The best crypto leverage trading platforms offer secure, reputable, and trustworthy exchanges for traders looking to trade crypto with leverage.

In this guide, I rank and review the 10 best crypto leverage trading platforms for 2024.

Discover which exchanges offer the highest leverage limits with the most competitive fees. I also compare platforms based on supported markets, user-friendliness, safety, and trading tools.

Top Crypto Leverage Trading Platforms Ranked

The best platforms offering crypto leverage trading are listed below:

- Margex – The overall best platform for crypto trading with leverage

- MEXC – Top-rated crypto exchange offering 200x leverage limits

- OKX – Great option for trading leveraged crypto options

- Gate.io – No KYC exchange offering weekly and quarterly delivery futures

- KuCoin – Track leveraged tokens without liquidation risks

- Binance – Leverage trade crypto futures via automated bots

- Kraken – Professional-grade trading dashboard with 50x leverage

- Coinbase – Best platform for leverage trading in the USA

- dYdX – Decentralized trading site offering 20x buying power

- CoinUnited – 2,000x leverage limits on almost 280 crypto markets

Reviewing the Best Crypto Leverage Trading Platforms

Learn more about the leverage trading crypto platforms listed above. I go into a lot more detail, covering maximum leverage limits, available pairs, fees, and more.

1. Margex – The Overall Best Platform for Crypto Trading With Leverage

Margex is the best option when trading crypto with leverage. It specializes in perpetual futures, which are crypto derivatives. Perpetuals never expire, making them more user-friendly to trade. Margex supports some of the best cryptocurrencies to buy, including large caps like Bitcoin, Ethereum, and BNB. These cryptocurrencies can be traded with 100x leverage.

More than a dozen other altcoins can be traded with 50x leverage, including Cosmos, Uniswap, Solana, Cardano, EOS, and Litecoin. Some markets, including Aave, Ethereum Classic, and Filecoin, offer leverage of up to 25x. All leveraged markets can be traded with commissions of 0.06% per slide. This makes Margex one of the best Bitcoin exchanges for low fees.

In addition, you’ll also need to cover funding fees. These are charged every eight hours and will vary depending on the pair. You can easily view funding fees within your account dashboard. According to our Margex review, the platform doesn’t require you to complete a KYC process, so you can deposit and withdraw crypto anonymously. While Margex is a global trading platform, clients from the US are not eligible.

| Trading Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| Margex | 100x | 0.06% | Perpetual futures |

Pros

- The best place to trade Bitcoin with leverage

- Maximum leverage limit of 100x

- Supports perpetual futures

- Low trading commissions of 0.06%

- Also one of the best no KYC crypto exchanges

Cons

- US traders are prohibited from joining

- Some markets are limited to 25x leverage

Be sure to check out our full Margex Review for more info on this top-rated crypto exchange.

2. MEXC – Top-Rated Crypto Exchange Offering 200x Leverage Limits

MEXC is a popular crypto exchange that offers low fees on thousands of trading pairs. It provides high leverage limits on perpetual futures markets. Contracts can be settled in USDT or the underlying crypto. 200x leverage is offered on large-cap cryptocurrencies like Bitcoin, Solana, Ethereum, and Dogecoin.

This amounts to $200,000 worth of trading capital for every $1,000 risked. Some markets come with lower leverage limits. For example, MEXC offers leverage of 125x on Bonk, and 50x on dogwifhat. In terms of fees, perpetual futures can be traded at 0.02%. Those holding MEXC’s native tokens, MX, will enjoy a 50% discount.

Leverage also invites funding fees, which are charged every eight hours. MEXC offers an advanced trading dashboard that comes with in-depth order books and technical indicators. It also offers a native mobile app for Android and iOS. There are no KYC requirements but withdrawal limits will apply.

| Trading Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| MEXC | 200x | 0.02% | Perpetual futures |

Pros

- One of the largest selections of leveraged markets

- Trade with leverage of up to 200x

- Competitive futures commissions of 0.02%

- Contracts can be settled in USDT or the underlying crypto

- Offers advanced charting and analysis tools

Cons

- Doesn’t support fiat money withdrawals

- Unable to accept clients from some countries – including the US

3. OKX – Great Option for Trading Leveraged Crypto Options

OKX is one of the best crypto leverage platforms for trading options. It supports two options markets; BTC/USD and ETH/USD. OKX offers an advanced options chain that enables you to make smart trading decisions. This includes the delta, gamma, vega, and theta for multiple strike prices. Multiple expiry dates are supported too, ensuring complete flexibility.

OKX offers European-style options, meaning you can dip in and out of the market freely. Another option at OKX is to trade futures. It supports perpetual swaps and delivery futures on many cryptocurrencies, including Dogecoin, Toncoin, XRP, and Solana. The maximum leverage limit is 100x. Lower limits may be offered on small-cap markets.

I found that OKX fees are competitive. Options can be traded from 0.03%. Futures come with a 0.05% commission. Funding fees will also apply. OKX is also a great option for accessing Web 3 products. It offers a decentralized exchange and wallet that supports DeFi yields. OKX is also popular for its spot trading markets.

| Trading Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| OKX | 100x | 0.03% (options), 0.05% (futures) | Options, perpetual futures, delivery futures, leveraged tokens |

Pros

- Best crypto leverage trading platform for options

- Offers a full options chain for Bitcoin and Ethereum

- Also supports perpetual and delivery futures

- Competitive trading commissions

- Maximum leverage of 100x

Cons

- Some markets come with much smaller leverage limits

- Isn’t US-friendly

4. Gate.io – No KYC Exchange Offering Weekly and Quarterly Delivery Futures

Gate.io is a high-volume crypto exchange that was launched in 2013. It offers many derivative-style products that come with high leverage limits. This includes delivery futures with weekly and quarterly settlement dates. These are settled in USDT and are ideal for hedging and arbitrage trading. Alternatively, Gate.io also offers perpetual swaps.

This covers some of the best altcoins, such as Ethereum, Cosmos, XRP, and Litecoin. Gate.io is also a great option for trading crypto options. A huge range of strike prices and expiry dates are supported. In terms of limits, the maximum leverage at Gate.io is 100x. Like other platforms, limits are reduced when trading small-cap markets.

Gate.io uses a progressive fee structure that rewards high trading volumes. For example, futures can be traded at 0.05%. But this is reduced to 0.048% when trading at least $60,000 within a 30-day period. Gate.io offers anonymous accounts with daily withdrawal limits of 100,000 USDT. This means you can access leverage without completing KYC.

| Trading Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| Gate.io | 100x | 0.05% (futures), see options fee below* | Options, perpetual futures, delivery futures |

*Options fee formula: MIN (Trading Fee Rate x Underlying Price, 0.1 x Order Price) x ABS (Order Amount) x Contract Multiplier

Pros

- Access crypto leverage anonymously

- Withdraw up to 100,000 USDT daily without KYC

- Choose from perpetual and delivery futures

- Also offers in-depth options chains

- Maximum leverage of 100x

Cons

- Complicated options trading fees

- Not available in most European countries

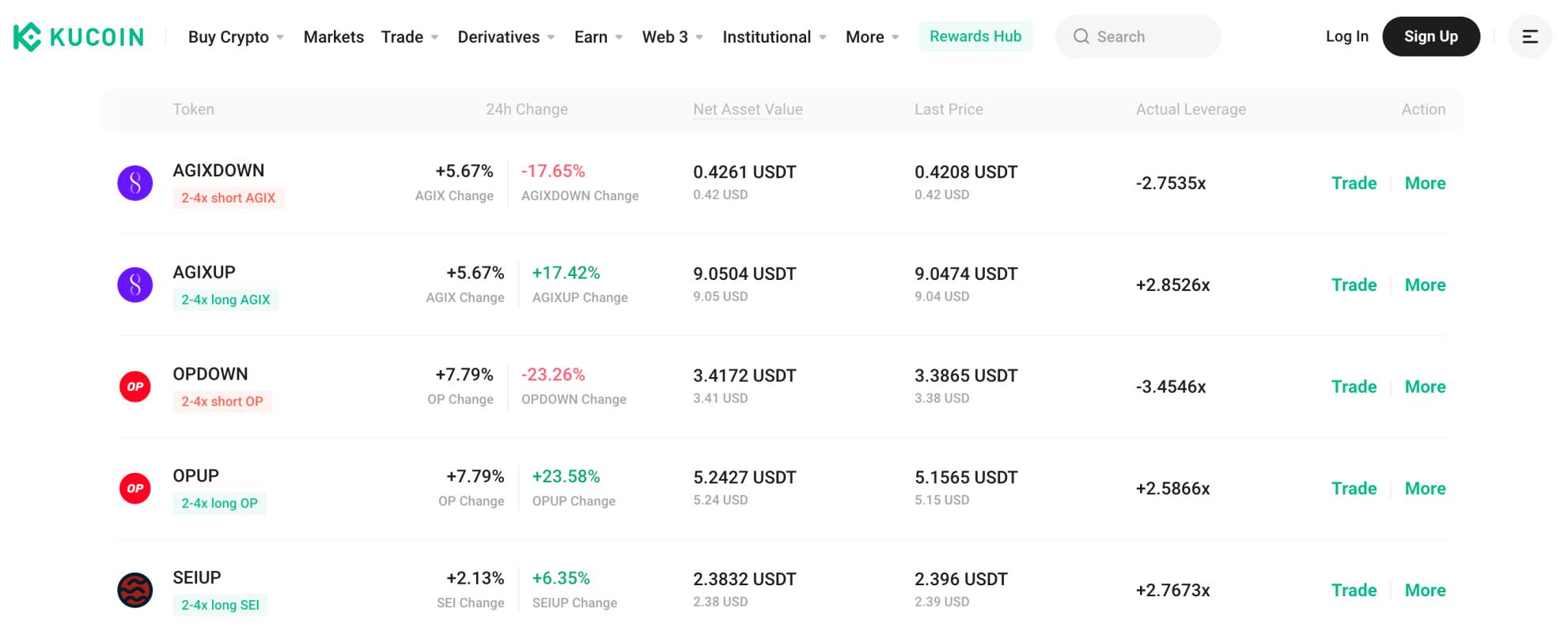

5. KuCoin – Track Leveraged Tokens Without Liquidation Risks

KuCoin is a tier-one exchange with over 30 million clients from more than 200 countries. It’s one of the best crypto leverage trading platforms for avoiding liquidity risks. This is because KuCion offers tracked leveraged tokens. This means your profit and losses will be amplified by the chosen leverage limit.

The maximum leverage permitted is 3x the stake. For instance, suppose you opt for the ADA3L market. This means you’re long on Cardano with a 3x multiple. So, let’s say Cardano increases by 30%. At 3x, your gains would amount to 90%. Conversely, if Cardano dropped by 20%, you’d be looking at losses of 60%.

