HashFlare Review: Is This Cloud Mining Platform Legit?

By: Alexander Reed | Last updated: 1/12/21

HashFlare is a cloud mining service with a somewhat shaky history and a shady reputation. In this post, I’ll examine the company in-depth and tell you what you need to know before signing up to it.

HashFlare Review Summary

HashFlare is a cloud mining company that used to supply various mining contracts. Recently it seems to have gone out of business. This review breaks down the math, in order to prove that cloud mining with HashFlare isn’t a wise investment.

That’s HashFlare in a nutshell. If you want a more detailed review keep on reading, here’s what I’ll cover:

- Cloud Mining in a Nutshell

- Company Overview

- HashFlare Services

- Is HashFlare Profitable?

- Public Opinion and Reviews

- Conclusion

1. Cloud Mining in a Nutshell

Cloud mining is the process of “mining from afar”; Instead of buying a Bitcoin miner, storing it, configuring it, and cooling it (which costs a lot of money and consumes time), you “rent” a miner and have someone run it for you. You then split whatever profits that miner makes with the service provider.

My main criticism about cloud mining companies is that the majority of them are just Ponzi schemes in disguise.

They take your money, but they don’t actually buy and run miners for you. They just keep on paying you from new users that come onboard until all of a sudden, they disappear (as can be seen here, here, and here).

However, not all cloud mining companies are complete scams. Some are just bad investments.

Not long ago, I reviewed one of the most popular cloud mining platforms around: Genesis Mining. I tried to establish whether it would be a profitable investment instead of just buying Bitcoins and holding them (aka hodling).

The bottom line was that the company seemed legit (i.e. they were actually mining), but I doubted whether it would be a good investment, considering the alternative of just hodling, a strategy that has proven to be profitable over 99% of the time.

2. Hashflare Overview

HashFlare is a company owned by another company of crypto experts called HashCoins. While in the past you could actually see who the team members were on the “About” page, the company has since removed any personal information about who runs the company. Luckily, the Internet never forgets.

The website seems to have launched its services somewhere around the beginning of 2015, and since then it has grown immensely. The current rough estimate is that the site has around 150 thousand visitors each month.

The company itself, Hashflare LP, was registered in the United Kingdom in late 2015. HashCoins or Hashcoins OÜ was founded in 2013 in Tallinn, Estonia.

3. HashFlare Services

Important Note

Up until July 2019 the company continued to offer different mining contracts, however, today it seems that no more new contracts are available for purchase.

This review was written initially in mid 2018. I will leave the info unrevised for your consideration.

HashFlare Mining Contracts

HashFlare allows you to buy three different types of cloud mining power (also known as Hashrate). Sha256 is used mainly for mining Bitcoin, Scrypt can be used for mining Litecoin, and ETHASH is used for mining Ethereum and Ethereum classic.

For the purpose of this review, I’ll focus only on Bitcoin cloud mining, but the same process can be applied to any other mining algorithm.

4. Is HashFlare Profitable?

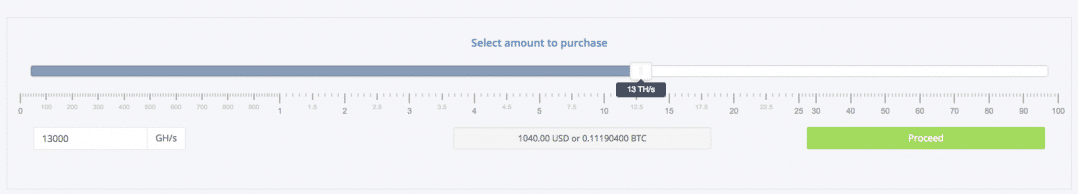

The most efficient miner today for mining Bitcoin is the Antminer S9 (true for mid 2018, today there’s the Antminer S19). It produces ~13 Th/s of mining power.

Buying the equivalent of this on HashFlare would cost you $1,040 per year. Buying the actual miner would cost you ~$853.

