There is a wave of optimism pushing across the Bitcoin and crypto markets. Indeed, after early yesterday’s contraction, bulls quickly loaded the dips, realigning prices back to green. Though the $66,000 Bitcoin price remains to be breached, this week’s events, including around spot Bitcoin ETF issuers like Blackrock, are setting up what could possibly be an explosive close above this local liquidation line.

Thus far, there are primers.

Spot Bitcoin ETF Issuers Scooping BTC En Masse

As bulls defy expectations and remain resilient in the face of sell-off fears primarily due to Mt. Gox coin distribution, it seems like whales are taking advantage of this expected impact (and FUD).

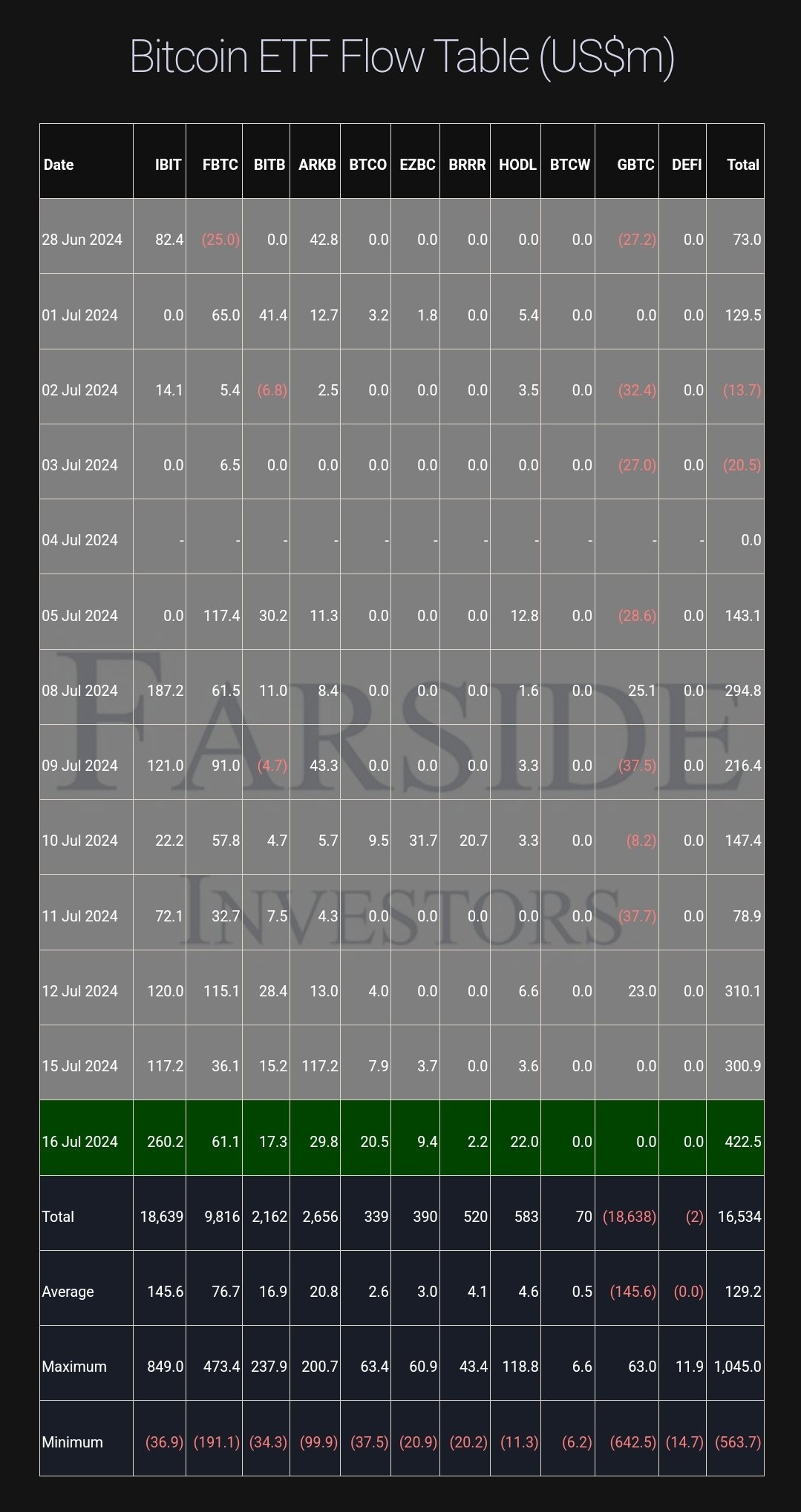

According to on-chain trackers, leading spot Bitcoin ETF issuers have been actively buying. Yesterday, they cumulatively bought a staggering $422 million of BTC for their clients.

BlackRock, Fidelity, and Ark Invest spearheaded the buying spree. There were activity from VanEck and Invesco.

And this was largely expected.

As seen over the months, especially after the approval of spot Bitcoin ETFs in January, issuers like Blackrock have been scooping more coins from the markets whenever prices rise, pointing to a demand.

Conversely, when prices dump, there are massive outflows; impacting sentiment and accelerating the sell-off.

