BitMEX Exchange Review and Comparison

In this Bitmex Review, we will cover the Bitcoin Mercantile Exchange, or BitMEX, a trading platform that offers a margin-trading service for experienced, professional Bitcoin traders. We will cover the services the exchange provides and its pros and cons.

Post Summary

BitMEX allows traders to buy and sell contracts for cryptocurrencies (not the actual coins themselves) combined with margin trading (aka leverage). While it supplies contracts for different cryptocurrencies, it works with Bitcoin only (deposits, withdrawals). The platform is mostly suited for experienced traders.

If you want a more detailed review about Bitmex keep on reading. Here’s what I’ll cover:

- BitMEX Overview

- BitMEX Services

- Currencies and Payment Methods

- BitMEX Fees

- Supported Countries

- Customer Support and Reviews

- BitMEX vs. Binance

- Conclusion – Is BitMEX Legit?

1. BitMEX Overview

BitMEX was created by a selection of finance, trading, and web-development experts. Arthur Hayes, Ben Delo, and Samuel Reed launched the exchange in 2014 under their company HDR (Hayes, Delo, Reed) Global Trading Ltd. in Victoria Seychelles.

2. BitMEX Services

BitMEX supplies a derivative trading platform with an emphasis on margin trading. This means you don’t really trade cryptocurrencies, rather you trade contracts that follow a specific cryptocurrency price. Additionally you can leverage your trade up to 100x.

This type of trading is very volatile for better and worse. It means you can generate large profits with small amounts of money, but it also means you can lose everything you’ve invested relatively quick.

If all this sounds very confusing to you, it probably means you shouldn’t use BitMEX since this type of leveraged derivative trading is aimed mostly for experienced traders. Let’s go over the type of contracts BitMEX provides:

Future Contracts

An agreement to buy or sell a cryptocurrency at a predetermined price at a specified time in the future.

Perpetual Contracts

A Perpetual Contract is similar to a traditional Futures Contract with the exception that it has no expiry or settlement.

Upside Profit Contracts

Allows buyers to participate in potential upside of a cryptocurrency. The buyer pays a premium on trade date for which he is entitled to receive the difference between the cryptocurrency price and strike price on maturity date if positive, else no payment occurs.

Downside Profit Contracts

The opposite of an Upside Profit Contract. Allows buyers to participate in potential downside of a cryptocurrency.

3. Currency Support

BitMEX is a cryptocurrency-only service with Bitcoin as its major trading option. Customers also have access to a healthy selection of other altcoins, including the following:

- Cardano

- Bitcoin Cash

- EOS

- Tron

- Ethereum

- Litecoin

- Ripple

Bitcoin trades have both spot and futures trading options, while all other currencies have only futures markets.

Currently, there is no support for fiat currency, and the exchange only handles Bitcoin; this means that profits and losses are shown in Bitcoin even when you’re working with altcoin contracts. Deposits and withdrawals can be made only in Bitcoin.

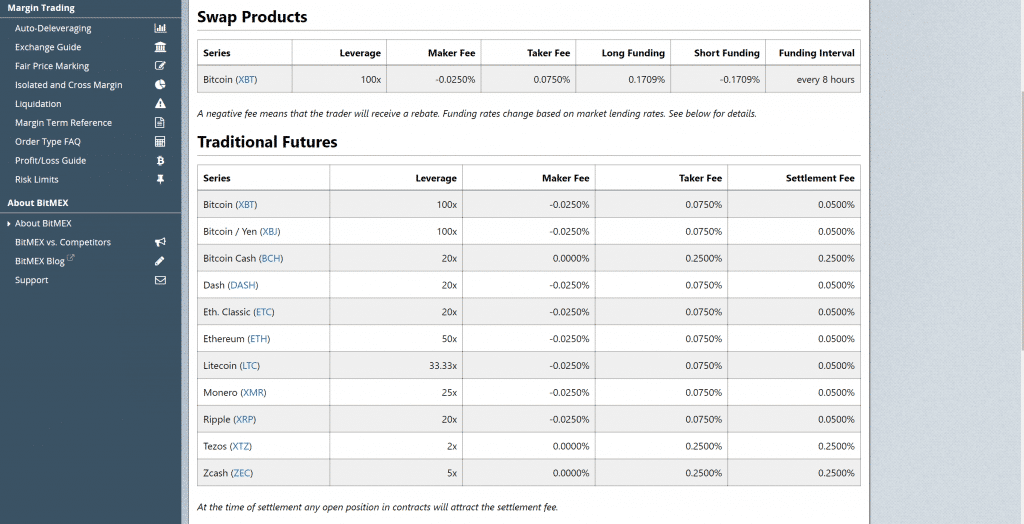

4. BitMEX Fees

Fees are very competitive on BitMEX. In fact, most users will find them almost negligible relative to the chunky profits to be made if you’re a savvy operator. The taker fee is set at 0.0750%, and the maker fee can be -0.0250%, so the maker actually grabs a little rebate on trades. Check out the full fee listings here.

