How to Buy New Crypto Before Listing in 2024

Investing in crypto projects before they’re listed on exchanges offers several benefits. You’ll often secure preferential pricing, a small market capitalization, and access to a new token from the ground up.

Read on to learn how to buy new crypto before listing on exchanges. Discover the top methods seasoned investors use alongside the pros and cons of purchasing pre-listing tokens.

5 Ways to Buy New Cryptos Before Listing

Here are five popular strategies when exploring how to buy new crypto before listing:

- Presales: Directly invest in brand-new crypto projects before their exchange listing

- Initial Exchange Offering (IEO): Invest in pre-vetted token launches via established exchanges

- Launchpads: Purchase pre-listing tokens with the launchpad’s native digital asset

- Airdrops – Earn free crypto tokens for completing basic tasks and sell them once they’re listed

- DEX Liquidity – Deposit established coins into a new DEX to earn its native crypto tokens

1. Presales: Directly Invest in Brand-New Crypto Projects Before Their Exchange Listing

Presales (also known as crypto ICOs – Initial Coin Offerings) are the best way to buy crypto tokens before they’re listed on major crypto exchanges. You’ll be investing in new projects directly – meaning you won’t need to use third-party platforms, get whitelisted, or join a private Telegram group. Instead, presale investments are made on a wallet-to-wallet basis.

This means presale investments can be made anonymously, as payments are made with established crypto coins. I found that many presale campaigns accept ETH, USDT, and BNB. Other popular coins are often accepted, too. Most presales come with various stages, and at each stage, the token price increases.

For example, stage one investors might pay $0.01 for the token. And stage two investors might pay $0.015. In this instance, stage one investors have already secured an immediate upside of 50%. What’s more, crypto presales are inclusive; they often come without minimum investment requirements, and most nationalities are accepted.

After the presale concludes, investors receive the newly issued tokens. They’re typically deposited to the same wallet address used when investing. The tokens will then be listed on crypto exchanges – meaning presale investors can sell them at any time. Unlike other pre-listing investment methods, presales rarely come with vesting periods.

One of the most successful presales of all time is Ethereum, which sold ETH for $0.31 in 2014. Today, ETH is worth almost 1 million percent more than its presale price. However, it’s important to remember that presales are risky. Not all presales are legitimate and there’s no guarantee the tokens will increase in value.

According to seasoned crypto analyst Jacob Bury, who shares tips on Discord, here’s a list of the best crypto presales for 2024:

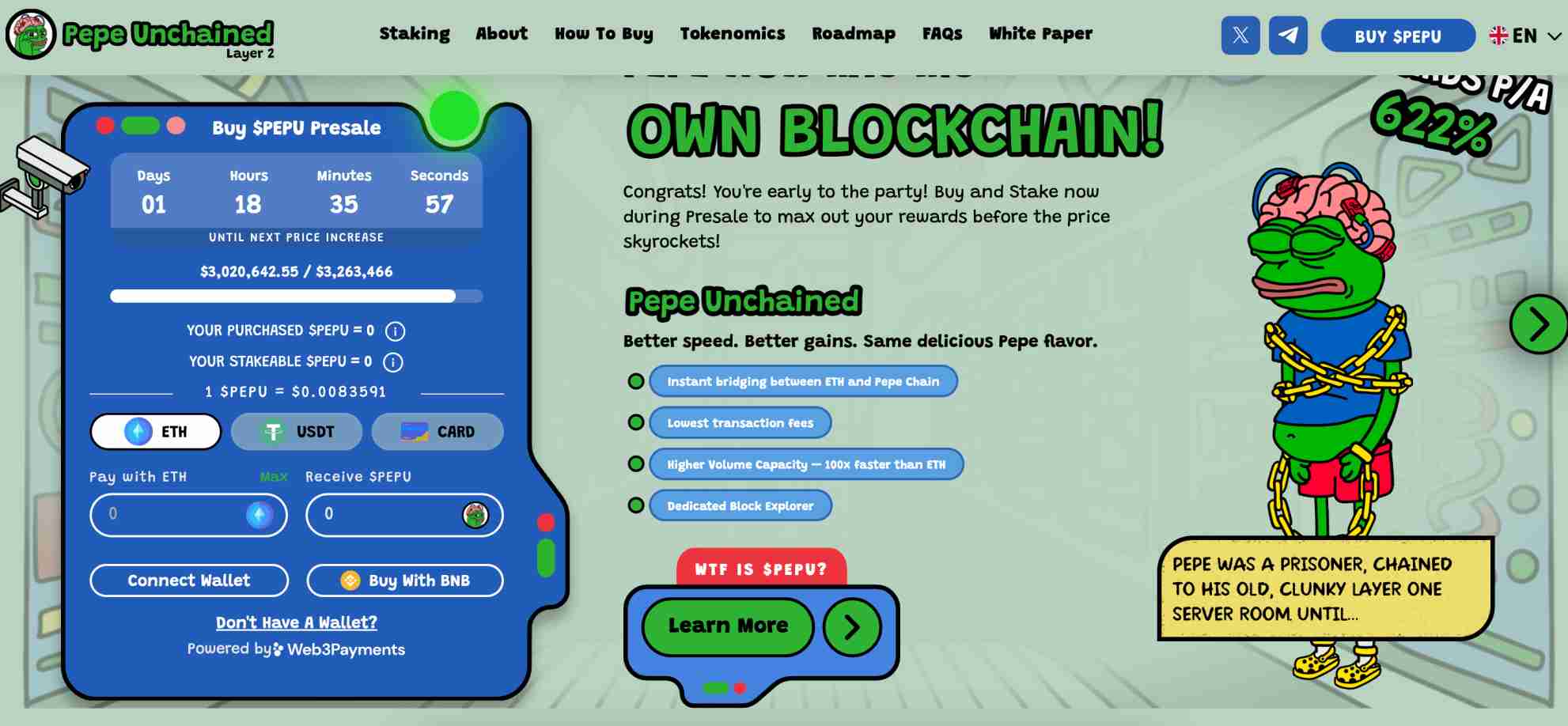

- Pepe Unchained: The next 100x meme coin with a native layer 2 network, plus staking APYs of 622%

- WienerAI: An AI trading bot with dog-themed meme features, over $7.6 million raised so far

- PlayDoge: Innovative play-to-earn game based on a Tamagotchi-style pet simulation

