Staking generates passive rewards and is an ideal solution for long-term crypto investors, leaving enthusiasts searching for the best crypto staking platforms to earn healthy APYs.

This guide will review the 9 best crypto staking platforms from the leading staking providers for supported coins, average APYs, withdrawal terms, security, and accessibility. I also explain how crypto staking works, the benefits and risks, and how to get started in under 10 minutes.

The Best Crypto Staking Platforms to Use Right Now

Listed below are the 9 best crypto staking platforms for 2024:

- Margex – The overall best crypto staking site, allows staked coins to be used for trading capital

- MEXC – A great option for staking stablecoins, USDT pays up to 8.8%

- Binance – Popular staking platform offering enhanced yields on longer lock-up periods

- OKX – Offers a decentralized staking aggregator that connects to hundreds of pools

- Crypto.com – Off-chain staking rewards with flexible and locked plans

- Coinbase – A safe and regulated staking platform offering 5.1% on USDC

- Kraken – Earn staking APYs of up to 24% with bi-weekly distributions

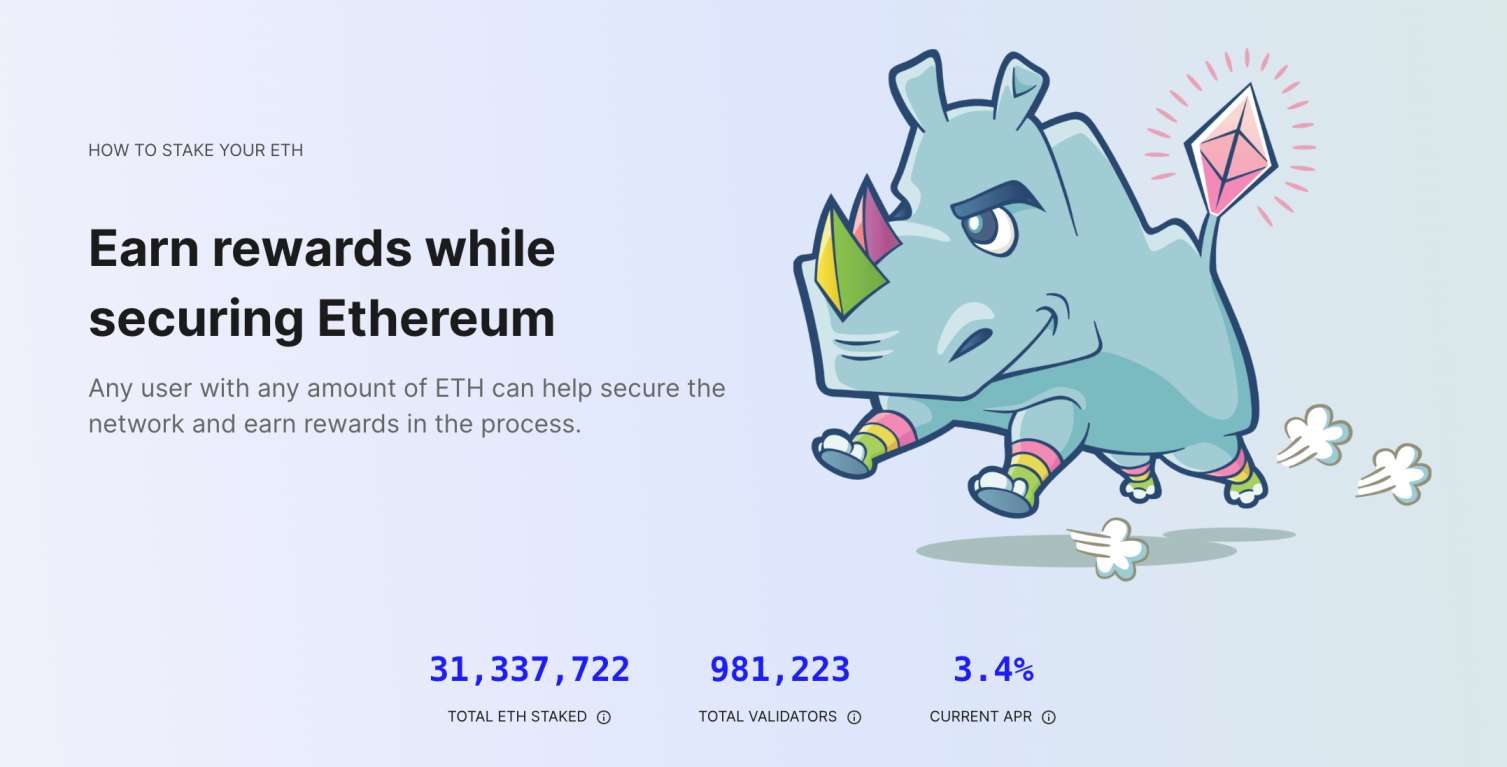

- Rocket Pool – One of the best options for Ethereum liquid staking, APYs of 3.1%

- Trust Wallet – Self-custody wallet app with in-built staking tools

Reviewing the Top Cryptocurrency Staking Sites

I’ll now review the best staking crypto platforms listed above. Read on to choose the most suitable staking site for your needs.

1. Margex – The Overall Best Crypto Staking Site for 2024

Margex is my top pick for crypto staking. While Margex is considered one of the best crypto leverage trading platforms, it offers competitive staking yields for long-term holders. For instance, you’ll get APYs of 3% on Bitcoin and 4.7% on Ethereum. Chainlink is also competitive at 3%.

If you’re looking to generate passive rewards without volatility, Margex offers 5% on USDT and USDC. Here’s the standout feature; Margex enables you to trade while coins are being staked. This offers much-needed liquidity, rather than the coins being locked. Best of all, staking yields are credited daily. The funds can be reinvested, allowing you to compound the returns.

In terms of trading, Margex specializes in perpetual futures. These derivative products allow you to trade with leverage of up to 100x. All markets support long and short trading. Commissions at Margex cost just 0.06%. Traders have access to plenty of analysis tools, including indicators and charts. There are no KYC requirements when joining Margex. If you want to learn more about this highly-rated exchange, we go into more detail in our dedicated Margex Review.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Margex | 3% | 5% | No lock-up terms. Staked coins can be traded. Rewards are paid daily. |

Pros

- The overall best crypto staking platform in 2024

- Offers APYs of up to 5%

- No lock-up terms

- Staked coins can be used to trade

- Rewards are distributed daily

- Also one of the best no KYC crypto exchanges

Cons

- Currently supports just five staking coins

- Doesn’t support spot trading markets

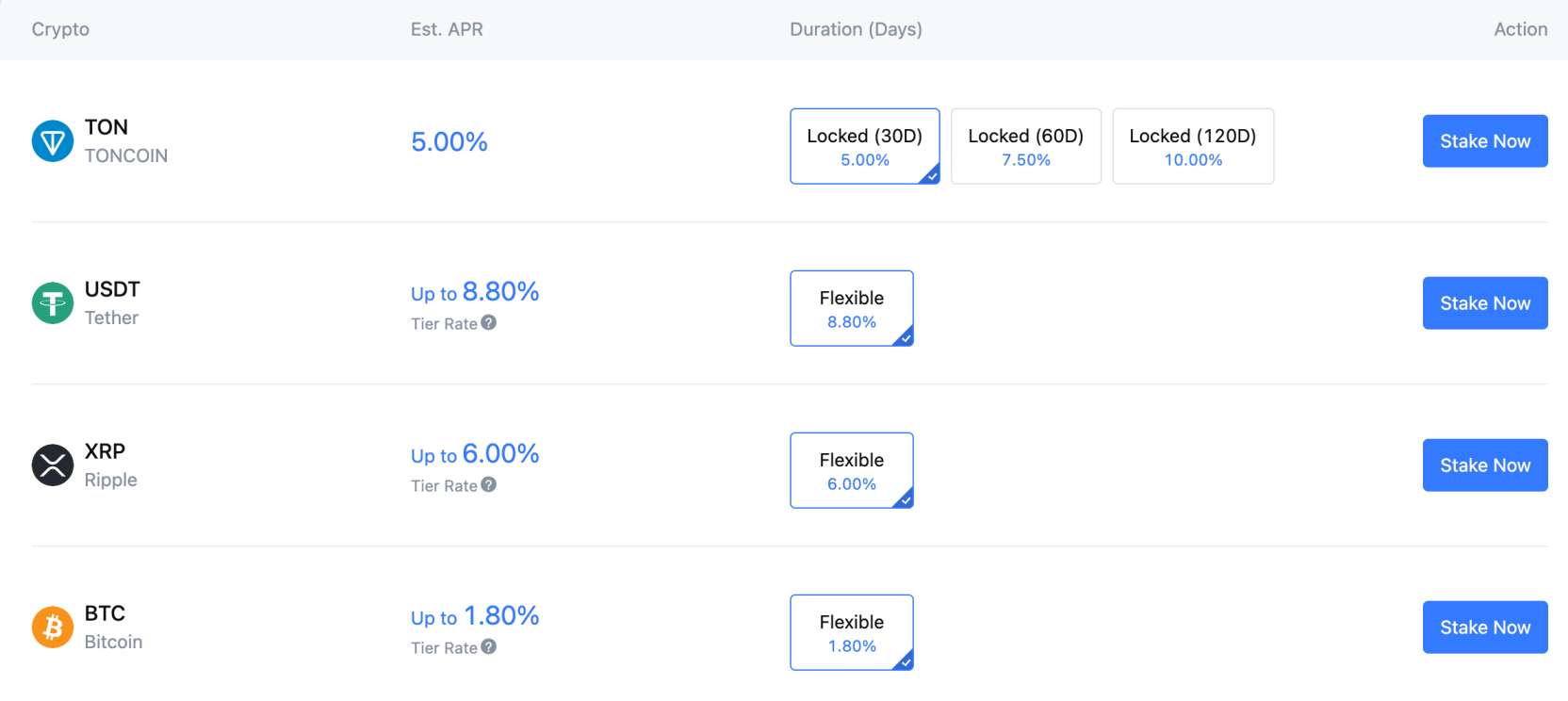

2. MEXC – A Great Option for Staking Stablecoins, USDT Pays up to 8.8%

MEXC is the best crypto staking platform for stablecoins. You’ll earn much higher yields than other platforms; USDT generates APYs of up to 8.8%. What’s more, USDT staking plans are flexible. This means you can withdraw the USDT tokens at any time. However, do note that MEXC has a tiered system on USDT plans.

Only the first 300 USDT earns 8.8%. Anything between 300 and 1,000 USDT earns 1.5%. Deposits above 1,000 USDT earn just 0.8%. MEXC also offers high APYs on standard cryptocurrencies. For example, you’ll get up to 10% on Toncoin and 6% on XRP. Ethereum is also competitive at 4.8%. However, Bitcoin yields just 1.8%.

MEXC distributes staking rewards daily, which is another plus point. When you’re not staking coins, MEXC is also a great option for trading. It offers over 2,000 crypto markets, including some of the best altcoins. It supports spot trading and leveraged futures of up to 200x. MEXC commissions are some of the lowest in the market.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| MEXC | 1.8% | 8.8% | Most coins come without lock-up terms. Rewards are paid daily. |

Pros

- Earn up to 8.8% when staking USDT

- Withdraw coins at any time without penalties

- Receive staking payments daily

- One of the largest crypto exchanges globally

- Offers rock-bottom trading commissions

Cons

- Only the first 300 USDT earns the top-tier rate

- USDC yields just 0.85%

3. Binance – Popular Staking Platform Offering Enhanced Yields on Longer Lock-Up Periods

Binance is best known for its low-cost, high-volume trading platform. That said, Binance also offers some of the best crypto staking rewards – especially for long-term investors. This is because Binance offers enhanced staking yields when the coins are locked for longer periods. For instance, you’ll earn Solana APYs of just 0.9% on flexible plans.

However, this increases to 8.9% when opting for a 120-day lock-up period. Similarly, Sui yields start from just 1.41% on flexible plans. In contrast, locking the coins for 120 days increases the yield to 9.6%. Binance also offers competitive staking rewards on stablecoins. USDT and USDC pay over 10% and 8%, respectively.

If you’re an American trader, Binance has a separate US platform. This comes with different yields and there’s no support for stablecoins. That said, you can earn up to 10.8% on Kusama, and 12.2% on Polkadot. Ultimately, Binance is the best option if you’re looking to combine competitive staking rewards with a top-rated trading platform.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Binance | 0.32% | 10.02% | Most staking coins come with multiple lock-up options, ranging from flexible to 120 days. Reward distributions depend on the pool. |

Pros

- Earn high APYs when locking up coins for longer periods

- USDT deposits pay 10.02% on a 120-day term

- Supports a wide range of altcoins

- Offers a staking rewards calculator

- Also one of the best exchanges for spot trading

Cons

- The maximum Bitcoin APY is 0.32%

- Flexible plans often come with low yields

4. OKX – Offers a Decentralized Staking Aggregator That Connects to Hundreds of Pools

OKX also makes my list of top crypto staking sites. While OKX is a popular centralized exchange, it also offers a decentralized ecosystem. It comes in-built with a bridge aggregator. In simple terms, this means OKX obtains staking yields from hundreds of external pools. Each pool operates a decentralized framework, meaning staking transactions are backed by smart contracts.

There is no requirement to leave the OKX platform. Simply search for your preferred staking coin and review the best pools. Once you’ve connected a wallet to OKX, you can begin staking straightaway. To offer some insight into yields, USDT offers a maximum APY of 38.37%. Some pools have limited liquidity though, so are less reputable than other providers.

Therefore, investors should do their homework before staking. Nonetheless, OKX supports thousands of staking coins across more than 40 blockchain networks. In addition, I like that OKX offers proprietary software on most device types. This includes mobile apps, desktop software, and a browser extension for Chrome.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| OKX | N/A | 38.37% | All terms depend on the staking pool provider. |

Pros

- Best crypto staking platform for decentralized investing

- Bridges to hundreds of staking pools

- Supports thousands of coins on over 40 networks

- Offers a native wallet for desktops, mobiles, and Chrome

- Doubles up as a decentralized exchange

Cons

- Doesn’t support Bitcoin staking

- Some staking pools come with limited liquidity

5. Crypto.com – Off-Chain Staking Rewards With Flexible and Locked Plans

Crypto.com offers some of the best off-chain staking rewards in the market. My Crypto.com staking review found that APYs of up to 14% are available. This top-tier rate is paid in Chainflip. Bitcoin and Ethereum yield up to 5% and 5.5%, respectively. You’ll also get 12% on Cosmos and Polkadot.

Stablecoins like USDT yield 6.5%, but there are better options elsewhere. The main drawback is that the highest Crypto.com staking rewards require a 3-month lock-up term. What’s more, you’ll need to stake a minimum number of CRO tokens to get the highest rates. CRO is native to Crypto.com. While Crypto.com offers flexible plans, the APY drops massively.

For instance, flexible plans on Bitcoin and Ethereum without CRO staking come with APYs of 0.2%. In terms of distributions, Crypto.com pays staking rewards weekly. This is another drawback, as many platforms offer daily payouts. Nonetheless, I like that the Crypto.com ecosystem supports over 250 coins, low trading commissions, and a native mobile app.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Crypto.com | 5% | 6.5% | Lock-up terms range from flexible to 3 months. Staking rewards are paid weekly. |

Pros

- Get up to 5% on Bitcoin deposits

- Some altcoins yield up to 14%

- Used by over 80 million people globally

- Considered a safe crypto exchange

- Available in the US

Cons

- Yields drop massively on flexible plans

- You need to stake CRO to get the highest APYs

6. Coinbase – A Safe and Regulated Staking Platform Offering 5.1% on USDC

Coinbase is another option to consider when choosing the best crypto staking platform. This US-based exchange is regulated, legitimate, and safe. It offers a user-friendly experience and top-rated customer support. What’s more, getting fiat money into Coinbase is a breeze; it supports debit/credit cards, e-wallets, ACH, SEPA, and more.

