What is Ethereum and How Does it Work?

In this article, I’m going to explain in depth what Ethereum is and a bit about how it works. Don’t worry; the explanation will be non-technical and easy to understand.

Don’t like to read? Watch our video guide instead

What is Ethereum: Summary

At its core, Ethereum is a decentralized, open-source blockchain network that features smart contract functionality. In layman’s terms, it’s a global supercomputer that anyone can use. Unlike Bitcoin, which is designed purely as a digital currency, Ethereum allows developers to build and deploy self-executing contracts and decentralized applications (dApps) without any downtime, fraud, or third-party interference.

Simply put, Bitcoin is like a calculator—an impressive tool for specific tasks—but Ethereum is more like a smartphone, loaded with apps and brimming with potential. Ethereum isn’t just about holding value; it’s about creating value through smart contracts, decentralized applications (dApps), and much more.

Bitcoin vs. Ethereum

When it comes to the titans of the cryptocurrency world, Bitcoin and Ethereum are the undisputed champions, each standing tall for different reasons. Bitcoin is the digital equivalent of gold: it’s the original, the pioneer, the one that started it all. But Ethereum? Ethereum is more like the digital Swiss Army knife—versatile, innovative, and packed with a multitude of tools.

Bitcoin: The Digital Gold

Bitcoin was born out of the ashes of the 2008 financial crisis, introduced by the enigmatic Satoshi Nakamoto. Its purpose is singular: to be a decentralized digital currency, free from the shackles of traditional financial systems and government control. Bitcoin is scarce—only 21 million will ever exist. This scarcity, combined with its robust security and decentralized nature, has cemented its status as the digital gold of our age. It’s a store of value, a hedge against inflation, and a symbol of financial sovereignty.

Ethereum: The World Computer

Enter Ethereum. While Bitcoin is a digital currency, Ethereum is a decentralized blockchain that enables developers to build and deploy smart contracts and decentralized applications (dApps). Ethereum’s flexibility is its hallmark. Smart contracts are self-executing agreements coded directly onto the blockchain. They eliminate the need for intermediaries, reducing costs and increasing efficiency. Whether it’s creating decentralized finance (DeFi) platforms, minting non-fungible tokens (NFTs), or launching initial coin offerings (ICOs), Ethereum is the engine powering the decentralized future.

Key Differences

- Purpose and Use Case: Bitcoin’s primary use case is as a store of value and a medium of exchange. It’s digital money. Ethereum, on the other hand, is a platform for decentralized applications. While Ether (ETH) is its native cryptocurrency, Ethereum’s main function is to facilitate smart contracts and dApps.

- Consensus Mechanism: Bitcoin uses Proof of Work (PoW) to secure its network, which requires significant computational power. Ethereum has transitioned to Proof of Stake (PoS) with Ethereum 2.0, aiming to be more energy-efficient and scalable.

- Supply: Bitcoin’s supply is capped at 21 million coins, enhancing its scarcity value. Ethereum doesn’t have a capped supply, but with upcoming updates like EIP-1559, its monetary policy is becoming more deflationary.

- Development and Innovation: Bitcoin’s development is cautious and conservative, focusing on security and stability. Ethereum’s development is fast-paced and innovative, constantly evolving to integrate new features and improvements.

The Verdict

Bitcoin and Ethereum are like comparing apples and oranges—both fruits, yet fundamentally different. Bitcoin represents financial freedom and a hedge against the traditional financial system’s pitfalls. Ethereum embodies technological innovation and the promise of a decentralized future. Together, they form the backbone of the cryptocurrency revolution, each playing a unique and crucial role in reshaping our digital landscape.

So, whether you’re a Bitcoin maxi, believing in its role as the ultimate store of value, or an Ethereum enthusiast, excited about the boundless possibilities of decentralized applications, one thing is clear: both are here to stay, leading the charge into a new era of finance and technology.

What is Ethereum?

