Bitcoin has been named the most successful asset of all time, but many are still left wondering: is Bitcoin a good investment? Since launching in 2009, Bitcoin has increased by hundreds of thousands of percent, but are those gains behind it or is Bitcoin still a good investment in 2024?

Read on to discover my Bitcoin investment thesis. I’ll explore the upside potential and risks, key market developments to be aware of, and best practices when investing for the first time.

Bitcoin Investing: Key Points

- Bitcoin has come a long way, but with less than 5% of the global population holding BTC, it still has plenty of room to grow

- The introduction of the Spot Bitcoin ETFs issued by the likes of BlackRock and Fidelity have opened the doors to institutional investors

- Younger generations prefer investments in digital assets and are more comfortable with Bitcoin. With the large generational wealth transfer from baby boomers to Gen Z and Millenials over the next 10 years, trillions of dollars are expected to flow into BTC and other cryptocurrencies

- As global conflicts increase and there is continued monetary debasement and inflation from world governments printing fiat, Bitcoin’s appeal should grow as an alternative investible asset, inflation hedge, and store of value.

- Bitcoin investing isn’t for everyone. It is considered a high-risk investment and too much exposure is not suitable for investors with a low risk tolerance or short investing time horizon.

Is Now a Good Time to Invest in Bitcoin? My Verdict

Is Bitcoin a good investment? Here’s my summarized answer. Like any financial instrument, Bitcoin comes with benefits and drawbacks. But overall, now could be a great time to begin building exposure. For a start, Bitcoin currently trades below its all-time high, so new investors can secure a discounted entry price. What’s more, Bitcoin recently completed its fourth halving event.

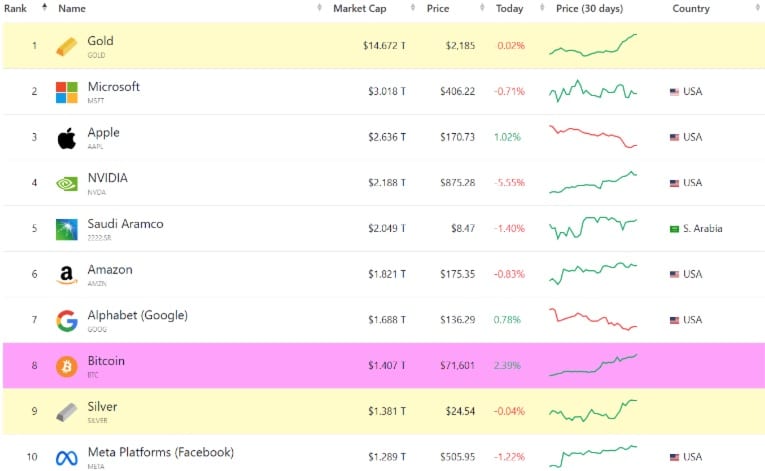

This means mining rewards were reduced by 50%, making the Bitcoin supply scarcer. The SEC recently approved Bitcoin ETFs too, creating seamless access for institutional investors. Another advantage is that Bitcoin is still an emerging asset class and only a small percentage of the global population owns Bitcoin. Experiencing impressive growth, as of 2024, Bitcoin’s market capitalization has surpassed the likes of Facebook (Meta) and is even a larger asset class than silver, quickly gaining on the likes of Google and Amazon.

Even with a trillion-dollar valuation, Bitcoin is still heavily undervalued. Based on historical cycles, Bitcoin is expected to begin its next bull run in late 2024 and into 2025. This could result in significant price appreciation, especially considering the new institutional inflows. All that said, Bitcoin operates in a speculative and volatile market – so should still be considered high-risk.

Should You Invest in Bitcoin? The Pros

Beginners will often ask the question; Should I buy Bitcoin now? Bitcoin won’t be suitable for all investor profiles, especially those with a low tolerance for risk. That said, even conservative investors are allocating small percentages of their portfolios to Bitcoin. Let’s explore some of the reasons why buying Bitcoin could make sense in 2024.