This actually makes sense because if you bought just the miner, you’d have additional expenses on electricity, cooling, and storage. However, the actual miner doesn’t charge anything after a year, and HashFlare does.

Using a Bitcoin mining calculator, I found that 13 Th/s in a “vacuum environment” (meaning no electricity costs, no mining pool fees, etc.) will produce $222 each month.

Seems pretty profitable – I’ll probably break even within five to six months. However, I haven’t calculated the MEF (maintenance and electricity fees) yet.

The MEF is linear and equals 0.0035 USD per every 10 GH/s of SHA-256. This means that for 13 Th/s, it would cost $4.55 daily or $136.5 monthly. So each month, we’re actually making $85.5.

A simple calculation of HashFlare profits would be something like this:

$85.5 *12 – $1,040 = -$14 per year

Wait, what? I’m actually losing money each year?

Well…it depends.

Payments are made to HashFlare in USD, but payouts are received in BTC. In the example above, I treated the Bitcoin exchange rate as constant. If this is actually the case, then yes, I’ll lose money.

However, if the BTC price rises, then we could say that I paid less but the payouts were worth more. Or could we?

Hashflare profitability if BTC goes up

As price goes up, more people start mining Bitcoin. This means that it becomes more difficult to turn a profit, and income is actually reduced.

So while I’m earning more dollars (since each BTC payout is worth more), I’m making less BTC in total. There’s a strong correlation between price and mining difficulty, so I assume that they cancel each other out.

Hashflare profitability if BTC goes down

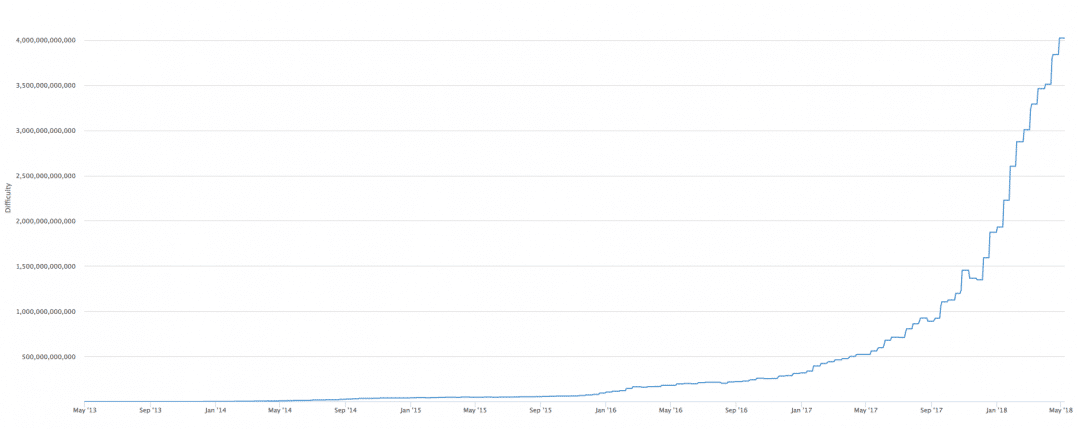

The funny thing is that even when Bitcoin’s price drops, difficulty can still increase. As you can see in the graph below, there have been only a handful of occasions on which the network’s difficulty has dropped, and some of these cases weren’t even related to price (e.g., one drop is attributed to miners switching over to Bitcoin Cash when it came out).

But here’s the real interesting part, which isn’t unique to HashFlare and can be found in almost every cloud mining company. If you look at their terms of service, you’ll find the following:

5.2. The Contract Term for HashFlare.io Cloud Machines is unlimited by default, unless stated otherwise. The Contract is valid while profitable, until expired or until terminated (refer to section 13), whichever comes first.

13.1. Without limiting any other rights we have, we may suspend or terminate access to your Account, the Website and/or the Service, nullify your Account Balance and/or hold the ability to withdraw mined funds if you breach any of these Terms of Service.

This basically means that if the price drops to a point at which you’re not making money at all, your contract will be terminated. Bitcoin has seen 80% price drops in the past, and that could seriously affect profitability.

HashFlare Isn’t a Good Investment

Considering the above, it seems that no matter what happens to Bitcoin’s price, HashFlare isn’t a very wise investment. Indeed, in July 2018 HashFlare announced that it is stopping its mining services and shutting down hardware on current SHA-256 contracts due to difficulty generating revenue.

The alternative, hodling, makes a lot more sense in my opinion. In this case, if Bitcoin goes up, you’re making a profit, and if it drops, you still have your coins. No one can “terminate” your bitcoins in the same way your cloud mining contract can be terminated.

5. Public Opinion and Reviews

While I have my mind made up about HashFlare, I make a habit of cross-checking with additional online reviews. However, since HashFlare has a referral program (i.e. you get paid for every customer you bring onboard), reviews should be taken with a grain of salt.

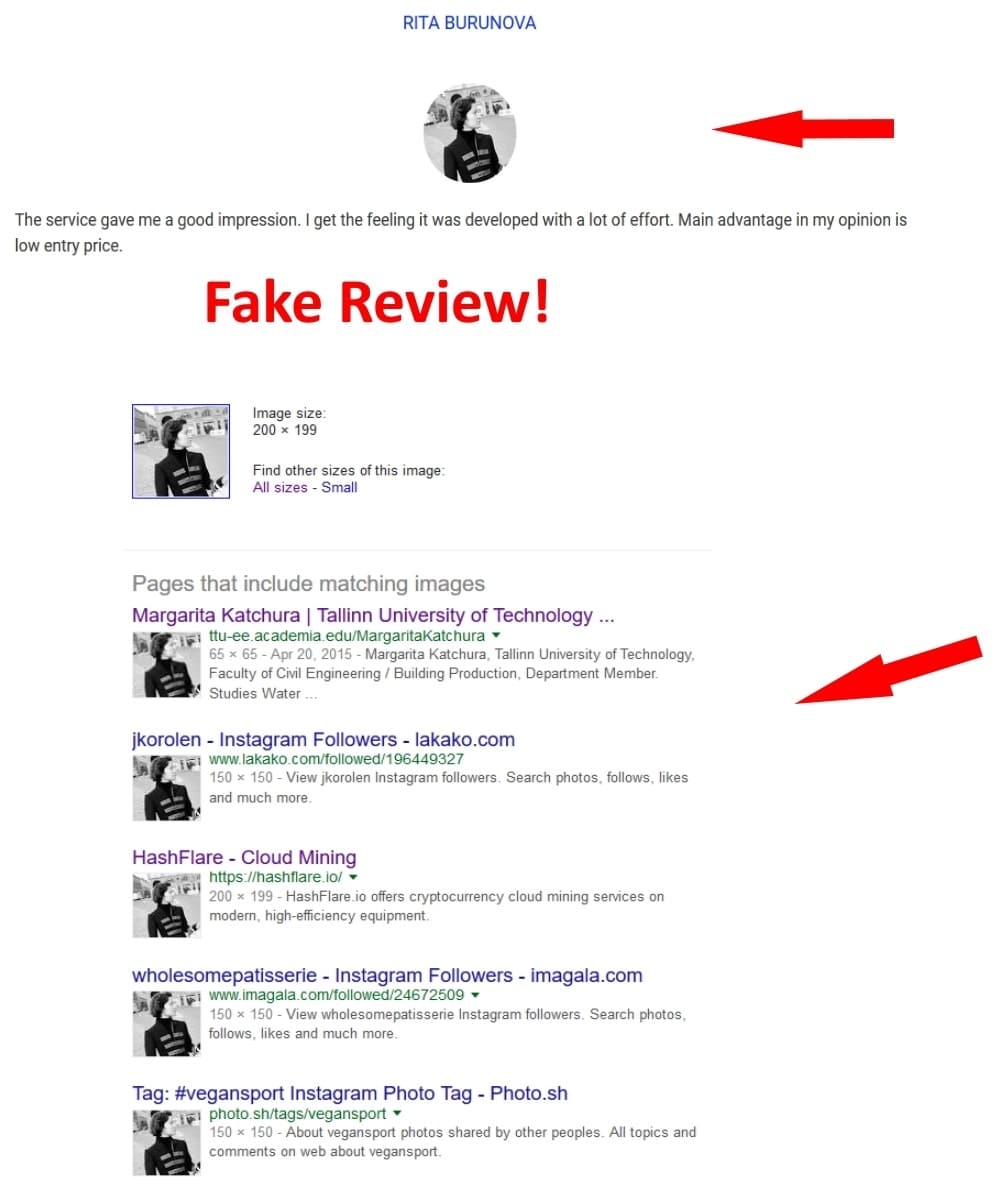

It seems like there’s a wide array of negative reviews about the company. Additionally, review site TrustPilot states that their customised software has discovered a large number of fake positive reviews on HashFlare and it has since removed them.

Most negative reviews complain about profitability, and some complain about the site being a complete Ponzi scheme, including the use of fake customer reviews as seen below and having virtually no customer support.

(source: ScamBitcoin.com)

6. Conclusion – Is HashFlare legit?

If I had to give a short answer, I’d say that while the company might be legit it’s NOT a good investment. There’s a thin line on the web between what constitutes a total scam and what’s considered to be just a bad investment opportunity.

I’m not as deterred by the bad reviews as I am by the simple math that just makes it seem impossible to actually profit with HashFlare.

Perhaps a different coin/algorithm will yield better results – you can use the same process I did for Bitcoin on any other crypto HashFlare offers and see for yourself.

In the past, I heard someone make a very amusing statement that summarizes this review perfectly:

“Cloud mining companies are basically taking your money today so they can slowly give you less of it back tomorrow.”

Personally, I wouldn’t invest my money in HashFlare, but in the end, I encourage you to do your own due diligence. Keep in mind that this post shouldn’t be taken as investment advice, it’s just my own research about another investment option in the crypto universe.

Have you had any experience with HashFlare? I would love to hear about it in the comment section below.

I had an account and mining contract with them from 2018 and mined some bitcoin but when the price of bitcoin dropped they blocked my access to any withdrawal. I communicated with them in that time for several times but no response at all. Their website is still online and even I could access to my account some month ago, but no withdraw or action I could do on my account. I wrote to their support again and my email bounced back.. they are big scammers and stole every ones money but no one could catch them or no legal action against them.

If anyone here claims that they could contact them and someone there helped them then they are scam too.

Has any progress on this front been made? I have several thousand dollars worth of Etherium in Hashflare. I have emailed them periodically since the website went under “maintenance,” and someone still answers my emails after enough time. However, I have had no luck withdrawing any of my money.

HashFlare.cc

HashFlare

From HashFlare.cc Review (2021 Updated) – Is it Legit or a Complete Scam?

https://99bitcoins.com/bitcoin-mining/cloud-mining/hashflare-review/

Is there any way to get my money out of Hashflare ?

There seems to be. Here is a link that seems to explain the process: https://support.hashflare.io/hc/en-us/articles/207973869-How-to-make-a-withdrawal-#:~:text=How%20to%20make%20a%20withdrawal%3F%201%20Go%20to,the%20withdrawal%20confirmation%20letter%20from%20the%20system.%20

HASHFLARE IS ON MAINTENENANCE FOR MONTHS NOW… You can not login anymore…

Is there any way to get my money out of Hashflare ?

I would like an answer to this as well. I jumped through all the hoops to verify my ID so I could withdraw the bitcoin and then they went in to perpetual maintenance status.

So bad because they put themselves as if they not scammers while they the scammers just like Bitclub Network that stole our moneys as well