Ethereum is the brainchild of Vitalik Buterin, a young prodigy who saw beyond the horizons of Bitcoin. Alongside him were Charles Hoskinson and Gavin Wood, who, after a few creative differences, decided to take their toys and build their own playgrounds—Cardano and Polkadot.

Ethereum is a do-it-yourself (DIY) platform for decentralized programs, also known as Dapps – decentralized apps.

If you want to create a decentralized program that no single person controls (not even you, even though you wrote it), all you have to do is learn the Ethereum programming language called Solidity and begin coding.

The Ethereum platform has thousands of independent computers running it, meaning it’s fully decentralized. Once a program is deployed to the Ethereum network, these computers, also known as nodes, will make sure it executes as written.

Ethereum’s goal is to truly decentralize the internet.

Many people believe the internet is already decentralized and that anyone can start their own site.

While in theory, that might be true, in practice, Amazon, Google, Facebook, Netflix, and other giants control most of the World Wide Web as we know it. There’s almost no activity on the web that happens without some sort of intermediary or third party.

But once the concept of digital decentralization was demonstrated by Bitcoin, a whole new array of opportunities became available.

We can finally start to imagine and design an internet that connects users directly without the need for centralized third parties.

People can “rent” hard drive space directly to other people and make Dropbox obsolete. Drivers can offer their services directly to passengers and remove Uber as the middleman. People can buy cryptocurrencies directly from one another without the need for an exchange that can get hacked or steal your money.

Ethereum allows people to connect directly with each other without a central authority to take care of things. It’s a network of computers that together combine into one powerful, decentralized supercomputer.

How Ethereum Works – Smart Contracts

Ok, so now you know what Ethereum does, but we haven’t touched upon HOW it does it.

Ethereum’s coding language, Solidity, is used to write “smart contracts,” which are the logic that runs Dapps. Let me explain…

In real life, a contract is only a set of “ifs” and “thens,” meaning a set of conditions and actions. For example, if I pay my landlord $1,500 on the 1st of the month, he then lets me use my apartment.

That’s exactly how smart contracts work on Ethereum. Ethereum developers write the conditions for their program or Dapp, and then the Ethereum network executes it.

They are called smart contracts because they deal with all of the aspects of the contract: enforcement, management, performance, and payment.

For example, if I have a smart contract that is used for paying rent, the landlord doesn’t need to actively collect the money from me. The contract itself “knows” if the money has been sent. If I indeed sent the money, then I will be able to open my apartment door. If I miss my payment, I will be locked out.

However, smart contracts also have their downsides. Going back to my previous example, instead of having to kick out a renter who isn’t paying, a “smart” contract would lock the non-paying renter out of their apartment.

A truly intelligent contract, on the other hand, would take into account other factors as well, such as extenuating circumstances and the spirit with which the contract was written, and it would also be able to make exceptions if warranted. In other words, it would act like a really good judge.

Instead, a “smart contract” in the context of Ethereum is not intelligent at all. It’s actually uncompromisingly letter-strict. It follows the rules down to a T and can’t take any secondary considerations or the “spirit” of the law into account, like what commonly happens with real-world contracts.

Once a smart contract is deployed on the Ethereum network, it can not be edited or corrected, even by its original author. It’s immutable.

The only way to change a smart contract would be to convince the entire Ethereum network (i.e., all the computers participating around the world) that a change should be made, and that’s virtually impossible.

This creates a very serious problem since, unlike Bitcoin, Ethereum was built with the ability to create really complex contracts, and complex contracts are very difficult to secure.

With any contract, the more complicated it is, the harder it is to enforce as more room is left for interpretations or more clauses must be written to deal with contingencies.

With smart contracts, security means handling with perfect accuracy every possible way in which a contract could be executed in order to make sure that the contract does only what the author intended.

Ethereum launched with the idea that “code is law.” That is, a contract on Ethereum is the ultimate authority, and nobody can overrule the contract.

This all came to a crashing halt when the DAO event happened.