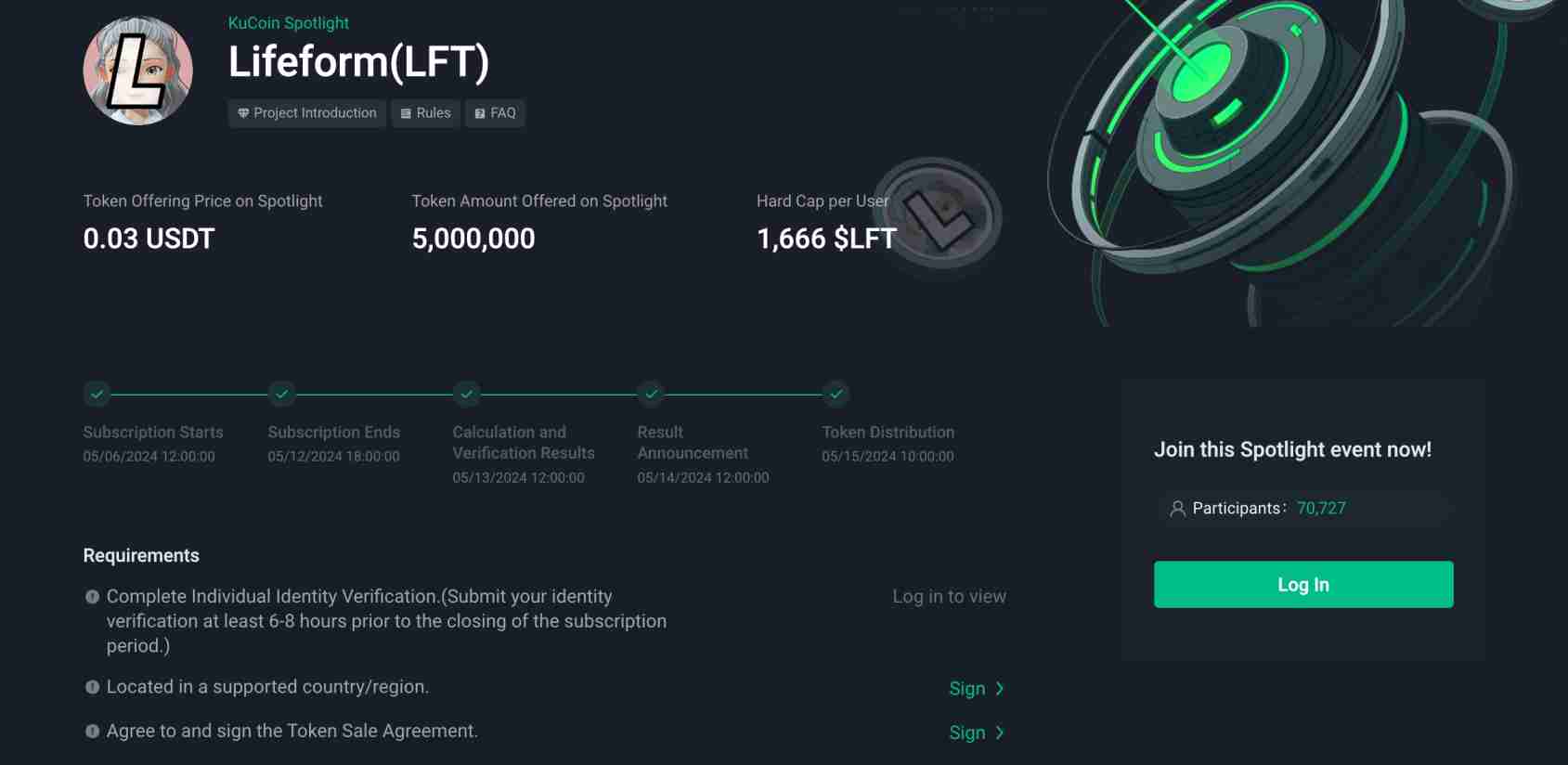

2. Initial Exchange Offering (IEO): Invest in Pre-Vetted Token Launches via Established Exchanges

Initial exchange offerings (IEO) are also worth considering when exploring how to buy new crypto before listing. Similar to presales, IEOs provide access to brand-new tokens before they’re traded by the public on the crypto market. This means you can buy new cryptocurrencies at a favorable entry price, not to mention a small market capitalization.

IEOs are held directly on crypto exchanges, which are responsible for conducting due diligence on the respective project. This means ensuring that the new project is legitimate and credible and that it offers something innovative and unique. As such, IEOs offer an extra layer of security for investors.

However, IEOs also come with some drawbacks. For a start, unlike presales, IEO investors must go through a KYC process. This often means providing personal information, a government-issued ID, and a proof of address document. I also found that IEOs often come with limited availability.

This means that each investor can only purchase a small number of crypto coins early. Another drawback is that the tokens will only be listed on the exchange hosting the IEO. This could mean liquidity issues if the exchange isn’t considered tier-one. In contrast, crypto presales often list on multiple exchanges, meaning access to a wider audience of investors.