Deposits and withdrawals continue to be free of charge, which is always very pleasing—you shouldn’t be left with any hidden costs once you’re done trading (other than the Bitcoin network fees).

Overall, the fees make for an appealing read on BitMEX, especially compared to other major exchanges, where fees usually sit at around 0.25%.

5. Supported Countries

BitMEX itself is a registered company in the Republic of Seychelles, but as with most Bitcoin operations, it’s a worldwide service. The exchange doesn’t limit access for any locations thanks to the cryptocurrency nature of the site. Local laws may affect your use of the service, but this is out of the company’s control.

6. Customer Support and Reviews

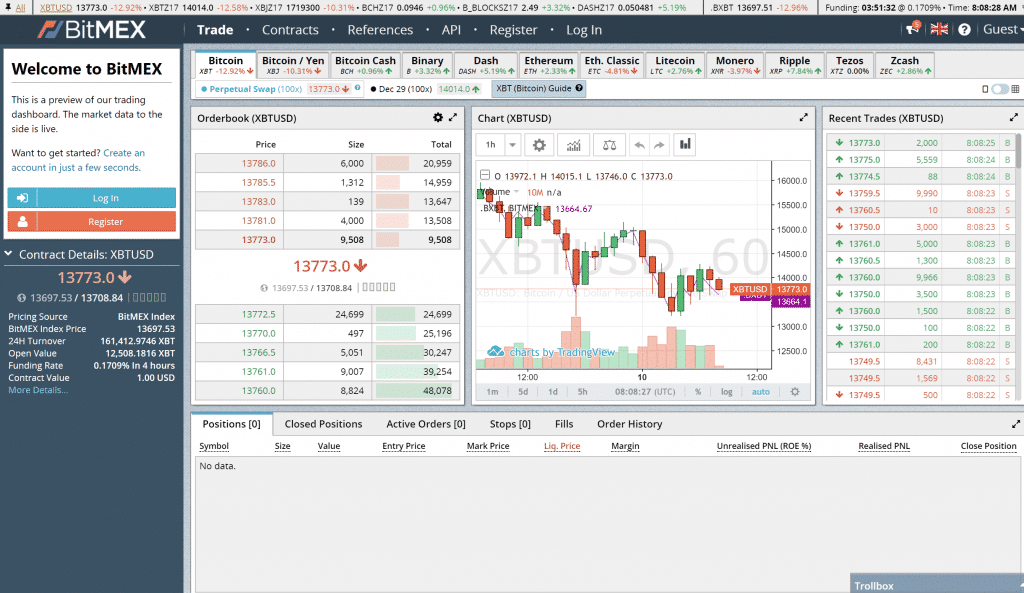

Support is offered via an email ticket, which is pretty standard for the industry. The really nice aspect of the service is the website, which is packed full of useful information and features. The support center gives a slick rundown of the exchange and helps to educate users on complex trades.

Live updates fill the site too. An announcement box keeps users up to date with any updates and issues. A live chat between traders also ticks along in the bottom right of the screen known as the Trollbox. While this may not be a direct line to BitMEX, it’s still really cool to be able to interact with other Bitcoin traders from within the exchange

Security information is loaded into the website, which is always a must for me when I’m looking at a new exchange. With BitMEX, you can quickly find out who owns the platform and how they’re keeping funds secure. Multisig withdrawals that only partners can sign, cold storage, and Amazon Web Services are the highlights when it comes to security.

No deluge of public reviews exists for BitMEX. There isn’t too much to read on the big review sites like Trustpilot, probably because the technicality of margin trading isn’t widely understood by the general public. No horror stories have offered themselves despite a decent hunt. Reddit and similar forums tend to be more filled with technical questions and chatter.

7. BitMEX vs. Bitfinex and other competitors

BitMEX isn’t the only exchange around supplying margin trading options. Exchanges like Bitfinex, Mexc and OKCoin are considered as worthy alternatives. However, there are some differences between these exchanges and BitMEX. Here they are in a nutshell:

- BitMEX allows higher leverage with a lower margin and smaller minimum contract amount.

- BitMEX uses the underlying index price for purposes of margin calculations, not the last traded price. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations.

- BitMEX allows customers to select the leverage they desire via the Leverage Slider or edit it manually even while in a position.

For a detailed review between BitMEX and its competition read this post.

8. Conclusion: Is BitMEX Legit?

If you know what you’re doing and want a market-leading cryptocurrency derivatives trading platform, then BitMEX will be a happy choice for you. For those looking for a more simple exchange to buy and sell some Bitcoin, I suggest you look into some other more user-friendly options.

The BitMEX team use their financial and web-development experience to create a slick platform that allows smooth trading while keeping users informed. Live update features, such as the announcement tab and the live chat function, provide that little extra bonus in making sure you never miss out on crucial news. The fees round things off to make the exchange an attractive all-around package.