How to Earn Interest on Crypto

If you’re holding cryptocurrency as a long-term investment, you may have thought about using it to generate a return. In this post, I’ll explain how you can earn interest on your crypto and how each method works.

How to Earn Interest on Crypto Summary

There are several ways you can make money with crypto. For those already holding crypto for the long term, you may want to consider earning a return on those holdings via staking, crypto interest accounts, DeFi, and yield farming. Finally, it’s important to research each method properly before putting any of your crypto to work.

Don’t like to read? Watch our video instead:

That’s how to earn interest on crypto in a nutshell. For a full explanation of each of these methods, keep on reading. Here’s what I’ll cover:

- Staking Cryptocurrencies

- Crypto Savings Account

- DeFi and Yield Farming

- Getting Started with Earning Interest

- Important Things to Consider Before Investing

- Conclusion

1. Staking Cryptocurrencies

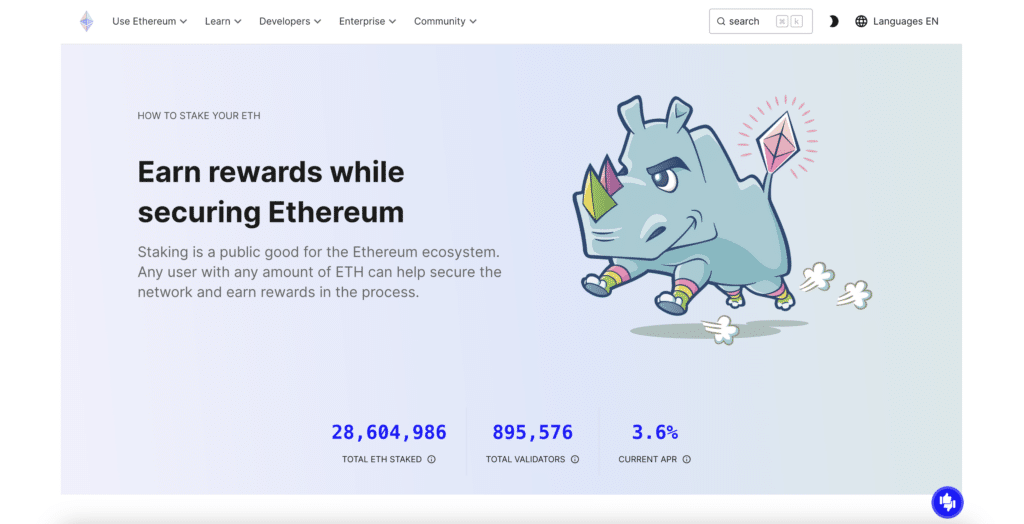

Put simply, staking is the action of locking up or “parking” a portion of your cryptocurrency coins for a period of time in order to help run and maintain a specific network. These networks are generally Proof-of-Stake (PoS) blockchains such as Ethereum 2.0, Cardano, Cosmos, Solana, and Polkadot.

In return for locking your coins to help maintain the network, a staking reward is distributed in the form of interest. The annual interest rate, in the form of either APR or APY, varies a lot between coins and can range anywhere from 0.05% to 100%+ per year. The Ethereum.org website is one good resource for information.

A higher interest rate often means additional risks, so you’ll want to research before deciding which coin you’ll want to stake.

Another important aspect of staking is that each coin has different rules. For example, different coins and platforms have requirements for how long you need to lock up your coins. There are platforms that do not impose lock-up requirements. Certain coins require long periods, while others allow for short periods. There is also the aspect of unstaking, which, in some cases, can take hours, days, or even weeks for your coins to be returned to you.

While staking can be done directly from your computer without the need for any dedicated equipment, this process is fairly technical, has a lot of limitations, and isn’t advised for beginners. The easiest way for a beginner to stake would be through an exchange or a wallet.

Most popular exchanges like Kraken, Bitstamp, Binance, and Coinbase allow you to stake a variety of coins. Rocket Pool is another popular choice. Aside from the ease of use of staking on an exchange, the minimum amount to stake will usually be fairly low, and in some cases, there won’t even be a minimum lock-up period. Always do your research before committing to stake your coins somewhere so you don’t accidentally find them locked up longer than you expected.

On the downside, when you’re staking on an exchange, you’re giving up control of your funds to the exchange. This means that your funds are at risk if the exchange gets hacked or goes out of business. Additionally, most exchanges charge a fee for providing their staking services.

A good alternative for people who don’t want to give control over their funds would be to stake through a wallet. There are a number of staking wallets: Ledger, Exodus, Trust Wallet, and Atomic Wallet, just to name a few.