Bitcoin has Increased by Over 100 Million Percent Since Inception

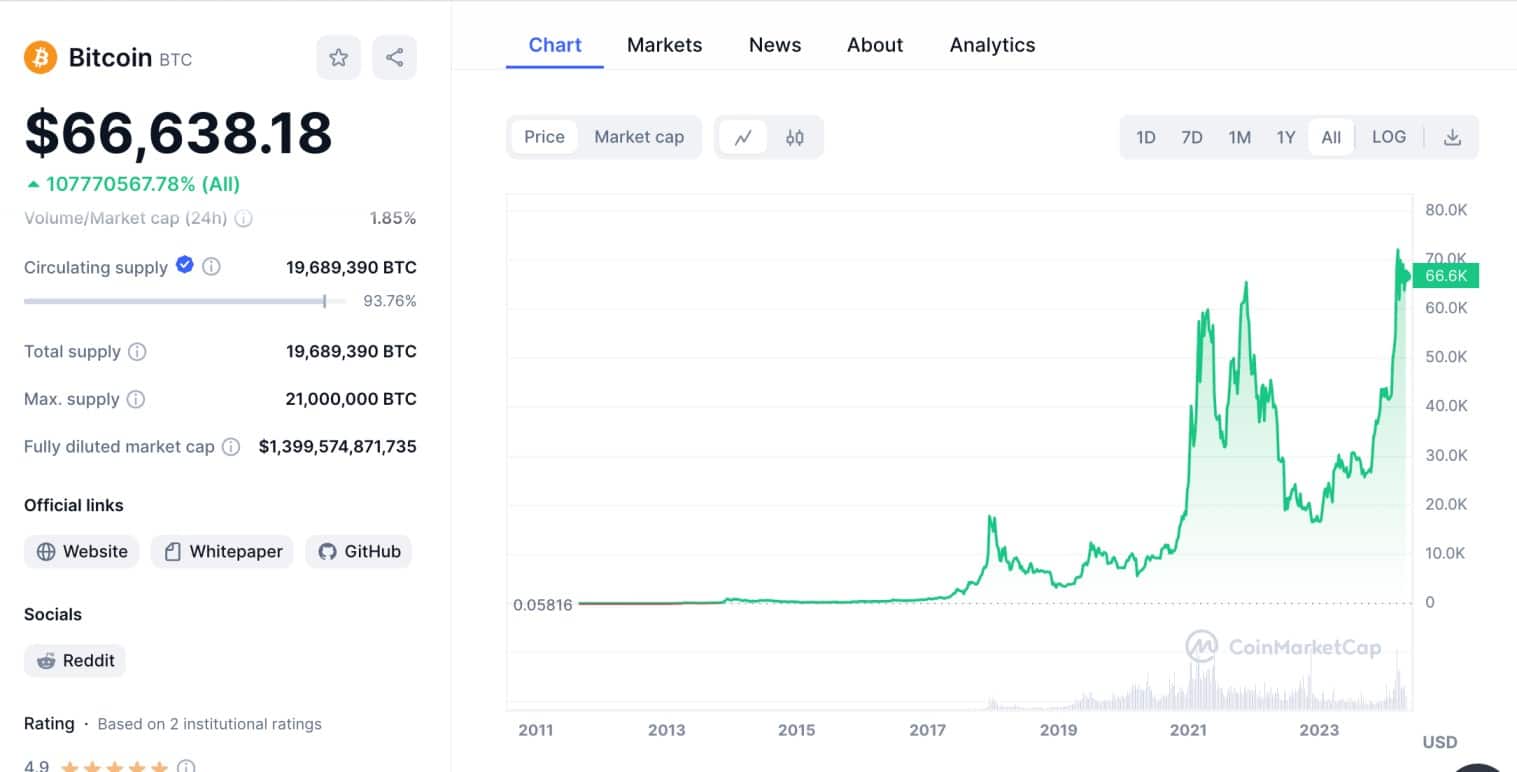

Bitcoin is one of the best-performing assets of all time. This is the case even though Bitcoin was only launched in 2009. While growth stocks like Tesla and Amazon have generated substantial returns for early investors, they’re inconsequential when compared to Bitcoin.

According to CoinMarketCap – the leading data aggregation platform for crypto, Bitcoin was trading at $0.058 in August 2011. This is the first recorded price available. CoinMarketCap states that Bitcoin’s all-time high of $73,750 was hit in March 2024. This means that since 2011, Bitcoin has increased by more than 100 million percent.

Bitcoin Continues to Outperform Traditional Financial Markets

Returns in recent years have also been significant – especially when compared to traditional financial markets.

- For example, the S&P 500 has increased by over 72% in the past five years. This amounts to an average annualized gain of 14.4%.

- Over the same period, the Bitcoin price has increased by over 1,235%. That’s an average annualized gain of 247%.

On a 12-month basis, Bitcoin has increased by 160%. The S&P 500 has risen by 22% over the same time frame. This shows that even with a behemoth market capitalization, Bitcoin can generate substantial growth in a short period of time.

Fun Fact: Nearly half of millennial millionaires have at least 25% of their wealth in cryptocurrencies. This is a trend expected to continue at an accelerated pace as baby boomers will be passing over $84 trillion in wealth to younger generations over the next 10 years. Younger investors are more comfortable with digital assets like Bitcoin, which will likely be experiencing significant inflows from this trend.

Bitcoin ETFs Open the Markets to Institutional Investors

Bitcoin ETF applications have been filed with the SEC since 2017. All applications were rejected until January 2024 – when the SEC finally approved the first wave of Bitcoin ETFs. This was a watershed moment for Bitcoin, considering it was branded a scam by financial institutions for many years.

Since the SEC approval, billions of dollars worth of Bitcoin ETF investments have been made. Some of the most notable ETF providers include Fidelity, BlackRock, and Invesco. It is also worth highlighting that the Bitcoin ETFs have not only broken, but absolutely smashed all previously held records for ETF inflows, showing the extreme levels of excitement and enthusiasm for this asset class. All that said, Bitcoin ETFs are only just getting going. Significant inflows are expected in the coming months and years as more institutions enter the market. This will help Bitcoin reach new levels.

Bitcoin’s Fourth Halving Event Means the Next Bull Cycle is Imminent

Still asking the question; Is Bitcoin a good investment? Another area to consider is the recent Bitcoin halving event. In a nutshell, halvings reduce the number of new Bitcoins that enter circulation. This is based on the rewards that are paid to miners for keeping the network secure.

The mining reward is reduced by 50% approximately every four years. This means there have been four halvings since Bitcoin’s inception. The 10-minute mining reward started at 50 BTC. Today, it stands at just 3.125 BTC. The halving process continues until the Bitcoin supply reaches 21 million. Thereon, no more Bitcoins will be created.

So why do Bitcoin halvings matter? The answer is simply supply and demand economics. When the same number of investors or higher are chasing an asset (demand), and the asset’s issuance gets halved (supply), the price goes up. Historically, Bitcoin enters a new bull cycle after the supply is reduced. This typically lasts for more than a year and has resulted in new all-time highs. For example, Bitcoin was priced at approximately $9,700 when it halved in April 2020. Bitcoin peaked at just over $68,000 the following year.

Bitcoin’s Fractionized Supply Makes it Affordable

Bitcoin trades for tens of thousands of dollars. However, there’s no requirement to buy one whole Bitcoin. On the contrary, each Bitcoin can be split into 100 million units (known as ‘Satoshis’). This means no matter your investment budget, you can buy Bitcoin with any amount. Considering the risks, this should be an amount you’re comfortable losing.

Nonetheless, let’s suppose you enter the market when Bitcoin is priced at $60,000. You decide to invest $600. This means you own 1% of one Bitcoin. Just like fractional shares, your gains and losses replicate Bitcoin’s price movements. So, if Bitcoin rises by 40%, your $600 investment will be worth $840. Similarly, if it declines by 50%, your $600 will be worth $300.