The DAO – When smart contracts go wrong

DAO stands for “decentralized autonomous organization,” which is a type of project structure in which token holders (coin holders) can participate in the management and decision-making of a project. This is similar to owning stock, which grants you voting rights. For DAOs, the decisions themselves are crowd-sourced and decentralized. In 2016, The DAO was the actual project name of a DAO that raised $150M in the Ethereum currency ether, or ETH, from over 11,000 investors.

While this all sounded very good, the code wasn’t secured very well and resulted in network participants figuring out a way to drain The DAO out of money.

Now, you could say that the person who drained The DAO of over $50 million worth of ether was a “hacker.” But some would argue that this was just someone who was taking advantage of the loopholes he found in The DAO’s smart contract.

This isn’t very different from a creative lawyer figuring out a loophole in the current law to effect a positive result for his client.

What happened next is that the Ethereum community decided that the code no longer is law and changed the Ethereum protocol rules in order to revert all the money that went into The DAO. In other words, the contract writers and investors did something stupid, and the developers and founders of Ethereum decided to bail them out.

The small minority that didn’t agree with this move stuck to the original Ethereum blockchain before the hard fork, and that’s how Ethereum Classic was born (which is actually the original Ethereum).

The Merge: Ethereum’s shift – Proof of Work to Proof of Stake

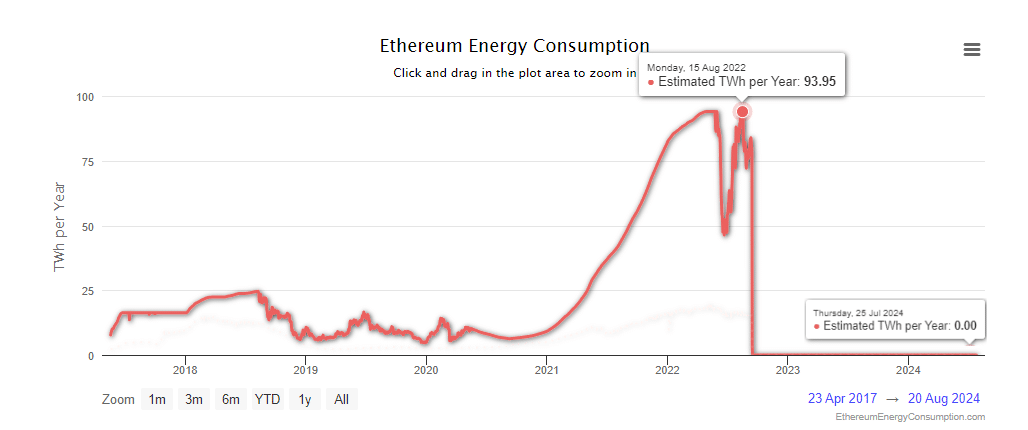

Here’s where things get even more interesting. Ethereum has undergone a major transformation called “The Merge,” a pivotal upgrade that transitioned the network from Proof of Work (PoW) to Proof of Stake (PoS). Originally, Ether was mined using PoW, which involved solving complex mathematical puzzles to validate transactions and secure the network, consuming a significant amount of energy.

However, with “The Merge,” Ethereum shifted to a PoS system, fundamentally changing how the network operates. Instead of miners, PoS relies on validators who lock up their Ether as collateral to secure the network and validate transactions. Validators are selected to create new blocks, validate transactions, and mint new ETH based on the amount of Ether they hold and are willing to “stake” as collateral.

This transition is part of the broader roadmap often referred to as Ethereum 2.0, aimed at improving the network’s scalability, security, and sustainability. One of the key benefits of PoS is its energy efficiency, which has reduced Ethereum’s energy usage by 99%. Unlike PoW, which requires vast amounts of computational power and energy, PoS is designed to be more environmentally friendly and scalable, making it possible to handle a greater number of transactions more efficiently.

Additionally, PoS reduces the risk of centralization. In a PoW system, the need for expensive mining hardware could lead to centralization of mining power among a few large entities. In contrast, PoS democratizes the process, allowing anyone with a minimum amount of Ether to participate in securing the network.

