In this Solana review, we’ll explore what Solana is and why it’s become one of the most talked-about blockchain platforms in the crypto world. Known for its high-speed transactions and innovative architecture, Solana is redefining the possibilities of decentralized finance. But does it live up to the hype? In this ultimate SOL guide, we’ll dissect every aspect of Solana, from its core technology to its impact on the broader crypto ecosystem, giving you a clear, expert analysis of

Solana Review: Summary

Solana has established itself as a leading blockchain platform, known for its unmatched speed and scalability. This ultimate guide will take you through the intricate details of what makes Solana stand out in the crowded crypto space.

Solana Pros:

- High Transaction Speed: Solana’s architecture enables processing thousands of transactions per second, making it one of the fastest blockchains available.

- Low Transaction Costs: The network’s efficiency allows for minimal transaction fees, making it attractive for both developers and users.

- Scalability: Solana’s use of Proof of History (PoH) combined with Delegated Proof of Stake (DPoS) offers a scalable solution, capable of handling a large number of transactions without congestion.

- Growing Ecosystem: With a rapidly expanding ecosystem that includes DeFi projects, NFTs, and Web3 applications, Solana is becoming a versatile platform for various blockchain innovations.

Solana Cons:

- Network Reliability Issues: Solana has experienced several network outages and performance issues, raising concerns about its ability to maintain consistent uptime and security as it scales.

- Inflation Rate: Solana’s tokenomics involve a high initial inflation rate (8% annually), which could dilute the value of SOL over time if demand does not keep up with supply.

- Complex Consensus Mechanism: While the combination of PoH and DPoS is innovative, it adds complexity to the network’s operation, which could pose challenges in terms of governance and future upgrades.

Key Highlights

- Solana, A high-performance blockchain, offers speed, scalability, and low transaction fees, making it a competitor to Ethereum.

- It utilizes a unique combination of Delegated Proof of Stake (DPoS) and Proof of History (PoH) consensus mechanisms for efficient transaction processing.

- Solana boasts a burgeoning ecosystem with a wide range of decentralized applications (dApps), including DeFi, NFT marketplaces, and more.

- Despite challenges, Solana continues to attract developers and users, with ongoing developments like the Firedancer upgrade.

What is Solana?

Solana, a high-performance layer-1 blockchain, supports fast, secure, and scalable decentralized applications (dApps) and cryptocurrencies. Known for its groundbreaking transaction speed and low fees, Solana has quickly become a favorite among developers and investors. But what sets Solana apart in a sea of blockchain projects? The secret lies in its unique technology stack, which we’ll explore in depth.

History of Solana

In 2017, Anatoly Yakovenko, a former Qualcomm engineer, founded Solana to create a blockchain that overcomes the limitations of existing networks like Ethereum and Bitcoin. The project officially launched in March 2020 and has grown exponentially in both its ecosystem and market capitalization. Solana rapidly gained popularity for handling thousands of transactions per second (TPS) with minimal fees. Making it one of the most scalable blockchain platforms in the world.

The Vision and Technology Behind Solana

At the core of Solana’s technology is a novel consensus algorithm known as Proof of History (PoH), which works in conjunction with Delegated Proof of Stake (DPoS) to synchronize the network and maintain its high throughput. This innovation enables Solana to process over 65,000 transactions per second, a capability that has positioned it as a leading competitor to Ethereum.

Solana’s architecture is built for scalability without compromising on decentralization. The network’s validators use a sequence of cryptographic timestamps to prove that transactions have occurred in a specific order, eliminating the need for energy-intensive mining. This approach not only speeds up the network but also drastically reduces costs, making Solana one of the most efficient blockchain platforms available today.

Core Features that Make Solana Unique

Solana’s rise in the blockchain space is driven by a set of core features that distinguish it from other Layer 1 networks. Among these, the introduction of Firedancer and its unique technological innovations have solidified Solana’s reputation as a high-performance, decentralized platform. Firedancer, developed in collaboration with Jump Crypto, is a new high-performance validator client that was unveiled at the Solana Breakpoint conference. This addition is monumental for Solana, as it introduces an alternative client, enhancing the network’s redundancy and resilience. With Firedancer, Solana validators now have multiple options, reducing the risk of a single point of failure and strengthening the network’s decentralization. Additionally, Firedancer demonstrated the ability to process over 1 million transactions per second which far exceeds the amount of transactions leading providers like Visa typically process.

Additional key features, which we will cover in more detail below:

- Proof of History (PoH): A unique system that timestamps transactions to improve scalability and security.

- Tower BFT: A high-performance consensus algorithm that speeds up the agreement process on the network.

- Sealevel: Enables parallel smart contract execution, boosting network performance.

- Gulf Stream: Memepool-less transaction forwarding protocol.

- Turbine: A block propagation protocol that breaks data into smaller packets, allowing for faster transmission and better network performance.

- Cloudbreak: A horizontally scaled state architecture that helps in managing and maintaining the high throughput of the network.

- Hyperledger Solang: a compiler which helps bridge the gap between EVM developers and the Solana ecosystem. Allowing developers to build on Solana with Solidity, the primary programming language used for Ethereum smart contracts.

Solana Saga Smartphone

In a bold move that pushes the boundaries of blockchain technology into everyday life, Solana introduced the Solana Saga Smartphone. The Solana Saga Smartphone is equipped with a built-in Solana wallet and dApp store, allowing users to seamlessly interact with the Solana ecosystem. Whether you’re managing your SOL assets, engaging with decentralized applications, or exploring new Web3 opportunities, the Solana Saga makes these processes more intuitive and accessible than ever before.

The device integrates with Solana’s robust blockchain features, ensuring that transactions are not only fast and efficient but also secure. With hardware-level encryption and a user-friendly interface, the Solana Saga aims to make decentralized finance (DeFi) and crypto management as simple as sending a text message. By integrating blockchain capabilities directly into a smartphone, Solana is making a powerful statement about the future of mobile technology and its potential to revolutionize the way we interact with the digital economy.

How Does Solana Work?

Understanding how Solana operates is key to appreciating its rapid ascent in the blockchain world. Solana’s architecture is a blend of innovative consensus mechanisms and cutting-edge technology that work together to deliver unmatched speed, security, and scalability. Let’s break down the core components that power the Solana network, starting with its unique combination of Delegated Proof of Stake and Proof of History.

Solana’s Delegated Proof of Stake & Proof of History

Solana utilizes a hybrid consensus model that combines Delegated Proof of Stake (DPoS) with its proprietary Proof of History (PoH) mechanism.

- Delegated Proof of Stake (DPoS): In Solana’s DPoS system, token holders can delegate their voting power to validators who are responsible for processing transactions and securing the network. This system not only enhances network security but also encourages community participation, as validators are incentivized to act in the best interest of the network to earn rewards.

- Proof of History (PoH): PoH is a cryptographic clock that provides a verifiable sequence of events, ensuring that all transactions are recorded in the correct order. By timestamping transactions, PoH enables the network to process transactions in parallel, significantly boosting scalability and reducing the time required to reach consensus. This innovative approach allows Solana to achieve its high throughput without compromising on security.

Tower Byzantine Fault Tolerance (BFT): Optimizing Consensus

Tower BFT is Solana’s consensus algorithm, designed to work in conjunction with PoH. It uses the cryptographic clock provided by PoH to reduce the communication overhead between validators, allowing them to reach consensus more efficiently. This mechanism not only speeds up transaction finality but also ensures the network remains secure, even in the presence of malicious validators.

Sealevel: Parallel Smart Contract Execution

Sealevel is Solana’s breakthrough in processing multiple smart contracts simultaneously. Unlike traditional blockchains where smart contracts are executed sequentially, Sealevel allows for parallel execution, which greatly enhances the network’s performance. This feature is particularly beneficial for developers looking to build complex decentralized applications (dApps) that require high throughput.

Gulf Stream: Accelerating Transaction Confirmation

Gulf Stream is Solana’s transaction forwarding protocol that minimizes the time required for transactions to be confirmed. By pushing transactions to validators even before the previous block is finalized, Gulf Stream reduces the confirmation time and helps maintain Solana’s high-speed performance. This method ensures that transactions are processed swiftly, contributing to Solana’s reputation as one of the fastest blockchains in the industry.

Turbine: Efficient Block Propagation

Turbine is Solana’s block propagation protocol that breaks data into smaller packets for efficient transmission across the network. This approach allows Solana to maintain high performance even as the network scales, ensuring that all nodes receive the necessary data quickly and without bottlenecks. Turbine plays a crucial role in keeping the network decentralized and resilient, as it enables efficient communication between validators.

Cloudbreak: Scalable Data Management

Cloudbreak is Solana’s solution for managing the massive amounts of data generated by its high-throughput network. It uses a horizontally scaled state architecture that supports concurrent reads and writes across the network, ensuring that Solana can handle large-scale applications without sacrificing performance. Cloudbreak is essential for maintaining the network’s scalability and supporting its growing ecosystem of dApps.

Solana Use Cases: How SOL is Revolutionizing Web3

In this section, we’ll explore how Solana has been integrated across various sectors in the Web3 landscape, including DeFi, DePIN, NFTs, gaming, and decentralized organizations. Let’s explore the specific areas where Solana is driving innovation and making a substantial impact.

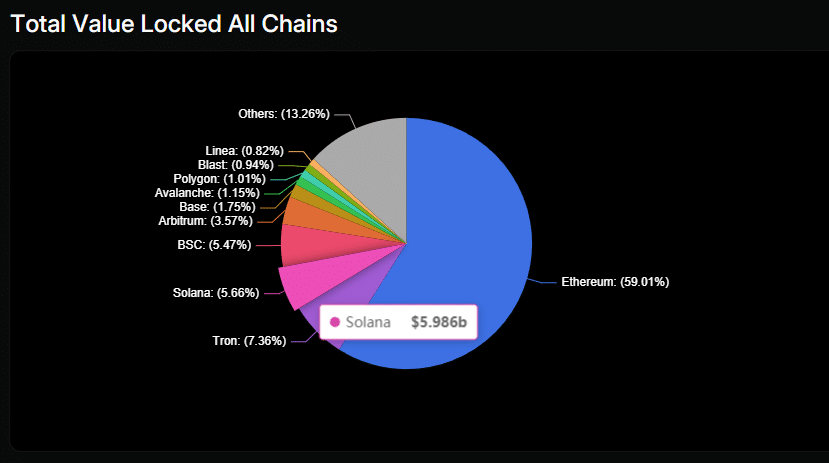

1. Decentralized Finance (DeFi)

One of the most prominent use cases for Solana is in the realm of Decentralized Finance (DeFi). Despite a few hiccups—cough, cough, FTX—Solana started 2023 with a modest TVL of around $200 million. Now, it proudly boasts a TVL of approximately $6 billion, highlighting the resilience and dedication of the Solana team and its ecosystem. Many feared the collapse of FTX and Solana’s issue with frequent outages in previous years may lead to its ultimate failure, but the project and community have shown extreme resilience and innovation to overcome some serious hurdles and setbacks.

