AI trading bots help traders find and analyze crypto trading opportunities to increase profits. These bots can even automate trades, making it easier to win more trades each day.

Since trading AI (Artificial intelligence) bots differ in risk levels, success rates, and how well they handle different market conditions, it’s important to choose the right one for your trading style. In this guide, we have ranked and reviewed the best AI trading bots for 2024 to help you pick the best option.

The Best AI Trading Bots 2024

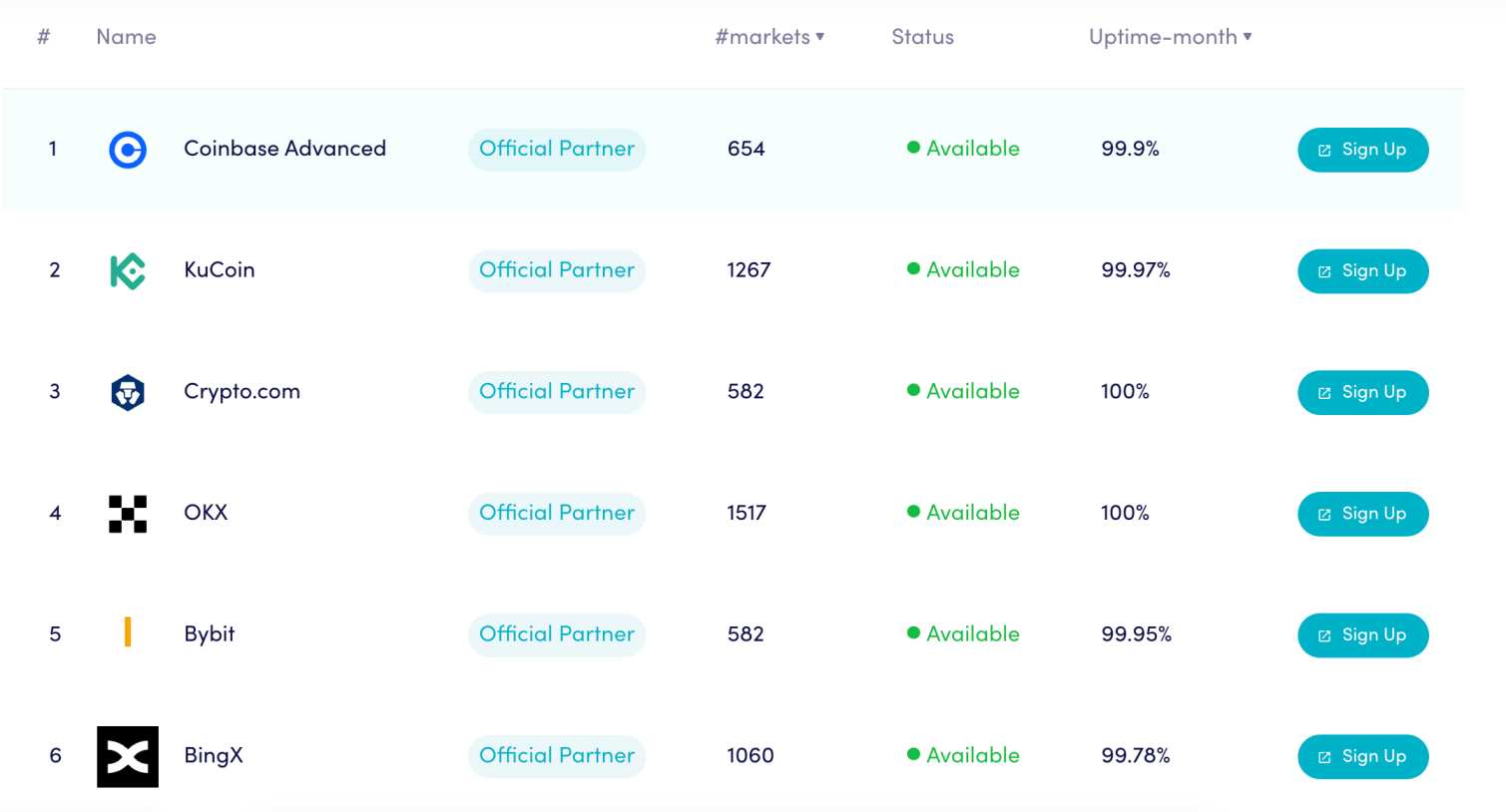

Overall, these 10 providers offer the best AI trading bots:

- WienerAI – Top AI bot for automated DeFi trading and finding the next 100x crypto

- OKX – Choose from over 600 pre-built AI bot strategies via profit-sharing agreements

- MEXC – Automatically copy experienced crypto investors for a passive trading experience

- Binance – One of the best options for long-term portfolios with an auto-rebalancing tool

- Bybit – Top-rated trading bots for high-risk investors via the Martingale system

- BingX – Great option for grid trading strategies to capitalize on sideways markets

- PrimeXBT – Copy successful crypto traders like-for-like with ROIs of over 500%

- Cryptohopper – Build a custom AI trading bot from the ground up without coding skills

- 3Commas – Automate a dollar-cost average strategy for risk-averse crypto investing

- WunderTrading – Best option for implementing TradingView alerts into an AI bot

Best AI Trading Bots Reviewed

Read on to learn more about the top AI trading bots. I explain how each bot provider works, which strategies are available, and what fees and risks to consider.

1. WienerAI – Top AI Bot for Automated DeFi Trading and Finding the Next 100x Crypto

- Pricing: Free for $WAI holders

- Strategy: Scans decentralized exchanges for 1000x trades

- Target Markets: Micro-cap tokens

The first AI trading bot to consider is WienerAI. It’s backed by a new crypto project that’s currently in presale, with over $7 million raised so far. Access to the bot requires $WAI tokens – which are native to the WienerAI ecosystem. The bot automatically scans decentralized finance (DeFi) platforms to discover trading opportunities.

