The best no KYC crypto exchanges allow you to trade anonymously. This means no personal information or ID verification documents.

Not all no KYC exchanges are safe, so read on to discover the top providers. In addition to security and trust, we rank anonymous exchanges for fees, supported coins, and trading tools.

List of the 15 Best Non KYC Crypto Exchanges

Consider one of the no KYC crypto exchanges listed below when trading anonymously:

-

- Best Wallet – Versatile no KYC crypto exchange and wallet

- Margex – Top no KYC exchange supports leverage trading and perpetual contracts

- Exodus – Premier no KYC exchange with a versatile wallet, supporting extensive crypto and network options

- BingX – Great option for day traders with short selling and 150x leverage

- BloFin – Streamlines high-leverage trading without initial KYC, enabling withdrawals up to $20K

- KCEX – New on the scene, offers effortless trading of spot and futures without KYC for basic-level transactions

- Changelly – Withdraw up to 1 BTC daily without ID verification checks

- CoinEx – KYC-free accounts with 24-hour cash-out limits of 10,000 USDT

- ChangeNOW – Facilitates unlimited crypto swaps without KYC, with a focus on simplicity and quick transactions

- Switchere – Allows easy crypto purchases up to $13K without KYC, supported by multiple global payment methods

- OKX DEX – The overall best crypto exchange, no KYC

- MEXC – Trade over 2,000 crypto tokens at just 0.01% per slide

- ByBit – Access over 400 cryptos as well as margin and derivative products

- Jupiter – Access brand-new Solana meme coins before they blow up

- Gate.io – Over 1,700 markets and 100,000 USDT daily withdrawal limits

Reviewing the Top No KYC Exchanges for 2024

KYC requirements are just one aspect to consider when selecting an exchange. Crypto traders should also assess safety and security, tradable pairs, commissions, and other important metrics.

We’ll now take a much closer look at the no identification crypto exchanges listed above for those that want to buy crypto with no KYC.

1. Best Wallet – Overall Best No KYC Exchange in 2024

Best Wallet is one of the best choices if you’re looking to buy crypto without KYC. This decentralized exchange has developed a user-friendly app for iOS and Android. Best Wallet is suitable for beginners and experienced traders alike. The app offers two primary products: a decentralized exchange and a wallet. There is no requirement to register an account, so you’ll have complete anonymity.

Best Wallet uses market-leading liquidity pools to offer a smooth and cost-effective trading experience. It supports all ERC-20 and BEP-20 tokens, covering everything from ETH and BNB to USDT and DAI. Traders get the best exchange rate at the time of the swap; Best Wallet doesn’t add a markup to the spread.

Additional networks will be supported in the future, including Bitcoin and Solana. What’s more, some Best Wallet features are still being developed, including token analytics, market insights, and news feeds. Nonetheless, we like that the in-built wallet offers non-custodial storage with two-factor authentication and biometrics.

Pros

- True privacy on a decentralized exchange

- Supports all ERC-20 and BEP-20 tokens

- Obtains market-leading prices from liquidity providers

- Also offers a non-custodial wallet

Cons

- Yet to support Bitcoin or Solana

- Many features are still being developed

2. Margex – No KYC Exchange Supports Leverage Trading and Perpetual Contracts

Margex operates in more than 150 countries and is used by over 500,000 traders. It not only offers a safe and private means to trade crypto but is also cost-effective. Market takers pay just 0.06% in trading commissions. That’s just $0.60 for every $1,000 traded.

Our Margex review shows that this exchange is a great option for trading crypto with leverage. You’ll get 100x leverage on major cryptocurrencies like Bitcoin, Ethereum, and BNB. Margex offers up to 50x on other popular coins, such as Bitcoin Cash, Polygon, Cosmos, and Polkadot. This means you can trade with considerably more than you have in your Margex account.

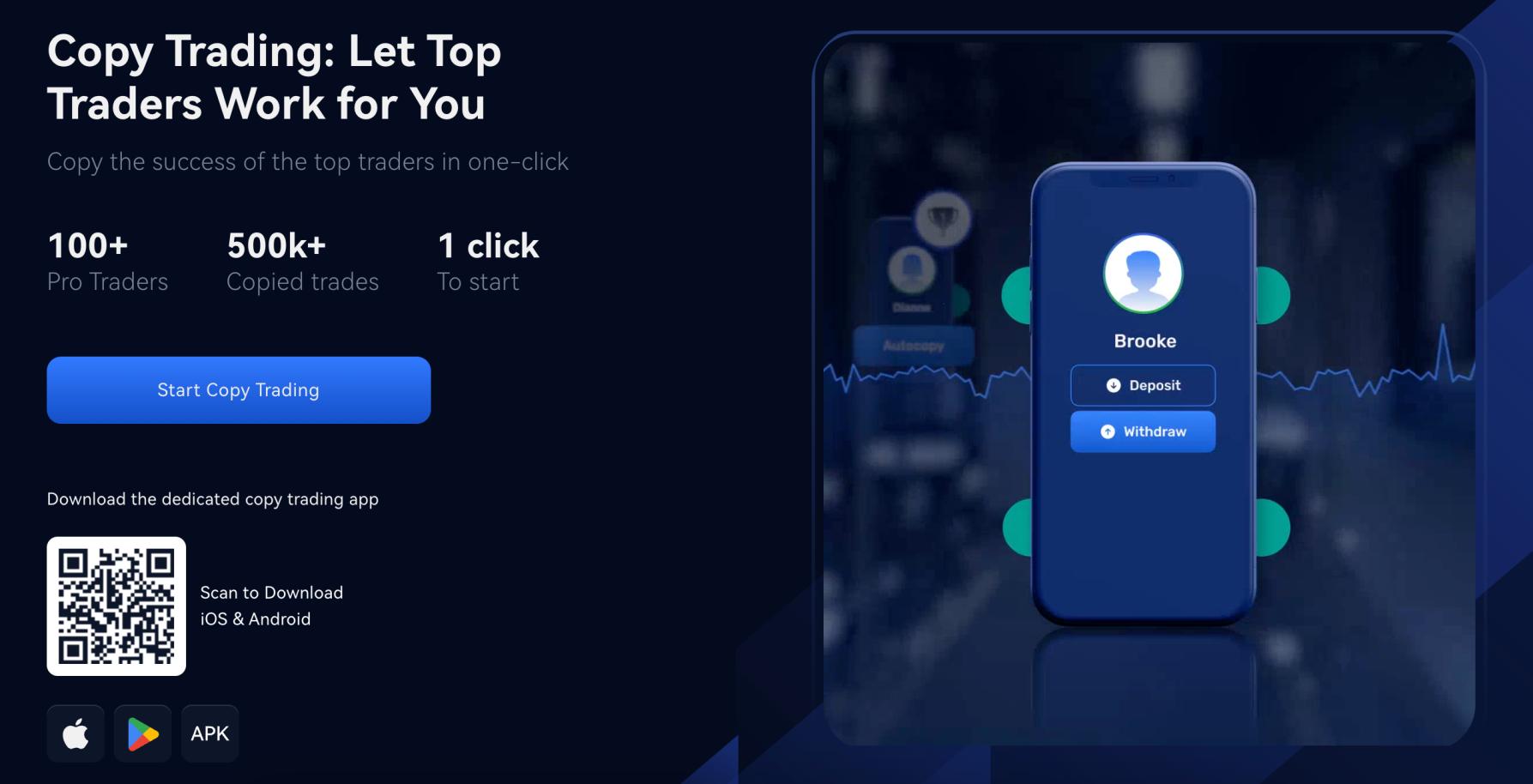

We also like that Margex offers perpetual futures. This enables traders to go long or short on all supported markets. Margex also offers copy trading tools. This is a passive investment feature that enables you to copy experienced crypto traders. However, Margex has smaller trading volumes than other no KYC crypto exchanges. What’s more, it doesn’t accept US clients.