Crucially, without liquidation risks, your position won’t be closed automatically. KuCoin also offers other leveraged products. This includes perpetual futures settled in USDT or the underlying crypto. Trading with leverage costs 0.06% of the position size. Leveraged tokens commissions are 0.1% per slide. You’ll also pay subscription and redemption fees of 0.1%.

| Trading Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| KuCoin | 100x | 0.1% per slide, plus 0.1% for subscription and redemption (leveraged tokens), 0.06% (futures) | Leveraged tokens, perpetual futures |

Pros

- Offers crypto leverage without liquidation risks

- Covers a wide range of leveraged markets

- Also offers perpetual futures with 100x leverage

- Contracts can be settled in USDT or the underlying crypto

- Used by more than 30 million clients globally

Cons

- Doesn’t offer delivery futures

- Leveraged tokens are capped at 3x

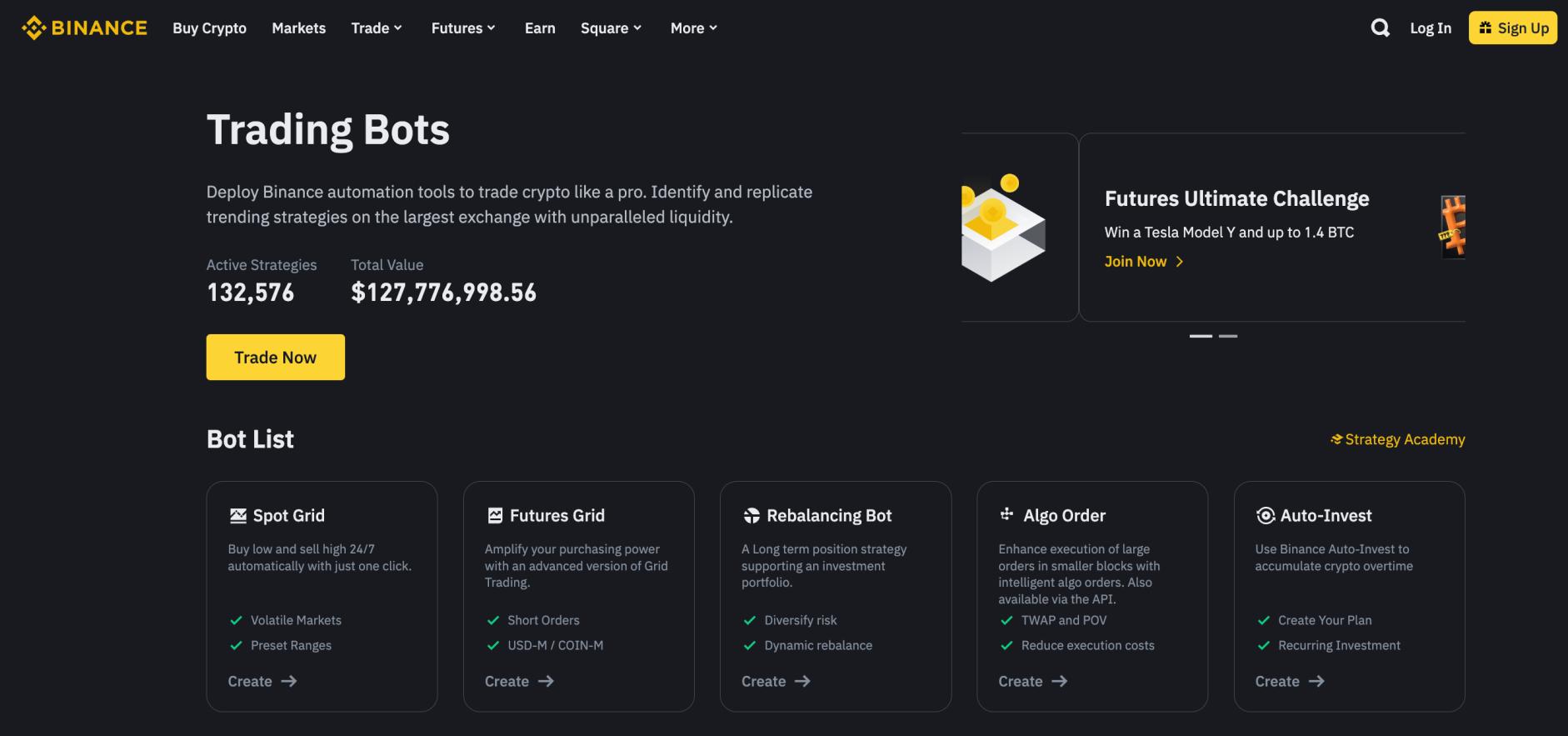

6. Binance – Leverage Trade Crypto Futures via Automated Bots

Binance is the largest leveraged trading platform globally. It processed more than $70 billion worth of leveraged trades in the past 24 hours. Traders not only benefit from huge liquidity levels but also competitive fees. What’s more, Binance enables users to trade leveraged markets passively. It offers thousands of automated bots that specialize in perpetual futures.

This means the trading bot will buy and sell futures contracts on your behalf. You can set your risk parameters, such as the maximum leverage limit. Binance offers up to 125x on BTC/USD, and less on other markets. You can filter bots by the return on investment, minimum run time, preferred trading pair, and other metrics.

Some bots come with a minimum investment of under $10. This means you can easily diversify without risking too much. Alternatively, Binance also supports leveraged options, which must be traded manually. Supported options markets include Bitcoin, Ethereum, BNB, Dogecoin, and XRP.

| Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| Binance | 125x | 0.03% (options), 0.05% (futures) | Options, perpetual futures, leveraged tokens |

Pros

- The largest derivatives platform by trading volume

- Used by over 186 million traders

- Auto trade leveraged futures via bots

- Maximum leverage limits of 125x

- Also offers options trading on five pairs

Cons

- Increased geo-blocking restrictions on leveraged markets

- Some nationalities are unable to deposit fiat money

7. Kraken – Professional-Grade Trading Dashboard With 50x Leverage

Kraken is a top-rated crypto trading platform that’s ideal for professional traders. The Kraken Pro dashboard comes packed with charting and analysis features. Not only is the charting layout customizable but you can deploy drawing tools and technical indicators. You can also view the Kraken order book in real-time.

