Let’s cut to the chase—this is your go-to Polymarket review, where we break down what Polymarket is and why it’s shaking up the world of decentralized prediction markets. So, what is Polymarket, you ask? Picture a platform where you can bet on the future of, well, anything. Elections, sports, even the next meme stock that’ll make Wall Street quiver. This isn’t your run-of-the-mill betting site—it’s a decentralized oracle of human judgment, crowd-sourcing the truth from the chaos of opinion.

This Polymarket review will also cover how to navigate this digital bazaar and help teach you how to ride the wave of collective wisdom. Strap in, because we’re about to explore what Polymarket is, how it works, and more importantly, how you can get started today.

Polymarket Review: Summary

Polymarket is a decentralized prediction market platform that allows users to speculate on the outcomes of real-world events by buying and selling shares using cryptocurrency. Polymarket leverages blockchain technology and smart contracts to ensure transparency and security in its transactions, allowing users to attempt to predict the outcomes of a wide range of topics, including politics, sports, pop culture, and more. The platform’s pricing mechanism reflects the current market probability of an event occurring, allowing users to profit if their predictions prove correct.

Polymarket Key Highlights

- Polymarket is a decentralized prediction market that allows users to bet on the outcome of real-world events using cryptocurrencies.

- Built on the Polygon (MATIC) blockchain, a Layer-2 scaling solution for Ethereum (ETH), it offers lower transaction fees and faster speeds.

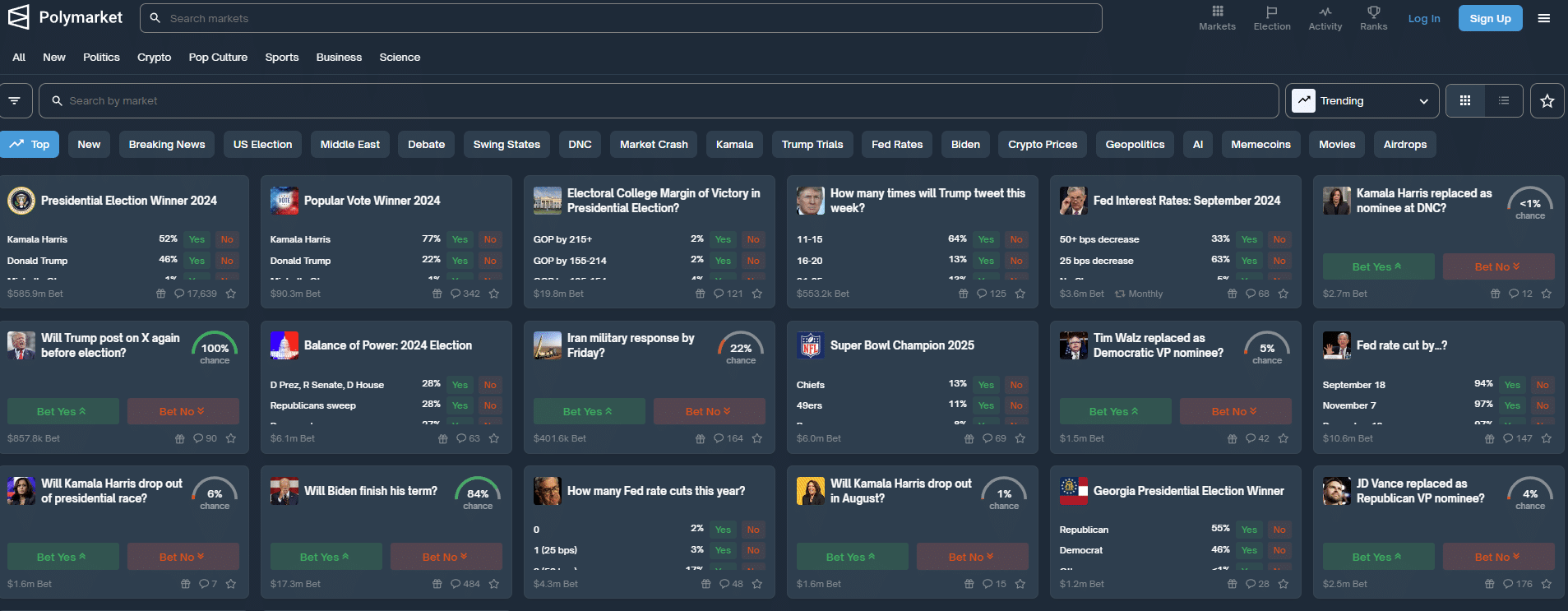

- The platform enables users to trade positions on a wide range of topics, from politics and finance to sports and entertainment.

- Polymarket employs a user-friendly interface and provides a unique opportunity to profit from accurate predictions.

- As a decentralized platform, it emphasizes transparency and security, with users maintaining control over their funds through self-custodial wallets.

What is Polymarket?

Polymarket is a revolutionary platform that allows users to speculate on real-world events in a transparent, permissionless environment. In simpler terms, Polymarket is where your opinions meet your capital, giving you the chance to wager on the outcomes of events that matter. Whether it’s political elections, global economic trends, or even the next viral sensation, Polymarket lets you put your money where your mind is.

But what truly sets Polymarket apart is its foundation in blockchain technology, ensuring that all markets are fair, transparent, and immutable. No middlemen, no gatekeepers—just pure, unfiltered market sentiment. It’s a platform built for those who trust their judgment and aren’t afraid to back it up with some skin in the game.

What are Prediction Markets?

Prediction markets, at their core, are platforms where participants can bet on the outcomes of future events. The idea is simple: by aggregating the bets of many, these markets can often predict outcomes with remarkable accuracy. The wisdom of the crowd, as they say. Polymarket takes this concept and supercharges it with the power of decentralization. No longer limited by geographical boundaries or institutional controls, Polymarket’s prediction markets are open to anyone, anywhere, with an internet connection and a few crypto assets to spare.

The result? A dynamic ecosystem where market prices are driven by the collective knowledge and opinions of participants worldwide. It’s not just about winning or losing a bet; you’re contributing to a broader understanding of what the future might hold.

Who Founded Polymarket?

The brain behind Polymarket is Shayne Coplan, a visionary who saw the potential to merge blockchain technology with prediction markets to create something truly disruptive. Coplan’s background isn’t the typical Wall Street pedigree; instead, Coplan’s insights come from a deep understanding of decentralized systems and a desire to build a platform that’s not just innovative, but also accessible. Polymarket is a glimpse into the future of finance, where transparency, decentralization, and user empowerment reign supreme.

Polymarket’s Position in the Decentralized Finance (DeFi) Ecosystem

While DeFi has largely been dominated by platforms focused on lending, borrowing, and trading, Polymarket brings something different to the table: the ability to bet on real-world outcomes with crypto assets. It’s a natural extension of the DeFi ethos—cutting out the middlemen, democratizing access, and putting power back into the hands of the individual.

By integrating prediction markets into the broader DeFi landscape, Polymarket adds a new layer of functionality, offering users not just a way to earn yields but also a means to hedge risks or even gain insights into future trends. It’s this versatility and innovation that cements Polymarket’s position as a leader in the next wave of decentralized applications.

Key Benefits of Polymarket

With a foundation rooted in decentralization and a focus on transparency, Polymarket offers a suite of benefits that set it apart from traditional platforms. Let’s break down what makes Polymarket tick and why it’s quickly becoming the go-to for those looking to speculate on the future.

Decentralization at Its Core

In traditional prediction markets, you’re often at the mercy of centralized entities—be it a governing body, a platform operator, or even regulatory frameworks. Polymarket throws that playbook out the window. By leveraging blockchain technology, Polymarket ensures that no single entity has control over the platform. The power is distributed among its users, ensuring that markets remain open, transparent, and free from censorship. This decentralization not only democratizes access but also fosters a trustless environment where the rules are clear, and the playing field is level.

The Role of Blockchain in Ensuring Transparency and Security

Blockchain technology isn’t just a buzzword for Polymarket; it’s the backbone that ensures transparency and security. Every transaction, every bet, and every outcome is recorded on the blockchain, creating an immutable ledger that anyone can verify. This level of transparency is unheard of in traditional markets, where the inner workings are often shrouded in secrecy. On Polymarket, everything is out in the open, reducing the risk of fraud and ensuring that all participants have equal access to information.

Security is another major benefit. Because Polymarket operates on the blockchain, it inherits the security features of the underlying technology. Smart contracts govern the platform, automating processes and eliminating the need for intermediaries. This not only reduces the potential for human error but also protects user funds from malicious actors. In short, Polymarket combines the best of blockchain’s transparency and security to offer a platform you can trust.

Access to Global Markets

One of the most compelling benefits of Polymarket is its global reach. Traditional prediction markets are often limited by geographic boundaries, legal restrictions, and currency controls. Polymarket breaks down these barriers by operating on a decentralized network that anyone with an internet connection can access. Whether you’re in New York, Nairobi, or New Delhi, you can participate in Polymarket’s markets without worrying about local regulations or currency conversions. This global access not only broadens the range of participants but also enriches the diversity of opinions and information that drive the markets.

Low Fees and Fast Transactions

In the world of traditional finance, fees can eat into your profits, and slow transaction times can mean missing out on crucial opportunities. Polymarket addresses both of these issues head-on. Thanks to its blockchain infrastructure, Polymarket can offer low transaction fees, making it more cost-effective to participate. Additionally, transactions on Polymarket are fast—often settling in seconds—ensuring that you can react to market changes in real time without delay. This combination of low fees and speed is a significant advantage for traders looking to maximize their efficiency.

Community-Driven Market Creation

Polymarket’s decentralized nature extends to the creation of markets themselves. Unlike traditional platforms where markets are dictated by a central authority, Polymarket allows users to create their own markets. This means that if there’s a topic or event you want to bet on, you can bring it to life on Polymarket. This community-driven approach not only increases the variety of available markets but also ensures that the platform evolves in response to the interests and demands of Polymarket users. It’s a system that empowers users and keeps the platform dynamic and responsive.

Polymarket Pros and Cons

No platform is perfect, and Polymarket is no exception. While it offers a host of innovative features and benefits that make it stand out in the decentralized finance landscape, it also comes with its own set of challenges. In this section, we’ll take a balanced look at the pros and cons of using Polymarket. Understanding both the strengths and limitations of Polymarket is crucial to making the most of what it has to offer.

Pros of Using Polymarket

Polymarket has several advantages that make it a great choice for prediction markets. Here are some of the main benefits:

- Decentralized and Trustless: Operates on the blockchain, eliminating the need for central authority and ensuring transparency and security.

- Diverse Markets: Offers a wide range of topics, from politics to niche events, driven by community interest.

- Low Fees and Fast Transactions: Blockchain-based, enabling quick transactions with minimal fees compared to traditional markets.

- Global Accessibility: Open to anyone with an internet connection and crypto, unrestricted by geography or local regulations.

- Accurate Market Prices: Polymarket works hard to show accurate market prices. The platform is driven by real-time trading activity. This ensures that prices truly reflect the thoughts of the market participants. It gives you a reliable view of how likely events are to happen.

Cons of Using Polymarket

Polymarket is a strong platform for prediction markets, but it has some downsides to think about:

- Price Slippage: Just like in other financial markets, price slippage can happen here. This means the price you pay when you trade might be different from what you expected. This usually occurs due to low liquidity or big orders. So, you may not always get the exact price you see.

- Polymarket Whales: Large players (whales) can influence markets, potentially skewing outcomes and reducing fairness for smaller participants.

- Limited Fiat On-Ramps: Requires users to have crypto; no direct fiat currency options, which can deter beginners.

- Complexity for New Users: Steep learning curve for those unfamiliar with blockchain or crypto terminology.

Getting Started with Polymarket: A Beginner’s Guide

Ready to jump into Polymarket? This guide will take you step-by-step through everything you need to get started, from setting up your account to making your first prediction.

What You Need to Know Before Diving In

Before you begin, it’s important to understand that Polymarket operates on the Polygon sidechain, which is an Ethereum Layer 2 solution. This means you’ll need some basic familiarity with how blockchain transactions work, as well as access to a crypto wallet and some USDC on the Polygon network. Understanding the basics of crypto wallets and the decentralized finance (DeFi) ecosystem will help you navigate Polymarket with confidence.

Necessary Tools and Resources for a New User

To get started on Polymarket, you’ll need a few essential tools:

- Cryptocurrency: Polymarket uses USDC, a stablecoin linked to the US dollar. When purchasing USDC, make sure to get it on the Polygon network. Not all exchanges support direct purchases of Polygon USDC, so check whether your chosen exchange, like OKX, Kraken, or Binance, allows you to buy USDC on Polygon. These platforms typically let you purchase USDC using your bank account or credit/debit card. If your exchange doesn’t support Polygon USDC directly, you may need to transfer your USDC to a wallet like MetaMask and use a bridge to move it onto the Polygon network.

- A Crypto Wallet: You need a crypto wallet to keep your USDC and use the Polymarket platform. MetaMask is a popular choice because it’s easy to use and works with most web browsers. It connects as an extension so you can manage your USDC and link to apps like Polymarket.

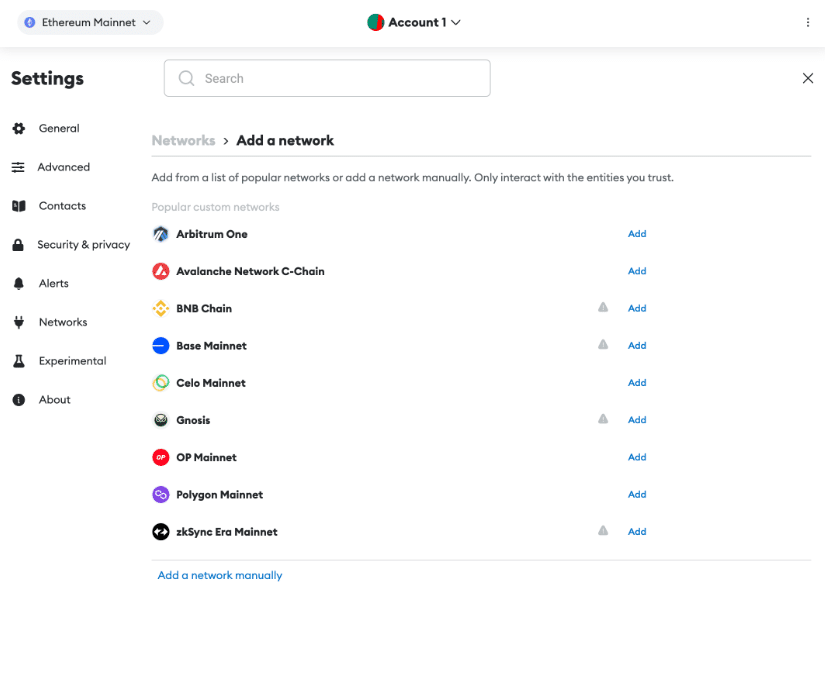

- Polygon Network Setup: Add the polygon network to your MetaMask. Click on the network dropdown at the top of the MetaMask window (it typically defaults to “Ethereum Mainnet”). Scroll down and click on “Add Network.” In the “Add a network” section, click Polygon.

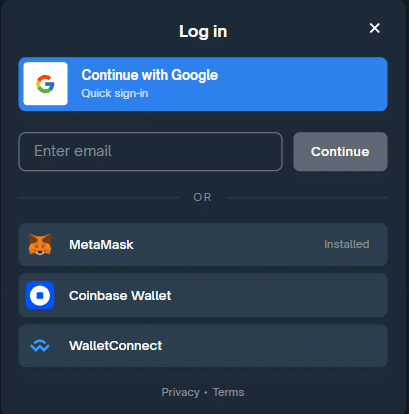

Step 1: Creating Your Account

The first step is to create an account on Polymarket. Visit the Polymarket website and sign up using your crypto wallet. The process is straightforward and involves connecting your wallet to the platform. No lengthy registration forms or KYC processes—just connect and you’re ready to go. You can even use your email address to create an account.

Step 2: Securing Your Wallet

Securing your crypto wallet is crucial when using platforms like Polymarket, where you’re fully in control of your own funds. If you plan to trade frequently and want to minimize transaction fees, consider moving your USD Coin (USDC) to the Polygon network. This can typically be done through your crypto exchange or by using a bridge service like the Polygon Bridge.

Once you have USDC on the Polygon network, make sure your MetaMask wallet is configured to interact with it. To do this, you’ll need to add the Polygon network to your MetaMask by adjusting the network settings.

After moving your USDC to the Polygon network, you’ll need to send it from your exchange or bridge service to your MetaMask wallet. Once your USDC is safely in your MetaMask wallet on the Polygon network, you’re ready to make your first deposit on Polymarket. You can find your deposit address in your trading account labeled “cash”.

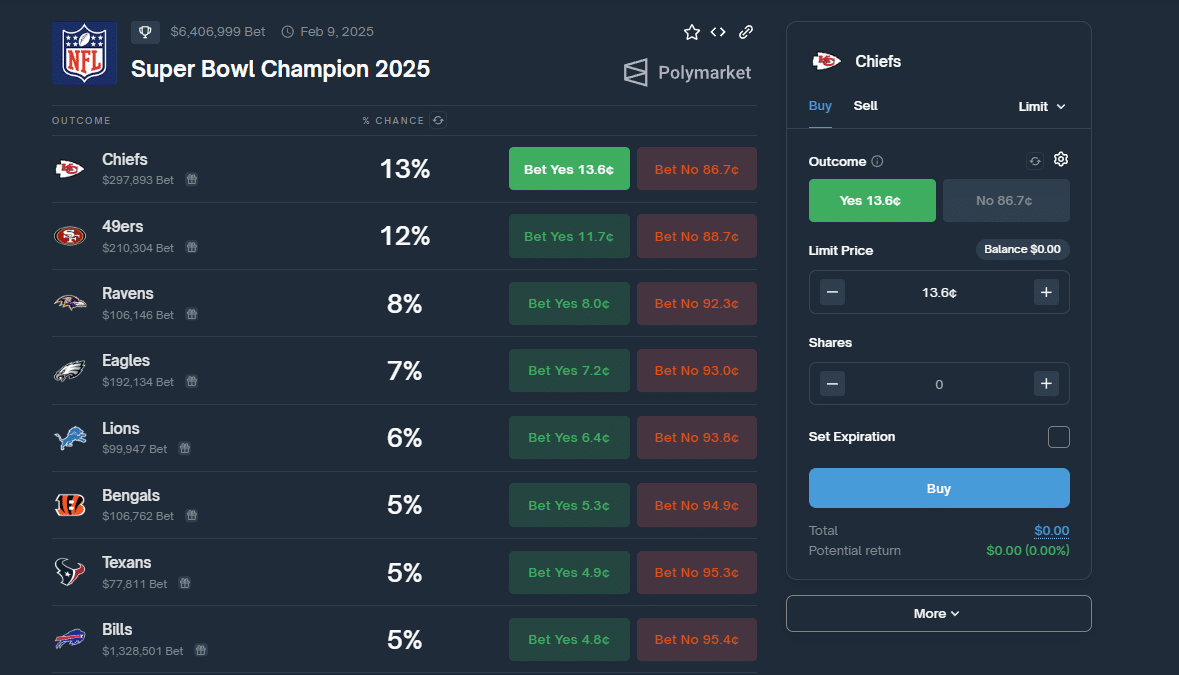

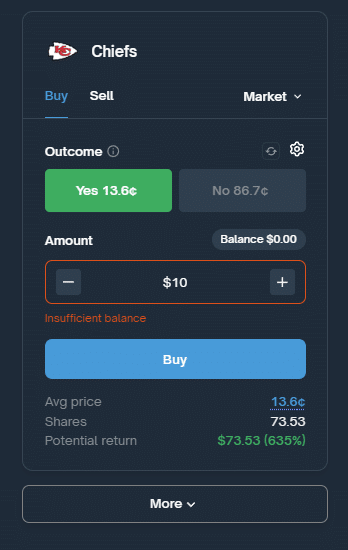

Step 3: Understanding Market Mechanics

Before placing your first prediction, it’s important to understand how Polymarket’s markets operate. Each market is essentially a question with multiple possible outcomes. Participants buy shares in the outcome they believe will occur. The price of each share reflects the probability of that outcome, according to the market.

If “Yes” shares are at $0.80, it means people believe there is an 80% chance the event will occur. Liquidity, which means how much money is in the market, is also important. Markets with higher liquidity usually have more stable prices. This means that big orders will not change the market a lot.

Lastly, anyone can create new markets on Polymarket. But remember that each market must meet some guidelines and gather enough liquidity before it operates. Familiarize yourself with the market mechanics in order to make informed decisions.

Step 4: Making Your First Prediction

Once you’re comfortable with the mechanics, it’s time to make your first prediction. Start by browsing the available markets, then select one that interests you. Using your USDC, deposit the desired amount of funds to your Polymarket account and you are ready to buy shares in the outcome you think is most likely. Your potential profits will depend on the accuracy of your prediction and the movement of the market. It’s that simple—place your prediction and see how it unfolds.

How to Transfer Crypto to Polymarket

Getting your funds onto Polymarket is essential for participating in prediction markets. This guide will walk you through connecting your compatible wallet, depositing USDT or USDC, and how to withdraw your crypto when you’re ready.

Connect Wallet

To begin using Polymarket, you’ll need to connect a crypto wallet. Polymarket supports MetaMask, Coinbase Wallet, and WalletConnect:

- MetaMask: Set up MetaMask for the Polygon network by adjusting the network settings. Once configured, connect it to Polymarket by selecting MetaMask from the wallet options.

- Coinbase Wallet: If you use Coinbase Wallet, simply select it from the list on Polymarket and follow the prompts to connect.

- WalletConnect: For mobile wallets, choose WalletConnect, scan the QR code with your wallet app, and approve the connection.

After connecting your wallet, you’ll be ready to deposit funds and make your first prediction.

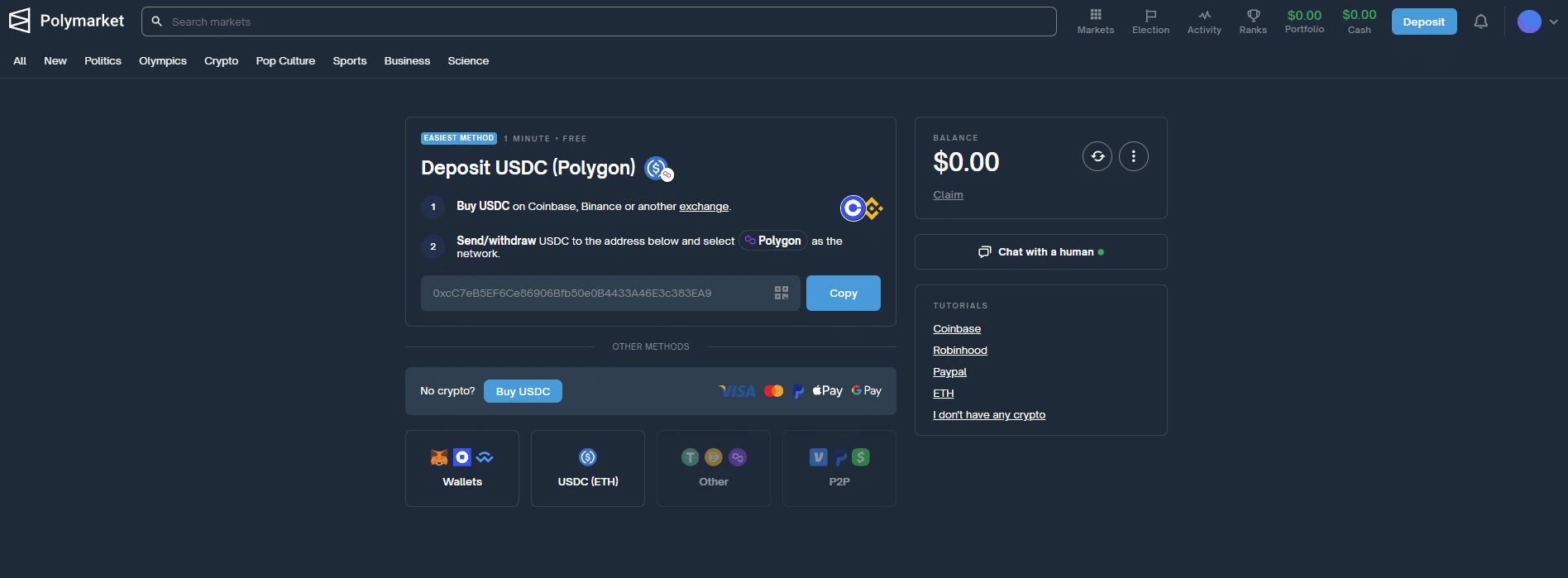

Deposit USDC or USDT

Whether you’re depositing USDC or USDT into your Polymarket account, the process is similar and straightforward. Here’s how to do it:

- Ensure Your Funds are on the Polygon Network: Before depositing, make sure your USDC or USDT is on the Polygon network. If your funds are on another network, such as Ethereum, you’ll need to bridge them to Polygon using a service like the Polygon Bridge.

- Connect Your Wallet: Ensure your wallet, whether it’s MetaMask, Coinbase Wallet, or another WalletConnect-compatible option, is connected to Polymarket.

- Navigate to the Deposit Section: On Polymarket, head to the deposit section where you can select the amount of USDC or USDT you want to deposit.

- Confirm the Deposit: After specifying the amount, confirm the transaction in your wallet. It’s crucial to verify that you’re sending funds on the Polygon network to avoid any issues.

- Wait for Confirmation: Once the transaction is confirmed on the blockchain, your USDC or USDT will be available in your Polymarket account, ready for use in making predictions.

For more detailed instructions, you can refer to this USDC guide and this USDT guide.

How to Withdraw Crypto From Polymarket

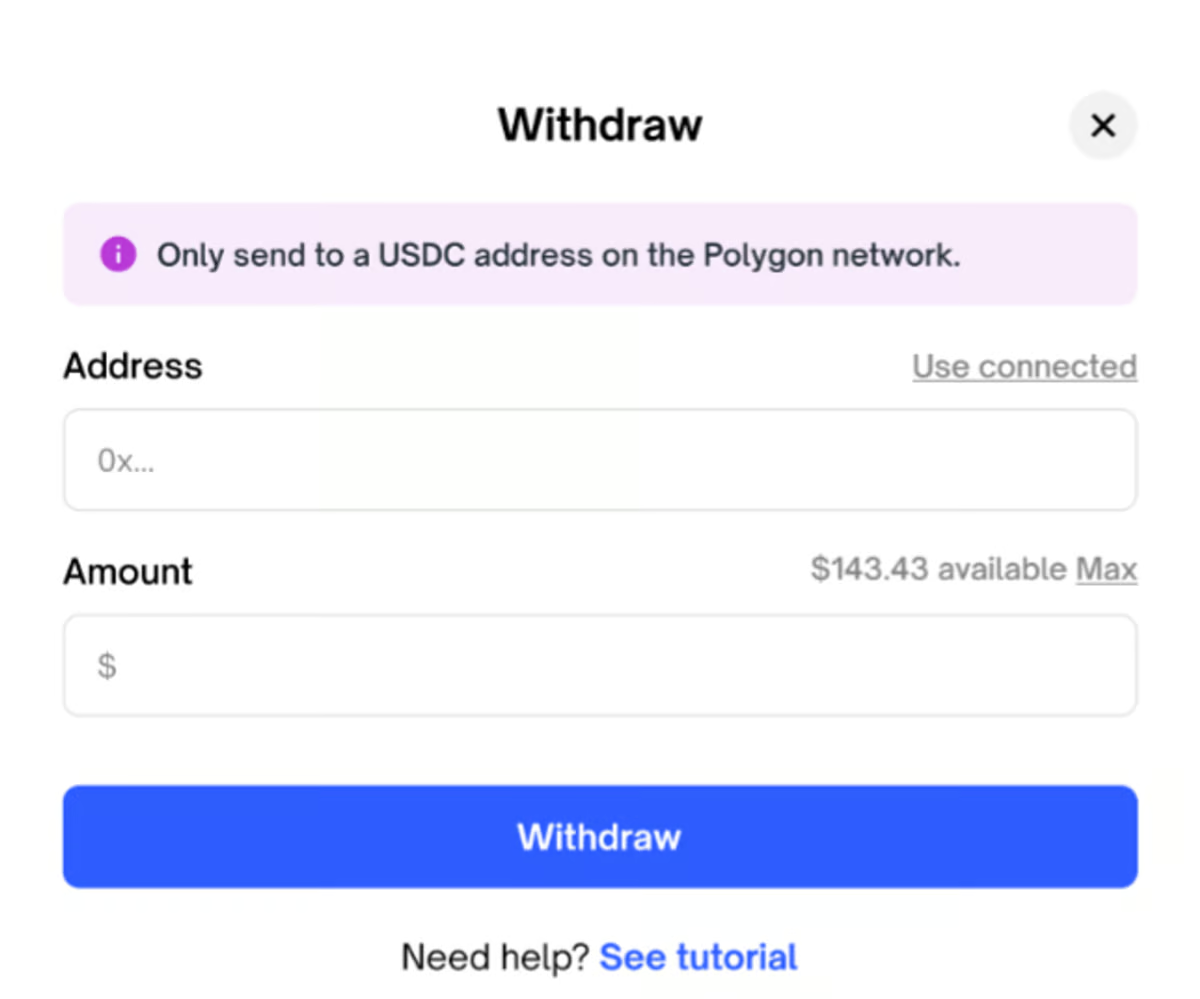

Withdrawing your crypto from Polymarket is a straightforward process. Follow these steps to securely transfer your funds back to your wallet:

- Navigate to the Withdrawal Section: On Polymarket, go to the withdrawal section where you can select the amount of USDC or USDT you wish to withdraw.

- Connect Your Wallet: Ensure your wallet, such as MetaMask, Coinbase Wallet, or another WalletConnect-compatible wallet, is connected to Polymarket and configured for the Polygon network.

- Initiate the Withdrawal: Enter the amount of crypto you want to withdraw, then confirm the transaction in your wallet. Double-check the wallet address and network settings to ensure that the funds are sent correctly.

- Wait for Confirmation: After confirming the transaction, your USDC or USDT will be transferred to your connected wallet on the Polygon network. The withdrawal should be reflected in your wallet shortly after the transaction is processed on the blockchain.

For a detailed guide on the withdrawal process, refer to the How to Withdraw from Polymarket guide.

How to Navigate Polymarket Like a Pro

To excel on Polymarket, it’s essential to understand how to navigate the platform and develop effective strategies. Understanding trends and strategic decision-making will help you make informed predictions and maximize your returns.

Analyzing Trends and Predictions

Navigating Polymarket like a pro starts with mastering the art of trend analysis. Successful traders know that prediction markets are driven by collective sentiment and real-world data. On Polymarket, each market reflects the probability of different outcomes based on the bets placed by users. To make the most informed predictions, keep an eye on emerging trends and shifts in market sentiment. Monitoring news, social media, and expert opinions can provide valuable insights into how events might unfold.

Additionally, study the historical data available on Polymarket. By examining how similar events played out in the past, you can identify patterns and better anticipate future outcomes. Understanding the order book and how buy and sell orders impact market prices is also crucial. The more you immerse yourself in the data, the better equipped you’ll be to predict market movements accurately.

Strategies for Maximizing Returns

Maximizing your returns on Polymarket requires a strategic approach. One key strategy is diversification. Just like in traditional investing, spreading your bets across multiple markets can reduce risk and increase the chances of a successful outcome. Consider allocating your funds to different events and outcomes, rather than going all-in on a single prediction.

Another strategy is to take advantage of market volatility. Prediction markets can be highly dynamic, with prices fluctuating as new information emerges. Savvy traders use this volatility to their advantage by buying low and selling high, capturing profits as market conditions change. Additionally, keep an eye on liquidity—markets with higher liquidity allow for easier entry and exit, making it simpler to adjust your positions as needed.

Lastly, always set clear goals and limits for your trades. Knowing when to enter and exit a market, and having a plan for managing losses, is essential for long-term success. By combining these strategies with careful analysis, you can enhance your potential returns on Polymarket.

The Financial Aspects of Polymarket

Understanding the financial mechanics behind Polymarket is key to maximizing your success on the platform.

Understanding Polymarket Fees and Payouts

Polymarket operates with a transparent fee structure, ensuring that users understand the costs involved in trading on the platform. Here’s a breakdown:

|

Fee Type |

Description |

|

Trading Fees |

0% (No fees are charged by Polymarket for trading) |

|

Gas Fees |

Variable (Dependent on network congestion) |

|

Withdrawal Fees |

Variable (Based on the chosen network and current gas prices) |

While Polymarket doesn’t charge trading fees directly, it’s essential to factor in gas fees, which apply to all transactions on blockchain networks. Gas fees can fluctuate based on network congestion.

Polymarket makes money through the spread on trading and by providing liquidity to its markets. Even without direct trading fees, Polymarket captures the difference between buy and sell prices, which contributes to its revenue. It is very likely that Polymarket will introduce trading fees at some point in the future to start generating revenue.

Here’s what Polymarket founder had to say about the platform’s revenue strategy in an interview with Forbes:

“We’re focused on growing the marketplace right now and providing the best user experience. We’ll focus on monetization later.” – Shayne Coplan

The payout structure on Polymarket is straightforward. If your prediction is correct, you will receive a payout based on the number of shares you hold and the initial price at which you purchased them. Payouts are typically distributed shortly after the resolution of the market.

Risk Management in Prediction Markets

In the world of prediction markets, managing risk isn’t just a good practice—it’s a survival skill. Let’s face it, even the best predictions can go sideways, and when they do, it’s the ones who’ve managed their exposure who live to bet another day.

First off, never bet more than you’re willing to lose. This is the golden rule of speculation, and it’s especially true in the volatile realm of prediction markets. The potential for high rewards can be tempting, but it’s crucial to remember that with high rewards come high risks. Diversification is your friend here. Spread your bets across multiple markets rather than putting all your chips on one outcome. This way, a single bad call won’t wipe you out.

Another key to risk management is to stay informed. Markets move on news, and the fastest way to get blindsided is to ignore what’s happening in the world. Keep your ear to the ground—follow the news, monitor social media, and stay updated on market sentiment. The more informed you are, the better you’ll be at adjusting your positions before things take a turn.

Lastly, set clear exit strategies. Know when to cash out and when to cut your losses. Emotional decision-making is the Achilles’ heel of many traders, leading to holding on too long or exiting too early. Be disciplined—set your targets, know your limits, and stick to them. In prediction markets, the smart money isn’t just on making the right call; it’s on managing the risks that come with it.

Polymarket Compared to Other Prediction Platforms

When comparing Polymarket to other prediction platforms, several key features and differences stand out.

Feature Comparison with Competitors

Polymarket compared to other prediction platforms like Augur:

- Blockchain Network: Polymarket uses Polygon, offering faster transactions and lower fees than Augur, which relies on the Ethereum blockchain.

- User Experience: Polymarket’s interface is simple and intuitive, ideal for both beginners and experienced users. Augur’s interface is more complex, with a steep learning curve

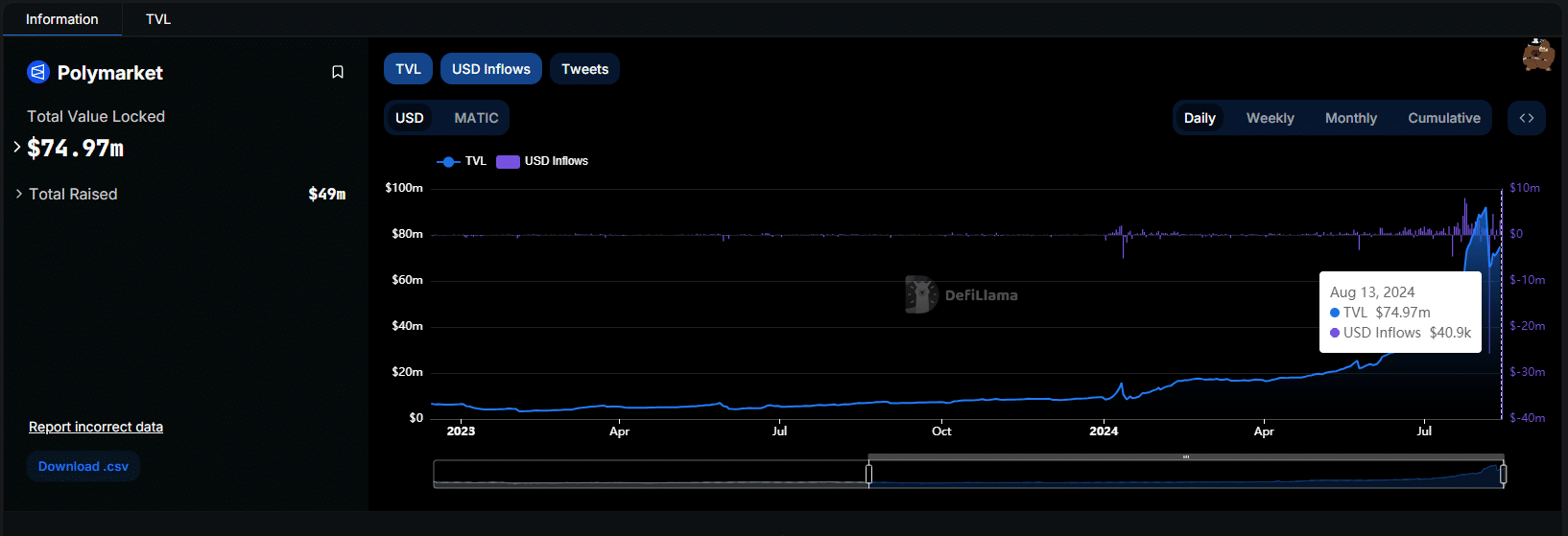

- TVL (Total Value Locked): As of the latest data, Polymarket has a TVL of approximately $74.92 million, significantly higher than Augur ($2.14 million). This reflects Polymarket’s growing user base and increasing trust in the platform.

|

Feature |

Polymarket |

Augur |

|

Blockchain |

Polygon |

Ethereum |

|

Transaction Fees |

Low (Polygon) |

High (Ethereum gas fees) |

|

User Interface |

Simple and Intuitive |

Complex |

|

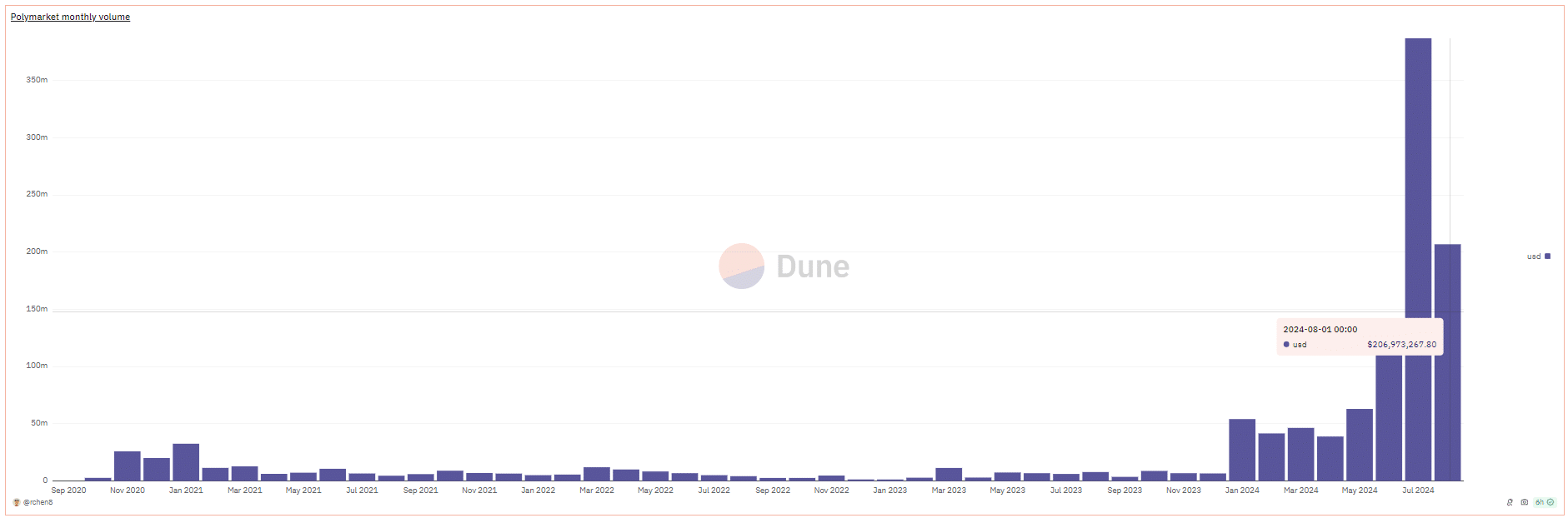

Monthly Volume |

$387 million |

$24 million |

Why Polymarket Stands Out in 2024

In 2024, Polymarket has firmly established itself as a leader in the prediction market space. But what exactly makes it so unique this year? Several factors set Polymarket apart, from its innovative use of technology to its engagement with major global events.

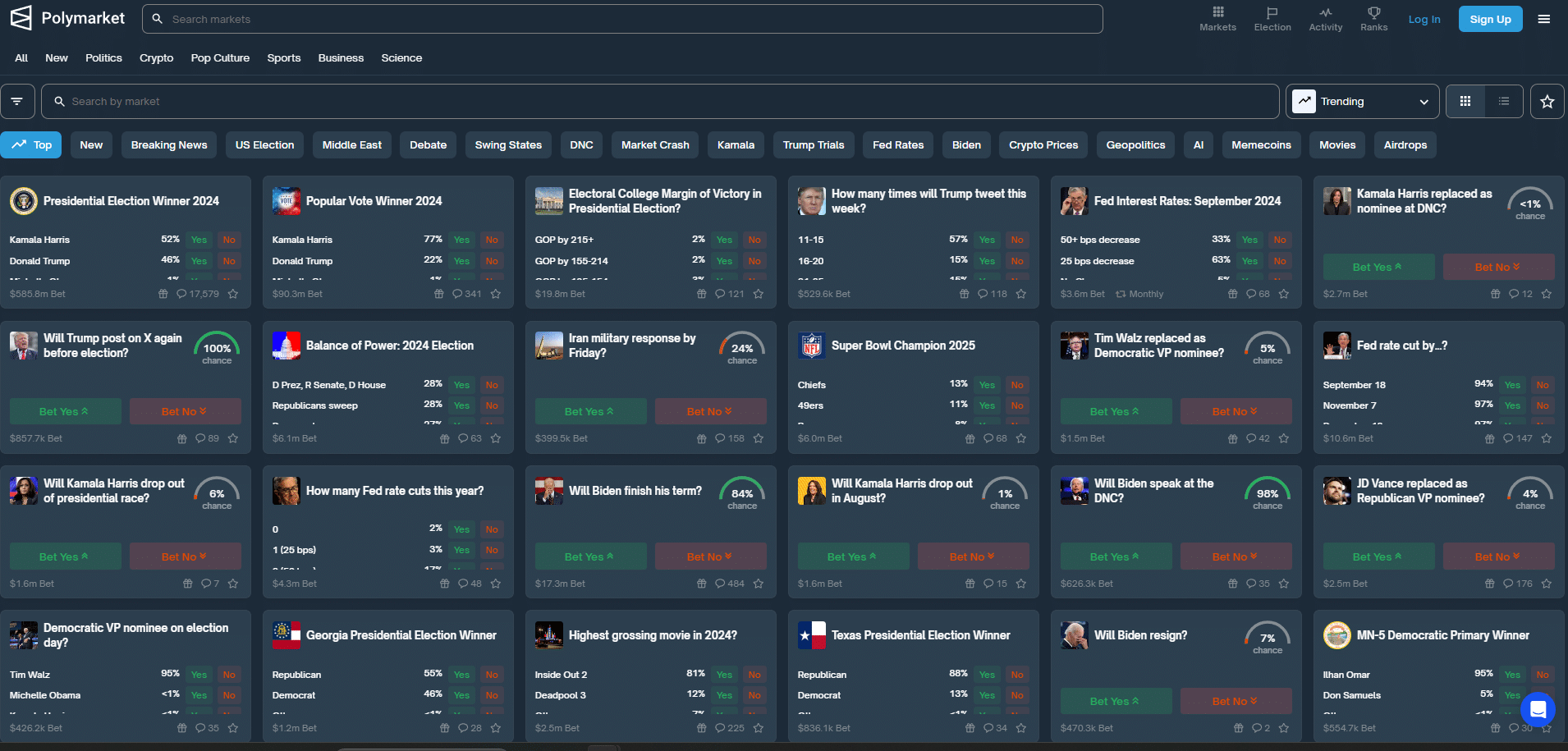

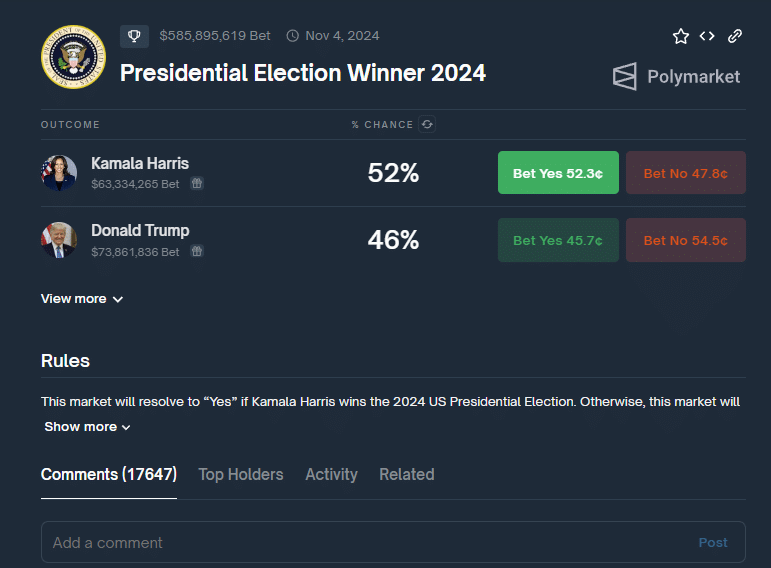

Polymarket and the US Elections

The 2024 Presidential Elections have been a major focus for prediction markets, and Polymarket has emerged as a key platform for users to stake their predictions on this pivotal event. As shown in the image, Polymarket’s Presidential Election Winner in 2024 has already attracted over $580 million in trading volume, highlighting just how significant and engaged this market is.

Key candidates like Kamala Harris and Donald Trump are driving substantial interest, with over $61 million bet on Harris and $72 million on Trump. These figures underscore the scale of Polymarket’s influence in capturing real-time sentiment and translating it into market prices. For example, Harris currently leads with a 52% chance, while Trump follows closely with 46%, reflecting the intense competition and the divided public opinion as the election approaches.

Polymarket’s ability to handle such large volumes of transactions with low fees, fast processing times, and a user-friendly interface makes it a go-to platform for those looking to make informed predictions on one of the most consequential elections in recent history. The sheer size and activity in these markets are a testament to Polymarket’s growing role in shaping and reflecting public sentiment. Politics have become a mainstay of Polymarket, you can learn more about the top political memecoin in our article on the Best PoliFi Tokens.

Global Reach and Market Diversity

Polymarket’s global reach is another factor that sets it apart in 2024. Unlike many traditional prediction platforms that may be limited by geographic boundaries, Polymarket operates on a decentralized network, allowing users from all over the world to participate. This has led to a rich diversity of markets covering everything from global political events to niche cultural phenomena.

Moreover, Polymarket’s commitment to inclusivity means that markets are not just limited to English-speaking users. The platform supports multiple languages and caters to a diverse global audience, making it accessible to a broader user base.

Polymarket Review: Conclusion

In 2024, it’s clear that Polymarket has carved out its niche, blending cutting-edge technology with a user-centric approach that makes prediction markets accessible to all. Whether you’re betting on the outcome of the US Elections or exploring the countless other markets available, Polymarket offers an unparalleled experience that’s both intuitive and efficient.

But let’s be real—what truly sets Polymarket apart is its commitment to decentralization and transparency. In a world where trust is often in short supply, Polymarket delivers a platform where the power lies firmly in the hands of its users. No middlemen, no gatekeepers—just you, the market, and your predictions. And with the added benefits of low fees, fast transactions, and a growing global community, Polymarket is more than just a tool; it’s the future of prediction markets.

See Also:

Frequently Asked Questions

Is Polymarket Legal in the United States?

How Do I Withdraw My Earnings from Polymarket?

Can I Use Polymarket if I’m New to Crypto?

What Happens if a Prediction Market is Cancelled or Resolved Incorrectly?

References:

- Polymarket. “Fees.” Polymarket Documentation. Polymarket, n.d. Web. https://docs.polymarket.com/#fees.

- Polymarket. “Learn Polymarket.” Polymarket, n.d. Web. https://learn.polymarket.com/.

- Polygon Technology. “Proof of Stake (PoS).” Polygon Documentation, Polygon, n.d. Web. https://docs.polygon.technology/pos/.

- Rchen8. “Polymarket.” Dune Analytics, n.d. Web. https://dune.com/rchen8/polymarket.

- Wilson Center. “Understanding Ethereum’s Layer 1 and Layer 2: Differences, Adoption, and Drawbacks.” Wilson Center, n.d. Web. https://www.wilsoncenter.org/article/understanding-ethereums-layer-1-and-layer-2-differences-adoption-and-drawbacks.