Pros

- Offers leverage of up to 100x

- Supports perpetual futures

- Copy trading tools for passive investing

- Trade online or via the Margex app

Cons

- Doesn’t accept US clients

- Lower trading volumes than other platforms

We have a dedicated Margex Review for any readers wanting to learn more about the crypto platform.

3. Exodus: Top Choice Among Best No KYC Crypto Exchanges

Founded in 2015, Exodus is a crypto wallet that allows you to buy, sell, manage, and store a wide range of crypto assets. It also enables swapping between thousands of assets across over 50 networks, including Ethereum, Solana, and BSC, ensuring you can easily find your favorite coin.

Crypto purchases on Exodus are supported via USD and other local currencies through third-party providers such as PayPal, Robinhood Connect, MoonPay, Blockchain.com Pay, Sardine, and Ramp. These platforms facilitate buying crypto using debit/credit cards, bank accounts, Apple Pay, and Google Pay. However, the availability of payment methods varies by jurisdiction, and the fees tend to be high, though the process is generally quick and easy.

A major advantage of using Exodus is the ability to download its app on both desktop and mobile or to access its services directly from your Chrome browser by providing only basic identifying information. These services include managing NFTs and multiple portfolios, exploring Web3, and staking crypto. Security at Exodus is robust, as it is a self-custodial wallet. This means Exodus does not have access to your private keys or secret recovery phrase, eliminating the risk of losing your funds due to hacks or bankruptcy.

Pros

- Supports a wide range of cryptocurrencies

- Integrated with Trezor hardware wallet

- Portfolio management tools

Cons

- Higher fees compared to some exchanges

- Not fully open-source

4. BingX – Great Option for Day Traders With Short Selling and 150x Leverage

We found that BingX is one of the top no KYC crypto exchanges for day traders. It offers a full suite of tools that enable traders to make smart decisions. This includes high-end charts with TradingView integration. Charts are fully customizable and come packed with technical and economic indicators. Not to mention drawing tools like the Fibonacci retracement.

BingX also offers short-selling capabilities via perpetual futures. Traders can also apply leverage of up to 150x. This boosts a $100 account balance to $15,000. More than 700 crypto tokens are supported by BingX. This includes some of the best meme coins to buy, such as dogwifhat, Shiba Inu, Dogecoin, and Bonk.

However, this is another no KYC exchange that’s aimed at experienced investors. There is an overwhelming range of tools, features, and markets – which can be intimidating for beginners. Nonetheless, we like that BingX offers competitive trading commissions. Market takers pay just 0.1% per slide.

Pros

- A great option for crypto day traders

- Go long or short on hundreds of markets

- Access leverage of up to 150x

- Buy and sell crypto at just 0.1% per slide

- Offers peer-to-peer funding methods

Cons

- Rated 2.6/5 on Trustpilot

- Reports of long waiting times for live support

5. BloFin: Leading No KYC Crypto Exchanges for Secure Trading

This centralized crypto exchange (CEX), BloFin, offers liquidity, convenience, and advanced trading options. Here, you can trade the spot market or trade on leverage as high as 150x, allowing you to potentially amplify your gains. BloFin features futures trading, copy trading to learn from experienced traders, and bot trading, currently supporting only Signal Bot with options to vote for new additions.

When it comes to KYC, registration is straightforward, and no verification is required for withdrawals up to 20K USDT. To withdraw beyond this limit, you must verify your personal information and address to increase your limits to one million and two million USDT, respectively. BloFin uses two main fiat gateways, Simplex and Alchemy, which makes buying crypto more expensive. However, trading fees for both makers and takers are just 0.1% for 30-day volumes below $1 million.

For security, BloFin ensures localized compliance and has partnered with the digital asset custodial service provider Fireblocks to offer insurance coverage. It has also partnered with AnChain.AI for its Know-Your-Transaction solution to safeguard user assets.

Pros

- Wide range of investment products

- Fund safety via institutional custody provider Fireblocks

- Flexible and fixed staking services for USDT, BTC, and ETH

Cons

- Relatively new in the market

- Lack of regulatory clarity

6. KCEX: Your Gateway to Easy No KYC Crypto Trading

This relatively new centralized crypto exchange, KCEX, was launched last year and is still establishing its authenticity and resilience compared to more established platforms.

Like BloFin, KCEX enables trading in both spot and futures markets, covering a wide range of crypto assets such as BTC, ETH, SOL, SHIB, DOGE, PEPE, and TRB, with leverage options up to 100x. Designed to cater to both beginners and professionals, KCEX is accessible via a mobile app, featuring a clean interface and effortless navigation for a seamless experience.

However, BloFin lacks staking support, and the advanced trading tools typically found in more popular CEXs, although new users can benefit from a lucrative welcome bonus. The fee structure is competitive, with futures takers charged at 0.02%, while spot trading and futures maker fees are zero.

For security, KCEX claims to use cold wallets to store 100% of its assets. Additionally, it provides 24/7 multilingual customer support to address any user concerns.

Pros

- A nice variety of cryptocurrencies

- Low trading fees

- Regular promotions and bonuses

Cons

- No staking or advanced trading tools

- Lack of educational resources

7. Changelly – Withdraw up to 1 BTC Daily Without ID Verification Checks

Changelly is a popular non KYC crypto exchange that was launched in 2015. It supports Bitcoin and over 500 altcoins, including Shiba Inu, Solana, Ethereum, Monero, and Cardano. Traders can swap any supported coin instantly. Changelly obtains market prices from over 20 liquidity providers. This ensures traders get the best price possible.

However, Changelly adds a 0.25% markup on swaps, which is more than other providers. Nonetheless, we like that Changelly offers a KYC-free experience. As long as you don’t need to withdraw more than 1 BTC per day, you can buy and sell cryptocurrencies anonymously. These limits should suit the majority of traders.

Changelly is also one of the best no KYC crypto exchanges for beginners. It offers a smooth and simple trading experience on desktop and mobile devices. The latter includes a mobile app for iOS and Android. We also like that Changelly never stores client-owed funds. Cryptocurrencies are sent straight to your stated wallet address after transacting.

Pros

- One of the best options for beginners

- User-friendly experience on desktops and mobiles

- Withdraw up to 1 BTC daily without KYC requirements

- Supports some of the best altcoins

- Established in 2015

Cons

- Adds a 0.25% markup on swaps

- Doesn’t offer a native crypto wallet

8. CoinEx – KYC-Free Accounts With 24-Hour Cash-Out Limits of 10,000 USDT

CoinEx is another top-rated non KYC exchange. It enables traders to open an account with an email address only. Thereon, you can withdraw up to 10,000 USDT every 24 hours without ID verification. CoinEx supports a huge range of markets. This covers over 960 coins and 1,400 pairs.

What’s more, CoinEx makes it simple to find trading opportunities. It displays markets based on a range of metrics, such as ‘top searches’, ‘top gainers’, and ‘new coins’. Clicking on a coin reveals real-time market data. CoinEx also supports perpetual futures. This includes linear and inverse contracts, which are aimed at experienced traders.

Other features include smart trading tools, loans, and liquidity provision. The latter offers a 50% share of trading fees when supplying liquidity. That said, we found that fees are slightly more expensive than other no KYC exchanges. For instance, you’ll pay 0.2% per slide on spot trading commissions. Futures are also above the market average, with CoinEx charging 0.05%.

Pros

- No KYC when withdrawing less than 10,000 USDT per day

- Only an email is needed to get started

- Supports over 900 coins and 1,400 tradable pairs

- Offers spot trading and perpetual futures

- Earn a share of trading fees when supplying liquidity

Cons

- Lower trading volumes than other non-KYC crypto exchanges

- Trading fees are above the market average

9. ChangeNOW: Simplifying Crypto Swapping Without KYC Verification

If you’re looking to enjoy limitless crypto swaps without undergoing KYC, ChangeNow might be the perfect fit. This exchange service enables you to buy, sell, and swap tens of thousands of crypto assets with over 50 fiat currencies via credit card or bank account, all within minutes. You simply select your currency, make a deposit, and receive your crypto—starting from as little as $2, making it highly accessible.

While registration is not required on ChangeNow, creating an account allows you to save on fees for off-chain swaps, earn cashback on every transaction, and perform AML address checks. As a non-custodial platform, you retain exclusive access to your funds, ensuring both security and privacy.

ChangeNow offers simple and fast crypto exchanges accessible on both desktop and mobile. Additionally, you can stake your crypto to earn passive income and explore dApps via its NOW Wallet with WalletConnect. The platform’s native token, NOW, is used for payments, airdrops, staking, and discounts within the ecosystem. With a market cap of $10 million, the token is burned quarterly to sustain its value.

Pros

- No account registration required

- Instant exchanges with no limits

- Support for hundreds of crypto

Cons

- Higher fees compared to some competitors

- No advanced trading features

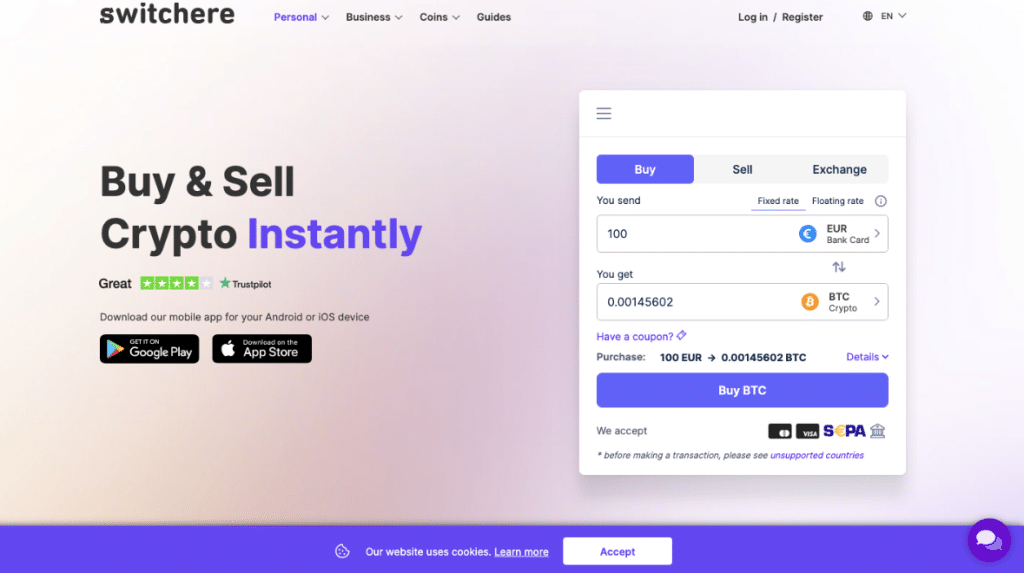

10. Switchere: Among the Best No KYC Crypto Exchanges for Small Purchases

This licensed crypto exchange, Switchere, provides a convenient and instant way to buy and sell digital assets using credit cards, SEPA, SOFORT, and local Asian banks. Users simply select the desired amount, enter account details, and receive crypto in their wallets with just basic verification. However, purchases exceeding $13k require identity verification and address proof. To eliminate this limit, proof of income must be submitted.

The Switchere crypto app offers a sleek web and mobile platform for the smart management of your coins, supporting 30+ coins and multiple blockchains such as ERC20, TRC20, BEP20, SOL, and POL networks. The app is accessible in popular web browsers like Chrome, Firefox, Opera, Edge, and Safari, allowing you to buy, sell, send, receive, and store crypto assets and make instant transactions.

By downloading the Switchere app, you can also use it as your personal crypto wallet and enjoy fast and efficient swaps at the best exchange rates with no hidden fees. For security, the platform employs two-factor authentication, a 3D secure protocol, and high-end encryption technology. Additionally, round-the-clock customer service is available in over ten languages.

Pros

- No KYC for small transactions

- Transparent fee structure

- Supports fiat & multiple payment methods for crypto purchases

Cons

- Limited cryptocurrency options

- Higher fees for larger transactions

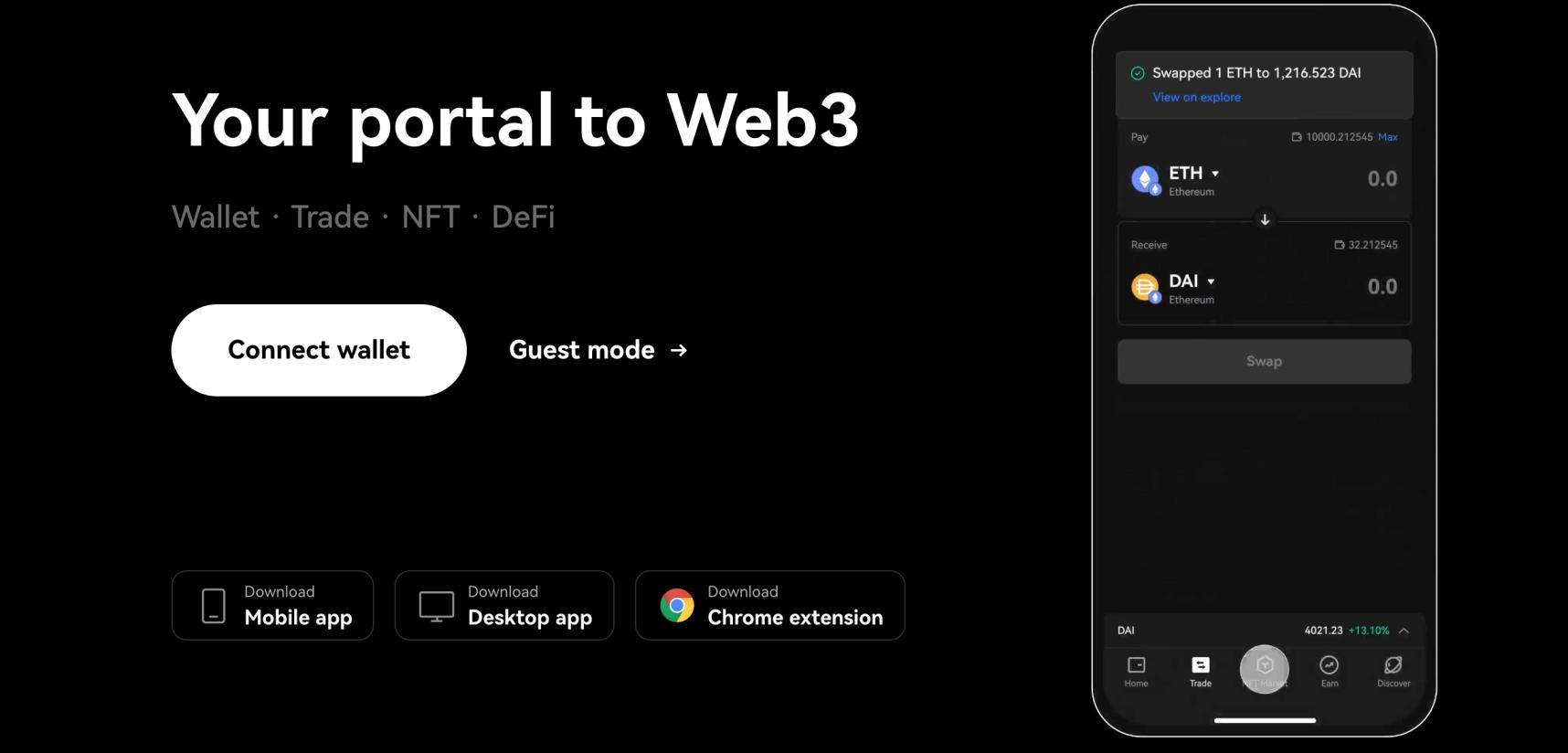

11. OKX DEX – One-Click Trading Across 70 Blockchain Networks With a Pricing Aggregator

OKX is our choice for the best no KYC exchange in 2024. No account requirements are in place. Traders can connect a wallet and access thousands of tokens from over 70 blockchain networks, including Bitcoin, Solana, Optimism, Polygon, BNB Chain, and Ethereum.

OKX has developed a bridge aggregator that connects with over 400 other exchanges. This means you’ll get the most competitive exchange rates when trading. The purchased tokens will be deposited in your connected wallet in seconds. We also like that OKX offers decentralized earning tools.

This will appeal to long-term investors who want to generate passive income from their holdings. Simply search for a token and choose the most suitable tool, such as staking or yield farming. OKX also offers a decentralized wallet, which comes as desktop software and a mobile app.

Pros

- The best no KYC exchange for crypto traders

- Trade thousands of tokens from over 70 network standards

- Connects with over 400 DEX aggregators

- Get the best price possible when trading tokens

- Offers competitive APYs on staking and yield farming

- Also offers a desktop and mobile wallet

Cons

- Using the main OKX exchange requires KYC

- Slippage adjustments are required on some trades

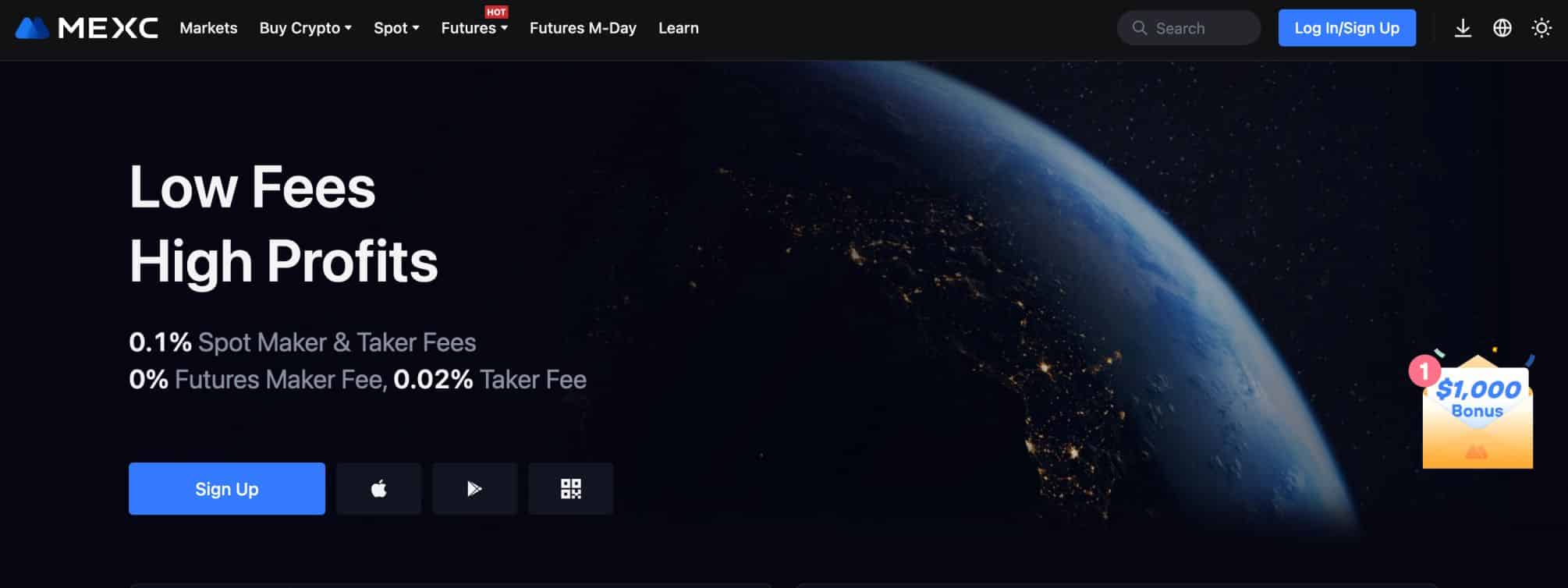

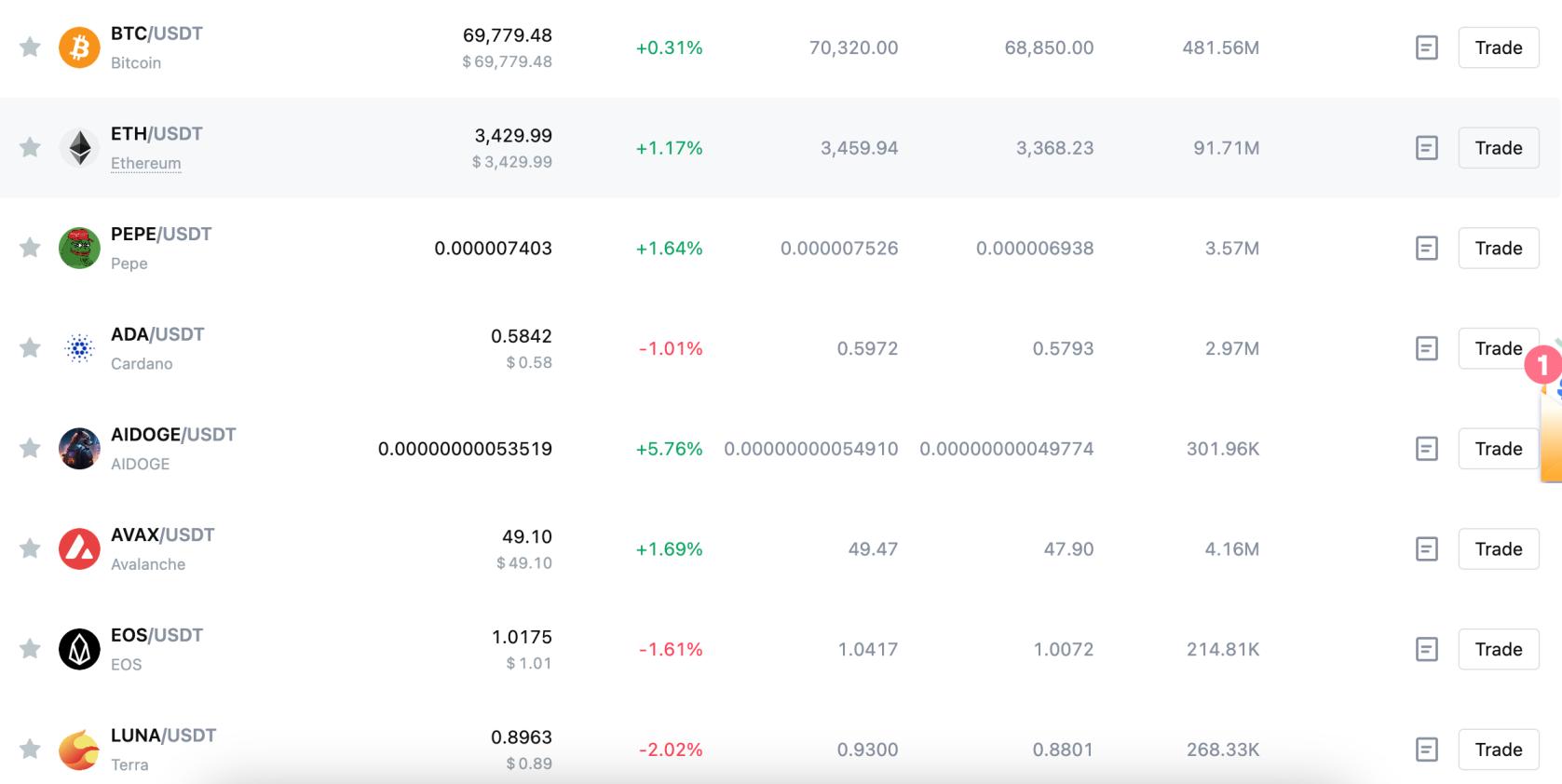

12. MEXC – Trade Over 2,000 Crypto Tokens at Just 0.01% per Slide

MEXC is also a top-rated no KYC crypto exchange. It’s considered a tier-one platform with significant trading volumes and liquidity levels. MEXC is also a safe exchange with proven reserves. We like that MEXC supports more than 2,000 crypto tokens, so you’ll never be short of trading opportunities.

This includes a great range of small, medium, and large-cap markets. Best of all, tokens can be traded at commissions of 0.1%. This means you’re paying just $1 for every $1,000 traded. MEXC not only supports spot trading but also leveraged futures. Major cryptocurrencies can be traded with leverage of up to 200x.

This means you can trade $100,000 worth of Bitcoin with just $500. Futures trading fees are even more competitive at just 0.02%. However, this is based on the total leveraged amount, not the margin. Another drawback is that the user experience might not be suitable for beginners. On the contrary, we found MEXC is best suited for experienced traders.

Pros

- Open an account with an email address only

- Trade more than 2,000 crypto tokens

- Spot trading fees of 0.1%

- Offers leveraged futures of up to 200x

- Proven reserves that cover customer balances

Cons

- Operates without a reputable license

- The iOS/Android apps are rated below 4/5

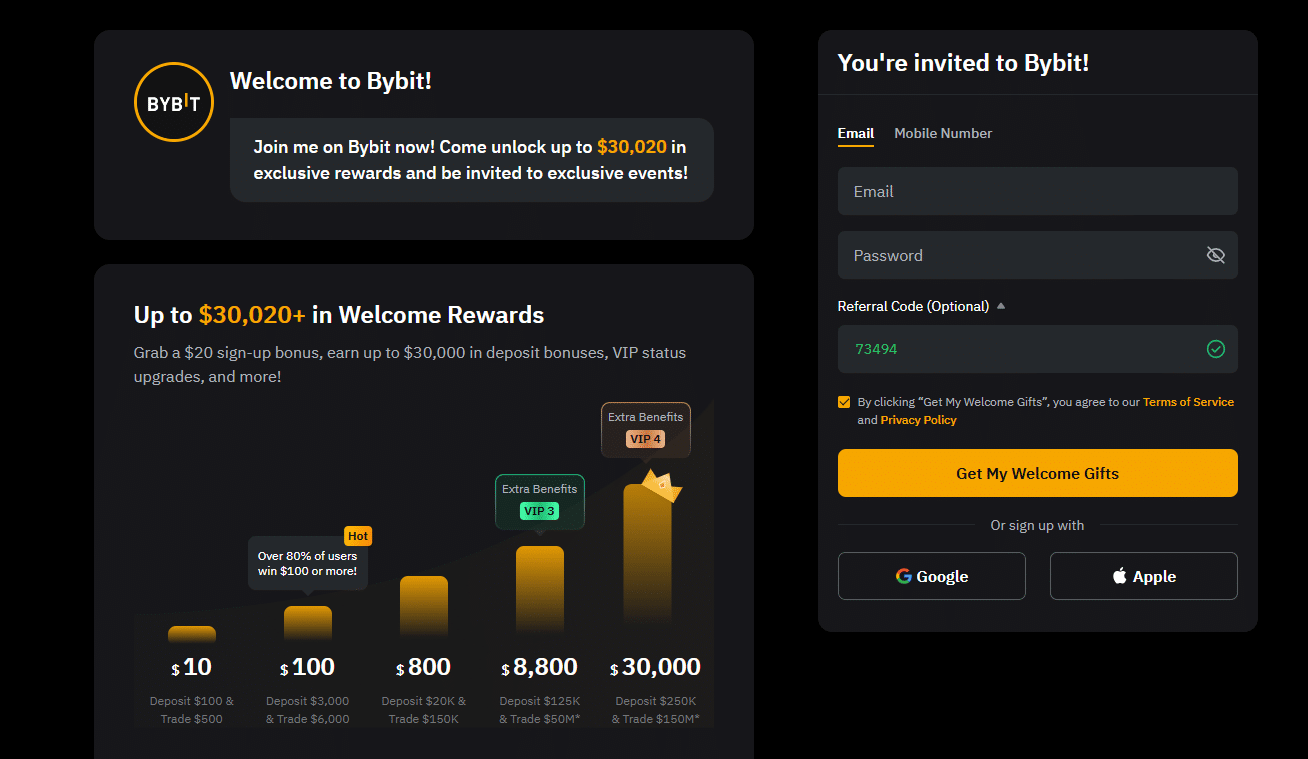

13. ByBit – Access over 400 cryptos as well as margin and derivative products

ByBit is a popular trading platform that offers a wide range of trading options, including spot trading, perpetual contracts, and leveraged products, with leverage up to 100x on popular cryptocurrencies like Bitcoin. The platform is equipped with advanced trading tools and a robust matching engine, ensuring high liquidity and minimal slippage even during periods of market volatility.