With renewed buying pressure from the big boys, the Bitcoin price remains resilient above $60,000, and the uptrend remains.

Technically, the close above the dynamic support line marked by the 20-day moving average was crucial. As long as bulls double down, BTC could extend gains in the sessions ahead, breaching $66,000 and even $72,000.

BTC Must Maintain $62,500 For All-Time Highs to Be Breached

The rally would, in turn, soak possible selling pressure from Mt. Gox victims who might be inclined to sell.

Latest reports show that Kraken, a top crypto exchange, will repay Mt. Gox victims within the next two weeks.

Additionally, another report suggests that at least 65% of creditors, primarily victims, have been reimbursed.

That prices are rising and most victims are receiving compensation could mean the market has successfully mitigated their impact.

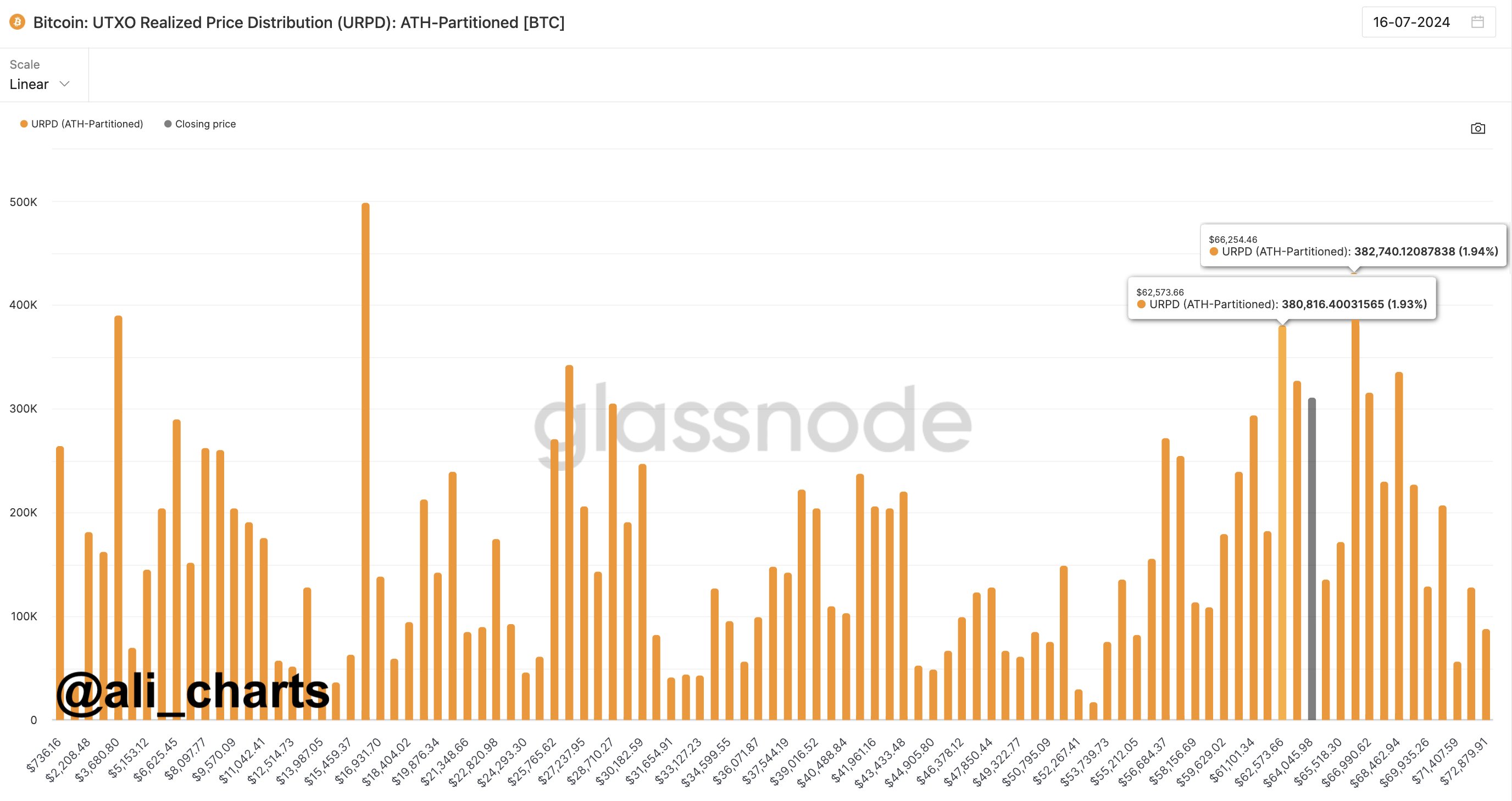

Even so, assuming there is a dump in the session ahead, some traders maintain that prices must stay above $62,500 if buyers stand a chance to breach $72,000 and all-time highs.

At this level, short-term holders (STHs), that is, entities who bought BTC within the last 155 days, will be in break even and in the money whenever prices edge higher.

Any drop below this line might force some STH holders to exit, forcing prices lower.

EXPLORE: Aftermath Of Donald Trump Assassination Attempt – MAGA is Pumping And Check Out This Presale

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.