Best RWA Projects: Real World Assets Cryptos to Watch!

Some of the best Real World Assets (RWAs) crypto projects are set to transform the way we think about investing in traditional assets like real estate, commodities, and bonds by tokenizing them on the blockchain. Picture this: a magic portal that lets you access high-value investments with just a few clicks, regardless of who you are or how much you have to invest. It’s like opening the door to a world where financial opportunities are no longer just for the wealthy elite or big institutions.

That’s the magic of tokenizing RWAs. Imagine buying a piece of a luxury apartment building, owning shares in a gold reserve, or investing in a collection of fine art—all from the comfort of your home and with just a few clicks. The benefits are multi-fold:

- Faster trade settlements

- Lower costs thanks to fewer intermediaries and less paperwork

- Enhanced security with blockchain technology

- Increased trust with ownership-tracking for greater accountability

- Fewer third-party risks and less reliance on custodians

RWAs: Key Highlights

- Real-world asset (RWA) tokens represent tangible assets, such as real estate, commodities, or bonds, on the blockchain.

- RWAs aim to bring traditional financial assets into the digital space, enhancing liquidity, transparency, and accessibility for the global economy.

- Smart contracts play a crucial role in automating and securing transactions involving RWAs.

Best RWA Projects: Summary

Real-World Asset (RWA) tokens digitize physical assets like real estate, commodities, and financial instruments on the blockchain, enabling easier and more transparent trading and fractional ownership. By leveraging smart contracts, RWAs automate and secure transactions, enhancing liquidity and accessibility while ensuring transparency and trust. Despite regulatory challenges and market volatility, RWAs democratize asset access and offer innovative financial opportunities. Here are our top picks at a glance that we will cover in more depth in this article:

- Ondo Finance

- Mantra

- Centrifuge

- OriginTrail

- Pendle

Let’s dive in and discover the best RWA crypto projects you should be watching.

What are Real-World Asset (RWA) Tokens?

Okay, so what exactly are RWA tokens? They’re digital tokens that represent physical assets on blockchain networks. This tokenization process means that assets like real estate or precious metals can be bought, sold, and traded on the blockchain with unprecedented ease and transparency. These digital tokens can represent assets such as:

- Real estate

- Commodities

- Artwork

- Financial instruments like bonds and stocks

- Corporate debt

- Agricultural products

Tokenizing physical or traditional financial assets means turning them into blockchain-based tokens backed by underlying assets, such as equities, bonds, and commodities.

Tokenizing RWAs breaks down high-value assets into smaller, more manageable pieces that can be traded easily. This process is also known as fractionalized ownership. Tokenizing assets in this fashion not only democratizes access to these assets but also enhances portfolio diversification and brings real-world goods to a global market. Plus, blockchain’s transparency means secure record keeping on an immutable ledger for all financial transactions, simplifying processes like tracking transfers and proving ownership.

RWA tokenization is creating a more cohesive financial system with greater transparency. By bridging DeFi with real-world assets, we’re making traditional financial products more inclusive and functional.

If you are just coming across the term DeFi for the first time, we have a great video here explaining the concept if you want to learn more:

The Role of Smart Contracts in RWAs

Smart contracts act like a reliable digital assistant, handling complex tasks without any human intervention. These self-executing contracts, with terms written directly into code, automate and secure RWA transactions, cutting out the need for intermediaries.

Picture this: You want to buy a tokenized piece of real estate. The smart contract checks your funds, updates ownership records on the blockchain, and transfers the property tokens to you—all automatic

This allows for fractional ownership, thereby increasing available liquidity. No need for real estate agents or escrow services, making the process faster, cheaper, and error-free.

Smart contracts are immutable and transparent. Once deployed, their code can’t be changed, ensuring fairness and consistency. All transactions and contract terms are recorded on the blockchain, accessible to everyone. This open ledger system fosters trust and accountability, as anyone can verify transaction details. In short, smart contracts are the backbone of the RWA ecosystem. They bring automation, security, and transparency to the table, revolutionizing how we interact with real-world assets. By leveraging these digital contracts, RWA projects make transactions seamless, cost-effective, and trustworthy.

Types of RWAs

RWA projects can come in many forms, literally anything physical that exists in the real world can be tokenized on the blockchain, but here are a few of the most prominent examples.