Users should note that to access most features, such as earning options, you’ll need to complete KYC. ByBit has a tiered KYC option where you can complete different levels of KYC to access more features. Without KYC, users can withdraw up to 20,000 USDT a day but with a 100,000 USDT monthly limit

The platform employs various security measures, such as multi-signature wallets and cold storage for the majority of users’ funds, to protect against hacking and unauthorized access.

ByBit also offers a DEX through its web3 wallet with access to over 10,000 tokens. This can be a better option for those looking to trade cryptocurrencies without ID verification.

Pros

- No KYC when withdrawing less than 20,000 USDT per day

- Only an email is needed to get started

- Supports over 10,000 tokens

- Offers spot trading and perpetual futures

- Leverage available

Cons

- Limited trading options without completing KYC

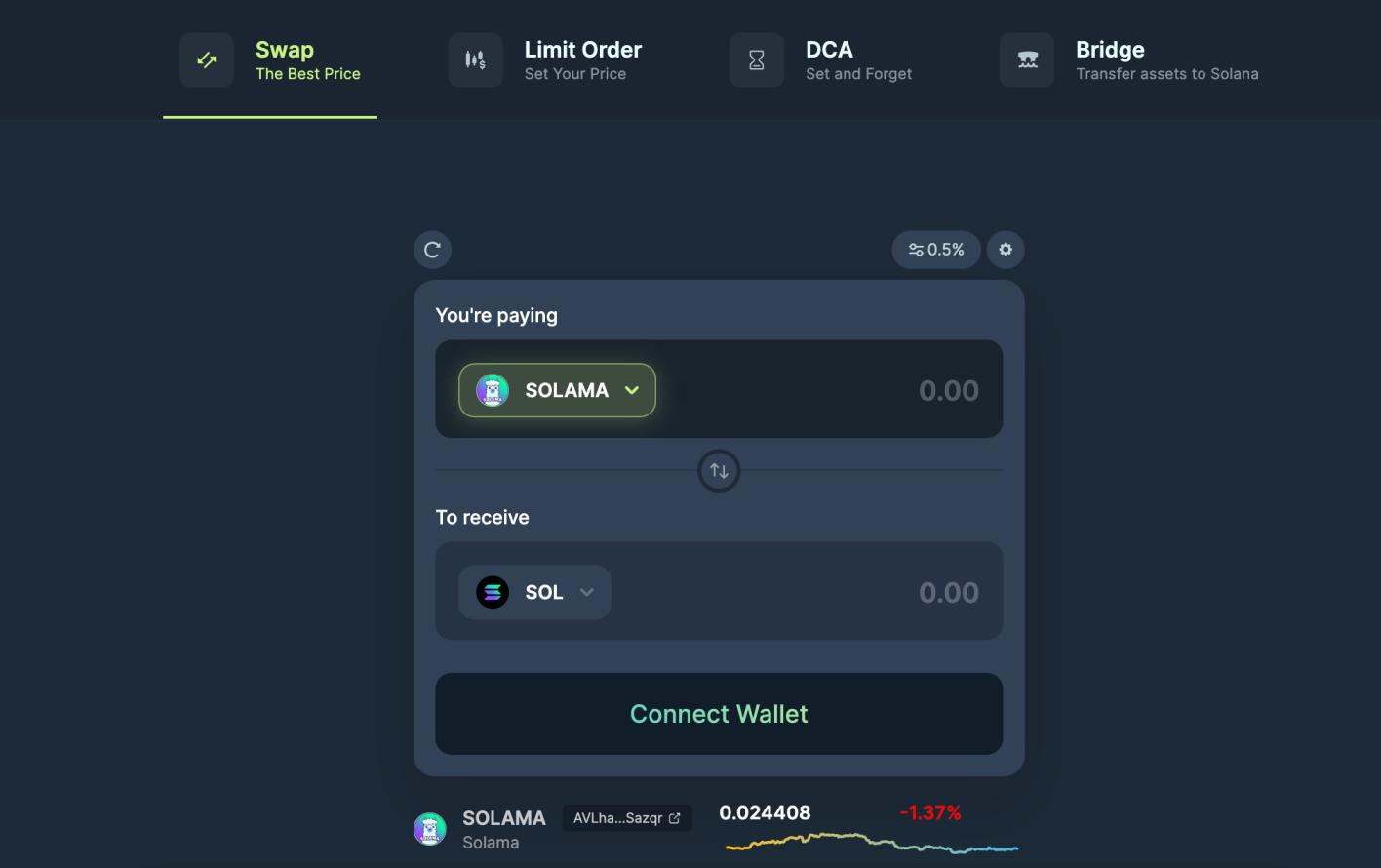

14. Jupiter – Access Brand-New Solana Meme Coins Before They Blow up

Jupiter is the best no KYC crypto exchange for trading Solana meme coins. It offers a safe, private, and reliable trading experience. Simply connect a wallet and swap SOL for your preferred coin. Alternatively, you can create a custom dollar-cost averaging schedule. For instance, you might want to buy $100 worth of a new meme coin every hour.

This ensures you avoid entering the market at peak pricing. Jupiter is also ideal for investing in non-meme coin projects. It supports almost every token on the Solana network. You can paste the project’s unique contract address to make sure you’re trading the right token. We also like that Jupiter offers bridging tools.

This enables investors to buy Solana-based tokens even if they aren’t currently on-chain. Cross-chain compatibility includes Ethereum, BNB Chain, Avalanche, Base, and Polygon. The main drawback of Jupiter is its lack of analysis features. You’ll need to use a traditional exchange if you want high-level charts and indicators.