Solana’s ability to handle up to 65,000 transactions per second with sub-second finality has attracted numerous DeFi projects. Platforms like Jupiter, a decentralized exchange (DEX) aggregator built on Solana, leverage this capability to provide users with fast and efficient trading experiences.

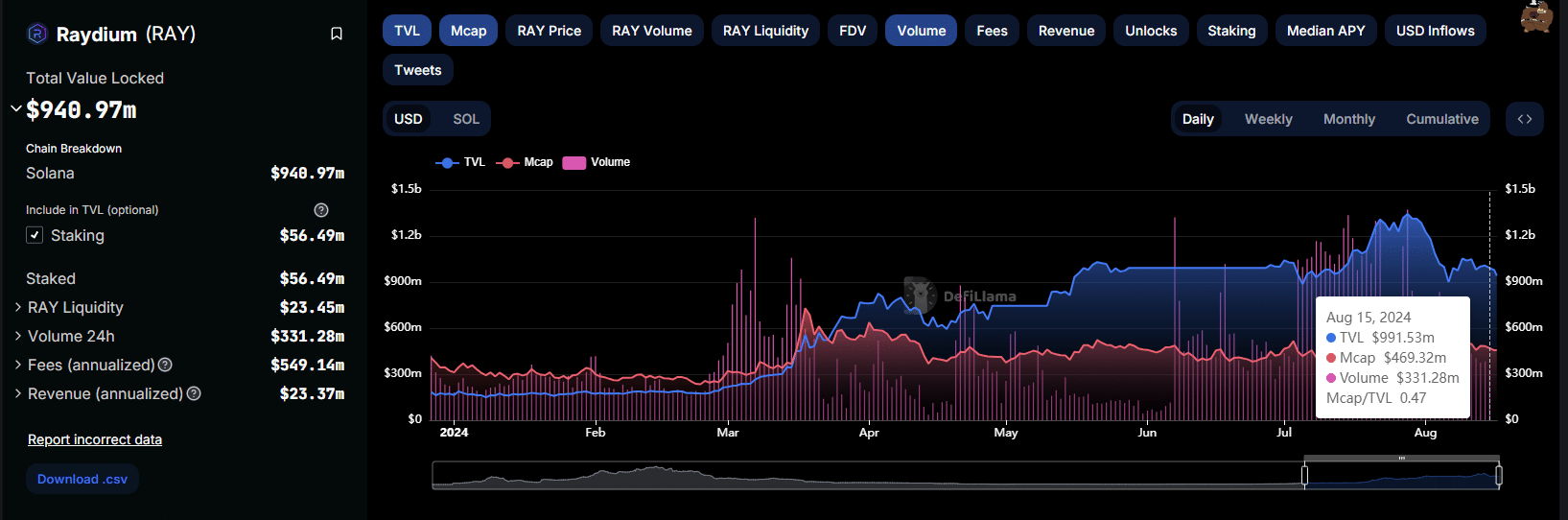

Furthermore, Solana’s DeFi ecosystem has expanded to include a variety of lending protocols, yield farming platforms, liquid staking networks and synthetic assets, all benefiting from the network’s high performance and cost-efficiency. Projects like Raydium, a DeFi protocol with an automated market maker (AMM) and liquidity pools, also capitalize on Solana’s infrastructure to offer near-instant trades and minimal fees.

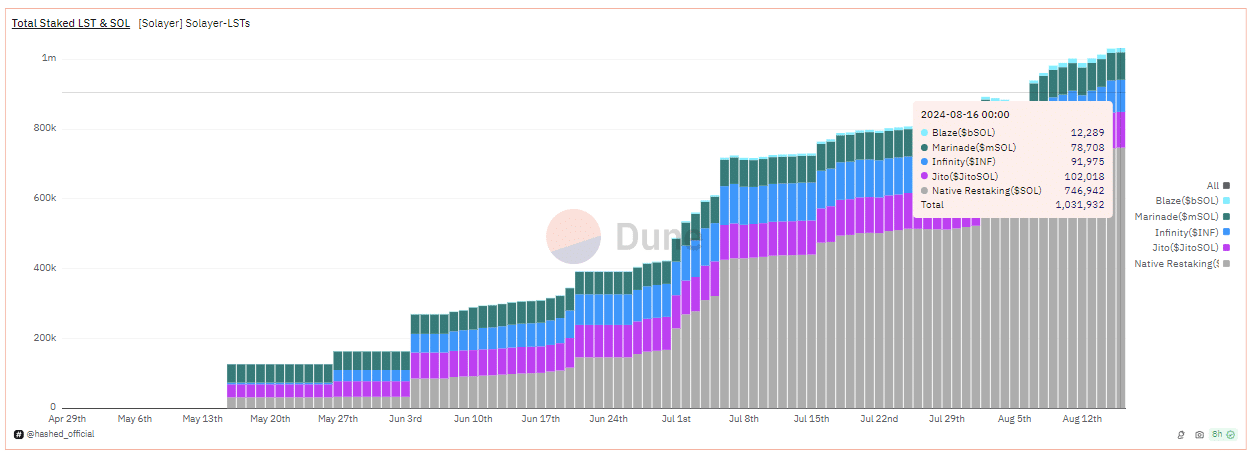

The Launch of Solayer: Expanding Solana’s DeFi Capabilities

Building on its commitment to innovation in DeFi, Solana recently launched Solayer, a groundbreaking liquid staking network. Solayer is designed to enhance the security and decentralization of Solana by allowing users to restake their SOL tokens across multiple protocols, rather than just one. This approach not only boosts validator participation but also strengthens the overall security of the network.

By enabling restaking, Solayer empowers token holders to maximize their rewards while contributing to the resilience of Solana’s ecosystem. This development is particularly significant as it offers a new layer of flexibility and security for both validators and delegators, ensuring that Solana remains at the forefront of decentralized finance.

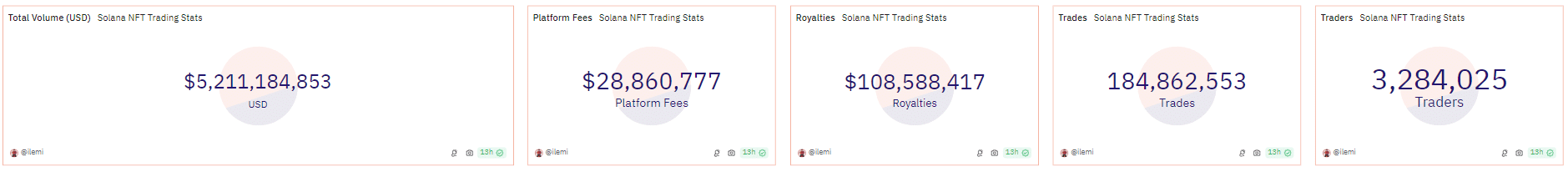

2. Non-Fungible Tokens (NFTs)

The NFT space on Solana has seen rapid growth, with platforms like Magic Eden and Solanart driving the adoption of digital collectibles. Solana’s low transaction costs and high-speed network make it an ideal environment for NFT creators and collectors. For instance, Solanart prides itself on being the lowest-fee NFT marketplace on Solana. Magic Eden is known for its wide variety of NFTs with a user-friendly interface and easy on-ramp.

3. Web3 Infrastructure and dApps

Solana is a cornerstone for building the next generation of Web3 applications. Its ability to support high-performance decentralized applications (dApps) has attracted a diverse range of projects. These include social platforms, gaming, and decentralized storage solutions that require reliable and scalable infrastructure.

Key infrastructure resources include:

- Solana SDKs: A set of software development kits (SDKs) that provide developers with the tools to build and deploy decentralized applications on the Solana blockchain.

- Solana Program Library (SPL): A collection of on-chain programs and libraries that provide standard building blocks for Solana-based decentralized applications.

- Metaplex: A platform that enables the creation, minting, and selling of NFTs on Solana, providing the infrastructure for digital artists and creators.

- Anchor Framework: A development framework that simplifies the process of building Solana smart contracts by offering tools, templates, and best practices.

- Solana Actions and Blockchain Links: Using Solana Actions, you can turn any transaction into a blockchain link that can be shared anywhere on the internet. Request a payment in a text message. Vote on governance in a chatroom. Buy an NFT on social media.

4. Solana Pay and Payments

Solana Pay is another transformative use case, transforming how businesses and consumers interact in the digital economy. Built on Solana’s high-speed network and integrated into Shopify, Solana Pay offers a decentralized payment protocol that enables instant, fee-free transactions. This service is particularly beneficial for merchants and e-commerce platforms, allowing them to accept payments in cryptocurrencies like USDC without the need for intermediaries.

In a recent move that’s turning heads in the crypto space, crypto exchange OKX’s wallet is now bringing Solana’s “Blinks” to EVM chains, enabling users to effortlessly embed blockchain links on webpages via a simple URL. OKX Wallet users can now initiate blockchain transactions, such as token staking and swapping across multiple chains directly on social media sites with zero fees.

“With the addition of multi-chain Blinks, users can now perform even more onchain actions directly embedded in their usual sites and platforms. We’re also working with partners across both the Solana and EVM ecosystems to ensure their applications are supported.” –OKX Chief Innovation Officer Jason Lau

5. Gaming and Metaverse

The gaming and metaverse sectors are rapidly evolving on Solana, driven by its ability to handle complex, real-time interactions between players and digital environments. Projects like Star Atlas and Magicblock are leveraging Solana’s Game Kit to create immersive gaming experiences that integrate DeFi elements, allowing players to earn rewards, trade assets, and participate in governance within the game.

Solana’s low latency and high throughput are critical in these environments, where smooth and uninterrupted gameplay is essential. The network’s capabilities also support the development of metaverse projects, where users can explore virtual worlds, own digital real estate, and engage in social and economic activities powered by blockchain technology.

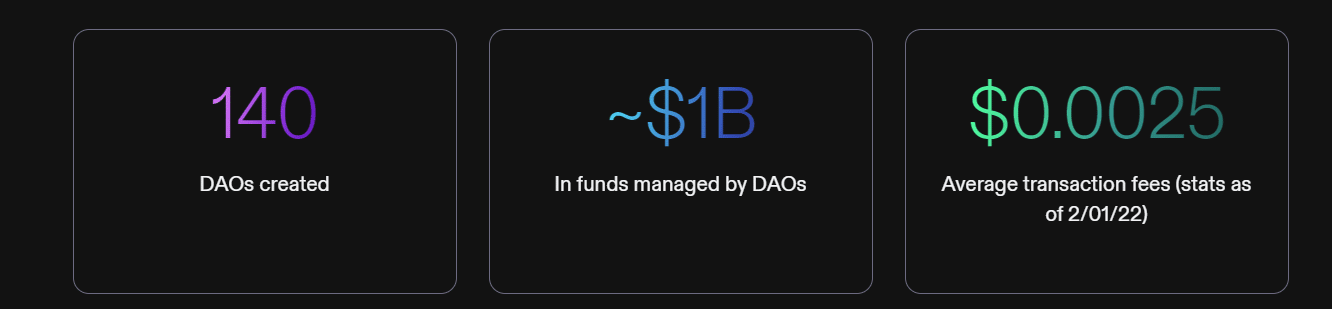

6. Decentralized Autonomous Organizations (DAOs)

Solana is also facilitating the growth of Decentralized Autonomous Organizations (DAOs), which are digital organizations governed by smart contracts and community votes. The efficiency and low cost of transactions on Solana make it an ideal platform for DAOs, where frequent voting and proposal submissions require a fast and affordable blockchain.