Real Estate

Imagine owning a slice of a luxurious Manhattan skyscraper or a cozy beach house in Malibu without the hefty price tag. Tokenizing real estate means converting property into digital tokens that represent ownership. This makes buying, selling, and trading real estate as simple as trading stocks. You can invest in high-value properties with just a few clicks, opening doors to real estate markets previously out of reach.

Commodities

Think about gold bars, barrels of oil, or even bushels of wheat. Traditionally, investing in these commodities required substantial capital and logistical challenges. Now, through tokenization, these physical commodities are converted into digital tokens. This allows anyone to invest in them, trade them easily, and even use them in various DeFi platforms. It’s like having a piece of Fort Knox in your digital wallet.

Bonds and Securities

Ever wanted to get in on the bond market but found it too complex or exclusive? Tokenized bonds and securities are your ticket. By converting these financial instruments into digital tokens, they become more accessible. You can trade tokenized bonds just like cryptocurrencies, enjoying the benefits of traditional investments with the flexibility of digital assets.

Art and Collectibles

Picture owning a fraction of a Picasso painting or a rare baseball card. Tokenizing art and collectibles brings high-value, often illiquid assets into the digital realm. This not only democratizes access but also provides a way to trade and invest in these items with ease. It’s like turning your favorite museum pieces into shareable, tradable assets.

Intellectual Property

Consider the music industry, where artists can tokenize their songs, allowing fans to buy a stake in their music. This type of RWA makes it possible for creators to monetize their work directly and for fans to invest in their favorite artists’ success. It’s a new way of thinking about ownership and revenue sharing in creative industries.

Each type of RWA brings unique opportunities and advantages, transforming how we interact with and invest in real-world assets. By digitizing these assets, we open up new avenues for liquidity, accessibility, and transparency, making the world of finance more inclusive and dynamic.