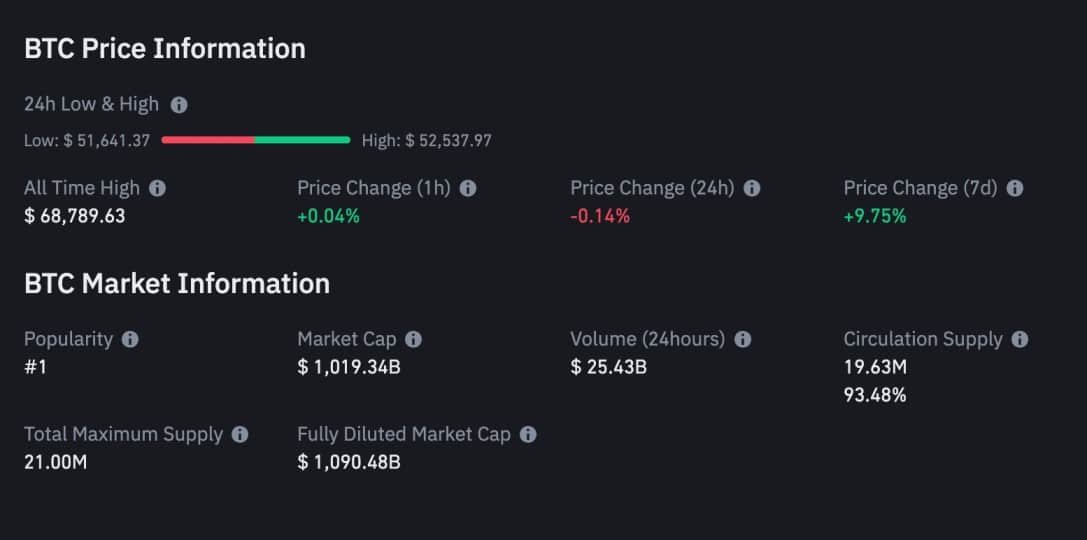

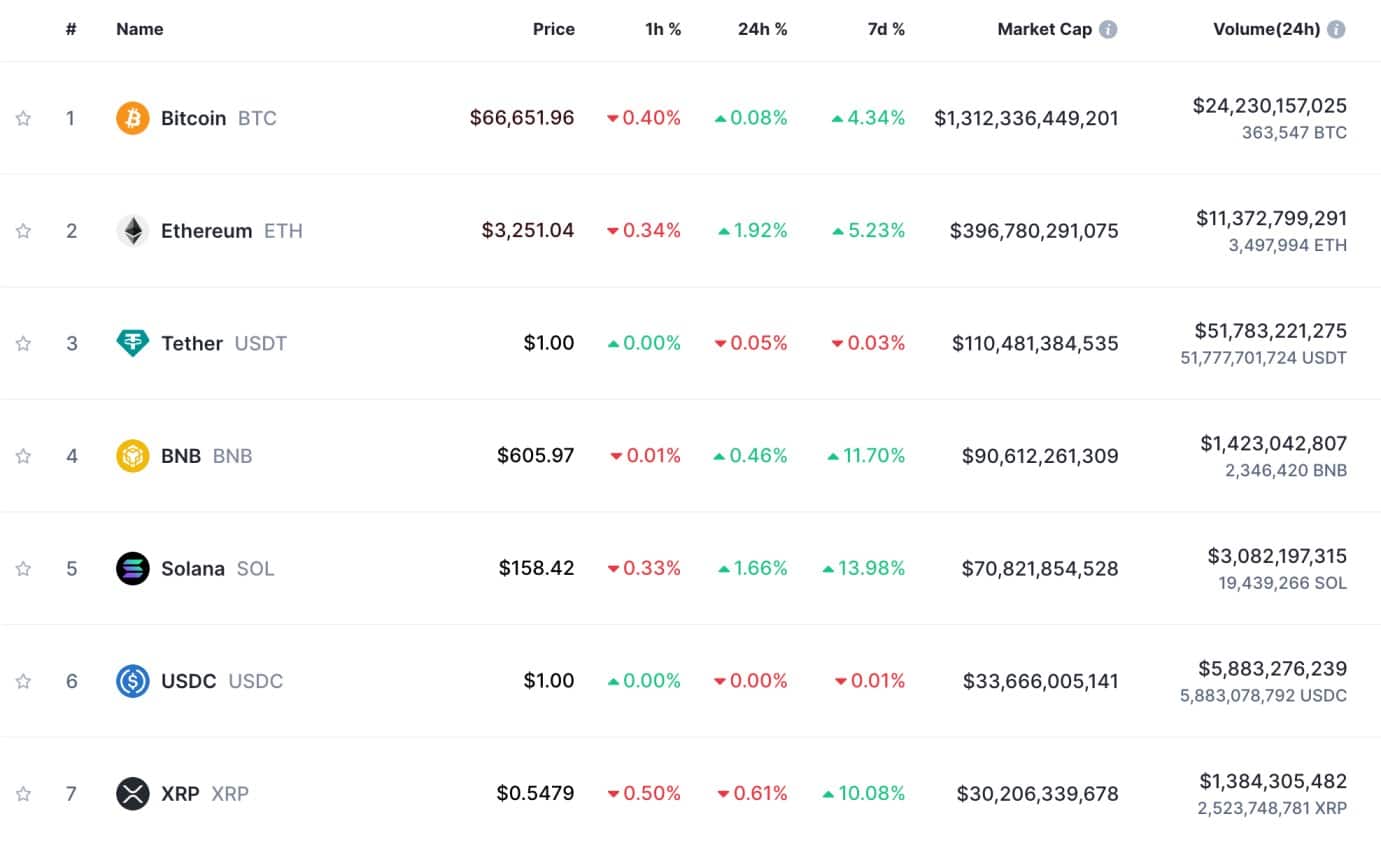

Bitcoin Enjoys Premium Liquidity

Bitcoin is a global phenomenon. It trades 24 hours per day, 7 days per week, and can even be traded completely peer-to-peer with no intermediaries. What’s more, Bitcoin generates substantial trading volumes, meaning it’s one of the most liquid markets worldwide.

For example, in the past 24 hours, more than $25 billion worth of Bitcoin has been traded. Now compare this to a blue-chip stock like Apple. Over the same period, Apple stock saw trading volumes of approximately $10.5 billion. This means more than twice the amount of Bitcoin was traded, even though Apple is one of the largest stocks by market capitalization.

So what does this mean for you as an investor? Put simply, Bitcoin’s strong liquidity ensures you can enter and exit the market at any time. You won’t need to worry about slippage, wide spreads, or even the market being closed. In addition, after selling Bitcoin, it can easily be converted to cash. You can do this on the best Bitcoin exchanges.

Is Bitcoin Worth Investing in? The Cons

It’s also important to consider the drawbacks when exploring the question; Is Bitcoin a good investment? Some of the core risks include high volatility and prolonged bear cycles where BTC can lose 50% or more of its value. Depending on how you store Bitcoin, there are also counterparty risks. Read on for more information about the pitfalls of buying Bitcoin.

High Volatility and Prolonged Bear Cycles

Bitcoin’s high volatility will be problematic for some investors. Especially those used to investing in more stable markets. The Bitcoin price often witnesses wild pricing swings. First-time investors must be prepared for this before entering the market. While volatility can’t be avoided, it can become inconsequential or even work to investors’ benefit if they dollar-cost average their investments.

Dollar-cost averaging or DCA means buying small amounts of Bitcoin regularly. Many crypto investors set up their crypto exchange platforms to buy small amounts of Bitcoin automatically every day, week, or month to keep their entry price points low and avoid investing based on emotion. You’ll pay less when the Bitcoin price declines, and enjoy a portfolio upside when it rises.

Another drawback is that Bitcoin frequently enters prolonged bear cycles. This means the Bitcoin price can decline consistently for many months. Price declines are particularly sharp when Bitcoin’s bull cycle peaks. For example, Bitcoin peaked at over $68,000 in November 2021. One year later, Bitcoin hit lows of under $17,000. That’s a decline of approximately 75%.

Similar declines were seen in prior cycles. While Bitcoin has always recovered and set new all-time highs, this isn’t guaranteed. Many investors see this as an opportunity to buy more Bitcoin at deeply discounted prices, also known as “buying the dip.”

Counterparty Risks

Counterparty risks should also be considered before investing in Bitcoin. For instance, consider an investor that buys Bitcoin from an exchange. Leaving the Bitcoins in an exchange account is risky, as you’re trusting the platform to keep them safe. Consider that the FTX bankruptcy saw billions of dollars worth of crypto ‘disappear’, including Bitcoin. Similar instances happened with the collapse of Celsius and BlockFi, crypto holders trusted those companies to hold their crypto and experienced losses when the companies went bankrupt. That is why we always encourage self-custody to remove counterparty risk.

After completing the investment, consider withdrawing the Bitcoins to a self-custody wallet. This enables you to store Bitcoin in a decentralized environment, meaning no third-party involvement. However, you’ll be responsible for keeping the self-custody wallet secure, which in itself is a risk.