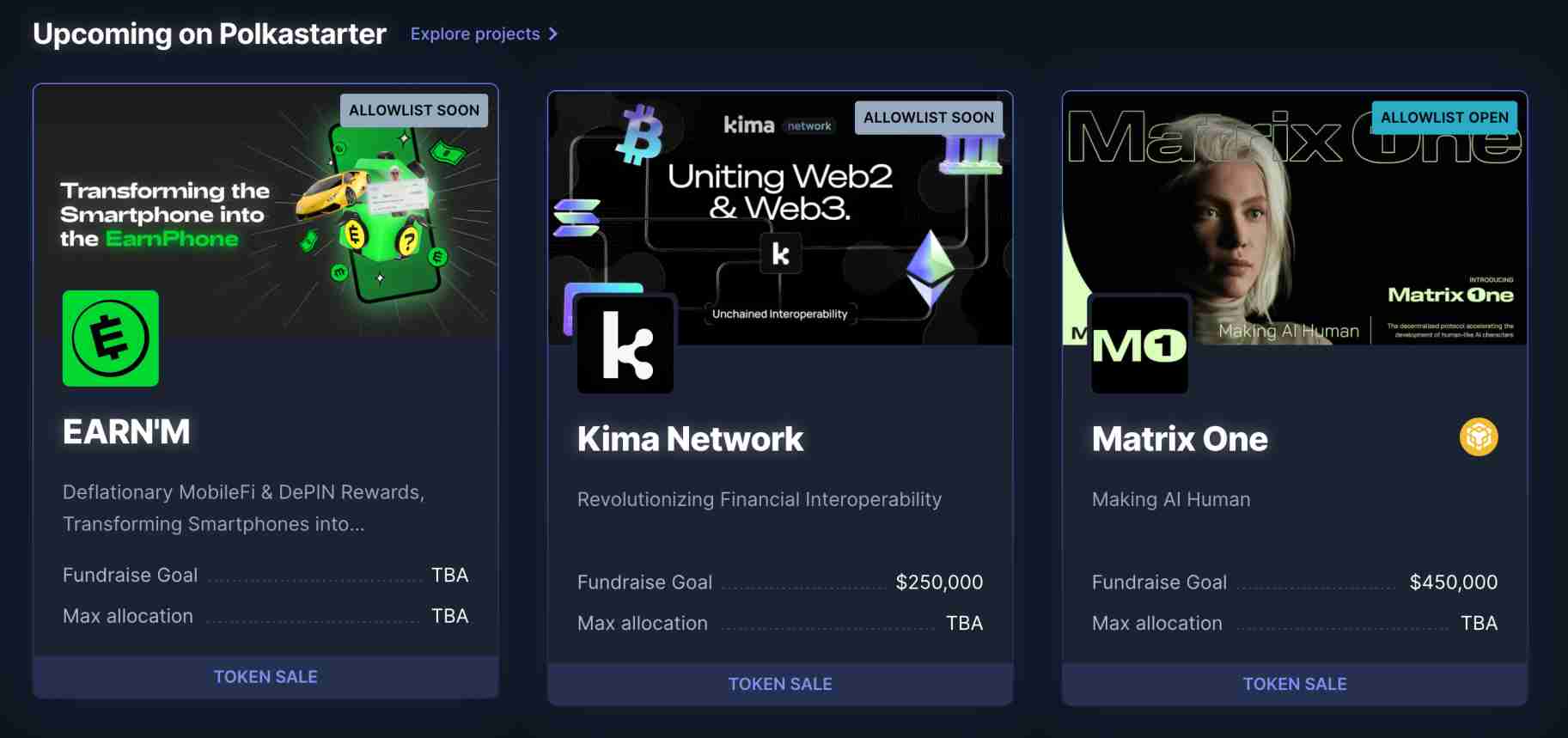

3. Launchpads: Purchase Pre-Listing Tokens With the Launchpad’s Native Digital Asset

The next option to consider when buying new tokens is crypto launchpads. These are third-party platforms designed specifically for new launches. To be listed, projects must apply to the launchpad, explaining why they should be chosen, alongside key information like the whitepaper, tokenomics, and roadmap timeline.