Best RWA Crypto Projects

Ondo Finance: Bridging Physical and Digital Assets

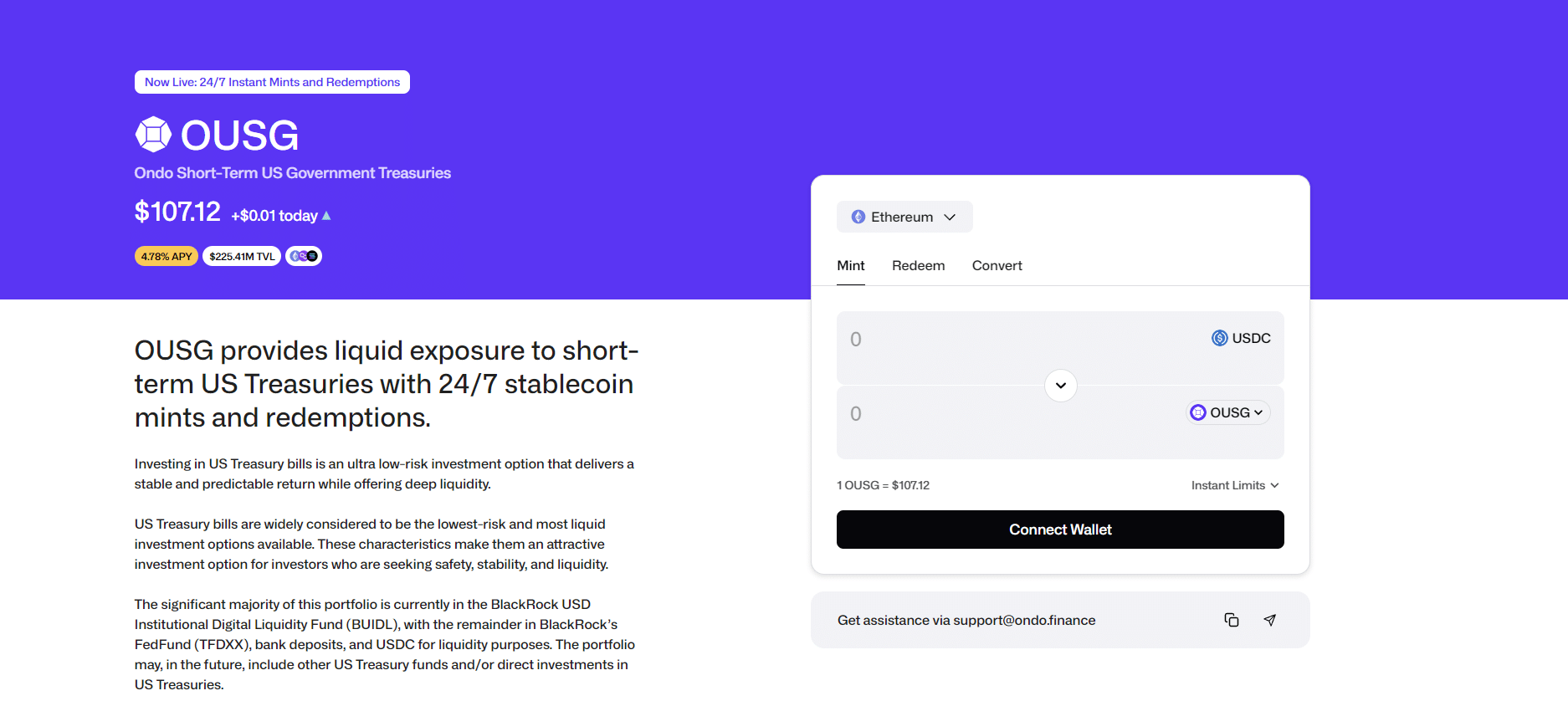

When I first tried Ondo Finance, I was impressed by how seamlessly it connects traditional finance with the DeFi world. They focus on tokenizing bonds, making these assets accessible to crypto enthusiasts. One standout offering of this RWA project is their OUSG (Ondo Short-Term U.S. Government Bond Fund), which allows users to invest in tokenized short-term U.S. government bonds and trade them with the stablecoin USDC. The significant majority of their OUSG portfolio is currently in the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), with the remainder in BlackRock’s FedFund (TFDXX), bank deposits, and USDC for liquidity purposes.

To put things in perspective, the global bond market is colossal, valued at around $128 trillion. Traditional finance often requires investors dealing with brokers, paperwork, and settlement periods that can take several days. By contrast, Ondo Finance streamlines the process, allowing for near-instantaneous transactions and eliminating the need for intermediaries. While traditional mutual funds might require a minimum investment of several thousand dollars, Ondo’s tokenized bonds can be purchased in much smaller fractions, democratizing access for retail investors.

My experience with their platform was smooth and intuitive. Navigating the user interface was a breeze, making investments in OUSG as straightforward as trading regular crypto. The transparency and efficiency of Ondo Finance were evident from the start. Their platform provided detailed information about the OUSG offering, making it easy to understand the benefits and risks involved. With their innovative approach to tokenizing traditional assets, they’re bridging the gap between physical and digital finance in a way that’s both user-friendly and effective.

Something that really stood out to me was Ondo Finance has successfully facilitated over $500 million in tokenized bond transactions, highlighting its growing influence and trust within the DeFi community. Compared to traditional bond markets, where transaction volumes are often dominated by institutional players, this level of activity in a relatively new DeFi platform underscores the significant potential and growing, global, adoption of tokenized finance.

Mantra: Revolutionizing Asset Tokenization

Mantra is focused on creating and managing digital tokens that represent real-world assets, aiming to make investments more accessible and transparent. One thing that stood out was their use of the Cosmos SDK, which ensures seamless interoperability and scalability on their platform. When I started using Mantra, I was excited about the potential to invest in assets like gold and silver. The platform’s interface was user-friendly, and their detailed guides helped me navigate the process. However, not all products were ready to go just yet. It was clear that while the foundation is solid, some features are still being developed.

In traditional finance, investing in precious metals like gold and silver typically involves purchasing physical bullion, coins, or shares in a gold exchange-traded fund (ETF). These methods can come with high costs, storage issues, and limited liquidity. The global gold market is enormous, valued at around $16 trillion, with the annual investment demand alone exceeding $200 billion. The silver market, though smaller, still boasts a significant value of around $1.4 trillion. Mantra simplifies this by allowing users to invest in tokenized gold and silver, which can be traded with the ease of any other cryptocurrency, eliminating many of the hassles associated with traditional methods.