It will then buy the respective tokens on your behalf. This means that $WAI holders can trade cryptocurrencies passively – so WienerAI is ideal for beginners and seasoned pros alike. Moreover, there are no additional fees charged by WienerAI; holders simply cover the trading commission without markups.

WienerAI is also considered one of the best new cryptocurrencies for growth investors – especially those targeting 1000x gains. It doubles up as a meme coin project that’s based on a sausage dog breed. The tokenomics are also attractive – including staking rewards of 163% and a capped supply of 69 billion $WAI. The presale is still ongoing but is in the final stages.

Pros

- The overall best AI crypto trading bot for 2024

- Scans decentralized exchanges for the next 1000x crypto

- Fully automated trading experienced

- No additional fees or commissions

- Doubles up as a dog-themed meme coin with huge potential

Cons

- Only available to $WAI token holders

- No guarantee of making profits

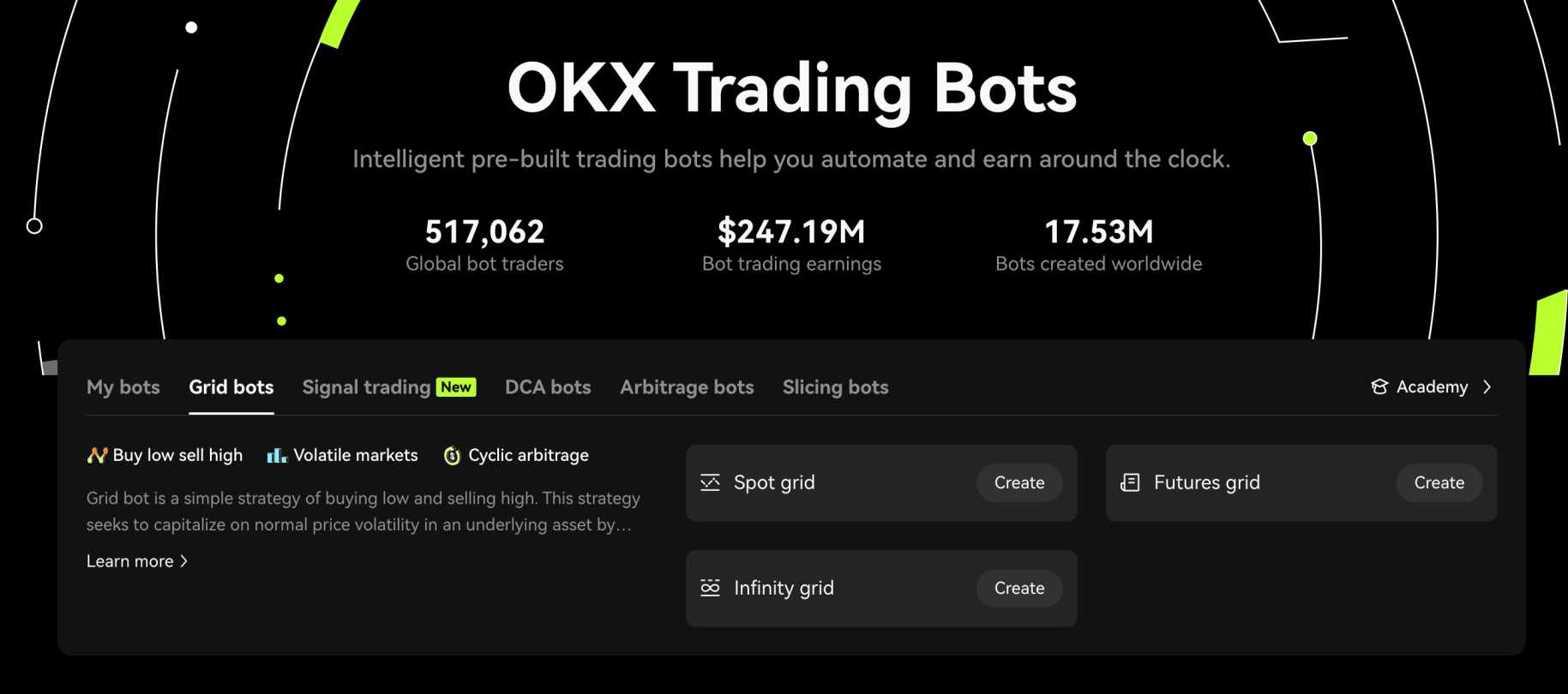

2. OKX – Choose From Over 600 Pre-Built AI Bot Strategies via Profit-Sharing Agreements

- Pricing: Average profit-sharing fee of 10-25%

- Strategy: Multiple strategies, including arbitrage, slicing, DCA, and grid trading

- Target Markets: Bitcoin and hundreds of altcoins

The next option to consider is OKX – a popular crypto exchange with over 600 pre-built bots. Users can find their ideal trading bot based on their preferred strategies -such as dollar-costing averaging (DCA), arbitrage, slicing, signal, and grid trading. Additional filters include the maximum drawdown, profit and loss in percentage terms, and the runtime since activation.

OKX’s AI trading bots cover hundreds of cryptocurrencies, including the best altcoins. For example, there’s a futures grid bot that short-sells CEL/USDT with 6x leverage. Alternatively, there’s also an AI bot that goes long on SHIB/USDT via a DCA strategy. All OKX bots are free to use, but profit-sharing fees apply.

This averages 10-25%, depending on the strategy. You’ll also need to consider standard trading commissions, which start at 0.1% per slide on the spot trading markets. Additionally, OKX also enables users to create a custom bot strategy, although this is more geared toward seasoned traders.