DAOs on Solana benefit from the network’s ability to handle large-scale participation, ensuring that governance processes are both inclusive and efficient. For instance, Superteam DAO is a rapidly growing community on Solana that connects top builders and contributors with projects needing talent. It leverages Solana’s fast transaction speeds and low costs to efficiently manage tasks, proposals, and rewards distribution.

For instance, Superteam DAO and Yield Guild Games (YGG) are two prominent DAOs leveraging Solana’s capabilities. Superteam DAO focuses on connecting top talent with projects within the Solana ecosystem, using the network’s speed and low transaction costs to manage proposals and reward distribution efficiently. Meanwhile, YGG is a decentralized gaming guild that invests in virtual world assets, enabling players to participate in the play-to-earn economy. YGG utilizes Solana’s scalable infrastructure to seamlessly manage gaming assets, distribute earnings, and enable community governance within the metaverse.

Getting Started with Solana

For anyone looking to dive into the Solana ecosystem, having the right tools and resources is essential. Whether you’re a developer building decentralized applications or a user managing your digital assets, Solana offers a range of options to help you get started efficiently and securely. In this section, we’ll guide you through the essential tools and the steps needed to create your first Solana wallet.

Essential Tools and Resources for SOL Users

Solana’s growing ecosystem provides a wealth of tools and resources designed to support both new and experienced users. Here are some of the key tools you’ll need to begin your journey with Solana:

- Phantom Wallet: A user-friendly, non-custodial wallet that supports storing, sending, receiving, and staking SOL tokens, as well as managing NFTs directly from your browser or mobile device.

- Solflare Wallet: Another popular wallet option for Solana users, Solflare offers both a web-based and mobile wallet, enabling users to manage their SOL tokens, stake directly from the wallet, and interact with Solana dApps with ease. Solflare’s integration with Ledger adds an extra layer of security for users who prefer hardware wallets.

- Solana Beach & Solscan: These are Solana block explorers that provide real-time data and analytics on transactions, blocks, and programs on the network. They are invaluable tools for anyone looking to monitor network activity or validate transactions.

- Solana SDKs: These software development kits offer developers everything they need to create and deploy decentralized applications on the Solana blockchain, making it easier to tap into Solana’s high-speed infrastructure.

- Solana Program Library (SPL): The SPL provides standardized, reusable on-chain programs and libraries that serve as foundational building blocks for developers. Whether you’re creating tokens, managing liquidity pools, or implementing governance features, SPL simplifies the development process.

- Metaplex: For those interested in NFTs, Metaplex is the go-to platform for minting, selling, and managing digital assets on Solana. It offers an intuitive interface and a robust set of tools that cater to both artists and collectors.

- Anchor Framework: Anchor is a powerful framework that streamlines the development of Solana smart contracts. It provides a suite of tools and templates that reduce complexity and accelerate the deployment process.

Creating a Solana Wallet: First Steps

Getting started with Solana begins with creating your own wallet, a necessary tool for storing and managing SOL tokens and interacting with the network. Here’s a simple guide to setting up your first Solana wallet, using Phantom as our example:

- Choose a Wallet Provider: For beginners, Phantom Wallet is highly recommended due to its ease of use and wide adoption within the Solana community. It offers browser extensions and mobile apps that make managing your assets straightforward. We have an article outlining which Solana wallets are the most suitable for different users in our Best Solana Wallets Guide.

- Download and Install: Visit the official Phantom Wallet website or app store to download the extension or app. Follow the installation instructions to add the wallet to your browser or mobile device.

- Create a New Wallet: Upon opening Phantom, you’ll be prompted to create a new wallet. This involves setting up a secure password and generating a seed phrase—a 12-word backup that you’ll need to store securely, as it’s the only way to recover your wallet if you lose access.

- Secure Your Seed Phrase: Write down your seed phrase and store it in a safe, offline location. Never share it with anyone, and avoid storing it digitally to protect against hacking or phishing attempts.

- Fund Your Wallet: Once your wallet is set up, you can add SOL tokens by purchasing them on an exchange like Binance or Coinbase, and then transferring them to your wallet address. Your wallet will also generate a public address, which you can use to receive SOL and other tokens on the Solana network.

- Explore the Solana Ecosystem: With your wallet funded and secured, you can now explore the Solana ecosystem. Whether it’s participating in DeFi, minting NFTs, or simply managing your assets, your wallet is your gateway to the Solana network.

Exploring Solana’s Ecosystem

Solana’s ecosystem has grown rapidly, encompassing a wide range of projects and applications that showcase the network’s versatility and performance. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and Web3 infrastructure, Solana’s ecosystem is rich with innovation and opportunity. In this section, we’ll explore some of the most prominent areas within Solana’s ecosystem and highlight key projects that are driving the network’s growth.

Key Projects and DApps on Solana

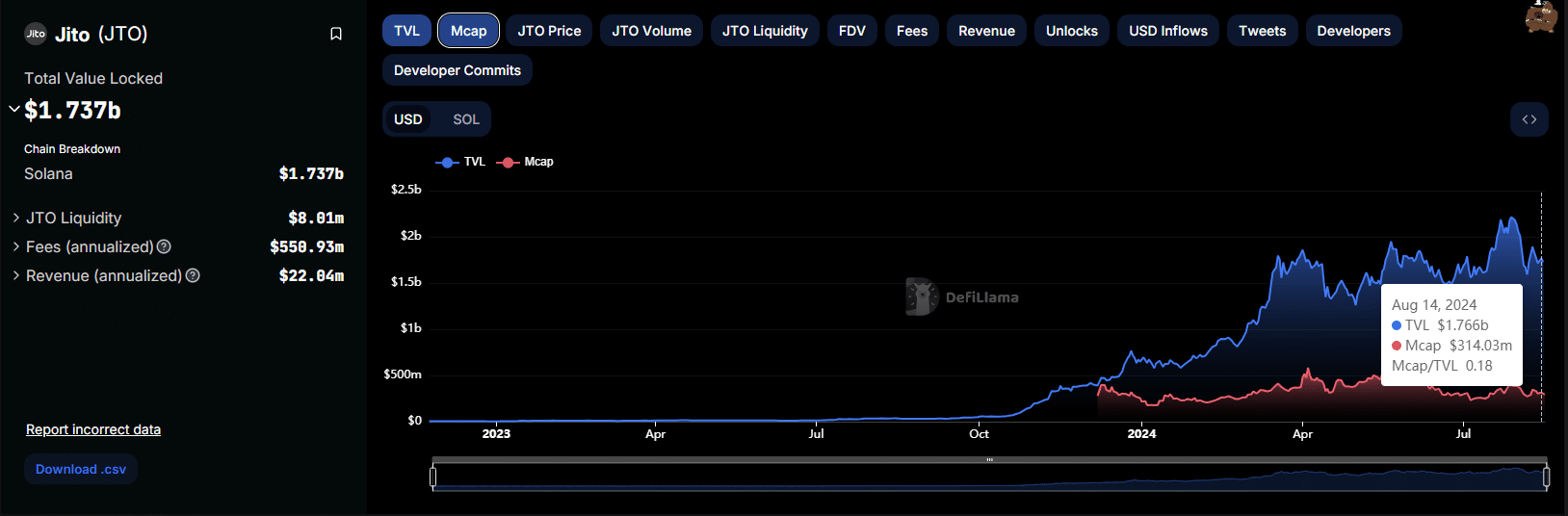

Jito

A cutting-edge infrastructure project on Solana focused on optimizing the performance and efficiency of the network. It provides a specialized MEV (Maximum Extractable Value) solution that enhances block production while minimizing latency. Jito’s integration into Solana ensures that transactions are processed with maximum speed and efficiency, contributing to the overall scalability of the network. This makes it a crucial player in maintaining the robustness of Solana’s DeFi ecosystem.

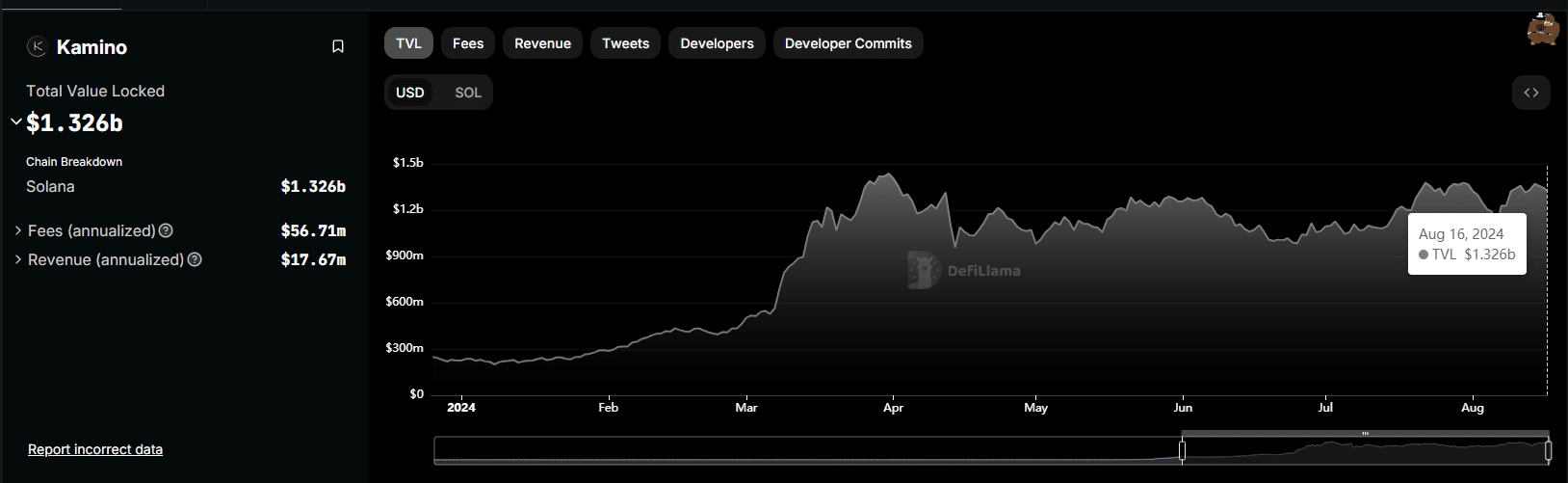

Kamino

An automated yield optimization platform designed to help users maximize their returns on the Solana blockchain. By utilizing complex algorithms and smart contracts, Kamino automatically reallocates assets across various DeFi protocols to ensure optimal yield generation. This automation simplifies the process for users, making it easier for them to participate in DeFi without needing in-depth knowledge of the underlying mechanics.

