Money is fake, especially nowadays with non-sound money. A 1970 minimum wage worker would make $45/hr based on inflation. While that’s upsetting, what should comfort you is that the US CPI (Consumer Price Index) was below expectations for June. But what does inflation mean for Bitcoin and cryptocurrency in general?

A slight uptick of 0.06% in prices marked the slowest core inflation increase since January 2021.

The U.S. Bureau of Labor Statistics reports core inflation at 3.3% annually, with decreased shelter inflation playing a key role in the subdued trend.

So. how will this impact Bitcoin, cryptocurrency, and risk assets? We’re about to tell you.

US CPI Data: This is When the Fed Rate Cut Expectations and Economic Outlook

The recent employment data, the declining ratio of job vacancies to unemployed workers, and low inflation are bolstering the Federal Reserve’s confidence to wrangle in the economy. In other words, the expected rate cuts for September are back on the menu boys.

Speculations even suggest a larger cut than anticipated by our 99Bitcoin’s analysts.

Ed Yardeni on CNBC: The market is pricing in 5 interest rate cuts over the next 12 months. It is a good sign that the market is broadening out to include small caps, rather than a melt up (tech stocks) that would be followed by a melt down.

— David Kass (@DrDavidKass) July 17, 2024

With the labor market cooling and immigration shifts affecting housing, reaching the Fed’s 2% inflation goal seems more feasible.

Really, the most important part of June’s Consumer Price Index report is a slowdown in shelter inflation, notably in rent prices. I don’t feel that at all here in New York City, but apparently it is true,

When Will Your Crypto Bags Pump?

Here’s how to understand crypto in relation to inflation (oh, that rhymes):

Step 1: Understand the value of gold (vs fiat)

- Store of values like gold must have their place in your portfolio to counter inflation (the government can print all the money it wants)

Step 2: Imagine getting on a plane to leave the country with a bag full of gold

And that’s it. If you understand these two points, the intrinsic value/use case of crypto is immediately crystal clear vs. perpetual U.S. inflation.

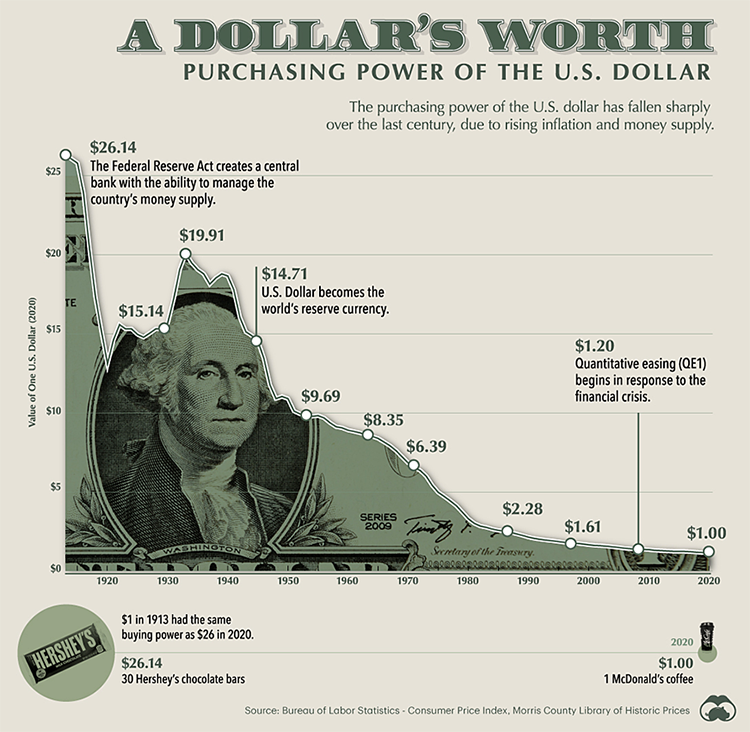

Central banks cause inflation. Inflation will continue to rise until central banks start settling their debt because inflation is when “dollars”/bank credit are created, which happens any time someone accepts a loan, uses a credit card, or gets paid for work.

The Federal Reserve has raised interest rates in the hopes that it will discourage borrowing and lending and slow down the rate at which funds are created.

Now that the economy is breaking or slowing, it is time for them to cut back again.

If the economy slows for one more month in August, Fed rates are sure to be cut in September. That’s when cryptocurrency will pump like mad.

EXPLORE: BlackRock CEO Recognizes Bitcoin As “Digital Gold,” Admits He Was Wrong

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.