One interesting aspect of Mantra is its OM token. By staking OM tokens, you can earn passive yield, which adds an extra layer of benefit to using their platform. The staking process is straightforward, and it’s a great way to earn rewards while supporting the network. Traditionally, similar benefits are often seen in dividend-paying stocks or fixed deposits, but these usually come with lower yields, greater barriers to entry, and less flexibility compared to staking in the DeFi space.

Despite a couple of products not being ready, my experience was positive. Mantra is on its way to revolutionizing the space, even if they’re not fully there yet. Their commitment to making high-value assets like gold and silver accessible to everyone is a significant step towards democratizing finance. As they continue to develop and roll out new features, Mantra is poised to bridge the gap between traditional finance and the innovative world of DeFi.

Centrifuge: Enhancing DeFi with Real-World Assets

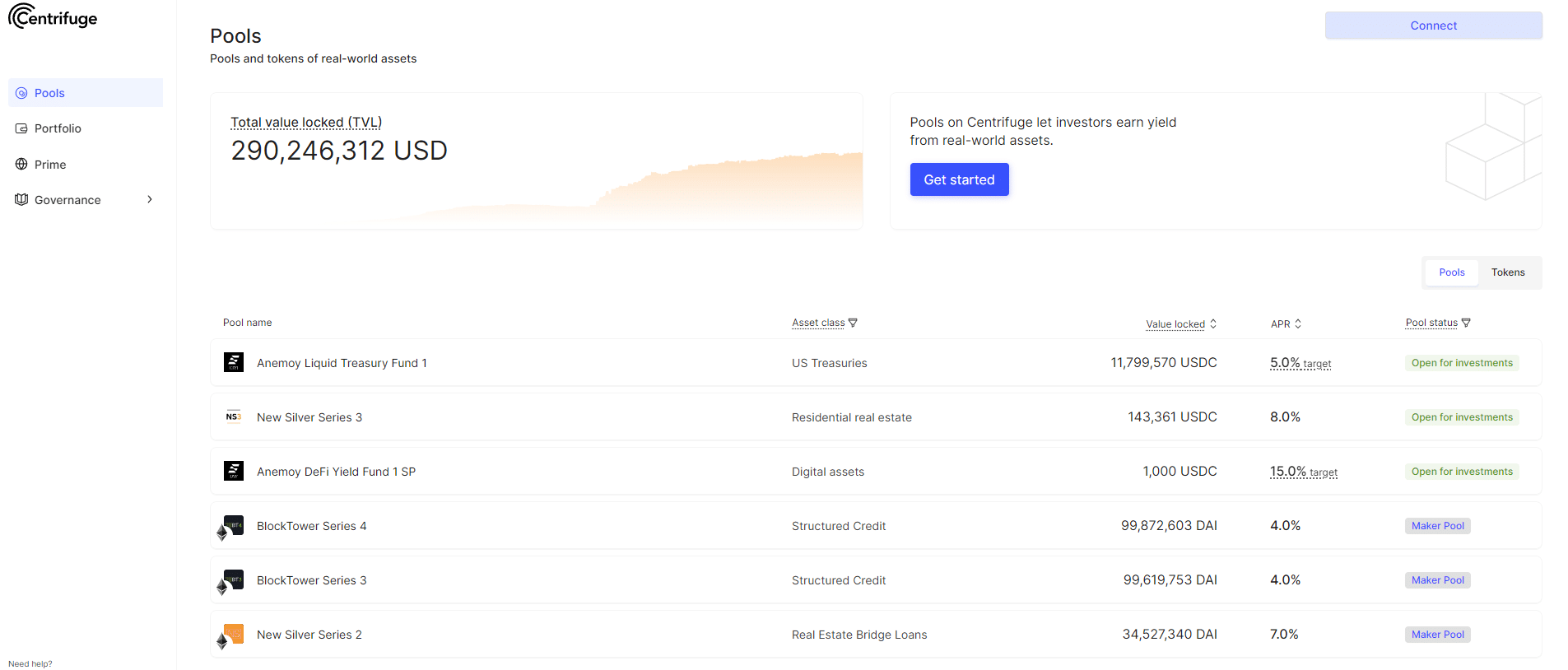

When it comes to integrating real-world assets into the DeFi ecosystem, Centrifuge is quite interesting. I decided to explore one of their asset pools, specifically the New Silver pool, to see how their platform worked. Centrifuge operates on a fully decentralized protocol with open governance, showcasing transparency and efficiency from the start. Through its DApp Tinlake, users can engage in asset-backed lending while leveraging Centrifuge Chain’s integration with Ethereum. This seamless connection between traditional assets and the world of decentralized finance opens up new possibilities for investors and borrowers alike within the crypto ecosystem.

Traditionally, asset-backed lending typically involves complex procedures, significant paperwork, and intermediaries like banks and brokers. The global asset-backed securities (ABS) market is valued at over $2 trillion, illustrating its substantial role in traditional finance. However, traditional ABS can suffer from high fees, lengthy settlement times, and limited accessibility for retail investors. Centrifuge simplifies this by allowing users to invest directly in tokenized assets with minimal friction.

Their platform made it easy to understand and participate in the tokenization process. With clear, step-by-step instructions, I could invest in real estate-backed assets through the New Silver pool. This pool offers the opportunity to finance real estate projects, turning investments into immediate liquidity. In the traditional real estate market, obtaining financing can be a drawn-out process involving appraisals, credit checks, and underwriting. The U.S. commercial real estate market alone is valued at $22.5 trillion (the fourth-largest asset market in the U.S.), yet accessing this market often requires substantial capital and connections. Centrifuge democratizes access by enabling fractional ownership, making it possible for a broader range of investors to participate.

In summary, while traditional finance offers robust mechanisms for asset-backed lending, it often comes with significant barriers to entry, high costs, and inefficiencies. Centrifuge’s platform addresses these issues by leveraging blockchain technology to create a more inclusive, efficient, and transparent financial ecosystem. Whether you’re an investor looking for new opportunities or a borrower seeking quicker access to capital, Centrifuge is paving the way for a more democratized financial future.

OriginTrail: Leading Innovation in RWA Tokenization

OriginTrail specializes in supply chain transparency, using decentralized knowledge graphs (DKG) to provide detailed tracking and reporting tools. Although I haven’t been able to fully utilize their services personally, the potential is clear. OriginTrail allows businesses to apply for their Inception Program, offering a sneak peek into their innovative platform.

In traditional finance and supply chain management, tracking the journey of a product from its origin to its final destination often involves multiple intermediaries and complex processes. The global supply chain management market was valued at around $24 billion in 2023 and is expected to reach over $63 billion by 2032. However, this market is plagued by inefficiencies, lack of transparency, and susceptibility to fraud. OriginTrail simplifies this by using blockchain technology to create a decentralized and tamper-proof record of every transaction.

Imagine being able to track the journey of a product from its origin to its final destination, ensuring every step is visible and verifiable. In traditional supply chains, this level of transparency is challenging to achieve due to siloed data and manual record-keeping. For instance, a 2020 study found that 94% of supply chain executives reported having visibility issues within their supply chains. OriginTrail’s technology can bring this level of transparency to supply chains, making it easier to manage and trust the flow of goods. The DKG ensures that all data is decentralized and tamper-proof, providing peace of mind that your supply chain information is accurate and reliable.

As an RWA project, OriginTrail is creating a more inclusive, efficient, and transparent supply chain ecosystem. Whether you’re a business looking to enhance your supply chain transparency or a consumer wanting to know more about the products you buy, OriginTrail is paving the way for a more trustworthy and streamlined future.

Pendle: Setting New Standards for Asset Liquidity

Exploring Pendle was like peering into the future of asset trading. They focus on unlocking the liquidity of real-world assets by allowing users to trade future yields of tokenized assets. Using Pendle, I was able to trade future earnings in a way that felt innovative and straightforward. The platform’s user-friendly interface and clear instructions made the process easy to understand. Pendle offers a unique way to gain control over future profits, giving me more flexibility and options in my investment strategy.

Trading future yields is typically done through financial instruments like futures contracts, options, and bonds. The global derivatives market, which includes these instruments, is one of the largest in the world, estimated to be worth over $1.2 quadrillion. However, trading in these markets often requires significant expertise, high capital, and can involve substantial risk due to market volatility. Pendle simplifies this by allowing users to split and trade the principal and yield of their investments separately, making it more accessible to retail investors.