Pros

- Choose from over 600 pre-built bot strategies

- Strategies including grid, DCA, and arbitrage trading

- No upfront fees to deploy the selected bot

- Only pay fees when the bot makes a profit

- Supports hundreds of altcoin markets

Cons

- Many bots apply high leverage to their positions

- Not available in some regions – including many EU nations

3. MEXC – Automatically Copy Experienced Crypto Investors for a Passive Trading Experience

- Pricing: Average profit-sharing fee of 10-15%

- Strategy: Copy trading strategies include high-frequency, stable, and long-term investing

- Target Markets: Hundreds of perpetual futures markets

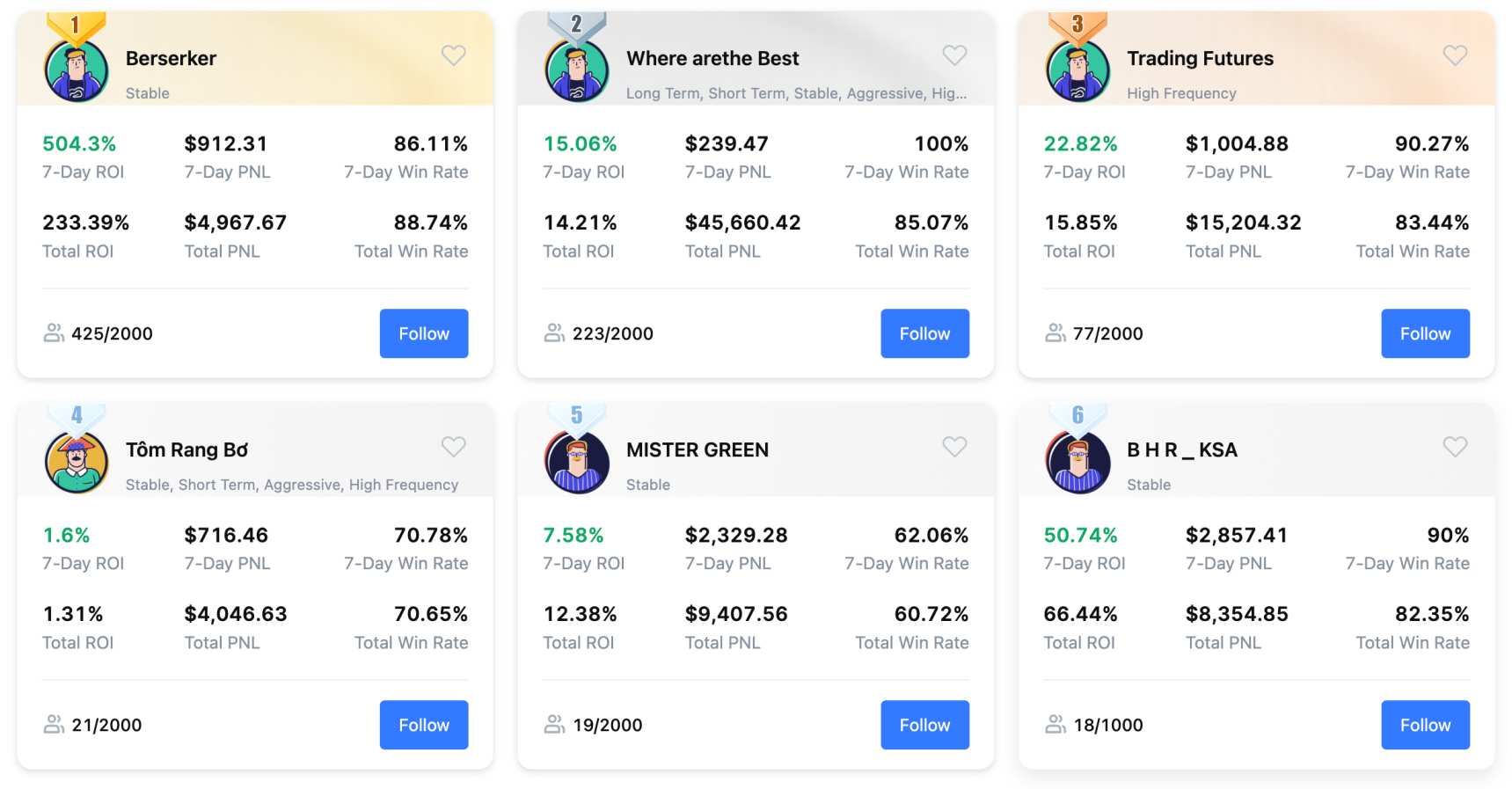

MEXC – one of the best Bitcoin exchanges, doesn’t directly offer AI trading bots. It does, however, offer copy trading tools – which, just like AI bots, offer a fully automated experience. There are almost 9,000 experienced traders to choose from, each with a unique strategy, system, and risk profile.

Finding a suitable trader to copy is easy; filters include the historical win rate, 7-day return on investment (ROI), preferred trading pairs, and the number of followers. All traders specialize in perpetual futures, meaning long and short trading is supported. Not to mention high leverage limits.

Simply click on a trader to explore their target markets and key statistics. There are no upfront fees when copy trading – although profit-sharing commissions apply. This averages 10-15%. Standard commissions are also charged, although this is capped at 0.1% when trading perpetuals. While MEXC is available in most countries, this doesn’t include the US.

Pros

- Offers a passive investing experience via copy trading

- Almost 9,000 experienced traders to choose from

- Automatically buy and sell perpetual futures

- Lots of strategies and risk profiles are available

- Average profit-sharing commission of 10-15%

Cons

- Doesn’t directly offer AI trading bots

- Isn’t available in the US

4. Binance – One of the Best Options for Long-Term Portfolios With an Auto-Rebalancing Tool

- Pricing: Average profit-sharing fee of 1-2%

- Strategy: Multiple strategies including rebalancing, arbitrage, and algo trading

- Target Markets: Hundreds of spot and futures pairs

The next option to consider is Binance – which offers over 113,000 pre-built bots. First, users must choose between the spot and futures markets, alongside their preferred cryptocurrencies. Binance supports hundreds of markets, including Cardano, Solana, BNB, Ethereum, Bitcoin, and Dogecoin.

Users can narrow down their search by the bot’s runtime and ROI. Multiple strategies are covered, although one of the best is the rebalancing bot. This is ideal for long-term investors, as it automatically builds, weights, and rebalances portfolios based on real-time market conditions.