Kraken also offers premium trading volumes and liquidity – especially on major markets like BTC/USD and ETH/USD. Leverage can be accessed in two ways. First, there are leveraged tokens that track real-time prices. These come without liquidation risks, but the maximum leverage is 5x.

The second option is to trade perpetual futures. You’ll have 95 futures markets to choose from, including meme coins like Dogecoin and Shiba Inu. Kraken futures come with much higher leverage limits of 50x. Kraken charges 0.02% on leveraged tokens, plus rollover fees of 0.02% every four hours. Futures can be traded at 0.05% of the position size.

| Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| Kraken | 50x | 0.02%, plus 0.02% every four hours (leveraged tokens), 0.05% (futures) | Leveraged tokens, perpetual futures |

Pros

- A safe crypto exchange that was launched in 2013

- Trade tokens with 5x leverage

- Perpetual futures come with leverage of 50x

- Professional-grade dashboard for experienced traders

- One of the best places to buy Bitcoin with fiat money

Cons

- 0.02% rollover fee every four hours on leveraged tokens

- US traders can only access the spot trading markets

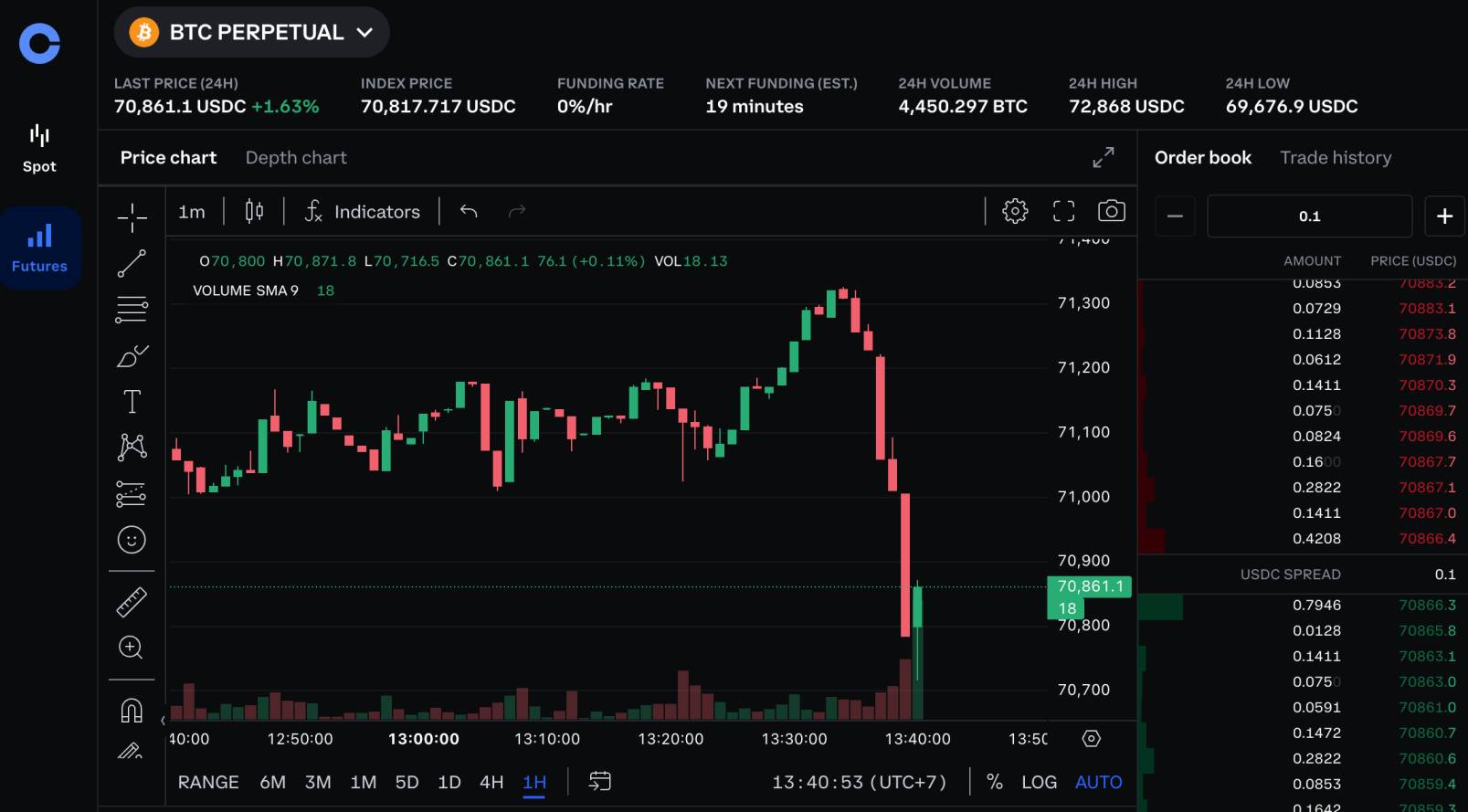

8. Coinbase – Best platform for Crypto Leverage Trading in the USA

Coinbase is the best crypto leverage trading platform for US clients. It offers perpetual futures via the Coinbase Advanced dashboard. The platform has approval from US regulators, ensuring a safe and credible trading experience. Futures contracts come in two forms. First, there are delivery futures, which are nano-sized.

This means you’ll be trading 1/100th of a Bitcoin or 1/10th of an Ethereum. These futures come with a settlement date. The second option is to trade perpetual futures. You’ll have access to additional markets, including Litecoin, XRP, Avalanche, and Solana. Both futures products can be traded with high-level tools, including custom charts and technical indicators.