Pros

- The best option for trading new Solana meme coins

- Simple and user-friendly trading experience

- No account is needed – just connect a wallet

- Offers dollar-cost averaging tools

- Bridge digital assets from outside of the Solana ecosystem

Cons

- Limited charting and analysis tools

- Doesn’t accept fiat currencies

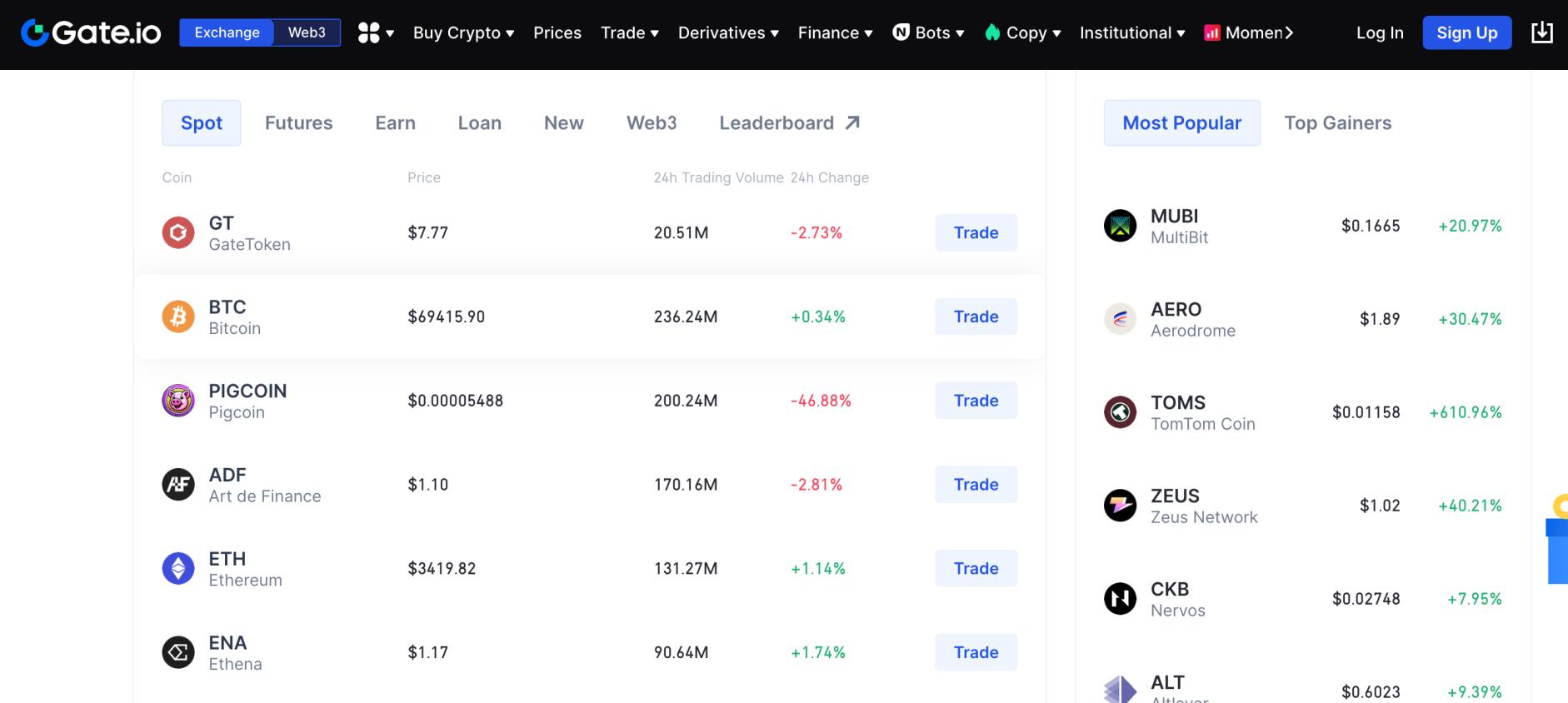

15. Gate.io – Over 1,700 Supported Markets and 100,000 USDT Daily Withdrawal Limits

Gate.io is a top 10 crypto exchange with daily volumes of over $2 billion. It supports more than 1,700 crypto markets, making it a solid option for diversification. This covers some of the best cryptocurrencies to buy, such as Bitcoin, XRP, Solana, Ethereum, Dogecoin, and Cardano. Plenty of new, micro-cap tokens are also available on Gate.io.

The easiest way to buy coins is via the ‘Convert’ tool. This will suit beginners who don’t feel comfortable using an advanced trading dashboard. That said, Gate.io also offers high-level charts, indicators, and in-depth order books. Using the spot trading platform means you’ll pay just 0.1% per slide. This fee reduces as you increase your trading volumes. Gate.io also offers a peer-to-peer crypto trading market.

Gate.io also offers a sizable derivatives platform. This includes perpetual and delivery futures, not to mention European-style crypto options. In terms of anonymity, KYC-free accounts get 24-hour withdrawal limits of 100,000 USDT. Staying within these limits ensures complete privacy.

Pros

- Withdraw up to 100,000 USDT daily without KYC checks

- Competitive spot trading commissions of 0.1%

- Supports more than 1,700 crypto markets

- Also offers leveraged futures and options

- Attracts huge crypto and Bitcoin trading volumes

Cons

- Unregulated in most global markets

- Doesn’t accept US traders

What is KYC?

KYC, or Know Your Customer, is a regulation that requires sellers of financial assets, including cryptocurrencies, to have a record of their customers’ identity.

The idea of this is to prevent fraud, protect consumers and add transparency for financial entities who can be audited by financial regulators.

However, some argue that KYC regulations go against the ethos of crypto, as it means a buyer’s identity can be seen by the government. As a consequence, there are some people who prefer to use non-KYC exchanges to protect their privacy.

What Are Non KYC Crypto Exchanges?

Non KYC exchanges enable you to trade crypto without traditional Know-Your-Customer (KYC) requirements. This means you’ll benefit from a private and anonymous trading experience. Opening an account typically only requires an email address. Some non KYC crypto exchanges have no account requirements at all.

There are some considerations to make before using a non KYC platform. First, while many exchanges offer a KYC-free experience, limitations often apply. This is usually determined by a 24-hour withdrawal limit. Fortunately, these limits are often very high, meaning very few traders will need to exceed them.

For example, Changelly enables traders to withdraw up to 1 BTC every day without revealing their identity. This amounts to $70,000 daily based on current Bitcoin prices. CoinEx has a similar procedure, although daily withdrawal limits are much smaller at 10,000 USDT. Once again, this is considerably more than most traders will need.

Another important consideration is that non KYC accounts are usually only available on crypto-to-crypto payments. So, if you want to buy Bitcoin with fiat money, KYC will be mandatory. The only possible workaround is to use a peer-to-peer exchange. Even then, some sellers will request KYC documents to ensure they comply with anti-money laundering regulations to facilitate those who want to buy crypto without KYC.

I should also note that some non KYC crypto exchanges are based offshore. This means you won’t have anywhere to turn if things go wrong. It also means that investor protections might not apply; such as minimum capital requirements or proof of reserves. Always do your research before choosing an exchange.

Why use a non-KYC exchange?

I’ll now cover some of the advantages of trading at a non-KYC exchange.

Trade Crypto Anonymously

Some crypto investors simply don’t want to reveal their identity when trading online. This aligns with the Bitcoin ethos of private and anonymous transactions. Ordinarily, KYC processes are intrusive.

- First, investors will be asked for their personal information when opening an account.

- This includes a name, date of birth, and nationality.

- Next, KYC requirements also demand ID verification documents.

- This means a government-issued ID and proof of address.

- Investors then need to wait for the KYC checks to be made, which can take several days.

In contrast, non KYC exchanges do not ask for personal information or identity verification documents. This ensures that investors can buy and sell crypto in complete privacy.

Fast Sign-Up Process

Getting started with a non KYC crypto exchange takes seconds. For instance, Best Wallet only collects an email address and password when new clients register. A crypto deposit can then be made instantly. Decentralized crypto exchanges like Best Wallet and Jupiter take things to the next level.

No account is required on these platforms. Instead, users connect a private wallet that’s already funded with cryptocurrencies. This enables them to trade tokens without delay. The newly bought tokens will then be deposited in the user’s wallet, which can be disconnected after the trade is completed.

Data Protection

A significant number of crypto exchanges have been hacked in the prior decade. This has resulted in billions of dollars in lost client funds. In some instances, hacks have breached client data, such as government-issued IDs submitted during the KYC process.

With data breaches becoming all too common, many investors are turning to non KYC crypto exchanges. In doing so, there is no risk of personal information or ID verification documents getting into the wrong hands. This is because traders are only required to supply an email when signing up.

Faster Withdrawals

Withdrawing tokens from a no KYC exchange is often fast and hassle-free. Users simply need to provide the exchange with their private wallet address. I found that withdrawal requests are often approved near-instantly, so the tokens will be received in minutes.