For instance, if one of the portfolio holdings declines in value, the Binance bot might sell a profitable coin to purchase more. This ensures coins are bought when prices are low and sold when they’re high. Other popular strategies include arbitrage, grid, and algo trading. Profit-sharing commissions apply but average just 1-2%.

Pros

- Supports over 113,00 pre-built bots

- Ideal for long-term investors seeking aut0-portfolio management

- Other strategies include algo and arbitrage trading

- Most bots come with a profit-sharing commission of under 2%

Cons

- Many bots have only been running for several days

- Prohibited in some countries – including the UK

5. Bybit – Top-Rated Trading Bots for High-Risk Investors via the Martingale System

- Pricing: No additional fees, standard commissions only

- Strategy: Multiple strategies including the Martingale system, grid trading, and DCA

- Target Markets: Hundreds of spot and futures pairs

Bybit – considered one of the best no KYC crypto exchanges, offers more than 1,000 pre-built bots. It’s one of the best options for high-risk investors seeking significant gains. This is because some Bybit bots leverage the Martingale system. This means the bot ‘doubles up’ when it closes a losing position. This repeats until the bot makes a profitable trade.

For example, suppose the initial stake is $10 and the bot trades BTC/USD. If the trade is unsuccessful, the next BTC/USD position will be $20. Then $40, $80, and so on. Once successful, the next trade reverts to the original stake of $10. The Martingale system can be used on hundreds of cryptocurrencies, including Chainlink, Pepe, Ethereum, and Solana.

Some strategies come with leverage, with multiples ranging from 3x to 50x. Alternatively, some Bybit bots specialize in spot trading, which will appeal to users with a lower risk appetite. Bybit is also suitable for DCA strategies and capitalizing on sideways markets. Best of all, no fees or profit-sharing commissions apply.

Pros

- Offers high-risk trading bots via the Martingale strategy

- Automatically trade the futures markets with leverage

- Also offers DCA and sideways bots for the spot trading markets

- No additional fees or profit-sharing commissions

Cons

- Some strategies won’t be suitable for beginners

- Limited filters when choosing a bot

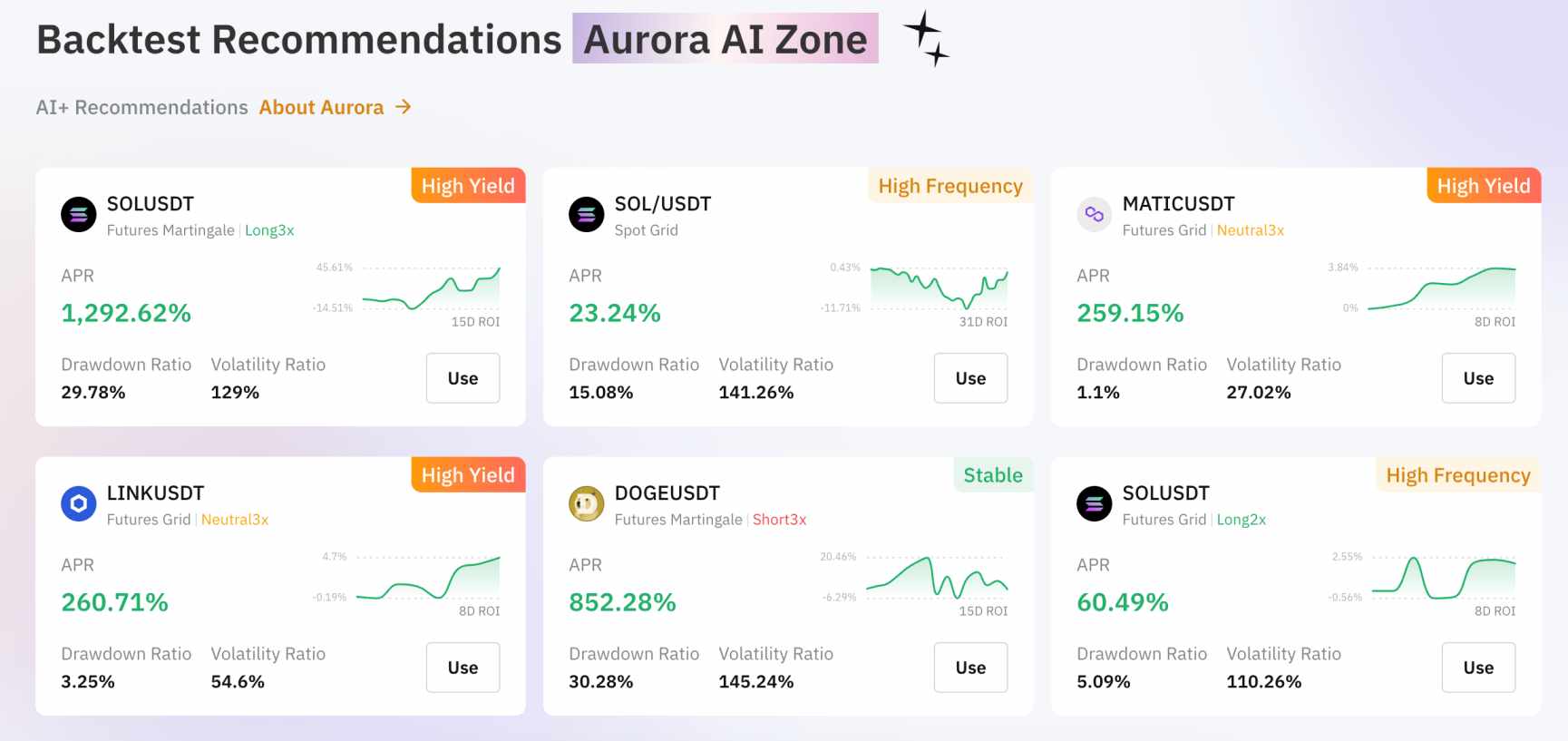

6. BingX – Great Option for Grid Trading Strategies to Capitalize on Sideways Markets

- Pricing: No additional fees, standard commissions only

- Strategy: Grid trading

- Target Markets: 750+ supported coins, via spot and futures markets

I rate BingX as one of the best AI bots for grid trading strategies. This enables users to capitalize on sideways markets within a predefined price range. For example, suppose ETH/USD has traded between $3,300 and $3,700 in the past two weeks. The grid bot could buy ETH/USD whenever it hits $3,305, and sell ETH/USD at $3,695.