Future Bitcoin Returns Could be a Lot More Modest

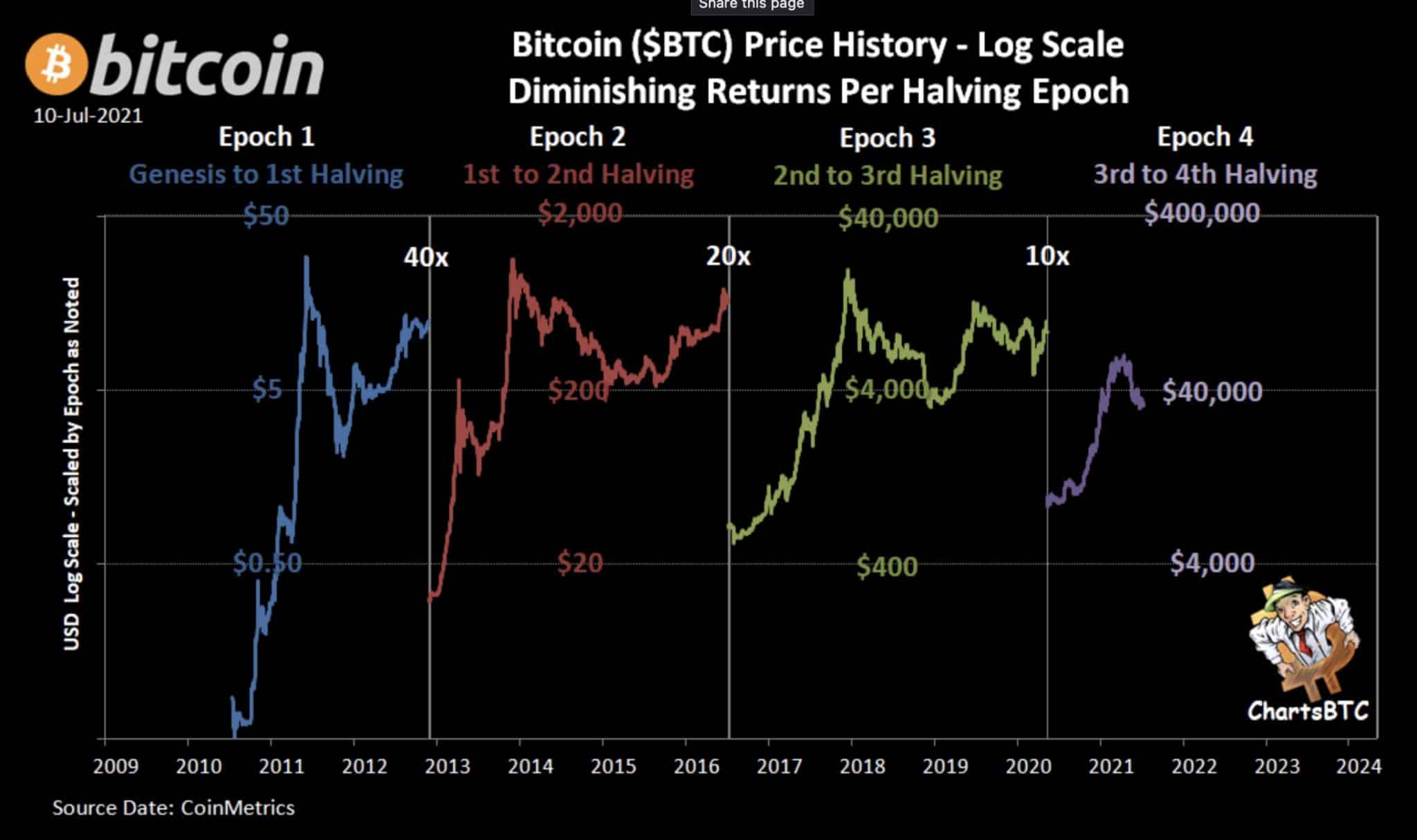

I mentioned that since 2011, Bitcoin has increased by over 100 million percent. And over the prior five years, Bitcoin has returned more than 1,235%. However, future returns could be a lot more modest. After all, Bitcoin has a market capitalization of over $1 trillion. This makes it harder for Bitcoin to replicate historical returns. Many investors have noted that each cycle, Bitcoin is experiencing diminishing returns, although even Bitcoins “diminished returns” still vastly outperform most other assets.

That said, some market commentators feel the opposite is likely to occur as Bitcoin reaches global adoption and with Wall Street’s interest in the Bitcoin ETFs, there is a growing belief that Bitcoin’s price will eventually reach $1 million. This would mean a 1,400% upside from current prices.

What Pro Investors Say About Bitcoin

Is now a good time to buy Bitcoin? Let’s explore what seasoned pros think.

Cathie Wood

One of the biggest proponents of Bitcoin is Cathie Wood – the CEO of ARK Invest. Wood initially predicted that Bitcoin would be worth $1 million by 2030. However, Wood has since increased her upper forecast to $3.8 million.

Wood explained that the specific price point will depend on broader factors, such as adoption and regulation. It also takes into account Bitcoin’s fifth halving, which will happen in 2028.

Michael Saylor

Michael Saylor – the co-founder of MicroStrategy, is an even bigger Bitcoin bull. Saylor believes that Bitcoin could hit $10 million in the coming years.

His firm, MicroStrategy, is now one of the largest Bitcoin holders. According to Bloomberg, MicroStrategy owns about 1% of the total Bitcoin supply.