In terms of staking, Coinbase supports 124 coins. One of the most popular is USDC, which yields 5.1%. While lower than some platforms, Coinbase offers institutional-grade security. Therefore, many investors are prepared to take a lower APY for the peace of mind offered.

Other popular staking coins include Cosmos, Ethereum, and Solana, which pay 5.71%, 2.61%, and 4.68%, respectively. I also like that Coinbase enables users to unstake their coins at any time. However, the drawback is that Coinbase charges high fees; it keeps up to 35% of the staking rewards generated.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Coinbase | N/A | 5.1% | All staking pools offer flexible withdrawals. Staking reward distributions vary depending on the coin. |

Pros

- One of the safest staking platforms in the market

- A great option for staking USDC

- Supports 124 staking coins in total

- Coins can be unstaked at any time

- Easily buy staking coins with fiat money

Cons

- Keeps up to 35% of the generated staking rewards

- Not available in all supported territories

7. Kraken – Earn Staking APYs of up to 24% With Bi-Weekly Distributions

Kraken is a popular crypto exchange that doubles up as a staking platform. It supports 21 staking coins, including Algorand, Cosmos, Ethereum, Kava, and Flow. The maximum staking APY is 24%, available on Kusama. Polkadot and Mina are also competitive at 18% and 21%, respectively.

Kraken also supports USDC with APYs of up to 6.5%. However, the best rates on Kraken require a lock-up period. This averages 14-30 days, depending on the staking coin. For example, the Graph yields up to 15% on a 28-day lock period. However, this drops to 6% on a flexible plan.

I like that Kraken distributes staking rewards twice per week. This is ideal for reinvesting the rewards and compounding the returns. In terms of fees, this depends on the coin and the amount being staked. For example, the first 70,000 ADA staked attracts a commission of 20%. The lowest commission is 8%, but you’d need to stake at least 10 million ADA.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Kraken | N/A | 6.5% | Choose from flexible or locked staking terms. Staking rewards are paid twice per week. |

Pros

- Supports 21 popular staking coins

- APYs of up to 24%

- Staking rewards are distributed bi-weekly

- Backed by an established and trusted exchange

Cons

- Charges staking fees of up to 20%

- US clients aren’t eligible for Kraken staking

8. Rocket Pool – One of the Best Options for Ethereum Liquid Staking

Rocket Pool is one of the best options for Ethereum ‘liquid staking’. In a nutshell, this staking method offers real-time liquidity, meaning rewards are earned without you being locked from the markets. For instance, let’s suppose that you own 1 ETH. You deposit that 1 ETH into the Rocket Pool protocol.

In doing so, you receive 0.9 rETH back. This is Rocket Pool’s native token. This means that you’ll earn Ethereum staking rewards, but can use the rETH to access liquidy. To reclaim your original ETH, you’d need to return the rETH. Everything is on-chain, ensuring transparency and security. In addition, you can unstake the ETH at any time.

There are no withdrawal penalties. In terms of yields, Rocket Pool currently pays 3.1%. While this isn’t the most competitive APY, you’re benefiting from increased security and liquidity provision. The yield increases to 6.57% when running an Ethereum node. However, this is riskier, as you’re responsible for safekeeping the network.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Rocket Pool | N/A | N/A | Liquid staking with no lock-up terms. Receive approximately 0.9 rETH for every 1 ETH deposited. The original ETH is redeemed when the rETH is returned. |

Pros

- The best option for liquid staking

- Receive rETH after depositing ETH into the staking pool

- Minimum requirement of just 0.01 ETH

- Unstaking is allowed at any time

Cons

- Only supports Ethereum

- rETH is volatile like most cryptocurrencies

9. Trust Wallet – Self-Custody Wallet App With In-Built Staking Tools

Trust Wallet is a great option if you want to earn staking rewards directly in a wallet. This prevents the need to transfer coins to and from exchanges. It offers a self-custody wallet, meaning nobody else has access to your private keys – not even Trust Wallet. Available as a mobile app for iOS and Android, Trust Wallet offers a user-friendly experience.