In comparison, traditional crypto exchanges are unable to approve withdrawals until the KYC process has been completed. Even then, withdrawals can be slow, especially when cashing out larger amounts. This is due to increased regulatory scrutiny on crypto exchanges, and how they handle money laundering risks.

Selecting the Right No KYC Exchange: My Criteria

I’ll now explain how you can choose the right crypto exchanges, no KYC, for your requirements. Some of the metrics I cover include daily limits, security, supported markets, and trading tools.

No KYC Limits

First, you’ll want to check what withdrawal limits are available on KYC-free accounts. As we mentioned earlier, this is often a 24-hour limit. Unless you’re looking to trade huge amounts, you’ll find that most withdrawal limits will be sufficient to buy crypto with no KYC.

However, if you need to go over the allowed limit, you’ll only have two options. You’d either need to complete KYC or split your withdrawals over multiple days. Just remember that limits can change at any time.

Safety and Security

The best no KYC crypto exchanges offer a safe trading experience. This means the exchange employs institutional-grade security controls. Ensure the majority of client-owned funds are secured in cold wallets. They should require multi-sig access to approve withdrawals. This ensures there isn’t a single point of failure.

- I also prefer exchanges that offer two-factor authentication. This requires a unique code when logging in and withdrawing funds. Many crypto exchanges support 2FA via the Google Authenticator app, which is free and secure.

- Whitelisting is also a great security feature to look for. This requires an extra security step when logging in from a new device or IP address.

Proof of reserves should also be explored. Especially since the FTX bankruptcy revealed the exchange didn’t have enough funds to cover customer balances. Ensure reserves have been audited and verified by a reputable source. It’s also a bonus if your chosen no KYC exchange is licensed.

Supported Coins

Once you’ve assessed limits and safety, you’ll want to check what coins the exchange lists. Consider whether you’re interested in large-cap coins like Bitcoin, or up-and-coming tokens with a small valuation. Some non KYC crypto exchanges are better than others when it comes to listing new projects.

Tradable markets should also be assessed. For instance, some crypto exchanges without KYC only support spot trading. While others also offer crypto derivatives, such as perpetual swaps and options. This enables traders to go long or short on crypto, not to mention apply leverage.

Top 10 Best No KYC Crypto Exchanges Overview

Here is an overview of the 10 best no KYC crypt exchanges, looking at their supported cryptos, supported countries and their custody offerings.

| Exchange | Cryptocurrencies Supported | Custody? | KYC Required? | Location Restrictions |

| Best Wallet | 60+ Chains Supported | Yes | No | Limited in some jurisdictions. |

| Margex | 15 Chains supported | Yes | No | Available worldwide, except U.S., Canada, Hong Kong, the Republic of Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea or Sudan, Afghanistan |

| Exodus | 50+ Chains supported | Yes | No | Available worldwide with some restrictions |

| BingX | 300+ Tokens supported | Yes | No | Available worldwide with some restrictions |

| BloFin | 129 spot trading pairs | Yes | No | Available worldwide with some restrictions |

| KCEX | 400+ Coins | Yes | No | Available worldwide with some restrictions |

| Changelly | 500+ Coins | No | No | Available worldwide with some restrictions |

| CoinEx | 55+ Coins | Yes | No | Available worldwide with some restrictions |

| ChangeNOW | 905+ Coins | No | No | Available worldwide with some restrictions |

| Switchere | 30+ Coins | No | No | Available worldwide with some restrictions |

Payment Methods

Most exchanges prefer crypto payments, as this won’t trigger any KYC requirements. This means you can easily deposit and withdraw funds anonymously. However, if you’re a first-time buyer who doesn’t own any crypto, things get a bit tricky. This is because fiat money deposits demand ID verification documents.

The only exception here is peer-to-peer crypto exchanges like LocalCoinSwap. You’ll be matched with a seller in your home country, meaning you can pay for your crypto purchase with local payment methods. You can then transfer the crypto to a more comprehensive exchange, such as OKX or Margex.

Trading Fees

I also prefer no KYC exchanges that offer low trading fees.

- For example, Margex charges commissions of just 0.06%. So, if you bought $100 worth of crypto, you’d pay just $0.06 in commission.

- MEXC is also competitive. Traders pay spot commissions of just 0.1%. Or 0.02% when trading futures.

Other trading fees can apply, such as overnight financing on leveraged positions. Fees also need to be paid when withdrawing crypto to a private wallet. These fees are often minimal, but should still be checked.

Trading Volume and Liquidity

Investors should prioritize no KYC exchanges with high trading volumes. This ensures the platform has sufficient liquidity, especially when trading smaller-cap coins. Increased liquidity means smooth trading conditions, as price movements won’t be as volatile.

What’s more, you won’t lose out on slippage. This happens when there isn’t enough liquidity to cover your order size. The result is you need to accept a less favorable price to trade. I always verify trading volumes on CoinMarketCap, as crypto exchanges are known to over-report.

Trading Tools and Features

I’d also suggest checking what trading tools and features the no KYC exchange offers. For example, Margex and MEXC offer copy trading tools. After you’ve chosen a suitable trader, you can copy their positions automatically. This means you’ll be trading crypto passively.

Intermediate-to-experienced traders should look for analysis tools. For instance, customizable charts and technical indicators. TradingView integration is also handy. Consider whether the exchange offers leverage too. This enables you to access more trading capital than your balance allows.

The Legalities of Crypto Exchanges With No KYC

Crypto exchange regulations are complex – especially when it comes to KYC. The key issue is that many exchanges operate globally. KYC regulations will vary within each supported country. What’s more, crypto exchanges without KYC are often located in countries with weak regulation. This enables them to adopt more flexible KYC verification requirements.

For example, I mentioned that Gate.io offers KYC-free accounts with limitations. However, withdrawal limits are set at 100,000 USDT daily. This will suffice for the vast majority of traders. In addition, KYC-free accounts often only support crypto deposits and withdrawals. If you want to add funds via bank transfer or credit card, then KYC requirements are mandatory.

The Future of Non KYC Exchanges

As the crypto market continues to mature and new laws are passed to regulate it, we can expect to see less non KYC exchanges in the future. This because as the financial system and cryptocurrencies become more entwined, there will likely be greater burden placed on financial operators to keep KYC information on file.

The future for non-KYC exchanges is, therefore, uncertain. It may be that buying crypto without KYC will only be possible with direct sales from user to user at some point down the line. Indeed, even DEXs now require some level of KYC. If you want to use a non-KYC exchange, there is no time like the present before they go away entirely.

Conclusion

In summary, demand for no KYC crypto exchanges is on the rise. An increasing number of traders favor anonymity, privacy, and data protection when selecting a provider.

Our top pick for KYC-free trading is OKX. No account requirements are in place for the DEX and traders can connect a wallet and access thousands of tokens from over 70 blockchain networks. OKX uses a DEX aggregator so you can find the best trading options and lowest prices.

For those interested in privacy, Non Gamstop Casinos UK also offer gambling without KYC checks.

FAQs

Which Crypto Exchange Doesn’t Have KYC?

Can I Use Binance Without KYC?

Is Bybit a KYC Exchange?

Do you need KYC to buy crypto?

Is there a way to buy crypto without KYC?

What’s the safest crypto exchange?

How do I buy BTC with no verification?

How can I buy crypto in the US without KYC?

Are there any non-KYC crypto exchanges?

Which non-KYC crypto exchange has the lowest fees?

References