The idea is to profit from the identified price range until it breaks out. The BingX bot can also enter stop-loss orders above and below the price range. This ensures users trade in a risk-averse manner. More than 241,000 users have invested in the spot grid strategy, translating to more than $177 million in closed positions.

Alternatively, the grid trading strategy can also be deployed on perpetual futures. However, this is a higher-risk strategy that won’t be suitable for conservative investors. No extra fees are charged when using a BingX bot, so it’s only standard commissions that must be covered. Spot trading commissions cost 0.1%. Futures commissions range from 0.02% to 0.05%.

Pros

- Best AI bot for trading crypto during sideways markets

- Automatically places orders within the selected price range

- Choose from over 750 coins via spot trading and futures

- Only pay standard trading commissions

Cons

- Doesn’t offer DCA strategies

- Limited options when making P2P deposits

7. PrimeXBT – Copy Successful Crypto Traders Like-for-Like With ROIs of Over 500%

- Pricing: Profit-sharing commissions of 15-40% depending on the account tier

- Strategy: Copy trading strategies

- Target Markets: 100+ markets including crypto, forex, indices, and commodities

PrimeXBT is a top-rated crypto exchange that offers automated investing tools. This comes via copy trading strategies, meaning positions are executed by human traders rather than AI bots. Nonetheless, the experience is 100% passive. Some of the best traders to copy have generated ROIs of over 500%.

This is based on an extended trading history for increased validity. For example, ‘wesfin1’ has produced an ROI of 553% since joining PrimeXBT 261 days ago. This trader has a 100% win rate in the prior month and has a maximum drawdown of 55%. Trading strategies vary depending on the trader.

Some are short-term day traders while others build positions on a long-term time horizon. All traders charge a profit-sharing fee. This varies depending on the user’s account tier. The drawback here is that standard users pay 40%. This is reduced to 15% for elite users. PrimeXBT is primarily used by crypto traders, although it also supports forex, indices, and commodities.

Pros

- Best AI bot for trading crypto during sideways markets

- Automatically places orders within the selected price range

- Choose from over 750 coins via spot trading and futures

- Only pay standard trading commissions

Cons

- Doesn’t offer DCA strategies

- Limited options when making P2P deposits

8. Cryptohopper – Build a Custom AI Trading Bot From the Ground up Without Coding Skills

- Pricing: From free to $129 per month

- Strategy: Custom strategy builder, plus pre-built strategies like DCA and momentum trading

- Target Markets: Trades any crypto pair on 15 supported exchanges

Cryptohopper is one of the best AI trading bots for building a custom strategy from the ground up. There is no requirement to learn or understand coding; Cryptohopper uses a ‘build and test’ system. First, users must determine which technical indicators they want to implement into their strategy.

Over 130 indicators are supported, including the Bollinger Bands, moving averages, and the RSI. Next, users must choose their trigger points. For example, the bot can be programmed to short-sell Litecoin if the RSI exceeds 75, and the current price is below the 200-day moving average. Crucially, Cryptohopper comes with a backtesting facility.

This enables users to test their bot creation via historical market data. Demo trading tools are also provided, allowing testing in live market conditions. Cryptohopper also offers pre-built strategies, such as DCA and momentum trading. In terms of pricing, users need the $29 per month plan to access the strategy builder.

Pros

- The best option for building a custom AI trading bot

- No coding skills are needed

- Offers backtesting and demo trading tools

- Also has a marketplace with pre-built strategies

Cons

- Costs $29 per month to use the strategy builder

- Advanced knowledge of crypto trading strategies is needed

9. 3Commas – Automate a Dollar-Cost Average Strategy for Risk-Averse Crypto Investing

- Pricing: From free to €79 per month

- Strategy: DCA investing, plus grid and signal trading

- Target Markets: Trades any crypto pair on 14 supported exchanges

3Commas is an established trading bot platform that’s ideal for DCA investing. Unlike traditional DCA strategies, the 3Commas bot automates the investing schedule based on your preferences. This is especially useful when building and maintaining a diversified crypto portfolio.

For example, suppose you want to buy the best meme coins, such as dogwifhat, Shiba Inu, and Bonk. You can instruct the bot to purchase $30 of each meme coin every week. This reduces the risk over time, as your purchases align with broader market conditions. What’s more, you can spread the DCA investments over multiple exchanges.

14 exchanges are supported, including Binance, Bybit, KuCoin, and OKX. 3Commas is also a good option for grid trading strategies during sideways markets. This strategy can trade up to 100 pairs simultaneously with pre-built risk-management tools. Pricing plans range from free to €79 per month, depending on the required features.

Pros

- Top-rated trading bot for DCA investing

- Automatically build and maintain diversified crypto portfolios

- Strategy tools come with risk-management orders

- Also supports grid and signal trading strategies

Cons

- The DCA bot costs at least €49 per month

- The free plan comes with limited functionality

10. WunderTrading – Best Option for Implementing TradingView Alerts Into an AI Bot

- Pricing: From free to $89.95 per month

- Strategy: TradingView alerts, plus DCA, grid, and spread trading

- Target Markets: Trades any crypto pair on 16 supported exchanges

Last on this list of AI bots for trading crypto is WunderTrading. This platform is a great option for implementing TradingView alerts into an automated bot. TradingView supports thousands of indicators and a proprietary programming language – PineScript. This means users can develop highly advanced strategies that operate 24/7.

Once the TradingView strategy has been backtested, and tested in live trading conditions, it can then be connected with the WunderTrading bot. The bot can be connected with 16 popular exchanges, meaning TradingView alerts are automatically executed in near-real time. For example, suppose the TradingView alert signals a buy order on ETH/USD.

The alert is sent to WunderTrading and the bot will buy ETH/USD on the preferred exchange. WunderTrading also supports other popular strategies, including spread, grid, and DCA trading. Copy trading tools are also supported. Pricing plans range from free to $89.95 per month. A 30% discount is available when paying annually.

Pros

- Implement advanced TradingView strategies into an AI bot

- Automate buy and sell orders on 16 exchanges

- Offers paper trading accounts for trial-and-error testing

- Also supports spread, DCA, and grid trading strategies

Cons

- Full functionality costs $89.95 per month

- Best-suited for experienced traders who understand PineScript

How do AI Trading Bots Work?

AI trading bots use artificial intelligence to generate real-time signals. These signals determine whether to buy or sell a crypto pair based on predetermined metrics. This generally includes technical indicators and risk-management orders.

- For example, consider an AI bot that specializes in sideways markets.

- It uses Trendlines, the Fibonacci Retracement, and Pivot Points to identify support and resistance levels on the XRP/USD pair.

- The bot finds that the key trading range is $0.40 to $46.

- Whenever XRP/USD hits $0.405, it places a buy order. The order is closed when XRP/USD hits $0.455.

- Stop-loss orders are placed just below $0.40 for protection against the eventual breakout.

This is just one example of how an AI trading bot works. Importantly, AI bots offer an automated trading experience. Users typically choose their preferred strategy, risk settings, and order sizes. The bot will then scan the markets, perform technical analysis, and place buy and sell orders autonomously.

For the best results, traders are advised to backtest their AI trading bot. This means testing the bot’s performance based on historical data. This should cover multiple years and cycles, ensuring that the backtesting process is accurate and reliable.

Types of Automated Crypto Trading Software

This section discusses the different types of automated crypto trading solutions. Read on to discover the right AI trading bot for you.

Algorithmic Trading

Algorithmic trading bots place buy and sell orders based on predetermined conditions. They continuously scan live crypto prices, charts, and trends via technical indicators. orders are executed when an indicator is triggered.

For example, the algorithmic bot might buy Bitcoin when the 50-day moving average is above the 200-day moving average. Algorithmic bots are best suited for seasoned traders with a firm grasp of programming languages, such as Python or Java.

Grid Trading

Grid trading bots are ideal for trading during consolidation cycles. This means the identified crypto pair has been trading in a tight pricing range for extended periods. Grid trading bots must first establish the support and resistance levels.

The bot can then enter buy and sell orders accordingly. Stop-losses are placed below and above the support and resistance levels, respectively. This ensures the bot avoids large losses when the pricing range breaks out.

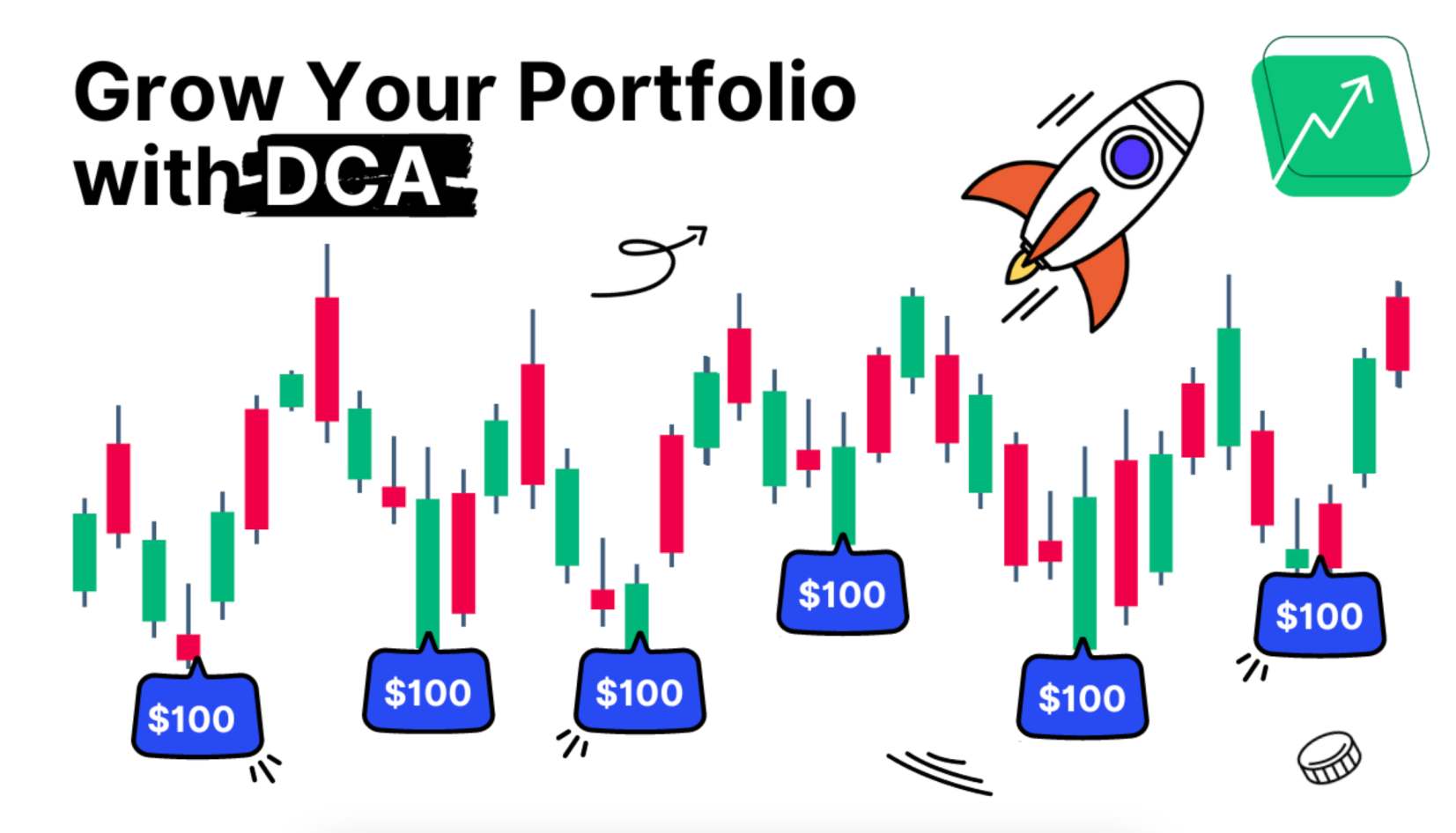

DCA Trading

The best AI trading bots for long-term investors use the DCA strategy. This initially requires some input from the user, in terms of the chosen cryptocurrencies and budget. For example, suppose you want long-term exposure to XRP, Litecoin, Bitcoin Cash, Ethereum, Dash, Monero, and Stellar.