“The Merge” has been a monumental step forward for Ethereum, setting the stage for a more sustainable and scalable future. As the network evolves, Ether will continue to play a crucial role in powering and incentivizing this decentralized ecosystem.

And let’s not forget another seismic shift: the approval of Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC). This approval marks a major step towards mainstream adoption of digital assets, bringing Ether closer to being recognized as a commodity. On the first day of trading, these Ethereum ETFs saw an impressive $361 million in trading volume within the first 90 minutes, highlighting strong market interest and investor confidence. This not only enhances market liquidity but also provides new investment pathways for both retail and institutional investors, further solidifying Ethereum’s position in the financial landscape.

Ether (ETH) – Ethereum’s currency

Ether (ETH) isn’t just some digital token floating around in the crypto cosmos. It’s the lifeblood of the Ethereum network, fueling every transaction, smart contract, and decentralized application (dApp) that runs on this revolutionary platform.

Ether’s role is multifaceted. Every interaction on the Ethereum network requires a transaction fee paid in ETH, known as a gas fee. This is the lubricant that keeps the Ethereum machine humming smoothly, compensating validators who secure the network and process transactions. If you are interested in buying some Ethereum, feel free to check out our How to Buy Ethereum Guide.

How to Send and Receive ETH

Sending and receiving ETH might seem like navigating a labyrinth the first time around, but it’s simpler than it seems. When you send ETH, you pay a gas fee, which is essentially a tip to the network validators for processing your transaction. The fee comes out automatically from your wallet, so you don’t have to worry about a separate transaction.

To check gas fees, you can use tools like Etherscan, which provide real-time data on current gas prices. This helps you decide the best time to make a transaction, ensuring you don’t overpay. Etherscan also allows you to track your transactions on the blockchain, giving you transparency and peace of mind.

Gas fees might sound like a nuisance, but they’re crucial for network security and efficiency. They prevent spam transactions and ensure that validators are fairly compensated. Every time you interact with a dApp, send ETH, or execute a smart contract, you pay a bit of ETH as gas. It’s a small price for the immense computational power at your fingertips.

The Power of Staking

With the transition to Proof of Stake (PoS), ETH has become even more pivotal. Validators stake their ETH as collateral to propose and verify new blocks, earning rewards in return. This not only secures the network but also aligns the interests of validators with the health of the Ethereum ecosystem. It’s a win-win, reducing the network’s energy consumption and democratizing participation. If you want to learn more about staking, you can find our guides on the Best Cryptocurrencies to Stake and the Best Crypto Staking Platforms.

EIP-1559: A Game Changer

The introduction of EIP-1559 brought a new twist to Ethereum’s economic model. Now, a portion of every gas fee is burned, reducing the total supply of ETH over time. This deflationary pressure is designed to increase the value of ETH as network usage grows, rewarding long-term holders and users alike.

In essence, Ether is the powerhouse driving Ethereum’s decentralized future. It’s versatile, indispensable, and ready to redefine digital finance. As Ethereum evolves, ETH will continue to be the pulse of this dynamic ecosystem, fueling innovation and securing the future of blockchain technology.

Major EIPs in Recent Years

Ethereum has seen several significant Ethereum Improvement Proposals (EIPs) over the past couple of years, each aimed at enhancing the network’s performance, security, and scalability.

- EIP-4844 (Proto-Danksharding): This EIP addresses data availability issues, primarily benefiting Layer-2 (L2) networks by reducing transaction costs. It introduces a new data type called “blobs,” which temporarily stores data off-chain, significantly lowering storage overhead and transaction fees. This proposal is a stepping stone towards future upgrades to Danksharding, a more comprehensive scaling solution.

- EIP-4895 (Shanghai Upgrade): Implemented as part of the Shanghai upgrade, EIP-4895 enables validators to withdraw staked ETH from the Beacon Chain. This update, which went live in April 2023, is a critical step in Ethereum’s transition to Proof of Stake (PoS), allowing validators to finally access their staked rewards.