Once you’ve transferred an eligible staking coin, you can start earning right away. I found that staking yields are competitive too. For example, on Juno, Axelar, and NEAR, Trust Wallet pays over 15%, 6%, and 8% respectively. You’ll earn approximately 14% on Cosmos and Polkadot. Solana and BNB yield over 5% and 4%.

Trust Wallet also offers a handy staking calculator. Simply select the cryptocurrency and type in the number of coins to see your rewards. However, these are estimations, so take them with a grain of salt. The main drawback when staking on Trust Wallet is it doesn’t support stablecoins.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Trust Wallet | N/A | N/A | All terms depend on the staking pool provider. |

Pros

- Combine wallet storage with staking rewards

- Offers competitive yields on many staking coins

- Comes as a user-friendly app for iOS and Android

- Also offers a browser extension for Chrome

- Its wallet supports over 100 blockchain standards

Cons

- Stablecoins can’t be staked

- Terms are determined by the respective validator

The Basics of Staking Crypto

In simple terms, staking in crypto is a passive investing tool. It enables crypto investors to generate a yield on their holdings. This means investors can increase the number of coins they own. This is similar to depositing cash in a savings account. However, not all cryptocurrencies can be staked. On the contrary, staking coins must operate on the proof-of-stake network.

Fortunately, this covers thousands of cryptocurrencies. For example, Ethereum is a proof-of-stake network, meaning most ERC-20 tokens can be staked. This includes Tether, Aave, Chainlink, and Maker. Similarly, other leading networks also offer staking capabilities. This includes BNB Chain, Solana, and Avalanche.

The main exception is Bitcoin, which operates on the proof-of-work network. That said, it’s still possible to earn yields on Bitcoin – you simply need to use a third-party platform. Options include Margex, MEXC, and Binance. Ultimately, staking is considered a great option for long-term investors who want to compound their returns.

How Does Cryptocurrency Staking Work?

Staking opportunities come with varying terms and conditions. For instance, some staking pools have a minimum holding period, while others offer flexible withdrawals. Yields are often dependent on the lock-up term. Investors should also be aware of fees, and how frequently rewards are distributed. Let’s take a much closer look at how crypto staking works.

Proof-of-Stake Consensus

Staking rewards are offered by proof-of-stake networks like Ethereum and Solana. Investors deposit their tokens into the network, which remain locked for a certain number of days. This helps keep the network secure and stable. After the staking period is over, investors receive their coins back. This includes the principal and the staking rewards generated.

As I explain in more detail later, most investors opt for off-chain staking, as the rewards are higher. This means a third-party platform is used, like a crypto exchange. This is also a more user-friendly option, as you don’t need to directly engage with the network.

What’s more, on-chain staking often comes with much higher minimums. Nonetheless, staking rewards are covered by network inflation. This is because proof-of-stake networks issue new coins when blocks are confirmed. For example, new ETH enters circulation approximately every 12 seconds.

Lock-Up Terms

Investors should understand the lock-up terms when staking cryptocurrency. This will vary depending on the staking coin and the chosen platform. For example, some staking pools offer flexible plans. This means you can withdraw your coins at any time – without financial penalty. This is like depositing funds in a traditional checking account.

However, similar to a certificate of deposit (CD), some staking pools come with a minimum lock-up term. This might be days, weeks, or a few months. Some platforms offer various lock-up periods. In many cases, longer terms come with the highest yields. However, you can’t withdraw coins while they’re locked, so do bear this in mind.

Staking APYs

Staking rewards are determined by the annual percentage yield (APY). This dictates how much you’ll earn over a 12-month period. Crucially, the staking rewards are paid in the respective cryptocurrency.

So, if you’re staking Solana, your rewards will be paid in SOL. This is ideal if you’re a long-term holder. After all, if the value of the cryptocurrency increases, your returns will be amplified. This is because the principal investment and the staking rewards benefit from price increases.

Let’s look at an example of how staking rewards work:

- Let’s say you have 10 SOL.