Other notable Bitcoin supporters:

- Jack Dorsey- Co-founder of Twitter

- Elon Musk- CEO of Tesla and Founder of SpaceX

- Raoul Pal- Former Goldman Sachs co-head of hedge fund sales in equities and equity derivatives, Founder of Real Vision

- Caitlin Long- Founder and CEO of Custodia Bank

- Chamath Palihapitiya- Venture capitalist, SPAC sponsor, and the founder and CEO of Social Capital. Palihapitiya was an early senior executive at Facebook

- Donald Trump- The former US president has released an NFT collection and as part of his presidential campaign for 2024, has come out as a Bitcoin supporter

- Paul Tudor Jones- Founder, Chief Investment Officer, and Co-chairman of Tudor Investment Corporation

- Stanley Druckenmiller- Winner of the Alexander Hamilton Award, Druckenmiller is a billionaire investor and Founder, former Chairman, and former President of Duquesne Capital

- Tim Draper- Founded Draper Associates, DFJ, and the Draper Venture Network, a global network of venture capital funds. He funded Baidu, Tesla, Skype, SpaceX, Twitch, Hotmail, Focus Media, Robinhood, and others.

Charlie Munger

In contrast to Cathie Wood and Michael Saylor is Charlie Munger. Prior to his death last year, the vice chairman of Berkshire Hathaway was a strong opponent of Bitcoin.

Munger was quoted as saying: “It’s like somebody else trading turds and you decide I can’t be left out.” Munger added, “I hate the Bitcoin success and I don’t welcome a currency that’s useful to kidnappers and extortionists and so forth.”

Berkshire Hathaway CEO and investing legend Warren Buffet is also a staunch Bitcoin critic, calling Bitcoin rat poison. It is worth noting that Buffet doesn’t have the greatest track record in technology investments as he has famously stated that he doesn’t invest in things he doesn’t understand. This has led to him passing on opportunities such as Tesla and Nividia, along with missing early opportunities to invest in Amazon and Google, so when it comes to emerging tech, this simply isn’t Berkshire Hathaway’s forte.

Bitcoin, Cryptocurrency and Diversification

I’ve established that Bitcoin is a high-growth asset with huge upside potential. It’s also a volatile asset that witnesses extended bear cycles. With this in mind, first-time investors should employ some risk-management practices.

First, I can’t stress enough how important dollar-cost averaging is and having a long-term investment horizon. This is the only surefire way of avoiding Bitcoin’s short-term volatility. This means you won’t need to ask the question – is it a good time to buy Bitcoin? Instead, if you believe in the long-term vision, invest small amounts regularly.

This means your cost basis will mirror market trends. What’s more, you’ll avoid the risk of buying the market peak. For example, consider someone who bought $10,000 worth of Bitcoin in November 2021. They would have entered the market when Bitcoin was priced at $68,000. The investment value would have declined to about $2,500 just one year later.

Now consider an investor who dollar-cost averaged their Bitcoin investments monthly. Sure, the first investment would have been at the market peak. But as Bitcoin entered its prolonged decline, each monthly investment would have been at a lower cost price. This averages the cost price over time, turning market downturns into a positive.

In addition, diversification is also important. For example, consider more traditional assets for your portfolio. This might include a mixture of blue-chip stocks and index funds. Gold, silver, real estate, and other commodities. You can also create a diversified cryptocurrency portfolio.

While Bitcoin is the gold standard, there are thousands of other cryptocurrencies in the market. These offer a higher upside, especially when investing in smaller-cap projects. For example, you might consider some of the best meme coins. Or other layer 1 blockchains like Ethereum, Solana, and Avalanche. Here’s a quick snapshot of how other popular coins have performed over the past year

- Ethereum: 59%

- Solana: 528%

- Avalanche: 88%

- NEAR: 225%

- Shiba Inu: 117%

The price percentages above are correct as of July 2024.

What is Bitcoin & How Does it Work?

It’s crucial to understand what you’re investing in before proceeding. Especially when investing in emerging assets like Bitcoin. Here’s what you need to know.

Bitcoin is a cryptocurrency that was launched in 2009. It isn’t owned by any single person or entity and isn’t backed by a central bank or government. Bitcoin was created by Satoshi Nakamoto; an anonymous developer whose real identity remains unknown. Nakamoto developed Bitcoin as an alternative way to build, store, and transfer wealth that exists outside of the corrupt legacy financial system.

Unlike ‘fiat money’, Bitcoin is decentralized. This means Bitcoin can be transferred without third parties, like financial institutions. This is the true definition of wealth, as nobody other than the Bitcoin holder controls the funds. Bitcoin has a finite supply of 21 million, making scarcity hard-coded into the assets and lending credibility to the narrative that Bitcoin is a commodity, a store of value, and an inflation hedge.