Raydium

One of Solana’s most prominent DeFi protocols. Raydium is an automated market maker (AMM) and liquidity provider built on top of the Serum DEX. Raydium allows users to trade, provide liquidity, and earn rewards seamlessly, all while benefiting from Solana’s low transaction costs and high speed. Its integration with Serum’s order book gives Raydium a unique edge, providing deeper liquidity and more efficient price discovery

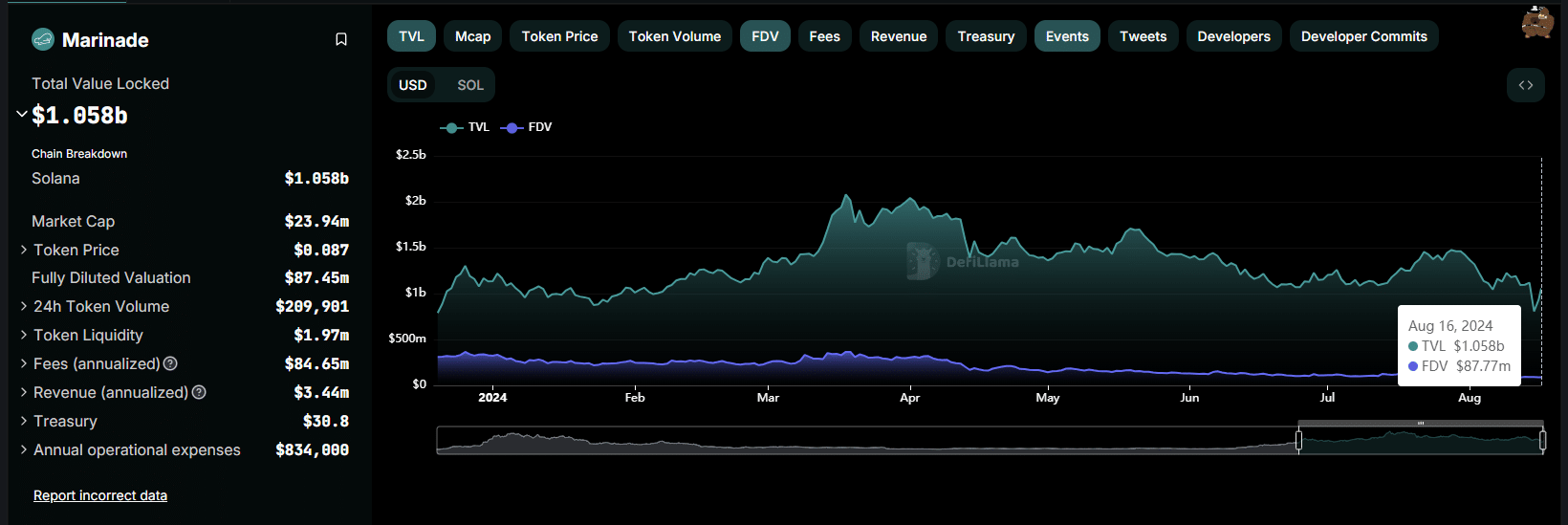

Marinade

Marinade is a liquid staking protocol on Solana that allows users to stake their SOL tokens and receive mSOL (Marinade staked SOL) in return. This enables users to continue participating in DeFi while earning staking rewards. Marinade plays a crucial role in increasing the liquidity of staked assets on Solana, offering users flexibility and additional earning opportunities within the ecosystem. It’s a vital component of Solana’s staking infrastructure, supporting network security while enhancing user engagement.

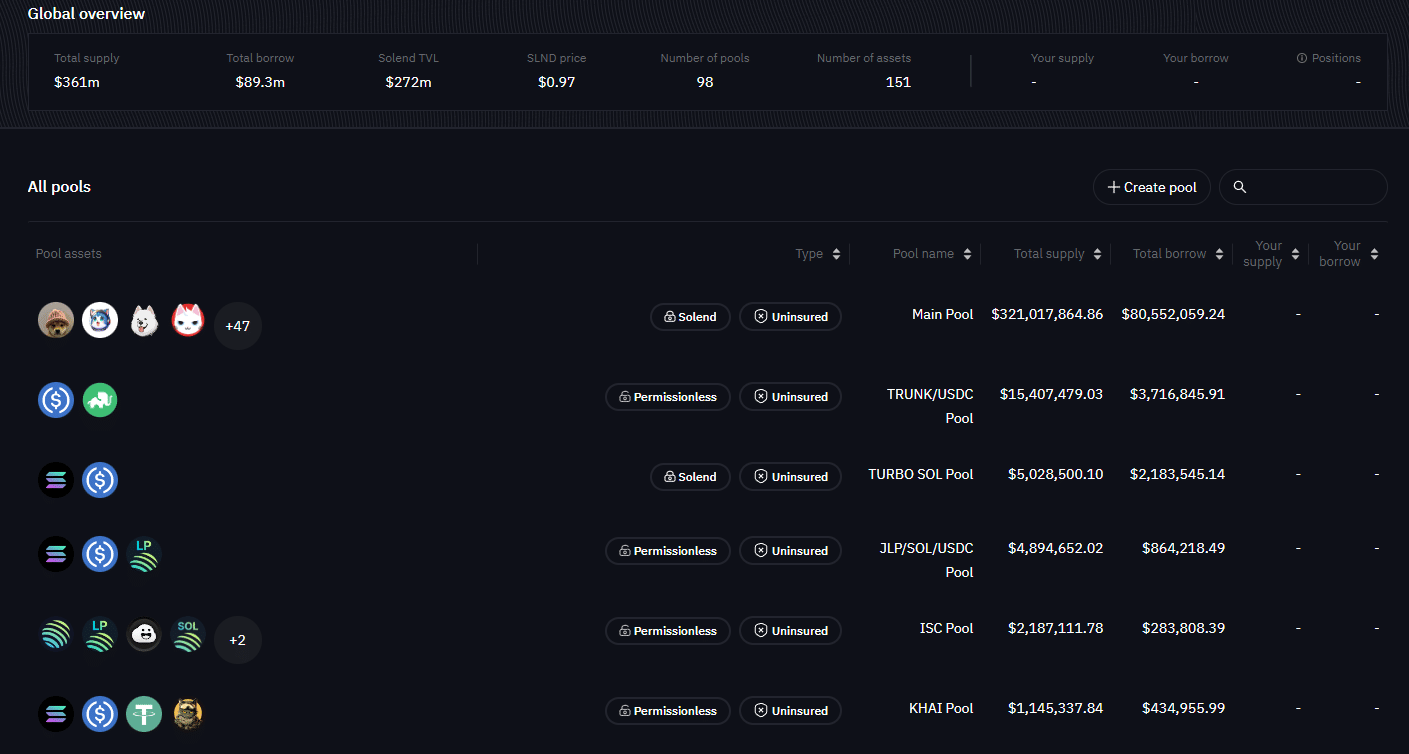

Solend

Solana’s largest decentralized lending protocol enables users to borrow and lend digital assets directly on the blockchain. By leveraging Solana’s high-speed and low-cost infrastructure, Solend allows for instant loan issuance and liquidation, with highly competitive interest rates. Users can supply assets to earn interest or use them as collateral to borrow other assets, providing liquidity and flexibility within the Solana DeFi ecosystem. Solend’s importance continues to grow as more users seek decentralized alternatives to traditional financial services.

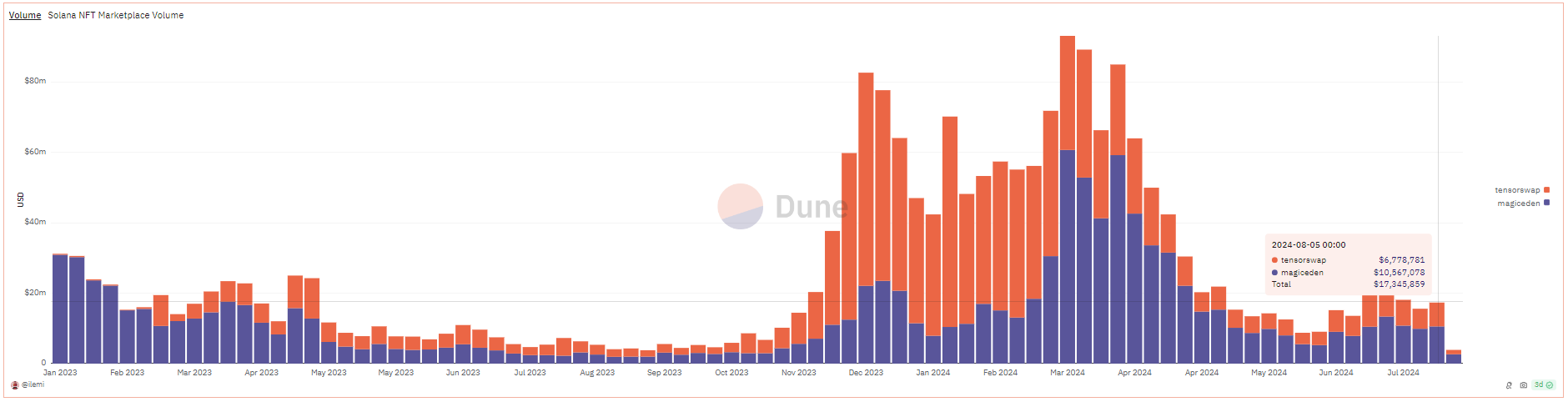

The Role of NFTs within Solana

Solana’s NFT ecosystem has rapidly expanded, with platforms like Tensor and Magic Eden leading the charge. These marketplaces have facilitated the creation, trading, and collection of digital art and collectibles. The success of these platforms is underpinned by Solana’s technology, which ensures that NFT transactions are processed quickly and cost-effectively, making it easier for creators to launch and sell their work without prohibitive costs.

Solana’s infrastructure supports a wide range of NFT-based projects, from gaming and virtual worlds to music and sports collectibles. Projects like Metaplex enable creators to mint NFTs directly on Solana, offering a suite of tools that simplify the process.

Lastly, NFTs on Solana are increasingly being integrated into decentralized finance (DeFi) applications. They can be used as collateral for loans, staked for rewards, or even fractionalized for shared ownership. This versatility is driving new use cases and expanding the potential of NFTs in ways that are only beginning to be explored.

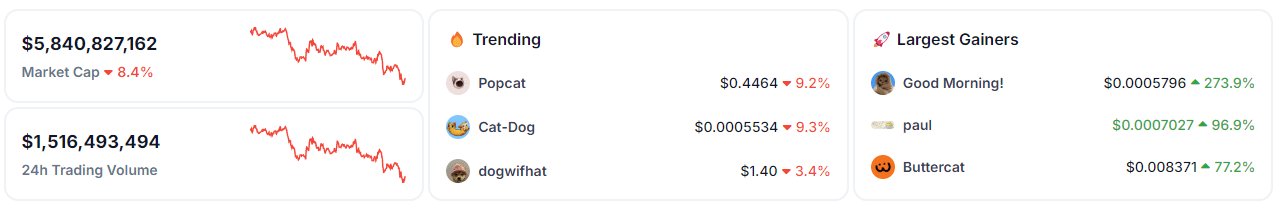

The Explosion of Meme Coins on Solana

Meme coins have become a cultural phenomenon within the cryptocurrency space, often characterized by their community-driven nature and viral appeal. The rise of meme coins on Solana can be attributed to the network’s ability to handle large volumes of transactions at minimal cost. Unlike other blockchains where high gas fees can stifle participation.

The meme coin phenomenon on Solana highlights the network’s flexibility and its ability to cater to a wide range of projects, from serious DeFi applications to lighthearted, community-driven tokens. As meme coins continue to capture the imagination of crypto enthusiasts, Solana’s infrastructure will likely remain a key player in facilitating the growth and proliferation of these tokens.

If you want to dive deeper into the world of Solana meme coins, be sure to check out our picks for the Best Solana Meme Coins in 2024!

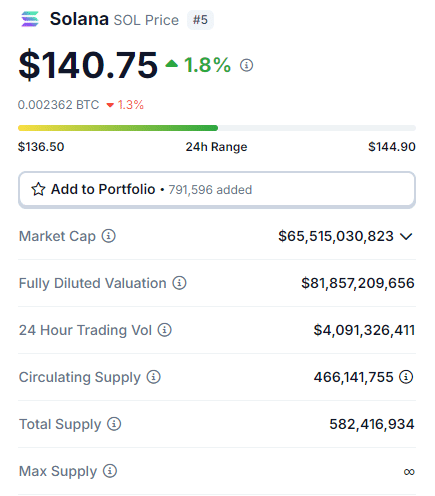

Solana’s Price, Tokenomics, and Investment Potential

Understanding Solana’s price movements, tokenomics, and overall investment potential is crucial for anyone looking to engage with SOL, whether as a trader, investor, or user of the network. In this section, we’ll dive into Solana’s recent price trends, analyze its tokenomics, and explore what makes SOL a compelling investment option.

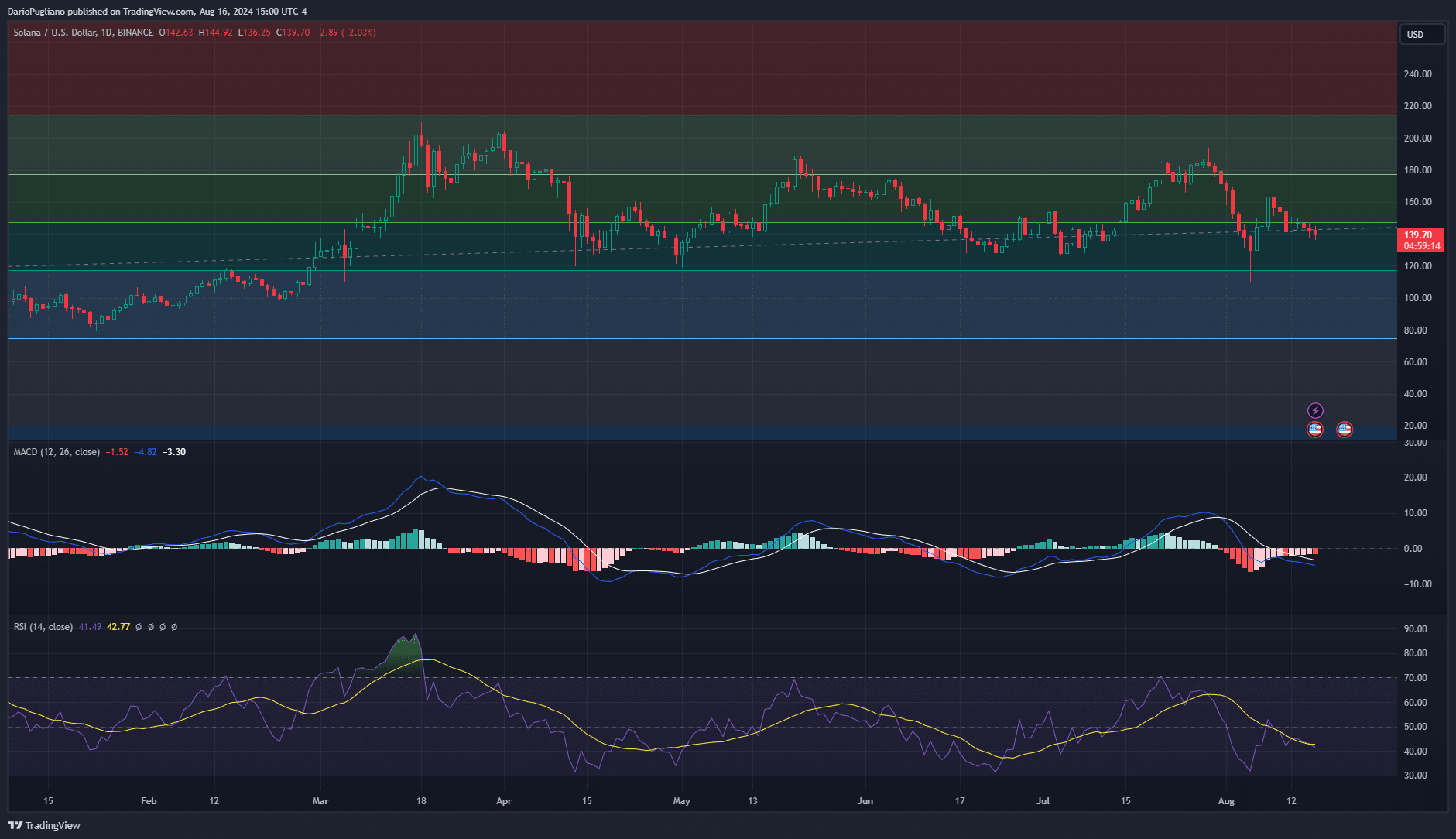

SOL Price Trends and Analysis

Solana’s price has experienced considerable fluctuations over the past year, reflecting both the broader market trends and specific developments within the Solana ecosystem. The chart below provides a visual representation of SOL’s price action, showcasing key support and resistance levels, as well as overall market sentiment.

SOL’s price surged significantly during the early part of the year, driven by strong market momentum, memecoin frenzy and airdrop enthusiasts. However, the subsequent market correction and macroeconomic factors led to a sharp decline, with SOL finding support around key Fibonacci retracement levels. This retracement has been crucial in determining potential entry and exit points for investors.

The price is currently hovering near the 0.5 Fibonacci level at $147.47, a critical zone often regarded as a psychological support or resistance area. If the price holds above this level, it could signal a potential stabilization, but a drop below might lead to further declines, with the next support at the 0.618 level ($117.43).

The MACD (Moving Average Convergence Divergence) indicator further emphasizes the bearish momentum, as the MACD line remains below the signal line, accompanied by negative histogram bars. However, these bars seem to be narrowing, which could indicate that the downward pressure is weakening, potentially paving the way for a shift in momentum. The RSI (Relative Strength Index) currently sits at 42.82, though not yet oversold, is approaching levels that often precede a reversal if buying interest increases.

Solana Tokenomics

Solana’s tokenomics might be intense, but if you’re ready, it’s worth the ride. So, let’s break it down and see what makes Solana one of the most intriguing assets in the crypto world today.

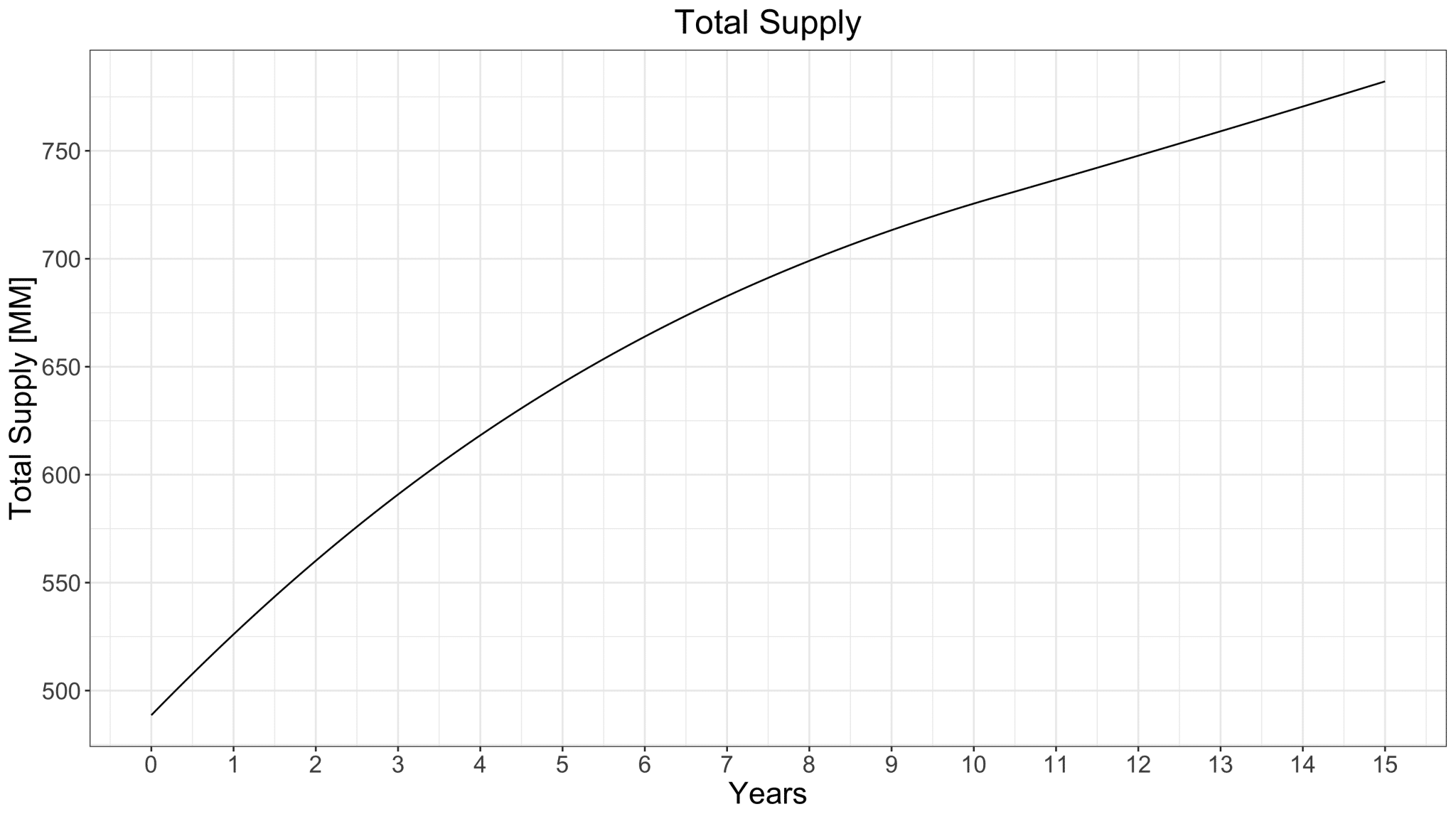

Solana’s native token, SOL, pays transaction fees, secures the network through staking, and enables participation in governance decisions. The first SOL block was created on March 16, 2020, followed by a Coinlist auction that ended on March 24, 2020. SOL has an uncapped maximum supply with a unique dis-inflationary type emission rate since genesis.

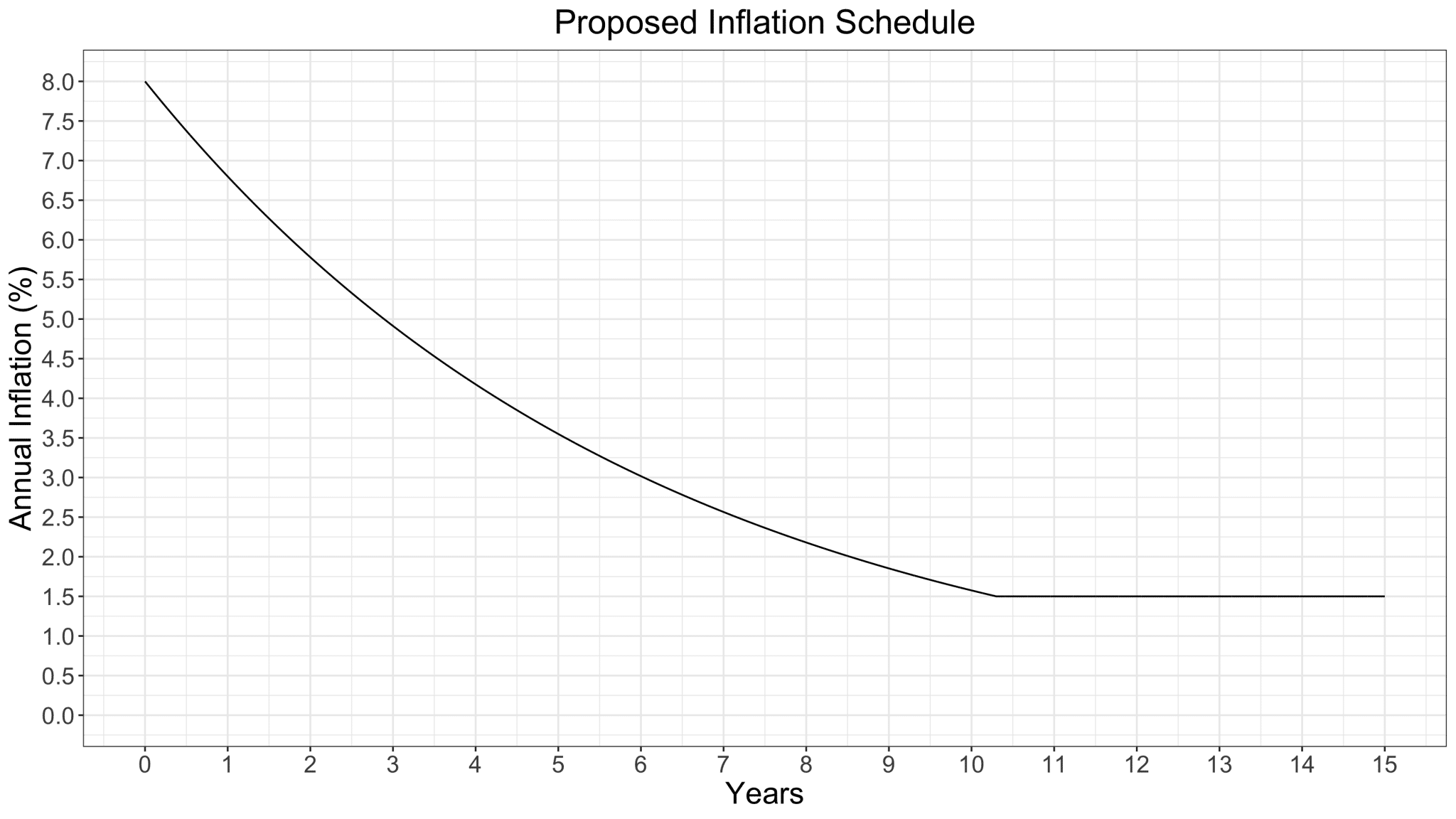

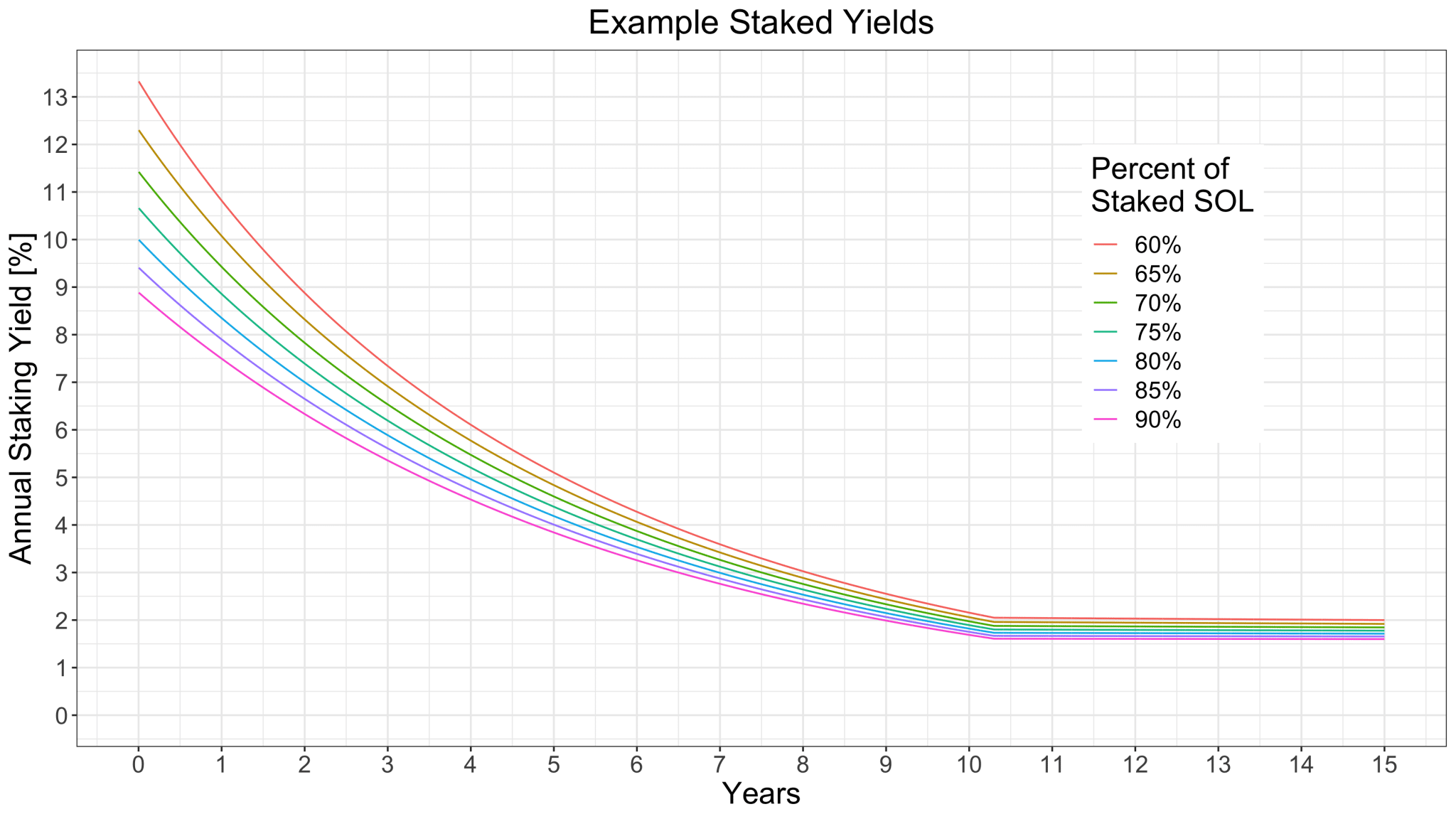

Solana’s Proposed Inflation Schedule

Initial Inflation Rate

The inflation process on Solana begins with an initial annual inflation rate of 8%. Solana strategically uses this high rate to bootstrap security by rapidly incentivizing staking. This pace of introducing new SOL tokens ensures enough validators and delegators participate in securing the network.

Long-Term Inflation Rate

Solana’s inflation rate is not fixed and will gradually decrease over time, eventually stabilizing at 1.5%. This reduction aligns with the network’s maturity, increasing demand for SOL as the ecosystem becomes more robust. By lowering the inflation rate, Solana aims to reduce the risk of oversaturation in the market with new tokens, supporting the value of SOL over the long term.

Disinflation Rate

To transition from the initial 8% to the long-term 1.5% inflation rate, Solana employs a disinflationary mechanism. The disinflation rate is set at 15% per annum, meaning that the inflation rate decreases by 15% of its current value each year. This gradual reduction ensures a smooth adjustment, avoiding sudden changes in token issuance that could destabilize the market. Over time, this approach leads to a steady decrease in the rate at which new SOL tokens are minted.

Stake Rewards Distribution

Validators and delegators receive a significant portion of newly minted SOL tokens from inflation as staking rewards. By participating in network security, they earn these new tokens, incentivizing participation and strengthening the network’s security. The distribution is proportional to the amount of SOL staked, so those contributing more to network security receive a higher share of the rewards.

Inflation Schedule Implications for Investors

For investors, Solana’s inflation schedule has several implications. The gradual reduction in inflation combined with increased staking activity can create upward pressure on prices as the circulating supply growth slows.

Investors should also consider the network’s disinflationary trajectory, which provides a predictable framework for how SOL’s supply will evolve. The supply of SOL is expected to reach 700m tokens by Jan 2030.

Additionally, holders who stake their SOL can benefit from the additional rewards generated through inflation, helping to offset any potential dilution while contributing to the network’s overall security and stability.

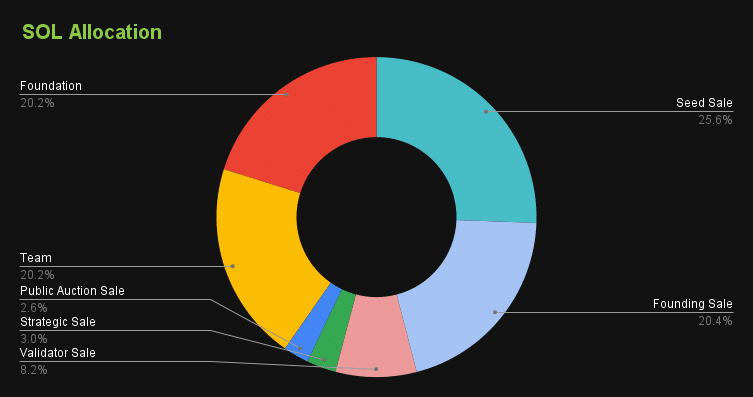

SOL Token Allocation

The Initial token distribution of Solana (SOL) is as follows:

- 15.86% allocated to Seed Sale

- 12.63% allocated to Founding Sale

- 5.07% allocated to Validator Sale

- 1.84% allocated to Strategic Sale

- 1.60% allocated to Public Auction Sale

- 12.50% allocated to Team

- 12.50% allocated to Foundation

- 38.00% allocated to Community Reserve

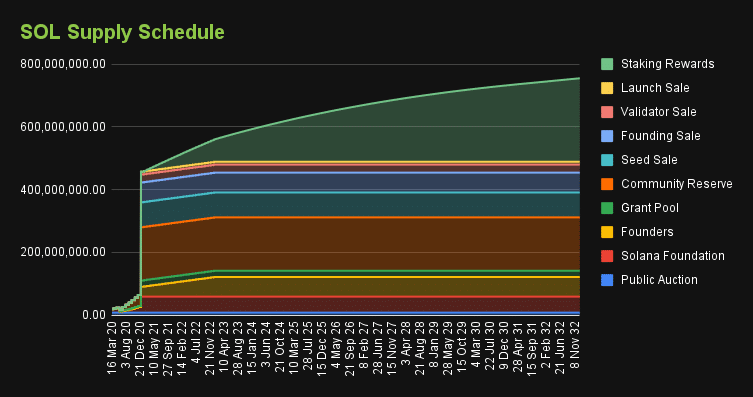

SOL Supply Schedule

The SOL Supply Schedule chart provides a detailed visual representation of how Solana’s native token, SOL, is distributed and released over time. The chart highlights various allocation categories such as Staking Rewards, Validator Sale, Founders, and Community Reserve, among others. It illustrates the gradual release of tokens from March 2020 to November 2032.

Expert Opinions on Solana’s Future Prospects

As Solana continues to solidify its position as one of the leading blockchain platforms, industry experts have weighed in on its future prospects. The consensus is that while Solana has made significant strides, the road ahead will be shaped by both opportunities and challenges.

1. The Case for Scalability and Adoption

Many experts point to Solana’s unparalleled scalability as a key factor in its continued success. Solana can process tens of thousands of transactions per second at minimal cost, making it well-positioned to support the next generation of dApps and Web3 innovations.

“We have a lot of companies building on Solana. It is a network effect. Ethereum is a bigger community for sure, but Solana is a real network with a lot of things being built on it.” – Chris Dixon

2. Addressing Network Stability

However, some industry observers have raised concerns about Solana’s network stability. The network has experienced several outages over the past year, which have led to questions about its reliability under high demand. New validator clients like Firedancer and ongoing optimizations are expected to address these concerns.

“[We’re] in a constant fight between performance, security, throughput, and decentralization, all of these problems […] whenever you improve one you may actually hurt some of the other ones but I think we’ve done an amazing job in solving a bunch of those. Having a second implementation and a second client built by a different team with a fully separate code base, the probability of the same kind of bug existing in both is virtually zero.” – Anatoly Yakovenko

3. The Role of Institutional Adoption

Institutional interest in Solana is growing, with major financial players beginning to explore the network for its speed and efficiency. Cathie Wood, CEO of ARK Invest, has expressed optimism about Solana’s potential to disrupt traditional financial systems, particularly in areas like decentralized finance (DeFi) and tokenized assets. As more institutions experiment with blockchain technology, Solana’s ability to offer scalable solutions could be a key driver of its adoption.

“Ether was faster and cheaper than bitcoin [back] in the day – that’s how we got ether. Solana is even faster and [more] cost-effective than ether. Each one of [the networks] is going to have a place.” – Cathie Wood

Solana vs. Other Blockchains

Each blockchain has its strengths and weaknesses, and understanding how Solana stacks up against these alternatives is crucial for anyone considering building on or investing in the network. In this section, we’ll compare Solana to other major blockchains across several key dimensions, including scalability, transaction speed, fees, decentralization, and ecosystem development.

Solana vs Ethereum: Technical and Performance Comparison

In the battle between Solana and Ethereum, the choice often comes down to the specific needs of developers and users. Solana offers unmatched speed and affordability, making it ideal for high-throughput applications and users looking to avoid high fees. Ethereum, on the other hand, provides a more established, decentralized platform with a broad ecosystem, but at the cost of slower speeds and higher fees. As Ethereum continues to evolve with its 2.0 upgrade, the competition between these two powerhouses will likely intensify.

Transaction Speed and Scalability

- Solana: Solana’s architecture is built for speed. With its unique Proof of History (PoH) combined with Delegated Proof of Stake (DPoS), Solana can process up to 65,000 transactions per second (TPS). This high throughput is achieved without sacrificing decentralization or security, making Solana one of the fastest blockchains in operation today.

- Ethereum: Before the Ethereum 2.0 upgrade, Ethereum could handle only about 15-30 TPS, leading to congestion and high gas fees during periods of high demand. While Ethereum 2.0 aims to improve this with sharding and a full transition to PoS, it still faces challenges in matching Solana’s speed and efficiency.

Transaction Costs

- Solana: One of Solana’s most significant advantages is its low transaction fees, often costing just a fraction of a cent. This affordability makes Solana particularly attractive for developers and users in the DeFi and NFT spaces, where frequent transactions are common.

- Ethereum: Ethereum’s gas fees are notoriously high, especially during periods of network congestion. Although Ethereum 2.0 is expected to lower these costs, they remain a barrier for many users and developers, especially when compared to Solana’s minimal fees.

Decentralization and Security

- Solana: While Solana’s architecture allows for high speed and low costs, it has faced criticism for being more centralized than Ethereum, with a smaller number of validators securing the network. However, the introduction of new validator clients like Firedancer and ongoing optimizations are expected to address these concerns.

- Ethereum: Many regard Ethereum as more decentralized, with a large and diverse network of validators. This decentralization strengthens the network’s security and resistance to censorship.

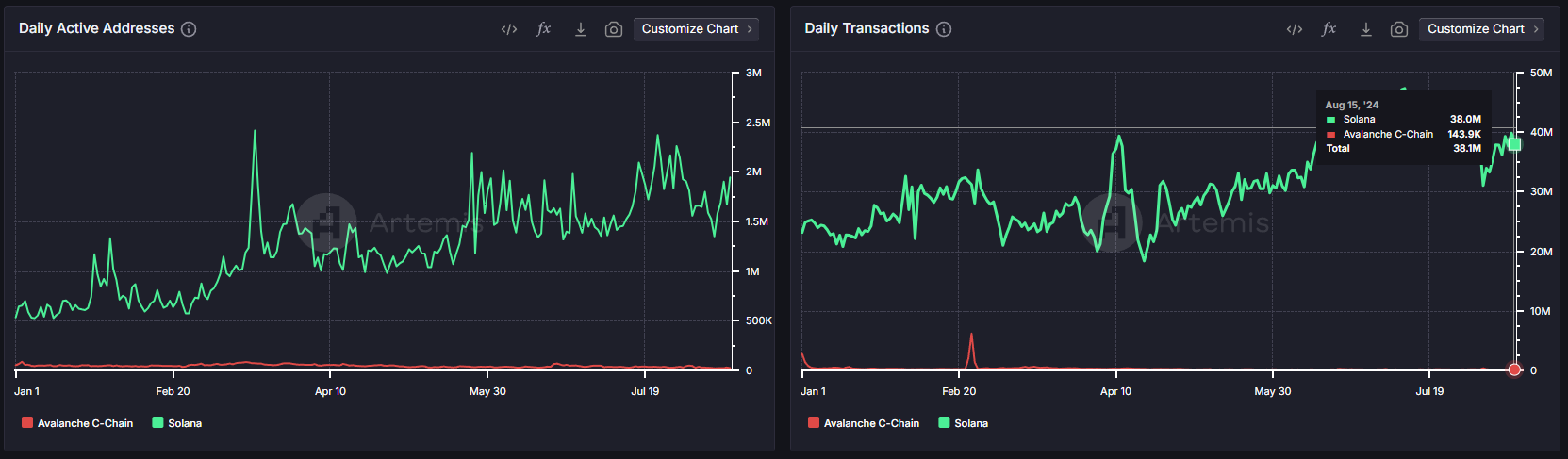

Solana vs Avalanche: Technical and Performance Comparison

Solana and Avalanche both excel in providing scalable, high-performance blockchain platforms, but they cater to different needs. Solana’s focus on speed and low latency makes it ideal for applications that require real-time performance. Avalanche’s flexible, interoperable platform offers developers the ability to create custom blockchain environments. The choice between these two often depends on whether you prioritize immediate transaction speed or the flexibility to build tailored blockchain solutions.

Scalability and Performance

- Solana: Solana’s architecture is built for speed and scalability, making it ideal for high-frequency trading, DeFi, and NFT platforms that require minimal latency. The network’s high throughput is one of its most significant advantages, enabling it to handle large volumes of transactions with ease.

- Avalanche: Avalanche is also highly scalable but focuses on providing a flexible platform where multiple blockchains can coexist. Its Avalanche-X platform supports the creation of custom blockchains (subnets) that can operate with their own rules, consensus mechanisms, and tokenomics. This flexibility makes Avalanche suitable for a wide range of applications, from DeFi to enterprise solutions.

Ecosystem Development

- Solana: Solana’s ecosystem has rapidly grown, particularly in DeFi and NFTs. Its low transaction costs and high speed have attracted a significant number of developers and projects. The network’s focus on performance has made it a popular choice for dApps that require high throughput.

- Avalanche: Avalanche’s ecosystem is also expanding quickly, with a focus on creating interoperable blockchains within its network. The ability to create subnets has attracted a diverse range of projects, from DeFi to gaming. Avalanche’s emphasis on interoperability and customizable blockchain networks offers developers a unique platform for innovation.

Decentralization and Security

- Solana: While Solana offers high performance, it has faced some criticism regarding its level of decentralization. The integration of Firedancer should address these criticisms.

- Avalanche: Avalanche is designed with decentralization in mind, supporting thousands of validators without sacrificing performance. The network’s architecture allows for secure, decentralized operations while maintaining high efficiency and scalability.

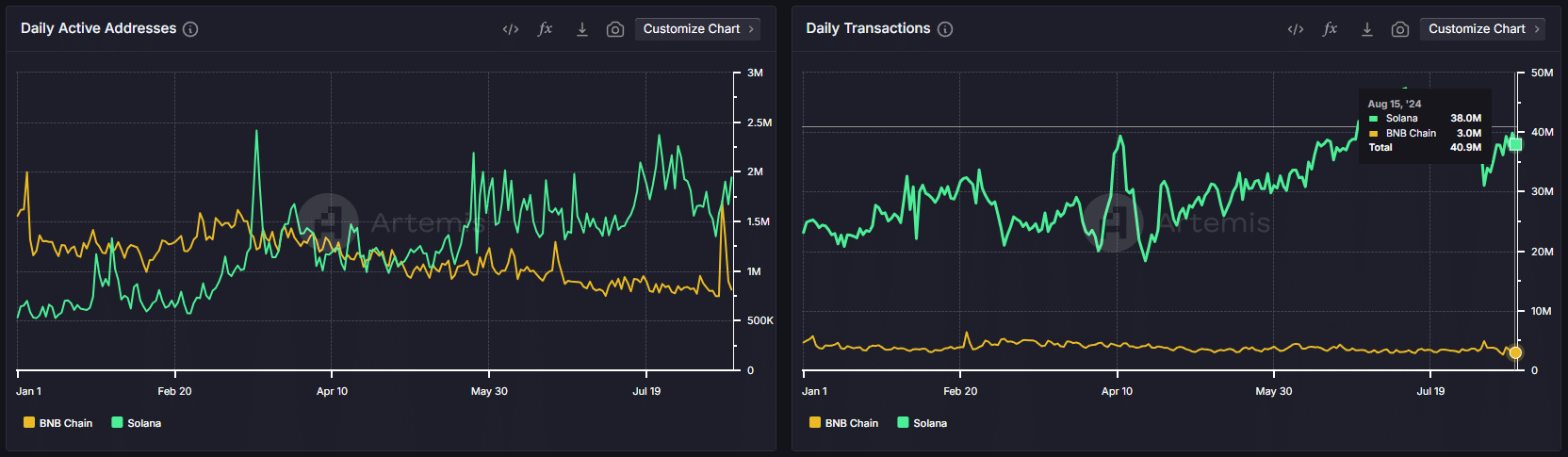

Solana vs BNB Chain: Technical and Performance Comparison

Both Solana and BNB Chain offer compelling features that cater to different needs within the blockchain space. Solana’s unmatched speed and low costs make it ideal for applications requiring high throughput and efficiency, while BNB Chain’s extensive ecosystem and low fees have made it a dominant force in DeFi. Ultimately, the decision hinges on whether developers prioritize Solana’s performance-driven infrastructure or BNB Chain’s broad ecosystem and integration opportunities.