However, do note that Coinbase futures come with leverage limits of 10x. This is much smaller than other platforms. Another drawback is fees. Like many Coinbase products, fees are not clearly displayed. It notes that futures trading fees are updated hourly based on account volumes. Therefore, you should assess fees before placing any orders.

| Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| Coinbase | 10x | Not published; displayed within the user’s account and updated hourly based on trading volumes | Delivery futures, perpetual futures |

Pros

- The best option for US clients seeking leverage

- Trade delivery and perpetual futures

- Backed by a regulated and safe crypto exchange

- Fast onboarding process

- Easily deposit funds with ACH, debit/credit cards, or PayPal

Cons

- Maximum leverage limit of 10x

- Doesn’t publish futures fees for US traders

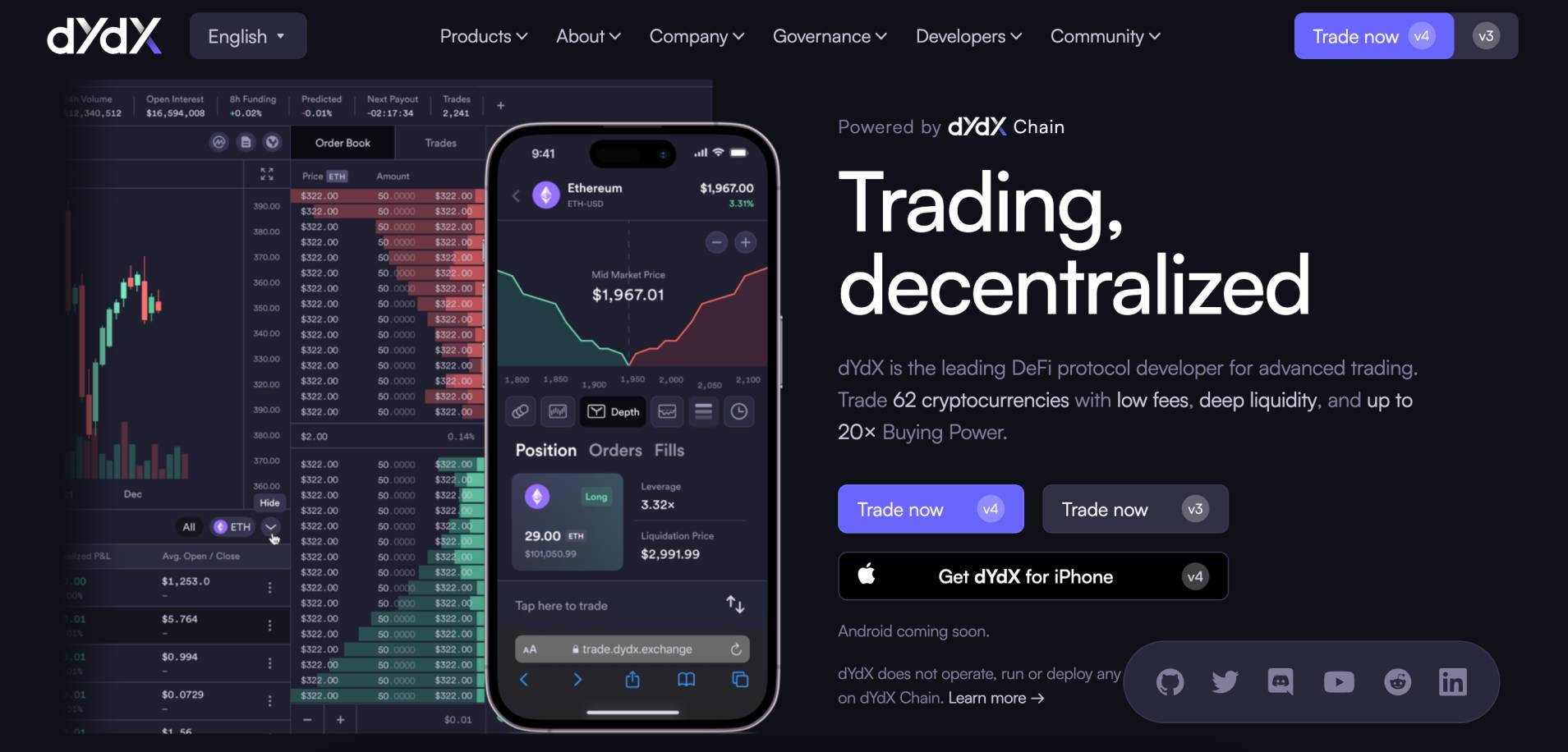

9. dYdX – Decentralized Trading Site With 62 Leveraged Products

dYdX is the only option on this list that offers decentralized trading. Built on the Ethereum network, dYdX enables clients to trade leveraged products without revealing their identity. Traders don’t need to open an account – just connect a wallet that holds a supported crypto. What’s more, dYdX offers self-custody storage.

This means your digital assets aren’t susceptible to counterparty risks. Buy and sell orders are facilitated by smart contracts, ensuring safety and transparency. In terms of markets, dYdX supports 62 cryptocurrencies. This includes everything from Bitcoin, Polkadot, and Shiba Inu to Arbitrum, Maker, and Bonk.

Large-cap markets offer leverage of up to 20x. All leveraged products are backed by perpetual futures, so long and short trading is supported. dYdX charges trading commissions of 0.05%. This aligns with the industry average. While lower fees are available when meeting trade minimums, this only starts at 30-day volumes of $1 million.

| Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| dYdX | 20x | 0.05% | Perpetual futures |