- EIP-1153 (Transient Storage Opcodes): This proposal introduces temporary storage, which significantly reduces gas costs associated with permanent storage on the blockchain. By enabling a temporary workspace for data, it accelerates smart contract operations and reduces transaction fees.

- EIP-4788 (Beacon Block Root Commit): Enhancing communication between the Beacon Chain and Ethereum Virtual Machine (EVM), this EIP allows smart contracts to access real-time information about the network’s state. This improvement is particularly beneficial for staking services and cross-chain applications.

Competitor Analysis

To fully understand Ethereum and its place in the cryptocurrency ecosystem, it’s essential to look at how it compares to other major players in the space.

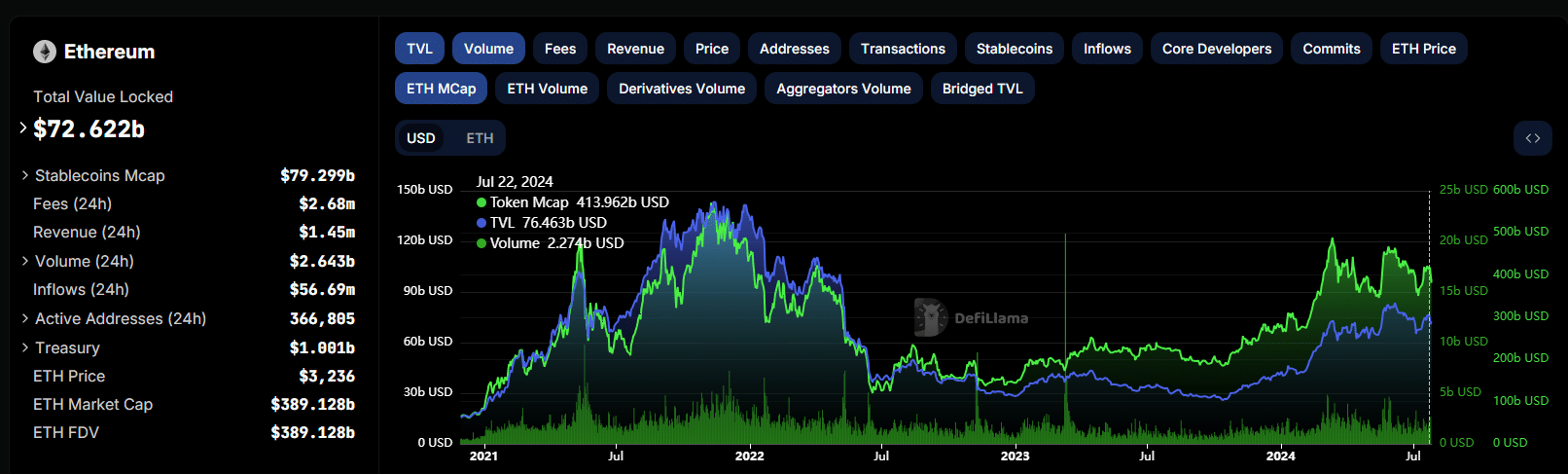

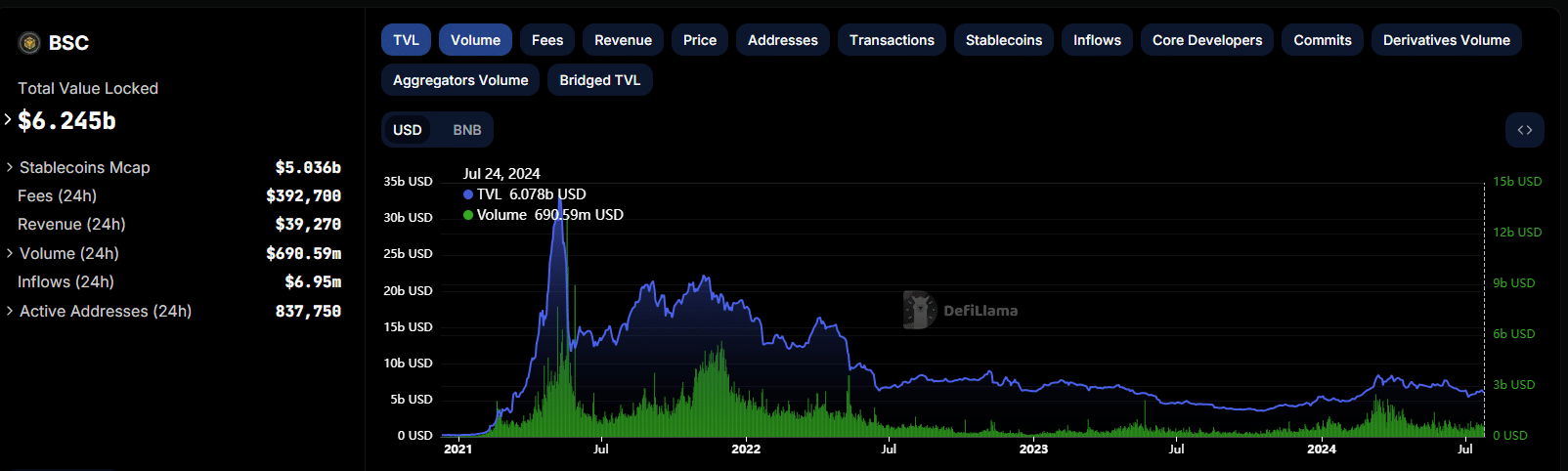

Binance Smart Chain (BSC)