The DCA bot will buy these coins at optimal pricing levels. For example, it might allocate funds to any of these coins whenever their price drops by 1.5%. Mimicking this strategy manually will be cumbersome – as you’d need to be glued to pricing charts. Especially when investing in many different coins.

Signal Trading

Some AI trading bots use the signal method. This means the bot automatically executes orders when a chart signal has been triggered. This prevents the need to trade manually.

For example, suppose the signal focuses on the RSI. Whenever the RSI hits 28, the bot will buy Litecoin. Conversely, the bot will short-sell Litecoin when the RSI hits 72. Signal trading is particularly powerful when used alongside TradingView alerts.

Arbitrage Trading

Arbitrage trading is considered a low-risk strategy. However, it’s only possible when using an AI trading bot that can scan pairs on multiple exchanges simultaneously. The concept is simple: arbitrage strategies take advantage of price discrepancies on two or more exchanges.

- For example, suppose Toncoin is trading at $7.22 on OKX and $7.40 on MEXC.

- This means the bot can make a $0.18 profit for every 1 Toncoin purchased on OKX and instantly sold on MEXC.

It’s crucial to choose an arbitrage bot that can execute identified opportunities in milliseconds. Otherwise, the trade can yield a loss if the price changes before both orders are placed.

Copy Trading

Although copy trading doesn’t use artificial intelligence or bots, it’s still an automated investing strategy. Instead of copying an algorithm, you’ll be mirroring an experienced crypto trader. So, any orders they place will be replicated in your account.

You can choose how much to invest, and the position sizes will be adjusted accordingly. The only drawback with copy trading is that it doesn’t offer a 24/7 experience. After all, human traders can only research and trade for several hours per day.

How to Choose the Best Crypto AI Trading Bot For You

Now we’ve discussed the different types of strategies and systems, you’ll need some guidance on choosing the right AI trading bot. Read on to discover the most important metrics.

Automation Level

The first step is to think about how much automation you require. For example, some users prefer a 100% passive experience. This means choosing a bot that offers plug-and-play solutions. Put otherwise, you simply need to specify your position sizes and activate the bot on your preferred exchange.

Thereon, the bot will trade crypto on your behalf 24 hours per day, 7 days per week. That said, some users prefer more control over an AI bot.

This might mean customizing the bot’s risk settings, active trading sessions, or trigger points. Alternatively, you might only want the bot to research and discover trading opportunities. Meaning – you want the option of whether or not the trade should be executed.

Trading Strategy

Another important metric is the trading strategy implemented by the AI bot. For example, low-risk traders might opt for an arbitrage or scalping strategy. These strategies target small profit margins but they’re super active. Scalping, for instance, often demands hundreds of positions per day.

Those looking for the biggest crypto gains might consider the Martingale strategy. This high-risk strategy doubles the position size if the previous trade yielded a loss. For example, if the first trade was worth $50 the next one will be $100, $200, and so on. The Martingale strategy reverts to the original stake ($50) when it yields a winning trade.

Risk Settings

Risk is just as important when researching AI trading bots for crypto. Some platforms automatically generate a risk rating for each bot it lists. This is based on multiple metrics, such as the maximum drawdown, average position size, leverage settings, and average trade duration.

The risk is also determined by the cryptocurrencies being traded. For example, Bitcoin and Ethereum are considered much more risk-averse than meme coins like Shiba Inu and Bonk. Ultimately, make sure the bot aligns with your risk tolerance.

Backtesting and Live Testing

Testing is the most important stage when deploying AI trading bots.

There are two different testing segments to undertake:

- Backtesting: The first segment is backtesting, which uses historical crypto data. This includes prices, volume, volatility, and order book depth across multiple years. Within minutes, the backtesting tool will provide performance results based on this data.

- Live Testing: Historical data isn’t guaranteed to repeat itself. So, live testing is also important. The bot will execute its strategy using ‘paper funds’. This means orders are based on real-time markets but without risking your bankroll.

AI bots should only be activated once the backtesting and live testing results are solid. Even then, constant monitoring is crucial; what works today might not work tomorrow.

Supported Exchanges and Instruments

Make sure the chosen AI bot is compatible with your preferred exchange(s). Especially when using a third-party provider that requires an API connection. This is particularly important when using cross-exchange strategies like arbitrage trading.

Additionally, consider which trading instruments the AI bot needs access to. For example, some AI strategies are best suited for perpetual futures. This is because they require short-selling tools and/or leverage. Other bots are designed for the spot trading markets, which are generally lower risk.

Pricing

Pricing should also be considered when exploring AI crypto bots. For a start, assess how prices are charged. Some trading bots are free to deploy but come with a profit-sharing commission. This means you’ll lose a percentage of any profits made but won’t need to pay anything when orders are closed at a loss.

Profit-sharing commissions can vary widely, so ensure you check this before proceeding. Alternatively, some AI bots charge a monthly subscription fee. This means you keep 100% of any profits the bot makes. However, you’ll need to ensure these profits exceed the monthly fee being paid.

Past Performance

An AI bot’s past performance shows its success rate since being deployed. This is usually shown as a profit or loss figure in percentage terms. Naturally, the best bots have a high profit percentage. However, the runtime is equally important.