Make sure you take a look at what fees each wallet charges: you may find some that don’t charge any staking fees at all. Remember that in most cases, wallets will offer a smaller variety of coins they make available for staking.

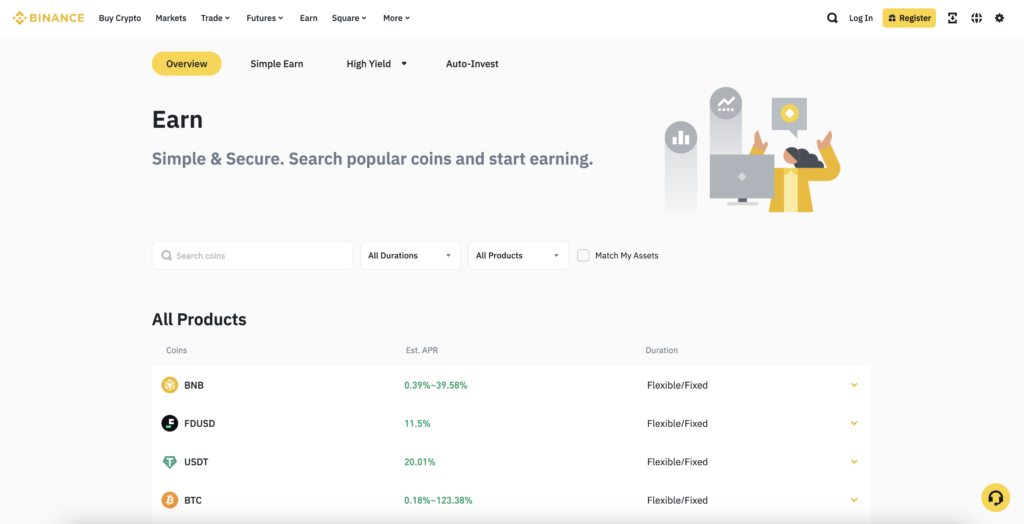

2. Crypto Savings Account

The next option for generating interest on your crypto holdings is through a crypto savings account. A crypto savings account is an account provided by a centralized company that agrees to pay you interest for holding your crypto on their platform. The company can then use your deposit to pay lenders who will return it in time with interest.

Again, the downside is that you’ll have to give up control over your funds. On the upside, however, there is usually no lockup period for a savings account, and it’s a good alternative for coins that don’t support staking, such as Bitcoin. You will need to look at other methods if you want to earn free Bitcoin.

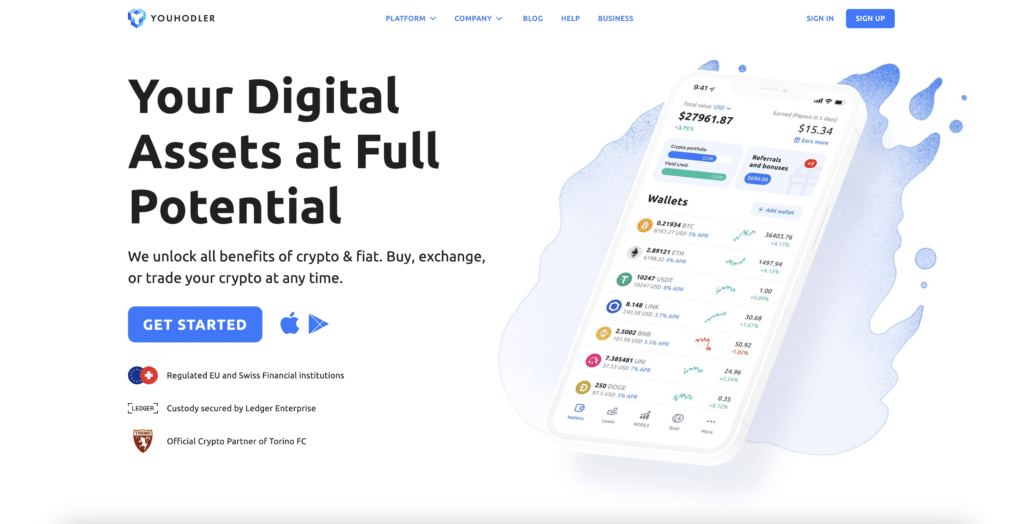

Some of the more popular companies that allow for a savings account are YouHodler and Nexo. Many exchanges, such as Binance, KuCoin, Coinbase, Gemini, and CEX.IO, allow you to have a savings account as well.

Again, you’ll need to do your research regarding how much interest you can get for each coin and what fees you’ll be charged. Remember that high interest rates usually signal some form of increased risk, whether it’s a new, untested coin or a less reputable company – so don’t just blindly choose the highest return possible.

