Ethereum’s price is down at spot rates, , but one analyst thinks BlackRock, Coinbase, and other on-chain developments will push it higher.

When Ethereum first launched, it was trading for cents. No one knew it would evolve to be what its founders intended: A global computer.

Fast-forward ten years later, the network is the top smart contracts platform, allowing users to deploy smart contracts.

Those who got in early, buying the coin for cents, are now in the millionaire category.

$ETH Has seen a pretty brutal August so far. At some point it was down -35% earlier this month.

August has generally been a very volatile month for ETH.

Q3/Q4 is usually pretty slow for ETH but of course this is no guarantee for the future so let's see. pic.twitter.com/NAHfZMuzNQ

— Daan Crypto Trades (@DaanCrypto) August 20, 2024

Ethereum is Down, But Analysts Remain Upbeat and Bullish

However, at press time, Ethereum is nearly -50% down from all-time highs but over 1000X from all-time lows.

The problem is that traders are anxious, unsure whether the uptrend will continue or whether the bears of 2022 will flow back and ravage the markets.

Amid this state of affairs, there is a growing chorus from optimistic analysts that the drawdown is but a short-term development. The lull, in their view, precedes another sharp leg up.

This is not the first time this has happened. If anything, the crypto market, not just ETH, is volatile. In some instances, sharp dips are primers of an unexpected bounce.

Looking at the daily chart, Ethereum is capped below $3,000, and local resistance is found at $2,700.

Notably, prices are trending inside the bear bar of August 5, though the upswing of August 8 and 12 is worth noting.

(ETHUSDT)

Unless there is a breakout above $2,700, reversing all losses of August 5, the coin remains in bearish territory.

A push lower toward the $2,100 level may see an ETH crash, even confirming the breakout of early August.

Nonetheless, optimism is high primarily because of the following.

ETH Supply Crunch: What Does This Mean?

One analyst on X thinks the rapidly falling supply of ETH on top exchanges will lead to a supply crunch.

Of note, the ETH balance on exchanges is down below 10% for the first time. The massive withdrawals of ETH across these ramps mean it is following trends seen in Bitcoin.

The more users pull coins from exchanges, the higher the probability of prices rising since analysts tend to interpret the move as bullish.

BlackRock Factor And Rapid Scaling

Beyond the development of the supply crisis, Ethereum is backed by top asset managers and tech companies.

BlackRock, the analyst added, is keen on adding more products on Ethereum.

Thus far, they are the issuers of a spot Ethereum ETF and manage over $5 billion worth of assets.

Additionally, their CEO, Larry Fink, is bullish on tokenization, believing it would soon command trillions in valuation in the coming years.