Pros

- The best decentralized exchange with leveraged products

- No account or KYC requirements

- Supports 62 cryptocurrencies

- Go long or short via perpetual futures

- Transactions are facilitated via smart contracts

Cons

- Maximum leverage of 20x

- You’ll need a funded crypto wallet

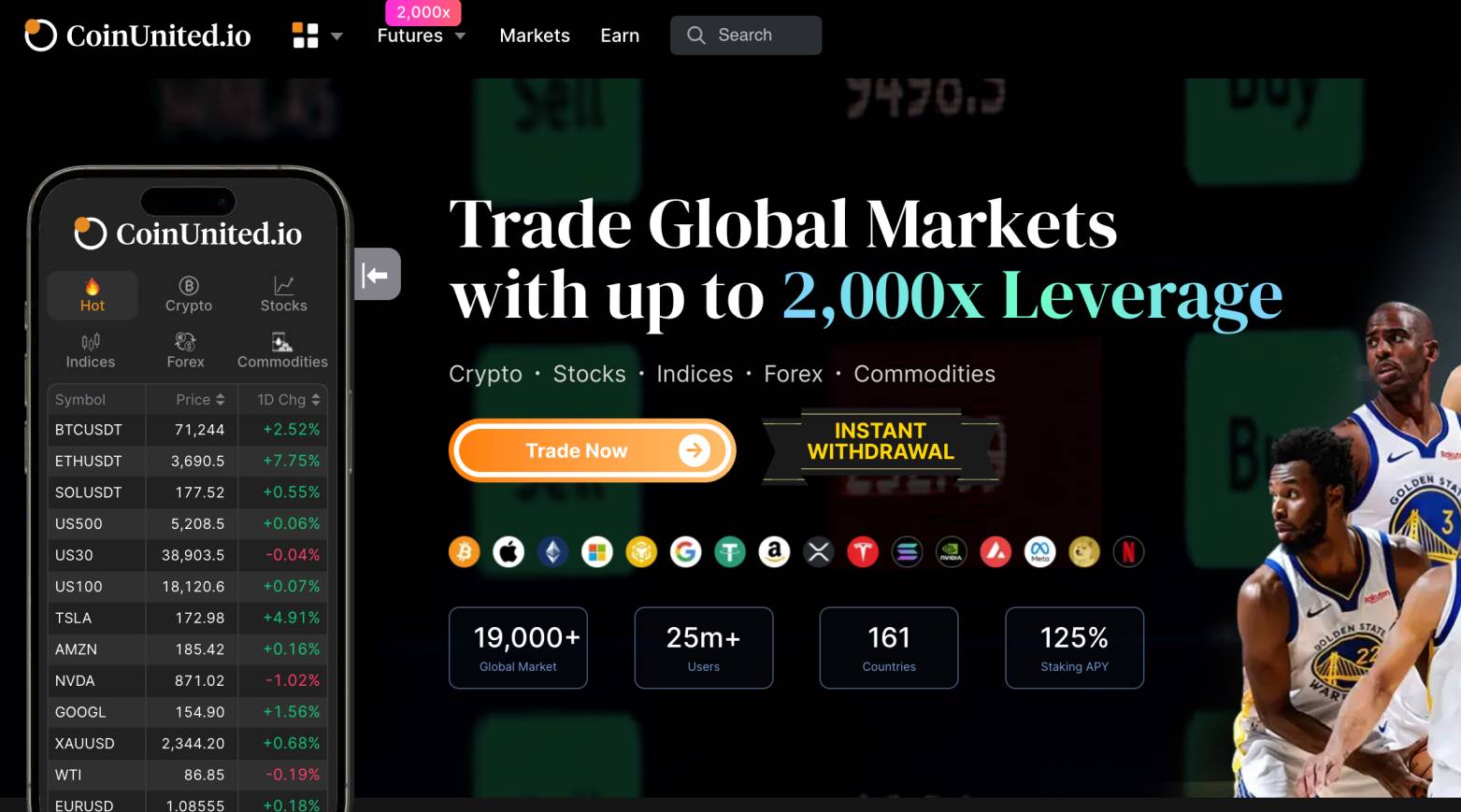

10. CoinUnited – 2,000x leverage limits on almost 280 crypto markets

CoinUnited offers the highest leverage limits in the crypto market. At 2,000x, a $1,000 margin position can be amplified to $2 million. Not only does CoinUnited offer 2,000x leverage on Bitcoin but almost 280 altcoins. This includes everything from Pepe, Shiba Inu, and Chainlink to Cardano, Toncoin, and XRP.

Leveraged products are traded via perpetual futures. While the CoinUnited dashboard is somewhat basic, it covers the most important analysis features. This includes an order book with bid and ask prices, drawing tools, and technical indicators. In addition to crypto, CoinUnited also supports other financial markets.

This includes commodities, currencies, indices, and stocks. More than 25 million traders use the CoinUnited platform. Over 160 countries are supported. Another benefit is that CoinUnited offers instant withdrawals and customer support is available 24/7. However, CoinUnited isn’t licensed by any reputable bodies, so proceed with caution.

| Platform | Max Leverage | Standard Commissions | Leveraged Markets |

| CoinUnited | 2,000x | 0.04% | Perpetual futures |

Pros

- Trade crypto with leverage of up to 2,000x

- Supports almost 280 crypto markets

- Also lists commodities, currencies, indices, and stocks

- Withdrawals are processed instantly

- Used by over 25 million clients globally

Cons

- Isn’t licensed by any reputable regulators

- The trading dashboard looks outdated

What is Crypto Leverage Trading?

In simple terms, leverage amplifies a trading position by a certain multiple. This means you can trade with more than you deposited in a crypto exchange. For example, suppose you have an account balance of $500. Applying leverage of 20x would boost that $500 by 20 times. As such, you can enter a trading position worth $10,000.

Leverage is supplied by the platform, meaning you’re borrowing funds. Interest is charged when trading crypto with leverage, which is based on the total value of the position. This means leverage trading is only suitable for short-term speculation. Most crypto leverage products are traded via derivatives.

This means you don’t own the underlying coins or tokens. Perpetual futures are the most commonly traded product. These are futures contracts without an expiry date. Some platforms also offer delivery futures, which often come with weekly or quarterly settlement times. Options are another way to trade with leverage.

It’s important to know that leverage is a high-risk strategy. What’s more, the risks increase in line with the leverage multiple. This is because of liquidation, which closes a trade when it declines by a predetermined percentage. Liquidation results in the original margin being lost. This means you can lose your entire trading bankroll in one trade.

How Does Leverage Trading Crypto Work?

Leverage crypto trading is best left for experienced traders who can effectively manage risk. While leveraged positions can amplify profits significantly, the same goes for losses.

With this in mind, I’ll now explain how crypto leverage works in a lot more detail. This will help you evaluate whether leverage is right for your risk appetite.

Choosing Leverage Level (2x to 100x+)

The first step is assessing how much leverage you want to apply. Maximum limits are determined by two factors; the trading platform and the crypto pair. Most platforms offer the highest limits on large-cap pairs like BTC/USD and ETH/USD. For instance, you’ll get up to 100x and 200x at Margex and MEXC, respectively.

In contrast, dYdX and Coinbase cap leverage limits to 10x and 20x. Trading smaller-cap markets will also mean lower leverage. For example, MEXC reduces the maximum leverage to 125x when trading Bonk. And 50x when trading dogwifhat. Your chosen leverage limit will be multiplied by the ‘margin’ stake.

In simple terms, the margin is the collateral you put up to execute a leveraged position. So, suppose you’re looking to risk $1,000. Using leverage of 100x would increase the position from $1,000 to $100,000. However, you could lose your entire $1,000 margin, so think carefully when evaluating stakes. What’s more, higher margin levels increase funding fees.

If your trade is profitable, the percentage gain is multiplied by the total position size, not the margin. For instance, suppose your margin is $500 and you apply 200x leverage. The total position size is $100,000. You go long on BTC/USD, which increases by 10%. This means you’ve made 10% of $100,000 – so your profit is $10,000.

Placing Your Order

It’s important to place orders correctly when trading crypto with leverage.

Here’s what information you’d need to provide to the exchange:

- Long/Short: Leverage is traded via derivatives, meaning you can go long or short. Choose a buy order if you believe the pair will increase. Or a sell order if you think the pair will decline in value.

- Market/Limit: You can execute a trade instantly by selecting a market order. This is fine when trading large-cap pairs. However, limit orders are more suitable when trading smaller-cap markets. This enables you to specify the order execution price.

- Trade Quantity: The trade quantity also needs to be stated when completing an order. Most leveraged products are quoted in USDT. Just remember, this is the margin that you’re willing to risk.

- Leverage Multiple: The leverage multiple also needs to be stated. Most exchanges offer a slider button. Move the slider to the required multiple, such as 5x or 10x.

These are the fundamental requirements when placing a leveraged order. However, I strongly advise traders to also set up risk management positions. This will limit potential losses and lock in profits.

- Stop-Loss: Choose the trading price that you want the position to close automatically. For instance, suppose you’re entering a long trade at $100 per token. If you want to limit losses to 10%, set the stop-loss order at $90. Make sure the stop-loss level is above the liquidation price. More on this shortly.

- Take-Profit: Enter the take-profit price, which will close the leveraged position once triggered. For example, suppose you want to make 30% gains. Based on a $100 entry price, set the take-profit level at $130.

Finally, check everything is correct before placing the order. You won’t need to watch over the markets manually. This is because you’ve installed a stop-loss and take-profit order. The position will be closed automatically when one of these price levels is triggered. That said, you always have the option of closing a trade manually.

Interest and Fees

There are two fee categories to look for when crypto leverage trading. First, there are standard commissions, which you pay to enter and exit the market.

Here’s an example:

- Margex charges 0.06% per slide. This is based on the total position size.

- Your margin is $100 and you apply leverage of 100x. This means your total position is $10,000.

- You pay $6 (0.06% of $10,000) to enter the market.

- A few hours later, your leveraged position has increased to $15,000.

- You close the position and pay a commission of $9 (0.06% of $15,000).

On most platforms, commissions will vary depending on the tradable product. For example, Gate.io charges 0.05% to trade perpetual and delivery futures. Options commissions are slightly lower at 0.03%.

The second fee is related to interest. This is because you’re borrowing funds from the exchange, which invites fees. However, there are some considerations to make.

For a start, funding time frames vary depending on the exchange. For example, Margex charges funding fees every eight hours. On Kraken, it’s reduced to four-hour cycles. Some platforms operate on 24-hour time frames.

In addition, funding rates are percentage-based. This means the more leverage applied, the more you pay.

Here’s a simplistic example:

- A leverage trading platform charges 1% every 24 hours

- Your margin is $100 and you apply leverage of 50x. The total position is $5,000, so you pay $50 interest every 24 hours.

- Now suppose you increase the leverage multiple to 200x. Your total position size is now $20,000. This means your daily interest rate has increased to $200.

Importantly, interest fees are deducted from the margin collateral. If the margin gets too close to the liquidation point, the trade can be closed automatically.

Liquidation

Liquidation is the most important metric to understand when exploring crypto leverage trading. I’ve briefly mentioned how it works, but I’ll now go into a lot more detail.

If your leveraged position is liquidated, it’s automatically closed by the exchange. This means that your original margin collateral is lost. The crucial part is knowing when a trade will be liquidated. The exact formula will vary depending on the exchange.

However, the simple rule of thumb is:

- Liquidation occurs when the value of your position declines by the same percentage as the margin collateral.

For instance:

- Suppose you want to risk $1,000. This is your margin collateral.

- You apply leverage of 25x, which amplifies the $1,000 margin to $25,000 in trading capital.

- Put otherwise, your margin percentage is 4%.

- Let’s say you’re long on ETH/USD. If ETH/USD declines by 4%, your trade will be liquidated.

- In this example, liquidation means you’ve lost your $1,000 margin.

Some additional points to note.

First, the real liquidation point will be more than the margin percentage. This is because you also need to factor in interest fees. As mentioned, fees will be deducted from the margin collateral. This increases the risk of being liquidated. What’s more, most exchanges will send you a ‘margin call’ when you’re approaching liquidation.

This isn’t an actual phone call. Instead, you’ll likely receive an email and see a notification on the trading chart. The margin call allows you to add more collateral to the margin balance. This means the liquidation point moves further away. However, you’re also increasing your losses if prices continue to go against you.

Crypto Leverage vs Margin Trading

Leverage and margin trading both involve amplifying position sizes. The two terms are often used interchangeably – especially in the crypto space. However, each refers to a different part of the trading mechanism.

For example, leverage is the trading multiple. Leverage of 50x means you’re boosting a trading position by 50 times. Margin is the initial collateral that you put up to execute the leveraged trade.

Let’s clear the mist with an example:

- Your account balance is $200. You want to risk the entire balance on a leveraged trade. This means your margin collateral is $200.

- You choose a leverage multiple of 20x. This increases the $200 margin to $4,000 in trading capital.

- As such, you are trading with a margin percentage of 5%.

Leveraged Tokens

In addition, you’ll also come across ‘leveraged tokens’ at some exchanges. This enables you to increase your exposure without liquidation risks. This is because leveraged tokens don’t require loans.

- Let’s take the ‘SOL3L’ market on KuCoin as an example.

- This enables you to go long on Solana with 3x leverage

- So, for every 1% that Solana increases, you’d make 3% gains

- Conversely, you’d lose 3% for every 1% that Solana declines

Although liquidation and margin calls aren’t possible, your trade can still go to zero. For instance, suppose Solana declines by 33.3%. That’s a decline of almost 100% when factoring in the 3x multiplier.

Is Trading Crypto with Leverage Safe? Potential Risks

In general, trading crypto with leverage is safe. At least in practical terms. However, several risks must be considered before proceeding.

For instance, leverage amplifies gains and losses. Liquidation can result in the entire margin collateral being lost. Counterparty risks linked to exchanges should also be considered. Not to mention the emotional stress of losing money.

Let’s explore the risks of crypto leverage trading in more detail.

1) Magnified Losses

Unsuccessful leverage trades will amplify losses.

- For example, consider a standard $1,000 trade without leverage. The trade declines by 20%, so your $1,000 is now worth just $800. This means you’ve lost $200.

- Now consider the same trade but with 2x leverage. Your $200 loss is increased by 2, so that’s $400. Therefore, your $1,000 position is now worth just $600.

- If leverage was increased to 3x, the loss would stand at $600.

These amplified losses continue until you’re liquidated.

2) Margin Call Risk

The margin call occurs when you’re approaching liquidation. It’s essentially a final warning; you’ll either need to add more funds to your margin balance or risk being liquidated.

There is no obligation to meet a margin call. After all, adding more funds means you’re risking more money. If liquidation is inevitable, you’ll also lose the additional margin added.

3) Liquidation Risk

If the leveraged trade continues to decline in value, it will be liquidated. This means the trade is closed by the exchange. The exchange keeps the margin collateral, meaning you’ve lost 100% of the stake.

4) Counterparty Risk

Investors should also consider counterparty risks when trading with leverage. This is because leverage is offered by exchanges, which are third-party platforms. As such, you need to trust that your trading balance is safe. You also need to trust that the leveraged markets offered are fair and legitimate.

- The risk here is that the exchange trades against you.

- Meaning – it liquidates a position fraudulently.

- For instance, the exchange might claim that there was a flash crash, which results in a sudden price capitulation.

- This means your trading order is liquidated on the way down, before the price miraculously recovers.

This is why choosing the right leveraged trading platform is so important. Stick with reputable providers like Margex, MEXC, and OKX.

5) Emotional Stress

Trading crypto with leverage can be emotionally stressful. Crypto prices are volatile without leverage, so rapid price movements will be enhanced. For example, consider a crypto token that declines by 10%. With 5x leverage, your losses have been amplified to 50%.

In addition, being liquidated can result in significant losses. This can lead to psychological risks, such as depression and anxiety. Ultimately, emotional investors will always lose money. You can reduce these risks by following best practices, such as bankroll management and deploying stop-loss orders.

Conclusion – The Best Leverage Trading Platform for Crypto

In summary, I’ve revealed the best platforms to trade crypto with leverage. Overall, Margex stands out as it offers leverage of up to 100x, low trading commissions, and a safe experience.

Ensure you’ve considered the risks before proceeding. Leverage will amplify both profits and losses.

See also: 10 Best Automated Crypto Trading Platforms for 2024

FAQs

What is leverage trading in crypto?

Which exchanges have leverage trading?

What is the best crypto leverage trading platform?

Where can I get 100x leverage for crypto?

Is crypto leverage trading legal in the US?

Does Binance US offer leverage trading?

Is crypto leverage trading risky?

References

“Bitcoin Extends Downtrend, Falls 12% to $47,176.” Reuters, 4 Dec. 2021, www.reuters.com/technology/bitcoin-extends-downtrend-falls-121-47176-2021-12-04/.

“Basics of Buying on Margin: What’s Margin Trading?” Charles Schwab, www.schwab.com/learn/story/basics-buying-on-margin-whats-margin-trading.

“Flash Crashes.” CFA https://rpc.cfainstitute.org/en/policy/positions/flash-crashesFlash Crashes (cfainstitute.org)

“Bitcoin Shows Its Volatility Once Again, Tumbling Back to $67,000 in Overnight Decline.” CNBC, 15 Mar. 2024, www.cnbc.com/2024/03/15/bitcoin-shows-its-volatility-once-again-tumbling-back-to-67000-in-overnight-decline.html.