Similar to IEOs, the launchpad is responsible for due diligence. This ensures that launchpad clients are investing in credible projects with a reasonable upside potential. Once approved, the launchpad will announce details of the token sale. This includes the date and time, number of tokens available, cost price, and the eventual exchange listing.

Unlike presales, most launchpad campaigns are sold at the same price. While this ensures everyone gets the same cost basis, it doesn’t incentivize early participation. One of the main drawbacks of crypto launchpads is the payment currency. In most cases, investors must hold the launchpad’s native token to access project sales.

This won’t be suitable for everyone, as the token value will rise and fall like any other crypto. Moreover, launchpad investors must go through a KYC process, including uploading a government-issued ID. I also found that launchpads typically come with vesting periods. This means investors can only sell a certain percentage of tokens at predetermined intervals.

For instance, investors might be able to sell up to 20% once the tokens are listed on exchanges. After that, they might need to wait another six months before making additional sales. Even then, they might only be able to sell 10% each month. Nonetheless, launchpad investments can still be lucrative – especially when holding long-term.

4. Airdrops – Earn Free Crypto Tokens for Completing Basic Tasks and Sell Once They’re Listed

Airdrops are one of the best options for getting pre-listing tokens without risking any money. There are several different airdrop types, although most require participants to complete tasks. These tasks typically help a new crypto project increase its exposure on social media networks.

For example, airdrop users might be asked to follow the project’s X page, subscribe to its YouTube channel, and join its Discord server. Each task earns the participant points. Daily tasks are often available, too – such as liking new posts on X or sharing a news article on Facebook. Either way – the more points earned, the greater the potential rewards.

These rewards are often paid in the project’s new crypto token before it’s listed on exchanges. Some airdrops have a point-to-token ratio. For instance, you might receive 1 token for every 100 points earned. Alternatively, some airdrops have a leaderboard system. This could mean the 50 highest-earning participants share the airdrop allocation.

Some of the top crypto airdrops use a raffle-based approach. Instead of earning points, you’ll receive a ticket for each completed task. A random draw will be made on a predefined date, with the token pool split between each winner. Airdropped tokens are often listed on exchanges a few days after the distribution – allowing participants to sell them.