Over 93% of the total supply is already in circulation. Every 10 minutes, 3.125 BTC new Bitcoins enter the market. This is reduced by 50% every four years. So, in 2028, the 10-minute issuance will reduce to 1.5625 BTC. Bitcoin is built on a technology called the blockchain. Bitcoin’s blockchain keeps a public record of all Bitcoin transactions and ensures transactions are immutable and unalterable as it exists as a public ledger with all transactions being verified by Bitcoin miners.

Transactions are matched to the wallet address and not the sender’s identity. This makes Bitcoin a pseudonymous technology. While Bitcoin can also be used as a medium of exchange, most enter the market for speculative reasons. That is, most people buy Bitcoin to make money. This is achieved when the Bitcoin price increases, similar to stocks and index funds. You can learn more in our in-depth What is Bitcoin article.

Ways of Investing in Bitcoin

If you are convinced and feel that Bitcoin is still a good investment, here we’ll explore the different ways to invest.

The most popular option is to use a crypto exchange. There are hundreds of exchanges online, but it’s best to use reputable ones that are regulated. Examples include eToro, Coinbase, Kraken, and Gemini, which are registered with the SEC and FINRA (among other licensing bodies).

These exchanges allow you to buy Bitcoin with a credit card, debit cards, bank transfers, and e-wallets like PayPal. After buying Bitcoin, you can withdraw the coins to a decentralized wallet. You can read more about the best decentralized crypto wallets for Bitcoin here.

Another option is to invest in a Bitcoin ETF. This will appeal to beginners who aren’t comfortable using crypto exchanges and wallets. ETF providers like BlackRock hold Bitcoin on behalf of shareholders. This means the value of the ETF rises and falls in line with the Bitcoin price.

However, like all ETFs, there can be a disparity in pricing. Nonetheless, you can invest in Bitcoin ETFs at most stockbrokers. You won’t need to worry about storage or hacks – as the Bitcoins can’t be withdrawn. You’re simply an investor in the ETF, with the ETF issuer being the Bitcoin custodian.

Investing in Bitcoin Pros and Cons

Bitcoin Pros:

- Bitcoin has the potential to offer high returns

- Bitcoin technology has been battle-tested and is considered highly secure

- Is considered to be an uncorrelated asset, making it attractive as part of a diversified investment portfolio

- Even a small allocation can significantly enhance overall investment portfolio returns

- Can be bought and sold 24/7 and is available on many trusted cryptocurrency exchanges while ETFs are available on most stock brokerage platforms

- Is considered by some to be a good hedge against inflation and a store of value

Bitcoin Cons:

- Highly volatile, making it unsuitable for short-term investing

- Can see corrections to the downside of 50% or more

- Experiences prolonged months of sideways or negative price action

- Is still considered a new and experimental technology

- Transactions are irreversible, leading to potentially costly mistakes

- Bitcoin is not FDIC-insured and lacks many of the consumer protections enjoyed by other asset classes

Should I Buy Bitcoin Now? My Conclusion

In summary, I’ve answered the question – Is investing in Bitcoin a good idea? The simple answer is yes (for most people) but be prepared for volatility and wild price swings. Consider dollar-cost averaging your Bitcoin investments. Ensuring your crypto portfolio is well-diversified is also a smart move because altcoins can offer a higher upside potential than Bitcoin. Check out our comprehensive guide on the best cryptocurrencies to buy to see which coins are hot right now.

Explore the Best Cryptos to Buy

FAQs

Is Bitcoin Worth Buying?

How Much Could Bitcoin Be Worth in 2023?

What is the Best Way to Invest in Bitcoin?

Should I invest in Bitcoin or Other Crypto?

Is Bitcoin Safe?

Should I Sell My Bitcoin?

Will Bitcoin Go Up?

When to Buy Bitcoin

How Much Bitcoin Should I Buy

Does Bitcoin Have Real Value?

References

- US SEC approves bitcoin ETFs in watershed for crypto market (Reuters)

- Why is Bitcoin Volatile? An Overview of Bitcoin Price Fluctuations (VanEck)

- Embattled Crypto Exchange FTX Files for Bankruptcy (The New York Times)

- Charlie Munger: the aphorism-loving, bitcoin-hating sage behind Warren Buffett (The Guardian)

- MicroStrategy Owns About 1% of All Bitcoin With Latest Purchase (Bloomberg)

- Is Bitcoin a Buy? 3 Reasons To Buy Bitcoin Like There’s No Tomorrow (The Motley Fool)