For example, in the traditional bond market, an investor might buy a bond and hold it to maturity to receive periodic interest payments. The bond market itself is enormous, valued at over $128 trillion. Pendle revolutionizes this concept by enabling investors to trade the future yields of these bonds separately from the principal, thus providing more liquidity and flexibility. This means that rather than waiting for interest payments over time, investors can access the value of those future payments immediately.

Pendle’s approach also mirrors the traditional financial technique of securitizing future revenue streams, which is commonly used in industries like entertainment and sports. For instance, musicians and athletes often securitize their future earnings to get upfront capital. Pendle brings this concept into the DeFi space, allowing anyone to trade the future yields of various tokenized assets.

Each of these RWA projects brought a unique and positive experience, highlighting the innovations they bring to the Real World Asset space. Whether it’s Ondo Finance’s seamless bond tokenization, Mantra’s accessible asset tokenization, Centrifuge’s efficient financing solutions, OriginTrail’s supply chain transparency, or Pendle’s forward-thinking liquidity options, these platforms have reshaped how I interact with real-world assets in the digital economy.

Risks and Hurdles Facing RWAs

Venturing into the world of RWAs isn’t without its challenges. One of the biggest hurdles is regulatory uncertainty. Different countries have different laws, and navigating this complex landscape can be tricky. Market volatility also plays a significant role. The value of tokenized assets can fluctuate wildly, just like any other cryptocurrency. This means your investments can be quite unpredictable.

Mainstream adoption is yet another challenge. For RWAs to become mainstream, there needs to be widespread understanding and acceptance of the technology. This involves educating the public and businesses about the benefits and workings of RWAs.

Lastly, smart contract risks cannot be ignored. Bugs or vulnerabilities in the code can lead to significant financial losses. It’s crucial to have rigorous audits and safeguards in place. While there are many benefits of blockchain technology, it’s not immune to hacks and vulnerabilities.

Despite these challenges, the potential rewards make RWAs an exciting opportunity in the world of digital assets. Aside from RWAs, you may also be interested in our article on the Top Crypto Trends to Watch for the Next Bull Run.

Best RWA Projects: Conclusion

So, there you have it—a tour of the fascinating world of Real-World Assets (RWAs) and the innovative solutions that are transforming how we interact with tangible investments. From tokenizing luxury hotels with Mantra to revolutionizing supply chains with OriginTrail, these projects are opening up various sectors in the traditional financial markets that were once only accessible to institutional investors. Imagine a world where owning a piece of a skyscraper or a gold bar is as easy as buying a cup of coffee. It’s not just a fantasy anymore; it’s happening right now.

The benefits are crystal clear: enhanced market liquidity, unmatched transparency, and lower barriers to entry. Yet, like any adventure, it’s not without its challenges. Navigating regulatory frameworks, ensuring security, and managing market volatility are all part of the journey. But with the right tools and knowledge, these hurdles can be overcome.

The future of finance is here, and it’s more exciting than ever.

Explore Further: The Next Cryptocurrencies to Explode in 2024

Frequently Asked Questions

Can RWA Projects be a Good Investment?

Absolutely! While considered quite experimental and at higher risk as we are in the early stages of this technology and concept, RWA projects can offer enhanced liquidity, transparency, and accessibility, making them attractive investment options.

How Do RWAs Contribute to the DeFi Ecosystem?

RWAs bring traditional assets into the DeFi space, enhancing liquidity and providing more investment opportunities.

Can RWAs Provide a Solution for Blockchain Scalability Issues?

While RWAs primarily focus on asset tokenization, they can indirectly contribute to scalability by increasing the use cases and adoption of blockchain technology.

What Are the Risks Associated with RWAs?

Risks include regulatory compliance, security vulnerabilities, market volatility, and adoption barriers.

How Does Tokenization Affect the Value of Real-World Assets?

Tokenization can enhance liquidity and accessibility, potentially increasing the overall value of the assets by making them more tradable and attractive to a broader range of investors.

References:

DeFiLlama. “RWA Protocols.” DeFiLlama, https://defillama.com/protocols/RWA

CoinGecko. “RWA Report 2024.” CoinGecko, https://www.coingecko.com/research/publications/rwa-report-2024

RWA.xyz. RWA, https://app.rwa.xyz/