Discover the ‘Binance effect’, and learn why market enthusiasm around new Binance listings is fading amid VC sell-offs, and what this means for retail.

The ‘Binance effect’ is dead. Once a ticket to instant riches for buying exchange tokens, new listings are now just sell-off opportunities for early birds.

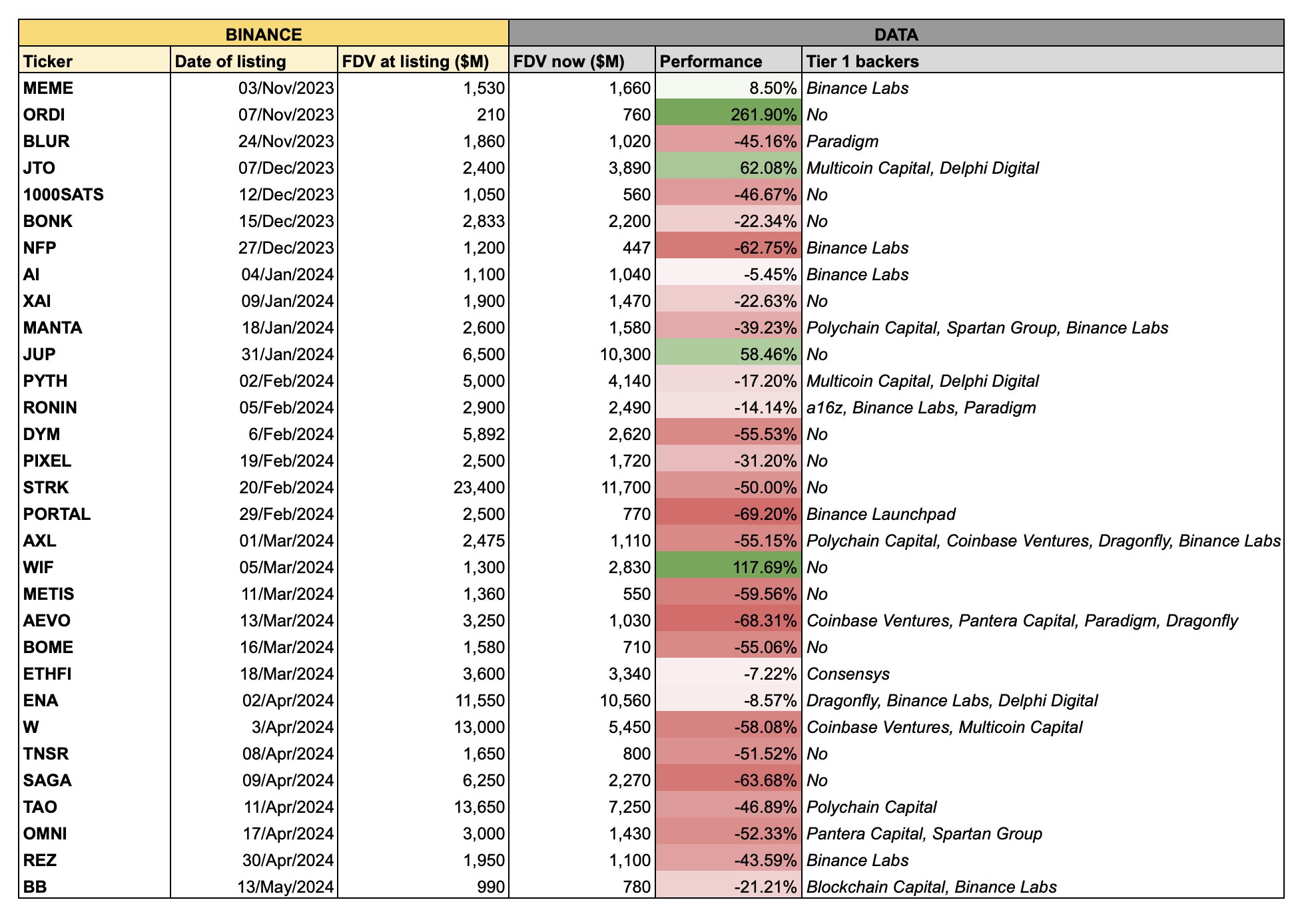

According to fintech company SwissBorg, over 80% of tokens listed on Binance, the world’s largest crypto exchange by trading volume, decline in value after the first six months.

This trend highlights an emerging pattern where Binance listings are increasingly seen as an exit strategy for venture capital firms rather than a lucrative investment opportunity for retail investors.

(FLOW)

The Downward Trend for Binance Listed Tokens

According to research by Flow, only 5 out of 31 recently listed tokens on Binance have seen price increases. These tokens—ORDI, JUP, WIF, JTO, and MEME—are primarily meme coins or projects without significant venture capital backing.

Performance Metrics:

- ORDI: +262%

- JTO: +62%

- JUP: +58%

- WIF: +117%

- MEME: +8.5%

Poor Performers (tokens like Binance Labs’ NFP, Pantera Capital-backed OMNI, and AEVO supported by Coinbase):

- NFP: -63%

- OMNI: -52%

- AEVO: -68%

-

“If you held a portfolio where you would invest an equal amount at each new Binance listing, you would be down over 18% in the past 6 months,” Flow stated.