3. DeFi and Yield Farming

Finally, we come to our most complicated option, which is DeFi. DeFi stands for Decentralized Finance – a term given to financial services that aren’t controlled by a central authority but by a network of independent computers using predefined rules.

Many decentralized services allow you to lock up your holdings and earn interest in return. The locked-up funds can be used for different purposes, such as lending, staking, supplying liquidity to decentralized exchanges, and farming.

It would be impossible to cover the whole theory behind all of this here, so suffice it to say that in return for the interest you’re receiving, your funds will be used for other purposes while they are locked up.

Let’s go over some of the more reputable DeFi services that are worth checking out:

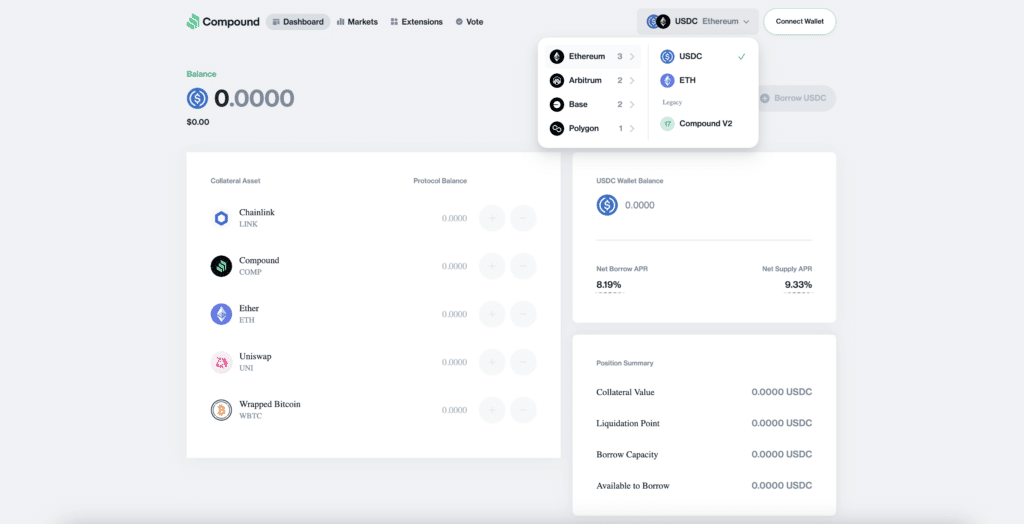

Aave and Compound

Aave and Compound are two leading DeFi networks that allow for decentralized borrowing and lending. You can earn interest on your crypto holdings by depositing any of the supported coins to their platform.

Uniswap

Uniswap is a leading decentralized exchange that we’ve covered in depth in our “What is Uniswap?” post. By providing liquidity to Uniswap, you can earn interest on your holdings. This comes from the fees that traders pay to use the protocol, part of which is distributed to liquidity providers.

Yearn Finance

Yearn Finance is a yield optimizer for maximizing DeFi returns by automatically switching your holdings between DeFi networks, so you don’t have to manually look for where you can get the most returns at any given moment.

It works by depositing stablecoins, cryptocurrencies that have a constant value, into the Yearn network and receiving Yearn tokens in return. For example, if you deposit the stablecoin DAI to the Yearn network, you receive yDAI in return.

These tokens then start accumulating interest as your deposited funds are constantly moved around to maximize returns. Whenever you wish to cash out, you can just trade your yDAI back to your original DAI stablecoin.

Aside from simply depositing coins to a limited range of lending protocols, Yearn also supplies an advanced service called “Vaults,” which manages the funds with more complex and somewhat riskier strategies.

Vaults are an actively managed deposit. Money placed in vaults can be used for trading, borrowing, or supplying liquidity. Vaults also support a wider variety of coins than the standard Yearn service.

DeFi Downsides

While the DeFi space holds a lot of opportunities to earn interest, it’s not without its downsides.

First, earning interest with DeFi usually works through using specific coins that support the network you’re looking to use. This means that, in some cases, you’ll need to convert your holdings into a different type of coin.

Additionally, decentralized services are usually much less intuitive for the average user and can require that you understand some additional technical jargon. Therefore, we advise using them only after doing extensive research and understanding how the service works completely.

If you’re not sure exactly what you’re doing, you may want to use a centralized service that will allow you the same functionality and yield through an easier interface.

Finally, DeFi is an emerging technology, and just like with any new technology, there is always the risk that there are bugs or flaws in the programming. Millions of dollars have already been lost in DeFi, especially in the early stages, but it is still a somewhat emerging area of cryptocurrency.

The DeFi subreddit maintains a complete list of helpful projects, guides, and resources. You can find a lot of information about DeFi there. You can also post and ask questions. Or browse through and read other users’ questions and the answers they received.

Note: When dealing with any crypto forum (like Reddit), be aware of scammers: anyone messaging you privately or asking you to reveal anything about your seed phrases or private keys.

4. Getting Started with Earning Interest

By now, you might be totally confused by the endless options available for generating interest on your crypto, and you’re probably asking – how do I choose where to put my money?

Our first guideline here at 99Bitcoins is always “Better safe than sorry.” This means that because crypto is still such a new and exciting but also risky space, we always try to minimize this risk as much as possible.

This means that we won’t lock up an amount we can’t afford to lose or that we need to have available at hand. A good rule of thumb for us is to use 10% of our crypto holdings to generate interest.

Of course, this can change depending on your risk tolerance and overall strategy, but if you’re just starting out, this is a good starting point while you get familiar with the options we covered.

Additionally, it’s always about what currency we’re looking to keep on holding and not how much interest we can make. This means that if we hold BTC, we won’t convert it to another currency in order to generate higher interest. Instead, we’ll look for a service that allows us to generate interest on our BTC.

5. Important Things to Consider Before Investing

First, take a look at the company or network supplying the service. Perhaps there’s a specific coin that you really like and want to support its network; therefore, staking that coin makes the most sense to you.

Additionally, check to see if the company you’re planning to use is centralized or decentralized. Centralized companies pose the risks of fraud, mismanagement, and theft, while decentralized companies pose technical risks and usually have more complex interfaces that aren’t very beginner-intuitive.

It’s up to you what type of company you prefer, but personally, we believe that simplicity trumps everything else in this case.

Other things to look at are lockup periods, service fees, frequency of interest payouts, minimum lock-up amounts, and, of course, the annual interest rate, either the APR or APY.

Finally, we prefer to lock up funds only in established networks and exchanges that have been running for some time without any major issues. Of course, this usually means a lower interest rate, but as I said earlier, better safe than sorry.

One thing you’ll want to avoid at all costs is crypto HYIPs (high-yield investment programs) and doublers. These are sites that promise unusually high yields or claim to double your coins and pretend to be legit decentralized companies, while in fact, they are just Ponzi schemes in disguise.

If you’re not sure whether or not a company is legit, make sure to take your time when doing your research; never rush into an investment. Ask around in the different community forums and on Reddit. There are several Reddit groups devoted to learning crypto. We linked the DeFi subreddit above. Another good one is Bitcoin Beginners.

6. Conclusion

As we covered above, there are several ways to make passive income over your crypto balance. Non-technical users may find it simplest to deposit crypto into a savings account or stake part of their balance at a crypto exchange like Kraken, Bitstamp, Binance, or Coinbase. Users who are concerned with losing control over their funds can stake their crypto using a crypto wallet such as Ledger or Exodus.

More advanced users can stake using their computer or use DeFi services such as Uniswap to lend for interest; however, using such services requires extensive research and is not without risks, so proper due diligence is required.

For me, the answer has always been to buy and hold, or “HODL,” as crypto enthusiasts would say. This position hasn’t changed – hodling is, in my opinion, the best strategy in the long run. You can definitely make some money while you’re hodling; just make sure you’re not risking more than you can afford to lose.

That’s it for today’s post about how to earn interest on your crypto holdings! Hopefully, by now, you know what options are available, their specific pros and cons, and how to choose the best one for your personal needs.

You may still have some questions. If so, just leave them in the comment section below.

Is there any advantage in a bloke getting serious about bitcoin when he is completely ignorant about it and just a few years off eighty.

To me it seems I might not have enough time left to make a quid if this is a slow drawn-out investment and a whole lot of learning attached to trying to understand the dos and don’ts of the system.

What do you reckon ?

Hello Keith,

Thank you for your question. You raise excellent points. Although we do not give investment advice, here is our take:

a) Yes it is a slow, drawn-out investment. The only advantage Bitcoin (and other big crypto coins) offer is the volatility – some days they can yield 10% or more. However, this is also a disadvantage! It can drop by 10% or more in a day too! So you have to do dollar-cost averaging for a long time, and hope Bitcoin would go to its all-time-high price soon, which is very unpredictable. AND RISKY!

b) Intensive learning – you would need hobby-level knowledge. I suggest you first read about it and understand its value to you or the outside world.

c) Bitcoin is not an investment per se. It is a payment system. The frenzy of buying BTC drove the price up since the 2010’s, but there is no way of telling if it will go up further in the 2020’s. NEVER invest more money than you can afford to lose since investing in any kind of cryptocurrency is a risky business.

So I’m sorry I won’t be able to answer your question directly but perhaps this gave you some initial direction for further investigation.