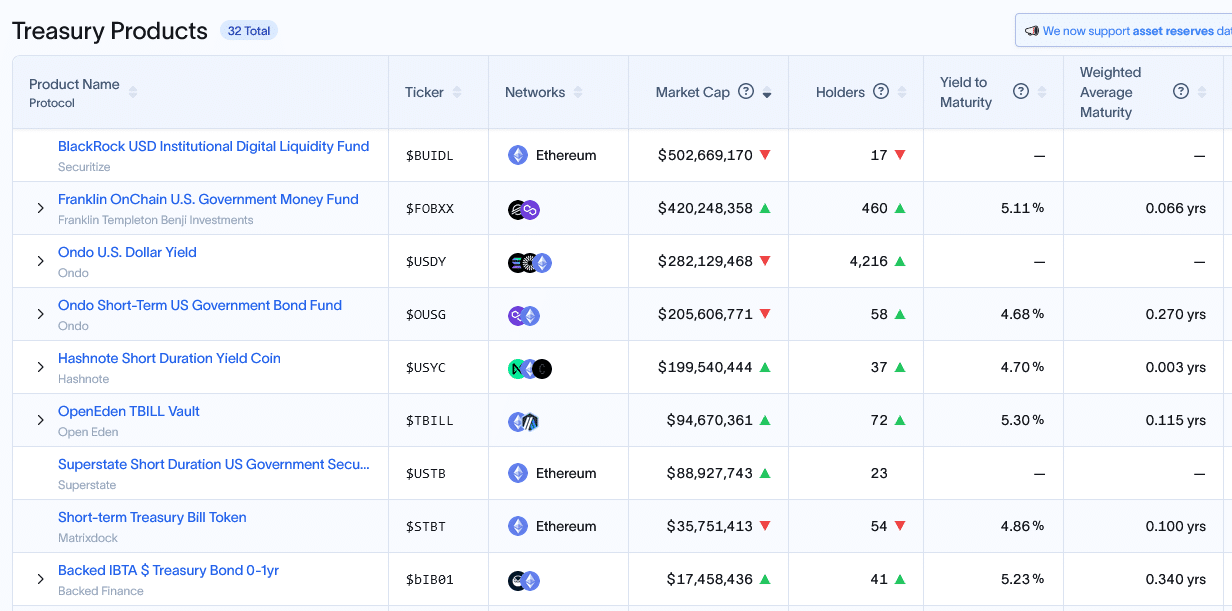

Thus far, BlackRock has tokenized United States Treasuries, launching BUIDL, one of the largest such products in the world.

(Source)

Beyond BlackRock, Coinbase is also ramping up development, looking to build out from Base, their layer-2 scaling solution for Ethereum.

By integrating a smart wallet that permits account abstraction, Coinbase developers effectively make Ethereum more accessible to the ordinary user. This will allow them to transact cheaply, helping drive mass adoption.

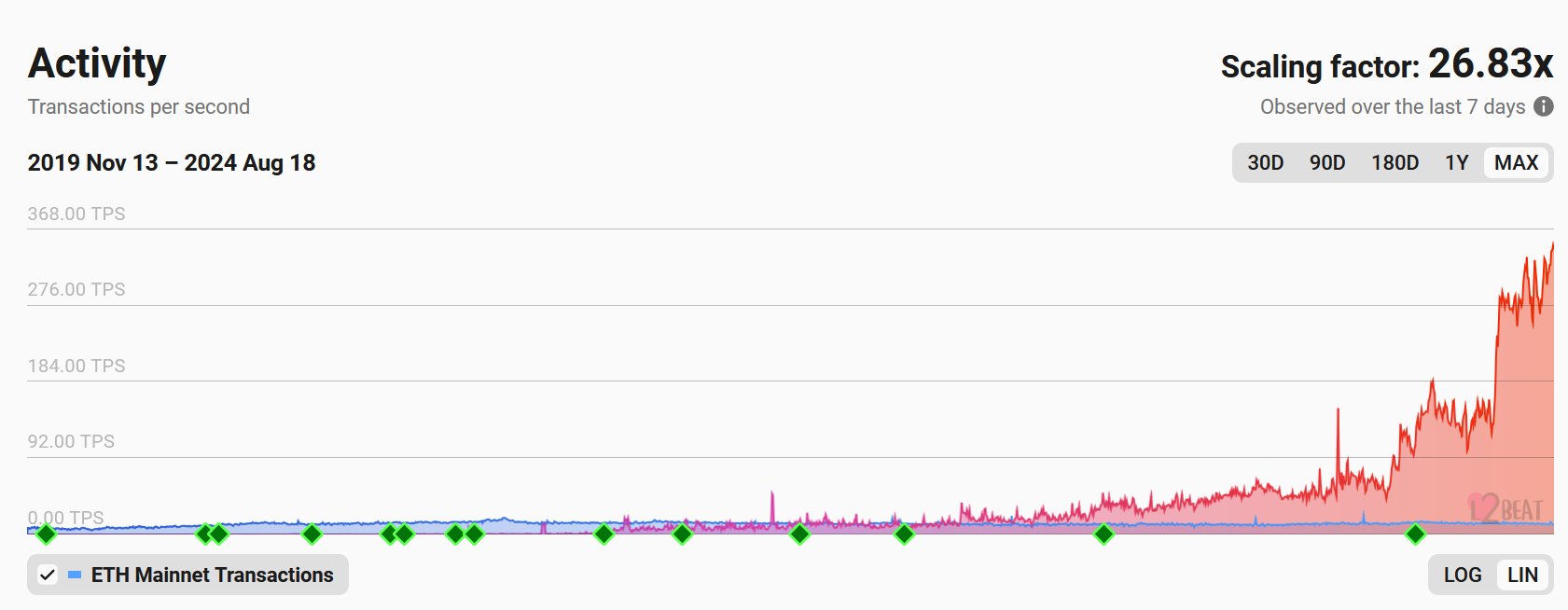

Already, Ethereum seems to be scaling, permitting users to engage while being highly reliable and secure.

The broader Ethereum ecosystem, including layer-2s like Arbitrum and Base, is scaling at record levels, reaching nearly 27X as of August 19. This means the platform is finding use and expanding its user base.

DISCOVER: Next 1000x Crypto – 17 Coins That Could 1,000x in 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.