to open a Margex account:

- Click the 'Sign Up' button from the Margex homepage.

- Type in an email address and choose a password. The latter must be at least 30 characters and consist of one lowercase and uppercase letter plus a number.

- Click the 'Register' button.

- Open your email inbox and look for Margex's verification email.

- Copy and paste the unique code.

And that's it—your Margex account is open and ready to be funded.

Conclusion

Overall, I found that Margex is a solid exchange if you're looking to trade crypto with leverage at competitive fees. It supports 36 perpetual futures, covering everything from Bitcoin and XRP to Litecoin, Avalanche, and Dogecoin.

Margex is also ideal for day traders, as both long and short positions are supported. However, it falls short in some areas, including a lack of regulation and an inability to trade spot markets.

FAQs

Is Margex trustworthy?

Margex is an unregulated crypto exchange, but its security features are solid. These include keeping 100% of client coins in cold wallets, 2FA, SSL encryption, and email notifications.

Is Margex allowed in the US?

No, Margex doesn't accept traders from the US.

How long does it take to withdraw from Margex?

Margex approves withdrawals once per day between 12 pm and 2 pm (UTC).

What are the fees on Margex?

In addition to funding fees, Marges charges a trading commission of 0.019% on limit orders. And 0.06% on market orders.

Is Margex suitable for beginners?

The Margex trading platform is user-friendly, although beginners might be best to start with the demo account. Alternatively, beginners can use the copy trading feature to replicate an experienced trader like-for-like.

Can anyone use Margex?

Margex is available in all countries apart from the US, Seychelles, Bermuda, Cuba, Crimea, Sevastopol, Iran, Syria, North Korea, Sudan, and Afghanistan.

References

- Avoiding and managing margin calls (Fidelity)

- Basics of Futures Trading (Commodities Futures Trading Commission)

- 3 Order Types: Market, Limit, and Stop Orders (Charles Schwab)

- What is SSL? (Cloudflare)