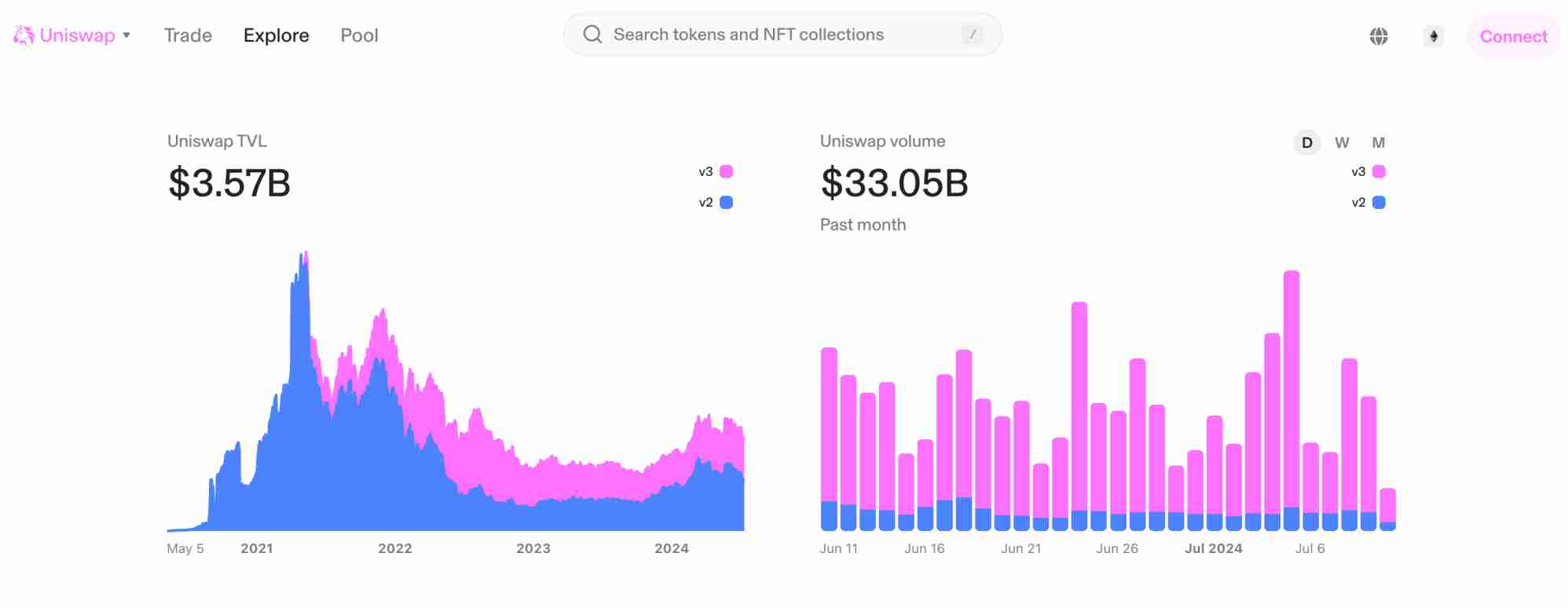

5. DEX Liquidity – Deposit Established Coins Into a New DEX to Earn its Native Crypto Tokens

The next option to explore is decentralized exchange (DEX) liquidity. New DEXs seek liquidity from external sources, allowing traders to buy and sell tokens in functioning markets. For instance, suppose the DEX offers the SOL/USDT trading pair. It requires sufficient amounts of SOL and USDT; otherwise, the DEX will struggle to attract traders.

Now, anyone can provide liquidity to DEXs and there are rarely minimum requirements. Best of all, some DEXs offer rewards in their native tokens before they’re listed on exchanges. Uniswap is a great example; those providing liquidity in its early days received UNI. Similarly, those who provided liquidity to Jupiter received JUP.

Both of these DEX tokens have produced sizable gains since the distributions were made. In addition, you’ll also earn a share of trading fees when providing liquidity. This means an extra source of passive income. The main drawback is that you’ll need to keep your crypto coins in the liquidity pool for extended periods, meaning they can’t be used for other investments.

Benefits of Investing in New Cryptos Before Listings

Investing in crypto tokens before their exchange listings provides many benefits. Let’s explore the most common advantages in more detail.

Discounted Entry Price

One of the main benefits of investing in pre-listing tokens is that most funding campaigns offer a discounted price. This means you’ll secure a lower cost basis when compared to the exchange listing. This is especially the case when investing in presales.

- For example, suppose the presale price is $0.20.

- Once listed on exchanges, the token will be priced at $0.60

- This represents a 200% upside from the presale price

Some investors will immediately lock in their presale upside once the tokens are listed. Others will hold long-term to target much higher growth.

Invest in Small-Cap Projects

Pre-listing projects are often brand-new, with little to no development. This means you’re investing in upcoming projects from the ground up – just like buying IPO stocks. The benefit here is that new crypto projects have a small market capitalization – often just a few million dollars.

This presents a huge upside potential. For example, ICODrops states that Ethereum’s ICO in 2024 raised $18.66 million. Ethereum’s current market capitalization is over $370 billion. This shows just how lucrative early-stage investments can be when investing in the right projects.

Enhanced Staking Rewards

You’ll come across the term ‘staking’ regularly when exploring how to buy new crypto before listing. In a nutshell, staking is a passive investment tool. Investors stake their tokens by locking them away, either on a flexible or fixed term. Those staked tokens generate passive rewards paid in the same token.

Crucially, it’s sometimes possible to earn staking rewards on tokens before they’re listed on exchanges. Not only that but staking rewards can be substantial for early investors. For example, those investing in the Pepe Unchained presale are earning staking APYs of 622%, currently. Similarly, WienerAI and PlayDoge investors are getting APYs of 155% and 89%, respectively.

What You Need to Get Started Buying Cryptocurrencies

This section explains what beginners need to know before investing in pre-listing crypto tokens.

Understanding Blockchain Basics

First, it’s crucial to have a basic understanding of blockchain basics. For instance, the vast majority of new tokens operate on an established blockchain network. This determines its token standard and performance metrics, such as speed, fees, and scalability.

For example, new projects on the Solana blockchain are called Solana Program Library (SPL) tokens. SPL tokens benefit from low fees and lightning-fast transactions. Similarly, new projects built on the Ethereum blockchain are called Ethereum Request for Comment 20 (ERC-20). While ERC-20 transactions are fast, they’re often expensive.

Additionally, beginners should understand key ‘tokenomics.’ Some projects have a limited supply – meaning new tokens can’t be issued once this supply is in circulation. WienerAI, for instance, has a total supply of 69 billion $WAI. However, some projects come without a capped supply, meaning new tokens can be issued at any time.

Getting a Wallet

Getting a secure crypto wallet is a minimum requirement – regardless of whether you’re buying pre-listing or established tokens. Wallets serve many functions, including storing the tokens you purchase. For instance, after investing in a new project, the tokens will be transferred to your wallet – which will have a unique blockchain address.

Moreover, wallets are required to invest in pre-listing campaigns – including presales, launchpads, and IEOs. For example, presales require users to connect their wallet and transfer coins to its address. It’s best to opt for a ‘self-custody’ wallet, also known as ‘non-custodial’ or ‘self-directed.’

This keeps your investments on-chain and ensures that no third-party involvement is needed when transacting. Some of the top Bitcoin wallets include Best Wallet, OKX, and MetaMask. Make sure your chosen wallet offers high security and that it supports your preferred tokens.

Step-by-Step Guide to Buying New Cryptos Before Listing

Still wondering how to buy new crypto before listing on Binance and other exchanges? This section offers a step-by-step walkthrough when investing in presales. Read on to invest in your first pre-listing token.

- Step 1: Research New Cryptos to Invest in: The first step is thorough research and due diligence. Many pre-listing tokens are launching almost daily – most will fail to deliver adequate returns. Spend time reading the project’s whitepaper, evaluating its road map timeline, and assessing the tokenomics. Also, consider the pre-listing price and subsequent date and time.

- Step 2: Invest in a Presale: Once you’ve identified a quality presale or initial coin offering to invest in, visit its website and connect your crypto wallet. Make sure the wallet is funded with a crypto coin accepted by the presale campaign. This is usually ETH, USDT, and BNB, although check this before proceeding. Type in the number of presale tokens to buy and verify the transaction from your crypto wallet.

- Step 3: Managing Your Assets: The presale tokens will be delivered to your crypto wallet after the campaign ends. Keep them there until you’re ready to sell. Cashing out depends on the type of exchange the tokens are listed on. If it’s a DEX, you can connect the same wallet and sell the tokens directly. If it’s a centralized exchange (CEX), you’ll need to deposit the tokens via a wallet transfer. You can then sell them manually.

How to Find New Cryptos

We’ll now take a closer look at how to find new crypto projects before listing. This will help you find new promising projects with the most potential.

Social Media

New crypto projects have limited resources – especially before completing their fundraising campaign. As such, they often use social media to spread the word. The most effective strategy is to use key search terms on X. For instance, ‘presales,’ ‘ICOs, ‘IEOs,’ and ‘crypto launch.’