Binance Smart Chain, launched by the popular cryptocurrency exchange Binance, is one of Ethereum’s closest competitors. BSC is known for its high-speed transactions and lower fees, making it attractive for developers and users.

BSC can process transactions much faster than Ethereum, with lower fees. It is compatible with the Ethereum Virtual Machine (EVM), making it easy for developers to migrate their Ethereum dApps to BSC. However, BSC is more centralized, with Binance playing a significant role in its operation and governance. This centralization raises security concerns, as BSC has faced security breaches and exploits, challenging its overall robustness.

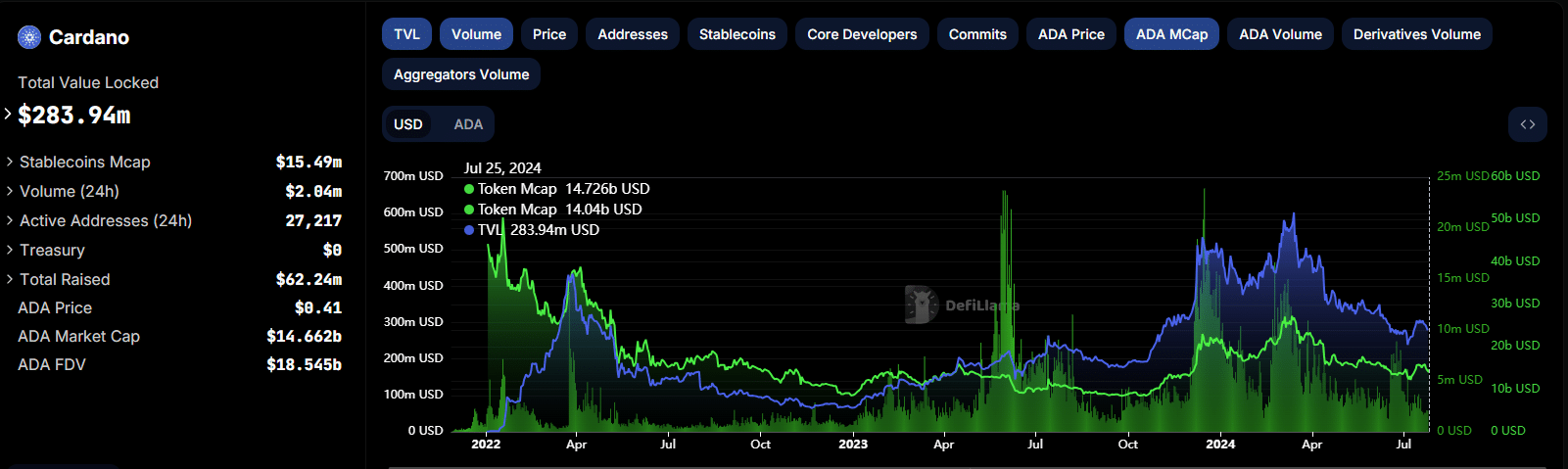

Cardano (ADA)

Cardano is another major competitor, known for its research-driven development approach. Founded by Charles Hoskinson, one of Ethereum’s co-founders, Cardano aims to provide a more secure and scalable platform.