The High Valuation Trap For Binance Tokens

Many new Binance listings launch at high, fully diluted values, averaging over $4.2 billion and sometimes reaching up to $11 billion. These high valuations often come without a strong user base or community support.

Last year, Ren and Heinrich’s analysis found that token prices spiked 73% in the first month after listing. But Binance’s once-dominant liquidity is now losing ground to Solana, Avalanche, Aptos, and Sui.

“Most of new Binance listings are tokens backed by Tier-1 VC and launch at crazy valuations. The average FDV on Binance listing date is over $4.2B, with some even reaching a ridiculous FDV of over $11B [billion],” said Flow.

DISCOVER: The Top Upcoming Meme Coin Launches in May 2024

The Bottom Line: Is Binance Effect Turning into a Scam Mechanism?

The current trend suggests that many tokens listed on Binance provide “exit liquidity” for insiders (VC firms).

Top-tier venture capital firms use the initial hype and high liquidity associated with Binance listings to cash out their investments, often at the expense of retail investors who buy into the hype.

All of this is turning the Binance chain into a volatile asset.

(BNBUSDT)

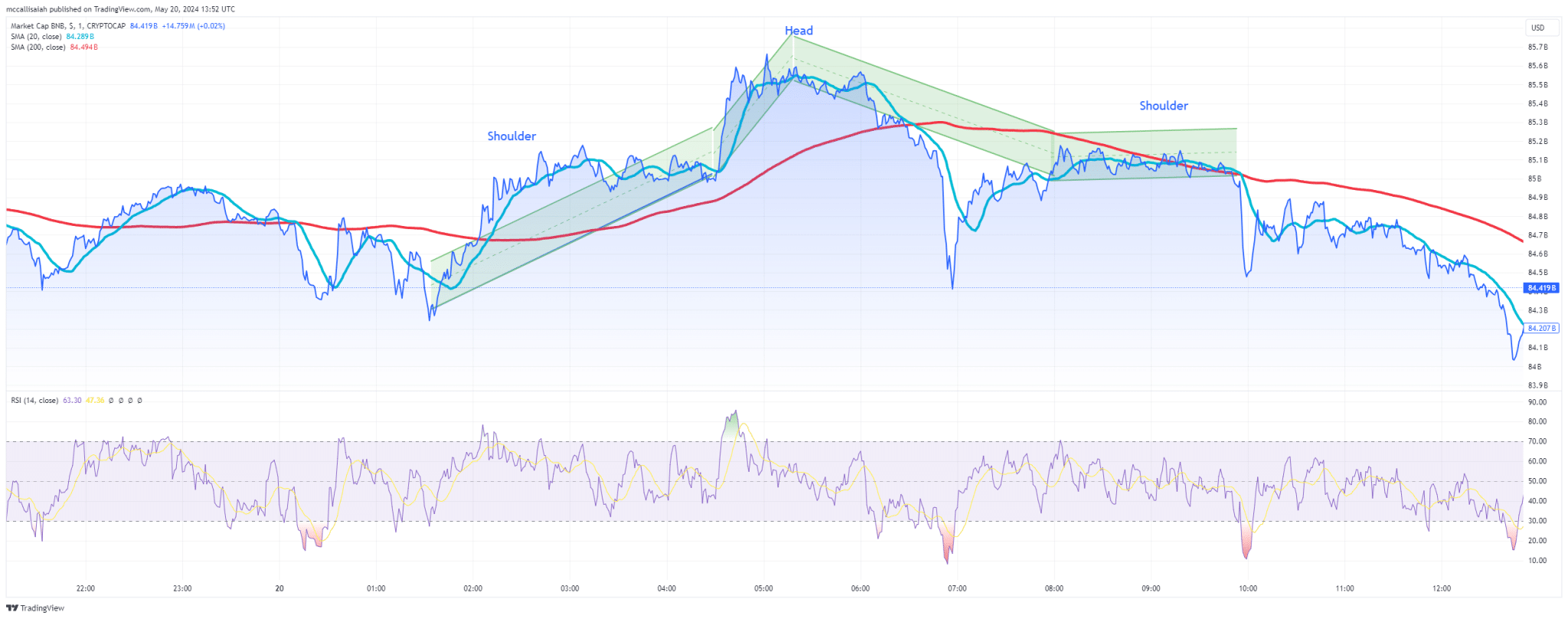

As it stands, Solana is up 21.36% over the past week and Ethereum 4.06%, while BNB chart is bearish across multiple technical indicators:

BNB has a bearish death cross, with the 20-day SMA crossing below the 200-day SMA, indicating potential for further downside.

Moreover, a bearish Head and Shoulders Pattern has appeared, suggesting a possible continuation of the downward trend.

Analysts at Flow postulate that Binance is becoming a chain where quick cash and grabs are launched, not applications with long-term value.

“More often than not, tokens launching on Binance are not investment vehicles anymore – all their upside potential are already taken away. Instead, they represent exit liquidity for insiders [VC] who capitalize on retail lack of access to quality early investment opportunities,” Flow explained.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital