Less than a week after Ethereum (ETH) developers released the Dencun Upgrade on the main net, on-chain data points to a sharp boom in layer-2 blockchain activity. According to trackers, there are now over 4.6 million active addresses in the last week alone, up from around 3.5 million before the Dencun Upgrade.

The number of active addresses is a valuable metric for gauging on-chain activity, with ecosystem growth represented by inactive wallets ‘waking up’ and new wallets being created by new users.

For context, an active address, as in the case above, refers to a wallet address that has either received or sent tokens in the past week.

Following Dencun, more users are willing to transact on the network, especially across layer-2’s which now boasts almost free gas fees.

Layer-2 On-chain Activity Spikes After Ethereum Dencun Upgrade

The Dencun Upgrade, an amalgamation of two separate upgrades — Deneb and Cancun, implemented the EIP-4844 proposal and forms the latest hard fork of many activated by Ethereum developers to address scalability challenges EIP-4844 proposals.

Via the Dencun Upgrade, a new concept of “blobs,” which enable the storage of specific transaction data off-chain, was introduced.

📈 New RECORDS in #Ethereum's L2 ecosystem🚀

4.6 MILLION weekly active addresses on #ETH L2s!

Props to the revolutionary Dencun Upgrade.

This is not a small step, it is a quantum leap for the entire Ethereum universe! pic.twitter.com/SnucFbBbuZ

— Leon Waidmann | On-Chain Insights🔍 (@LeonWaidmann) March 18, 2024

This model, which creates a new transaction type and fee, allows implementing layer-2 operators like Optimism and Base to reduce gas fees.

All this is while maintaining the security advantages afforded by the huge network of validators underpinning the Ethereum mainnet.

Will Dencun Give Ethereum Edge Over Solana?

It remains to be seen whether this on-chain activity spike will persist, what’s clear is that the crypto community appears confident in layer-2 platforms and their competitive edge or symbiotic advantage with Ethereum.

More protocols, especially meme coin projects, have been deploying on Solana than ever before – the competitor platform offers lower gas fees and is more scalable than Ethereum.

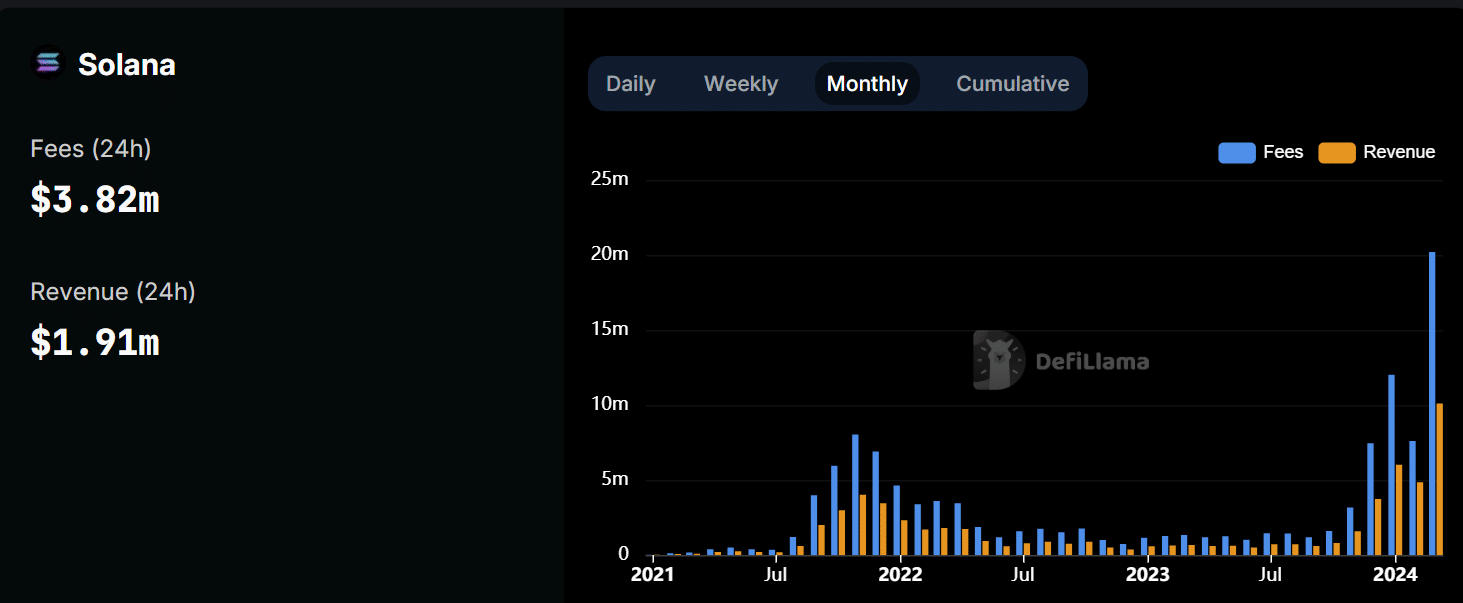

Over the weekend, the spike in Solana on-chain activity saw the network generate over $3.8 million in fees, up nearly 7.5x in the past month.

Out of this, Solana-based decentralized exchanges generated over $3.8 billion in trading volume, up 430% in the previous month.

Solana network activity is currently shattering all-time highs in many different areas. Daily network fees are now at $3.8M, a new record and up 754% on the month. Meanwhile, daily DEX trading volumes are over $3.8B, also a new record and up 430% on the month.

In terms of users,… pic.twitter.com/tfiCLdClr6

— David Alexander II (@Mega_Fund) March 17, 2024

However, with concerns about centralization in Solana, some argue that Dencun will play a pivotal role in increasing the adoption of layer-2 options and, indirectly, Ethereum (ETH).

Explore: 7 BEST Meme Coins to Buy NOW – What is the NEXT SHIBA INU?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Exciting to see the Dencun Upgrade catalyzing a surge in layer-2 blockchain activity, as highlighted in your article. At Pinax, having contributed to the EIP-4844 implementation, we’re keenly observing its real-world impact. How do you and your readers feel about the upgrade so far? Has it lived up to the community’s expectations in terms of scalability and cost-efficiency improvements? We’d love to hear your thoughts and share our insights on the transformative potential of these advancements for Ethereum’s ecosystem. – The Pinax Team