Cardano’s development is based on peer-reviewed research, ensuring a high level of security and reliability. It uses a PoS consensus mechanism, similar to Ethereum’s transition, which is more energy-efficient. However, Cardano’s rigorous research approach can slow down development and implementation of new features. While Cardano has strong potential, it still lags behind Ethereum in terms of adoption and the number of dApps on its platform.

Now that we have a solid grasp of Ethereum’s strengths and its place among competitors, you might be wondering how to get involved and potentially earn some Ether for yourself.

To explore various ways to earn Ether, check out our comprehensive guide on how to earn free Ethereum. This guide covers everything from staking and mining to participating in airdrops and bounty programs, providing you with practical tips and strategies to start earning Ether today.

Frequently Asked Questions

Is Ethereum a Currency?

Ethereum is the infrastructure for running Dapps worldwide. It’s not a currency, it’s a platform. The currency used to incentivize the network is called Ether (ETH).

How Much is Ethereum Worth Right Now?

At the moment, 1 Ether ~ 2,577 USD

What’s the Difference Between Bitcoin and Ethereum?

The one major difference between Bitcoin and Ethereum is that Bitcoin is used as an application for decentralizing money, while Ethereum is used to run smart contracts and decentralize basically everything.

Comparing Bitcoin to Ethereum would be like comparing apples to oranges since they don’t fulfill the same purpose. Having said that, here are the main differences between their small similarities (since they’re both cryptocurrencies).

- Total Supply – Bitcoin has a total supply of 21m coins, while Ether isn’t limited in its supply.

- Hashing Algorithm – Bitcoin uses the SHA-256 algorithm, while Ethereum uses KECCAK-256.

- Avg. Block Confirmation Time – Bitcoin has a block time of 10 minutes, Ethereum transitioned to PoS

- Mining Hardware – Bitcoin is mined with ASICs, while Ethereum is staked.

- Initial Coin Distribution – Bitcoin was always based on mining, while Ethereum conducted an ICO.

For a complete comparison between the two coins, visit my Bitcoin vs. Ethereum page.

How is Ethereum Created?

With “The Merge,” Ethereum transitioned to a PoS system, drastically changing how Ether is created and secured. In PoS, there are no miners. Instead, there are validators who are responsible for proposing and validating new blocks on the blockchain.

Validators in PoS are selected based on the amount of Ether they hold and are willing to “stake” as collateral. This staked Ether acts as a security deposit, ensuring that validators act in the network’s best interest.

Conclusion

Hopefully, by now, you have a better understanding of what Ethereum is – A network of computers working together to replace the centralized model of programs and companies that run the Internet today. If you want to learn more about how Ethereum works, I suggest continuing with our Ethereum wallet guide.

Special thanks to:

- Jimmy Song, whose post about smart contracts, helped us a lot in creating this video.

- Nitzan Raber

This is mind blowing, thanks for sharing this valuable content.

Really interested. Very informative. Thanks 👍

How could i create my own DeFi app ( dapp) ?

Here is a link that will help you: https://www.leewayhertz.com/build-defi-app/#:~:text=How%20to%20build%20Defi%20apps%3F%201%201.%20Install,function%28deployer%2C%20network%2C%20accounts%29%20%7B%20await%20deployer.deploy%28MyToken%29%20More%20items

blockchainx

So When you buy Ethereum your buying the newer one and not Classic right? Does classic even trade?

This was a great insight!

Thank you so much for sharing, now I feel like I have a little bit more information Ethernum.