- At the time of the deposit, 1 SOL = $200. This means your Solana investment is worth $2,000

- You choose a staking pool that pays an APY of 10%

- After one year, you’ve earned staking rewards of 1 SOL (10% of the 10 SOL deposit)

- You unstake your coins, so you now have 11 SOL

The price of SOL has since increased to $300

- So, your original 10 SOL was worth $2,000. It’s now worth $3,000

- The 1 SOL you earned from staking rewards is worth $300

- This means your SOL portfolio is now valued at $3,000

The best crypto staking platforms make daily distributions. This means you’ll receive staking rewards daily, which can then be reinvested into the same pool. In turn, the newly earned coins will also generate staking returns. This increases the APY, as you’re compounding your investments.

Crypto Mining vs Staking

Mining and staking are two different ways to earn income from crypto.

- Mining is associated with proof-of-work blockchains, which include Bitcoin.

- It requires specialist hardware devices (like ASICs) to verify transactions.

- The first miner to solve the cryptographic problem earns the block rewards.

- Then the process starts again.

- Mining helps keep the blockchain safe, but it’s energy-intensive.

- What’s more, mining isn’t completely passive like staking. Miners must take into account maintenance and constant monitoring.

In contrast, staking offers an energy-efficient way to verify blockchain transactions. It’s also fairer and more inclusive, as everyone has a chance to earn staking rewards. This is unlike mining, as only one person can solve a block.

On-Chain & Off-Chain Staking

I’ll now explain the difference between on-chain and off-chain staking.

- On-Chain Staking: On-chain staking removes the middleman; you’ll be engaging directly with the blockchain network. This means your staking coins are held by the blockchain, rather than a third party. This is the safest option, as you’re removing counterparty risks. However, on-chain staking often comes with high minimum and lower APYs.

- Off-Chain Staking: Off-chain staking is the most popular option for retail investors. It enables users to stake their coins through a third-party platform. This is usually a reputable exchange like Margex or MEXC. Off-chain staking comes with small minimums and higher APYs. However, you need to trust that the platform is keeping your coins safe.

The choice between on-chain and off-chain staking is a personal one. For instance, on-chain staking comes with greater responsibilities – as you often need to become a validator. If you suffer downtime, you could be penalized. This means losing your original staking deposit. Nevertheless, on-chain staking is still considered the most secure option

If you’re looking for a hassle-free way of staking coins, off-chain platforms might be the better option. You won’t need to become a validator or meet a high minimum deposit. And, you’ll benefit from more competitive yields. However, make sure you’re using a safe staking platform. And ensure your funds are diversified across several providers.

Benefits of Staking Crypto

Recently, crypto staking has emerged as one of the most popular ways to participate in network validation to earn passive rewards. With the crypto sector continuing to evolve, staking has witnessed a spike in adoption, with crypto enthusiasts taking full advantage of the perks that come with staking. I’ll now discuss the core benefits of staking cryptos.

Earn Passive Income

Staking enables investors to earn passive income. Similar to savings accounts, you’ll earn a percentage of your original deposit. Without a staking pool, your coins won’t earn anything. Therefore, it makes sense to generate additional yields, rather than leave the coins in a private wallet.

For example, suppose you own $10,000 worth of Bitcoin:

- We’ll say the price of Bitcoin doesn’t move after one year

- Had you kept the Bitcoin in a private wallet, it would still be worth $10,000

- Had you deposited the Bitcoin in a Margex staking pool, you’d have earned 3%. That’s an extra $300 worth of Bitcoin.

Just remember, you’ll still benefit from price increases when staking crypto. This enables you to generate returns on two fronts; price appreciation and passive staking rewards.

Flexible Terms are Available

Flexible staking terms are available if you know where to look. For example, with the exception of Toncoin, MEXC offers flexible withdrawals on all supported staking coins.

This includes everything from Bitcoin, Ethereum, and USDT to XRP, Gala, and dYdX. As such, investors can withdraw their coins at any time. This ensures that investors can access liquidity whenever they need it.

Create a Compounding Returns

Staking enables you to create compounding returns – especially when distributions are made daily. This involves reinvesting your rewards back into the same staking pool. This means you’re earning ‘interest on the interest’.