Adjust the search settings so that X displays results from the latest post. Consider using YouTube with the same search terms. This can yield videos from reputable crypto analysts. The respective video will usually offer information about the new project, allowing you to make an informed decision.

Discord

Discord is also valuable when exploring how to find new crypto coins before they explode. Jacob Bury, for example, has a popular Discord server that aims to find the next 1000x crypto projects.

Bury focuses on new project launches with untapped potential and micro-cap valuations. However, Bury is just one analyst that’s active on Discord. Consider searching for different Discord servers for alternative viewpoints.

Launchpads

Launchpads are third-party platforms that host new crypto launches. Projects must apply to the launchpad, which will conduct due diligence on its potential and legitimacy.

Launchpads provide investors with all required information, such as links to the whitepaper, tokenomics, and listing price. Investors must hold the launchpad’s native token to invest, and complete a KYC process.

News Sites

Crypto news sites can also be used when searching for new launches. It’s important to check whether the article is organic or sponsored. This is because new cryptocurrencies often pay news websites to promote their projects.

Nevertheless, the article should provide an overview of the token, including what real-world problems it solves. You can then research the project independently.

Common Pitfalls to Avoid

Investing in pre-listing tokens is a high-risk endeavor. Not only can the value of your investment decline but some project launches are scams.

- Scams: Many new crypto launches are scams. One of the most common crypto scams is a rug pull. The project will build and promote its token extensively, before ‘pulling the rug’ from investors. This often means keeping the funds raised and dumping the respective tokens on public exchanges. Honeypot scams are also common. This is where the project changes the smart contract code, often to issue new tokens or create a huge transaction tax.

- Extreme Volatility: New crypto tokens are often extremely volatile once listed on exchanges. Some presale investors will sell their tokens immediately, while new buyers will look to enter the market simultaneously. This can create unfavorable market conditions – meaning ultra-high price spikes in both directions. Beginners should be prepared for this market dynamics.

- Post-Listing Declines: No matter how much hype a new launch gets – the token’s value can decline once listed on exchanges. This is increasingly likely if broader market conditions are bearish. Or if bad news has surfaced about the project. Alternatively, declines can happen if too many presale investors sell their tokens to lock in their initial upside. Only consider holding long-term if you believe in the project’s potential.

- Low Liquidity: Another risk is that new launches often struggle to attract enough liquidity. This means that traders experience increased volatility, wide spreads, and high slippage. This is especially the case when tokens launch on DEXs, where available liquidity is much lower than established CEXs. Cashing out a profitable token can be challenging if liquidity levels are too low.

Conclusion

In summary, we’ve explored where to find new cryptocurrencies, how to buy them, and what risks to consider before starting. New launches offer the best way to secure significant gains, especially considering the low market capitalization and discounted entry price.

However, the sheer number of launches makes it difficult to pick the right one. Independent research and diversification are imperative. Never invest more than you can afford to lose, as a project’s success is not guaranteed.

See also: Top 16 New and Upcoming Binance Listings in 2024

FAQs

Is it safe to invest in crypto before listing?

How do I know pre-listed cryptos are legit?

How do I sell crypto before it’s listed on major exchanges?

How do you find new crypto coins before they list?

Where can you buy tokens before launch?

References

“Initial Coin Offering (ICO): What Are They and How Do They Work?” CNBC, 13 July 2018, www.cnbc.com/2018/07/13/initial-coin-offering-ico-what-are-they-how-do-they-work.html.

“Crypto Scams.” California Department of Financial Protection and Innovation, Why and when to use API keys | Cloud Endpoints with OpenAPI | Google Cloud

“Tips to Help Keep Your Crypto Wallet Secure.” CNBC, 11 June 2021, www.cnbc.com/2021/06/11/tips-to-help-keep-your-crypto-wallet-secure.html.

“Honeypot Scams: How to Recognize and Avoid Them.” CertiK, www.certik.com/resources/blog/honeypot-scams.