Mango Markets, once a market-leading decentralised exchange and DeFi platform on Solana, is preparing a settlement with the US Securities And Exchange Commission (SEC).

The SEC has been pursuing Mango Markets over allegations of securities law violations.

Mango Markets – Latest Crypto Firm SEC Has In Sights

In response to SEC, the protocol’s governing body, Mango DAO, initiated a vote regarding a settlement proposal with the SEC. The proposed settlement would involve paying fines and winding down operations of its MNGO token.

Mango Markets has a rocky history. Most notably when it suffered a $110 million exploit by Avraham Eisenberg in October 2022. That 9-figure loss had an irreparable impact on the project. Although Eisenberg was charged with fraud and market manipulation in December of the same year, the damage had been done.

Mango DAO Proposal Seeks A 6-Figure Settlement

Mango Markets 100% votes to bow the SEC (2 days to go) and cease all activitieshttps://t.co/Gnin9eOJcV pic.twitter.com/svr3xnttta

— Mikko Ohtamaa (@moo9000) August 20, 2024

The Mango Markets DAO proposal is as follows, “There have been investigations by US regulators (DOJ, SEC, and CFTC) against Eisenberg for his role in the exploit. In addition to those actions, some regulators have made their own inquiries into Mango Markets. The payment of a civil penalty in the amount of $223,228, to be paid from the DAO Treasury to the SEC and permanently enjoin the DAO from violating Sections 5(a) and 5(c) of the Securities Act of 1933.”

If accepted, the settlement would require Mango DAO to; “Immediately cease all of its offers, sales or resales of MNGO tokens on the protocol through the means or instrumentalities of interstate commerce in the United States; destroy or otherwise make unavailable for trading, selling, offering, or purchasing any and all MNGO tokens in the DAO’s possession or control within 10 days of the entry of the Final Judgment.”

RELATED: Crypto’s Worst Nightmare: Anti-Crypto Gary Gensler Tipped for Harris Treasury Secretary

The SEC alleges that the DAO violated Sections 5(a) and 5(c) of the Securities Act of 1933, while Mango Labs and Blockworks Foundation are accused of violating Section 15(a) of the Securities Exchange Act of 1934. For clarity, this name does not refer to the media organization of the same name.

As part of a potential token wind-down, the DAO would also need to request that MNGO be de-listed from all crypto exchanges where it is currently traded. It is listed on a number of centralised exchanges, most notably; Kraken, Gate.io & AscendEx.

DAO Treasury Holds 7-Figures In USDC And $14 Million In Investor Funds Still Locked On Mango Markets

Mango Markets DAO treasury currently holds around $2 million in USDC and various other digital assets. Therefore, if the SEC would counter with a higher settlement figure than the proposed $223,228, Mango would have the means to pay a larger fine.

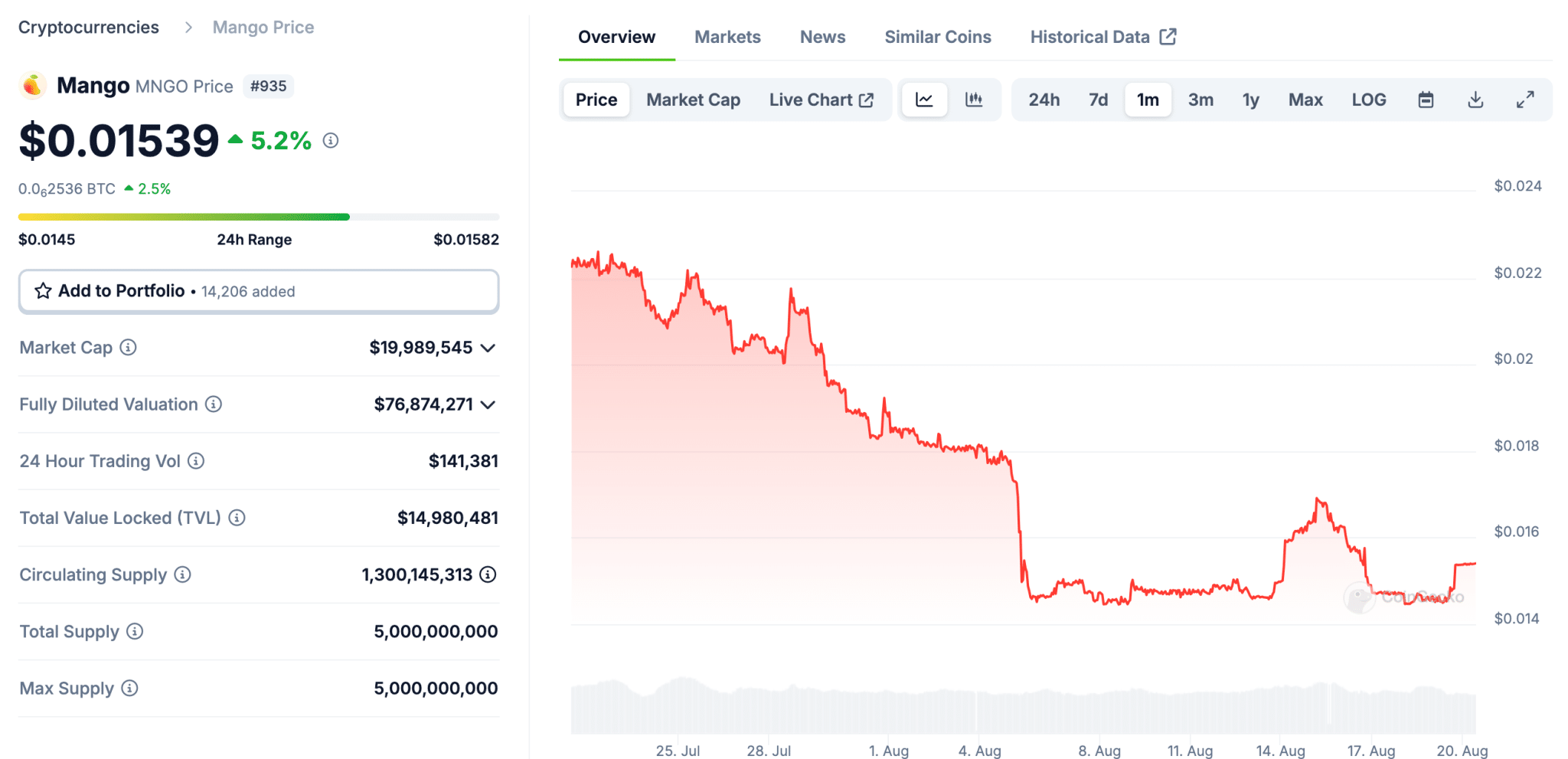

Data from CoinGecko shows that the MNGO token has been ranging between $0.014 – $0.017 for the past two weeks. It has processed $141,000 in trading volume over the past 24-hours. Coingecko also indicates that the Mango Markets platform still has over $14 million TVL (total value locked).

EXPLORE: 19 New Cryptocurrencies to Invest in 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.