For example:

- Suppose you’ve deposited 100 AVAX into a staking pool

- The staking pool pays 20%

- After one year, you’ve earned staking rewards of 20 AVAX, which you reinvest

- This means you’ve now got 120 AVAX

- You earn another 20% in year two

- This time, you’ve earned staking rewards of 24 AVAX

- This is because the 20% rewards are based on 120 AVAX, not the original 100 AVAX

Repeating this process over time can generate significant returns. This is the same as reinvesting stock and ETF dividends.

How to Stake Cryptocurrency

If you’re new to cryptocurrency staking, here’s a quick overview of the process:

- Step 1: Choose a Staking Platform – The first step is to choose a crypto staking platform. It should support your preferred coins, pay competitive APYs, and offer suitable withdrawal terms.

- Step 2: Deposit Staking Coins – You’ll need to deposit coins before you can begin staking. The staking platform will provide you with a unique wallet address. Copy it and transfer the coins from a private wallet. If you don’t own any staking coins, you can buy some from Margex or MEXC with a debit/credit card.

- Step 3: Choose Staking Pool – Next, choose the best staking pool for your requirements. Some platforms offer multiple lock-up terms. Make sure the terms align with your investing goals.

- Step 4: Receive Staking Rewards – Once your coins have been added to the staking pool, there’s nothing else to do. The platform will distribute the staking rewards to your account. This could be daily, bi-weekly, weekly, or monthly depending on the platform.

- Step 5: Withdraw Staking Coins – The final step is to withdraw your staking coins. You can do this at any time if you’re using a flexible staking pool. If not, you’ll need to wait for the respective staking term to pass.

To reduce the counterparty risk, consider joining several staking platforms. You can split the staking coins accordingly. For example, suppose you’ve got 10 ETH to stake. Consider depositing 2.5 ETH on four different staking sites.

Crypto Staking Taxes

In most countries, including the US, staking is a taxable event. It’s treated the same as other income sources, such as salaries. This means the staking rewards will be added to your total income for the year.

For example:

- Salary: $50,000

- Staking Rewards: $5,000

- Total Taxable Income: $55,000

Now for the challenging part; you’ll need to report the value of the staking rewards based on when they were received. So, if you’re receiving daily payouts, that’s up to 365 different valuations after one year.

Crypto prices change every second and can witness enhanced volatility. I’d suggest using crypto tax software if you’re a long-term staker. It will automatically assign a cost basis for each staking distribution.

Is Staking Crypto Safe?

Crypto staking isn’t a risk-free income source. Far from it.

- Counterparty Risks: If you’re opting for off-chain staking, counterparty risks are your biggest concern. If the crypto exchange becomes insolvent, you could lose your entire staking balance. This is why I suggested using multiple staking platforms to diversify the risk.

- On-Chain Risks: On-chain staking isn’t risk-free either. For instance, on-chain validators can lose their staking deposit if they’re considered unreliable. This could simply be because the validator experienced downtime.

- Liquidity Risks: You’ll also need to consider liquidity risks. For example, when searching for the highest APY crypto staking site, you might find that minimum lock-up terms are required. No matter the circumstances, you won’t be able to withdraw the coins until the lock-up period has passed.

Ultimately, all investments carry risk, so make sure you’re well-informed before staking.

Conclusion

In summary, staking is ideal for long-term crypto investors who want to generate passive returns on their holdings. My overall top pick is Margex, which offers competitive yields on Bitcoin, Ethereum, Tether, USD Coin, and Chainlink.

Unlike other platforms, Margex enables you to trade with the coins you stake. This means you have access to instant liquidity.

FAQs

What is Crypto Staking?

Is Crypto Staking Worth It?

What is the Best Crypto Staking Platform?

How Can I Stake Cryptocurrency?

Can You Get Rich from Staking Crypto?

What is the Best Crypto for Staking?

References

- Explainer: What is ‘staking,’ the cryptocurrency practice in regulators’ crosshairs? (Reuters)

- Earn rewards while securing Ethereum (Ethereum Foundation)

- What investors need to know about ‘staking,’ the passive income opportunity at the center of crypto’s latest regulation scare (CNBC)

- IRS clarifies when cryptocurrency ‘staking’ rewards are included in taxable income (BDO)