Consensus Mechanisms

- Solana: Solana utilizes a hybrid consensus model that combines Delegated Proof of Stake (DPoS) with its proprietary Proof of History (PoH) mechanism.

- BNB Chain: BNB Chain uses a Proof of Staked Authority (PoSA) consensus mechanism, which combines aspects of Proof of Stake (PoS) and Proof of Authority (PoA). This allows BNB Chain to maintain high transaction speed, but critics point to its centralization due to the small number of validators controlled by Binance.

Transaction Speed and Costs

- Solana: Known for its blazing speed, Solana can handle thousands of transactions per second with very low transaction fees. This makes it ideal for high-frequency trading, DeFi applications, and gaming.

- BNB Chain: BNB Chain also offers fast transaction speeds, though not as high as Solana’s. However, it compensates with its extremely low transaction fees, which have made it a popular choice for decentralized finance (DeFi) projects and users seeking cost-effective transactions.

Decentralization and Security

- Solana: While Solana excels in speed and scalability, it has faced some criticism regarding decentralization. The integration of Firedancer should address these concerns making Solana a leading decentralized project.

- BNB Chain: BNB Chain has been more centralized due to its PoSA model, where a limited number of validators are chosen to secure the network. This centralization has raised concerns about security and the potential for single points of failure, but it also allows for faster decision-making and upgrades.

Buying Solana (SOL)

Ready to invest in Solana? Here are the basic steps to get started:

- Choose a Cryptocurrency Exchange: Sign up on a reliable exchange that supports Solana, such as Binance, OKX, or Kraken.

- Deposit Funds: Deposit fiat currency or another cryptocurrency into your exchange account.

- Search for SOL: Use the exchange’s search function to find Solana (SOL).

- Place an Order: Choose between a market order or a limit order to purchase SOL.

- Store Your SOL: Transfer your SOL to a secure wallet for safekeeping.

For a detailed guide, check out our full article on how to buy Solana.

How to Store Solana: SOL Wallets

Keeping your SOL secure is crucial. Here’s a quick overview of how to store it:

- Choose a Wallet: Select a wallet that supports Solana, such as Phantom, Solflare, or Best Wallet.

- Set Up the Wallet: Follow the setup instructions, including creating a strong password and backing up your recovery phrase.

- Transfer SOL to Your Wallet: Withdraw SOL from your exchange account to your wallet’s public address.

- Enable Additional Security: Activate any additional security features, like two-factor authentication (2FA) or hardware wallet integration.

For a more comprehensive guide, refer to our full article on the best Solana wallets.

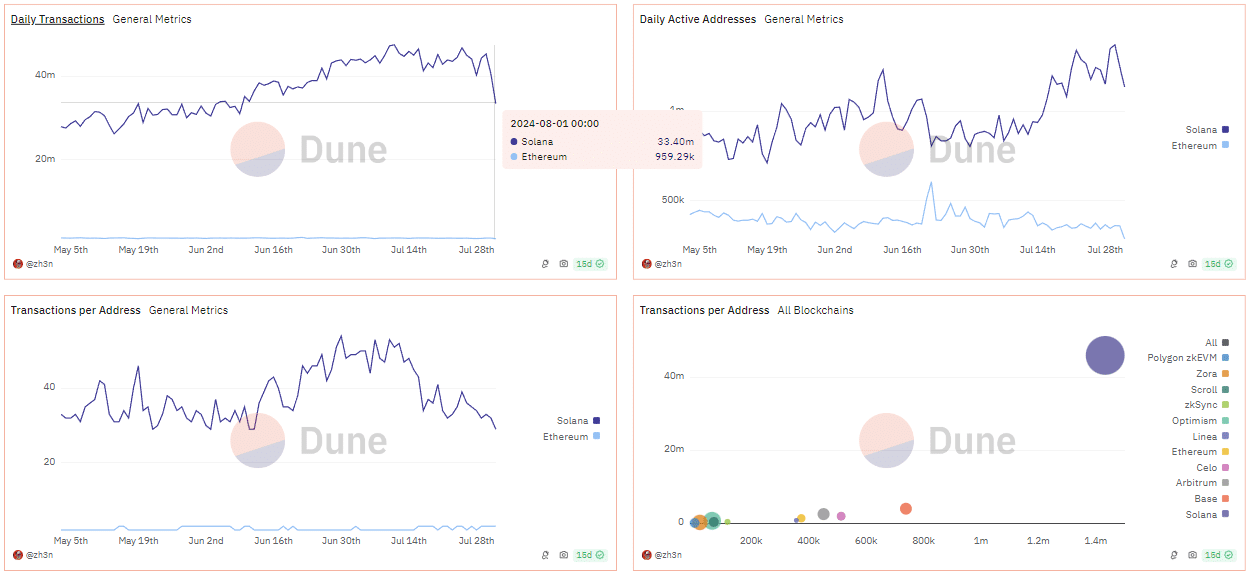

Solana Quarterly Report: Q2 2024

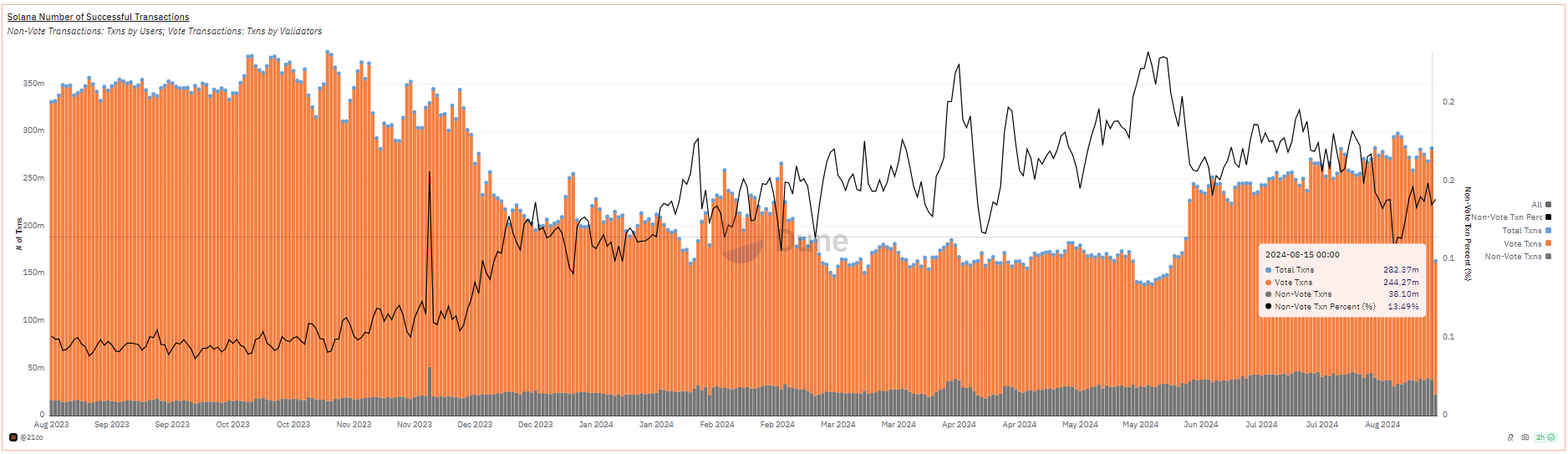

Solana released its Q2 report providing a comprehensive overview of the network’s performance, growth, and key developments over the past quarter. This report breaks down the key metrics and milestones that define Solana’s journey this quarter.

We’ll cover the key insights below:

Conclusion

As we conclude our Solana review, it’s clear Solana has rapidly emerged as a leading blockchain platform. Known for its incredible speed, low transaction costs, and innovative approach to scalability. From DeFi and NFTs to Web3 applications, Solana’s ecosystem is expanding at an impressive pace. However, it’s essential to consider the full picture, including the potential downsides.

One of the critical concerns with Solana is its inflation rate and emissions schedule. Solana’s initial tokenomics were designed with a high inflation rate, starting at 8% annually, which decreases by 15% each year until it reaches a long-term stable rate of 1.5%. While this gradual reduction in inflation is aimed at ensuring long-term sustainability, the current rate still results in significant token emissions. This could potentially dilute the value of existing SOL holdings over time, especially if the demand doesn’t keep pace with the increasing supply. So far, the demand has significantly outpaced supply, rewarding Solana holders with impressive price increases.

Additionally, while Solana’s architecture allows for remarkable scalability, it has come at the cost of network reliability. The platform has experienced multiple outages and performance issues, raising concerns about its ability to maintain consistent uptime and security as it continues to scale. However, Firedancer is expected to enhance network stability and performance, potentially mitigating some of the reliability concerns that have arisen as Solana expands.

Overall, while Solana presents significant opportunities due to its technical innovations and growing ecosystem, these must be weighed against the risks associated with its inflation rate and network reliability. As Solana continues to evolve, its ability to address these challenges will be key to sustaining its position in the competitive blockchain landscape.

See Also:

Frequently Asked Questions

Is Solana the Fastest Cryptocurrency?

What is Solana (SOL)?

How does Solana achieve its high transaction speed?

Is Solana environmentally friendly?

What are the risks of investing in SOL?

References:

- Hyperledger Foundation. “Meet Hyperledger Solang: A Portable Solidity Compiler.” Hyperledger, 12 Sept. 2022, www.hyperledger.org/blog/2022/09/12/meet-hyperledger-solang-a-portable-solidity-compiler.

- Solana Labs. “What Is a Validator? – Proof of History.” Solana Documentation, https://docs.solanalabs.com/what-is-a-validator#proof-of-history

- Blockchain Council. “What Is Proof of History and How Does It Work?” Blockchain Council, www.blockchain-council.org/blockchain/what-is-proof-of-history-and-how-does-it-work/.

- Narula, Neha, et al. “Chainlink: A Decentralized Oracle Network.” IEEE Explore, IEEE, 2019, https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=8798621

- “Blockchain Explained.” MIT Sloan School of Management, https://mitsloan.mit.edu/ideas-made-to-matter/blockchain-explained