For example, an AI bot might have a historical profit rate of 270%. However, if the runtime is just one week, the results are far from reliable. Instead, we’d much prefer an AI bot with a smaller profit rate but over a much longer time frame.

Some bots also come with a win rate. This is based on the number of winning and losing trades in percentage terms. For example, suppose the bot has placed 1,000 trades. 800 were winners and 200 were losers. This means the win rate is 80%.

How Profitable are AI Trading Bots?

Some AI trading bots are profitable, while others aren’t. It’s simply not possible to know how an AI bot will perform until it’s tested rigorously. Even then, market conditions and dynamics can change at any time. This is why AI bots should be monitored and tweaked accordingly.

Only then can the bot make consistent profits while following risk-management principles. For example, you might have success with a grid trading bot that makes profitable trades on ETH/USD for several weeks. However, once the consolidation period is broken, the existing strategy might no longer work.

All that said, AI trading bots have far greater capabilities than human traders. For a start, advanced bots can analyze thousands of crypto pairs simultaneously, and millions of data points every second. They can also deploy technical indicators and generate pricing forecasts in real-time, not to mention place orders on multiple exchanges almost instantly.

How to Maximize Returns with AI Crypto Trading Bots

Maximizing returns is the overall objective when deploying AI crypto trading bots.

Here are some tips that can help you achieve this goal:

- Risk Settings: Most AI bots come with various risk settings. It’s important to select a level that aligns with your risk appetite. For example, a conservative risk setting might deploy stop-loss orders at 2%. This means the bot will never lose more than 2% on any single trade. An aggressive risk setting might increase the stop-loss level to 15%. This means higher risk but also increased profit potential, as trades remain open for longer.

- Extended Testing: Consider using extended time frames when backtesting and live testing an AI bot. For example, testing its performance for at least a month means the results have validity. However, testing the bot for several days won’t yield the same reliability. Put otherwise, the longer the testing stage the better.

- Adequate Technical Framework: Having a solid strategy and risk-management setup is just half the battle. It’s also important to have a reliable and robust technical framework. This means using a Virtual Private Server (VPS) to maximize the bot’s uptime, a fast computer and internet connection, and an exchange that executes orders in milliseconds. Even a delay of a second can turn a profitable trade into a losing one – especially when scalping or arbitrage trading.

- Real-World Developments: AI trading bots are purely technical, meaning they’re typically programmed to follow pre-defined code. This means real-world developments aren’t considered when placing buy and sell orders. For example, if a crypto project is hacked and a major sell-off occurs, the bot won’t know why prices are plummeting. Instead, it will revert to technical charts and indicators, meaning potential large losses. This is why constant monitoring and risk management are so important, especially stop-losses.

Are AI Trading Bots Legal?

AI trading bots are not only legal but they’re encouraged by many exchanges. For a start, AI bots don’t guarantee success. On the contrary, many bots lose money. Additionally, most bots are simply programmed to follow a predefined strategy. It’s just that bots can implement these strategies faster and more effectively.

As such, bots don’t violate existing trading laws or exchange policies. However, there are some exceptions. Crucially, if the AI bot engages in market manipulation, this is illegal in most jurisdictions. Using bots to execute inside trading information is also prohibited. Pump and dumps, wash trading, and other unethical practices should also be avoided.

Security: Are AI Trading Bots Safe?

AI trading bots are generally safe. However, security measures depend on how the bot is deployed. For example, some trading bots are offered directly on exchange platforms, including Bybit, OKX, and Binance. This means the bot uses the exchange balance and doesn’t require third-party integrations.

Conversely, some bots are offered by intermediary platforms, such as Cryptohopper and 3Commas. This means the bot must be connected to an exchange via an API. While this is typically secure, it’s important to check what permissions the API has. This shouldn’t include anything other than placing orders within the bot’s parameters.

What’s more, remember that trading bots aren’t risk-free – even if stop-loss orders have been deployed. Especially when market prices are extremely volatile. For example, suppose you’ve got a stop-loss order at 5%. If a major dump occurs, the stop-loss order might not be matched by the markets, meaning you could lose significantly more than 5%.

Conclusion

We’ve explored the best AI crypto trading bots in 2024, covering a wide range of strategies, systems, and risk factors. AI bots not only offer a passive trading experience but their capabilities far exceed humans. Bots can analyze significant data sets for multiple coins simultaneously, 24 hours per day.

Moreover, orders can be placed on different exchanges at rapid speeds. However, AI bots aren’t a surefire way to make money. Make sure you research the bot’s parameters, such as its maximum drawdown, historical win rate, and return on investment. Also, ensure adequate backtesting and live testing before deploying the bot. If you are new to the world intersecting AI and Crypto, you may be interested in our Beginner’s Guide to AI Crypto Coins.

See Also: Best AI Crypto Coins in 2024

FAQs

Are there AI trading bots for crypto?

Yes, there are fully automated AI bots for crypto, allowing users to trade passively 24/7. Some bots can be customized and built from the ground up, offering a more hands-on approach.

How much do AI trading bots cost?

Some AI trading bots charge monthly subscription fees – prices depend on the provider and required features. Some bots are free to use but come with a profit-sharing commission paid to their creator.

Do AI bots really work in crypto trading?

Yes, some AI bots produce consistent profits, but they’re not guaranteed. This is why backtesting and live testing procedures are so important.

How do I start with an AI trading bot?

Choose a reputable bot platform and pick a strategy, such as DCA, arbitrage, or grid trading. Adjust the risk settings, backtest the bot, and connect it to the preferred crypto exchange for live trading.

Which AI trading bot is best for crypto?

WienerAI is the best AI trading bot for finding 1000x gems on DeFi exchanges. Alternatively, consider bots on OKX or Binance to automate trades on established coins like Bitcoin and Ethereum.

References

- AI Trading – What is AI Trading & How It’s Used In Stock Trading (NASDAQ)

- How A Trading Algorithm Actually Works (Wall Street Journal)

- What is Backtesting? (Corporate Finance Institute)

- What is an API (Application Programming Interface)? Amazon Web Services