The best crypto apps offer a secure and user-friendly experience. You’ll be able to trade popular coins on Android/iOS devices, meaning you’re always connected to the crypto markets.

Read on to discover the leading crypto apps for 2024. I rank and review apps based on supported coins, fees, safety, payment methods, and other important factors.

The 10 Best Crypto Apps Ranked

Check out the 10 best crypto apps from the list below:

- eToro – The overall best crypto app for beginners with copy trading tools

- Margex – Top-rated crypto derivatives app offering 100x leverage

- MEXC – Trade thousands of crypto pairs at just 0.1% per slide

- OKX – A great option for decentralized trading with a self-custody wallet

- Kraken – Popular crypto investment app for first-time buyers

- Coinbase – User-friendly crypto app with instant debit/credit card purchases

- Binance – The largest crypto app for trading volume, liquidity, and active users

- Crypto.com – Buy crypto and earn competitive savings account yields

- Robinhood – US-centric brokerage supporting 0% commission crypto trading

- CoinMarketCap – The best app for tracking crypto prices in real-time

Best Crypto Trading Apps Reviewed

I’ll now review the top crypto apps for investors in 2024. While some are ideal for first-time buyers, others offer an advanced suite for experienced traders. Read on to choose the right app for your crypto investing goals.

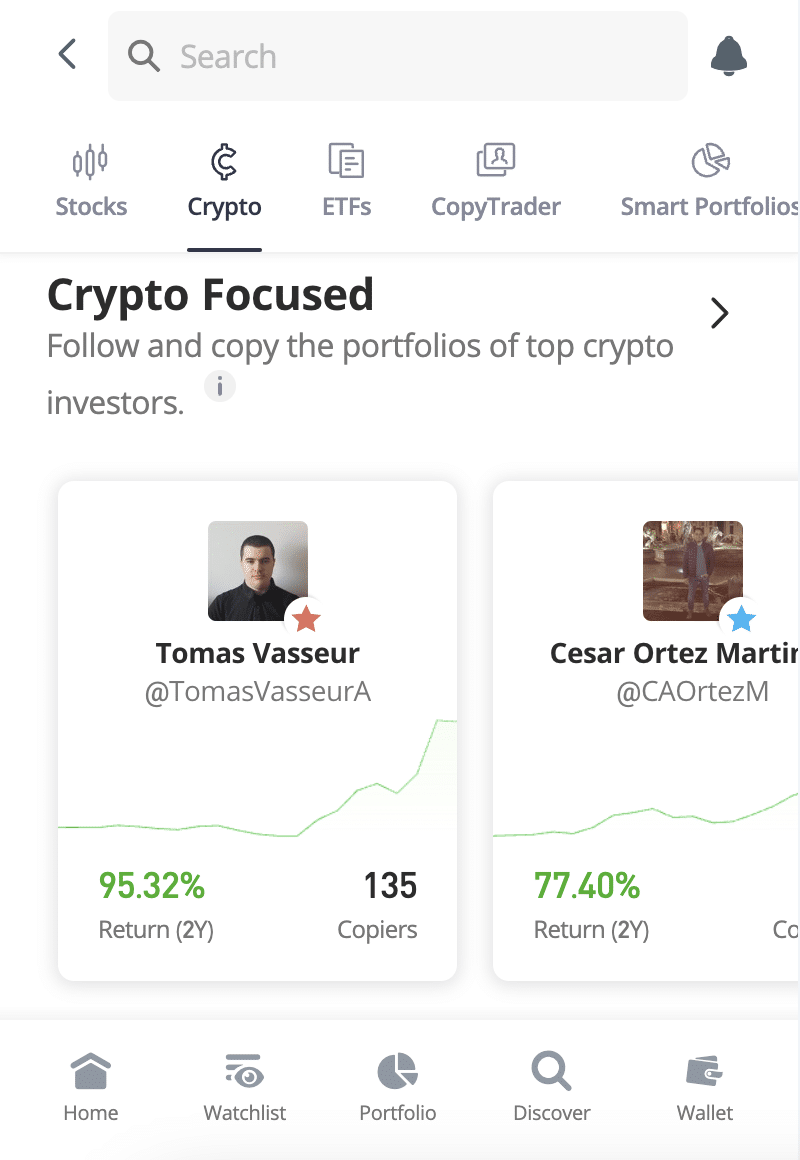

1. eToro – The Overall Best Crypto App for Beginners With Copy Trading Tools

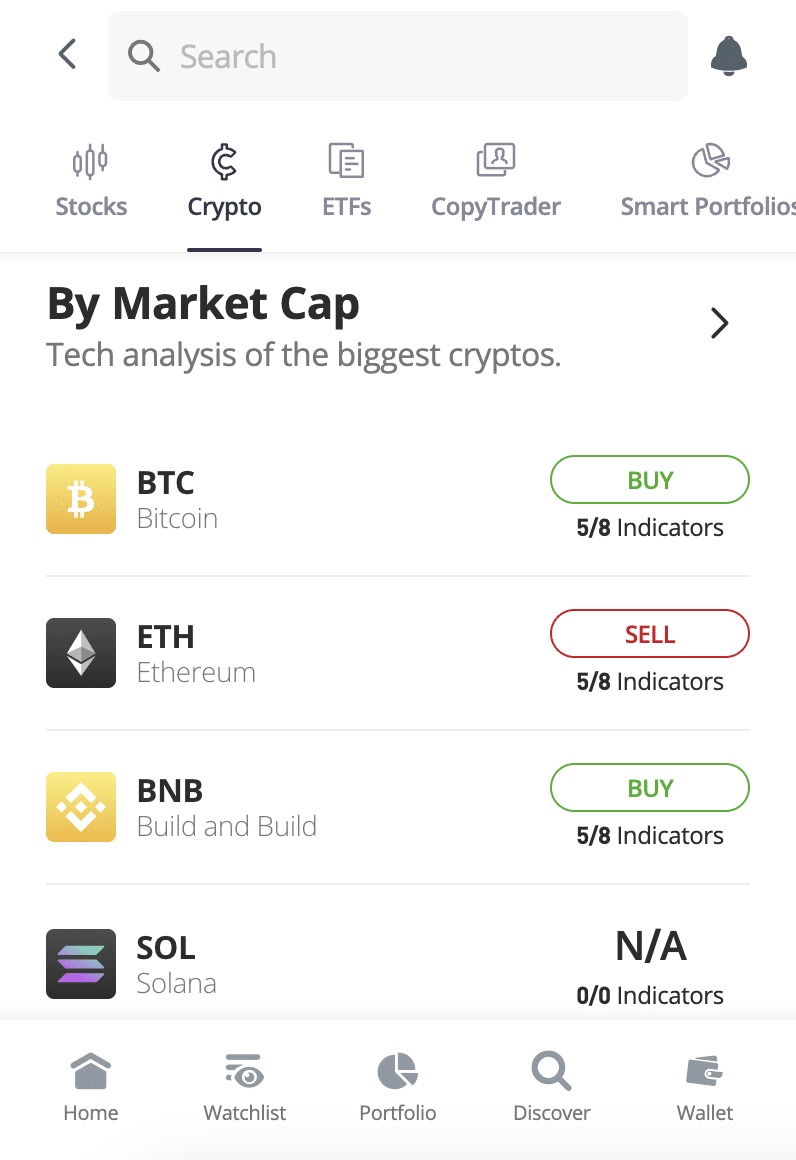

The eToro app is my top pick. Launched in 2007, eToro is a reputable online broker with multiple regulatory licenses. The eToro app, which supports iOS and Android, offers a user-friendly experience. Beginners can easily buy and sell popular coins, such as Bitcoin, Solana, BNB, XRP, Dogecoin, Shiba Inu, and Ethereum.

As a regulated trading app, eToro accepts fiat money deposits. Choose from Visa, MasterCard, PayPal, Skrill, and more. US traders must meet a minimum deposit of $100. Placing an order is seamless; just choose the coin and investment size.

The eToro app also offers a custodial wallet. This keeps your coins safe until you’re ready to sell. eToro also supports copy trading. Select an experienced trader, meet a $200 minimum investment, and copy all of their future positions. Commissions cost 1% at eToro, which is more than many apps. Additionally, there’s a 1.5% minimum FX fee on non-USD payments.

Pros

- One of the best apps to buy Bitcoin

- Also supports the best altcoins

- Holds multiple regulatory licenses

- USD payments are free of charge

- Offers copy trading tools

- Great user experience

Cons

- Crypto trading commissions of 1%

- High FX fees on non-USD deposits

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

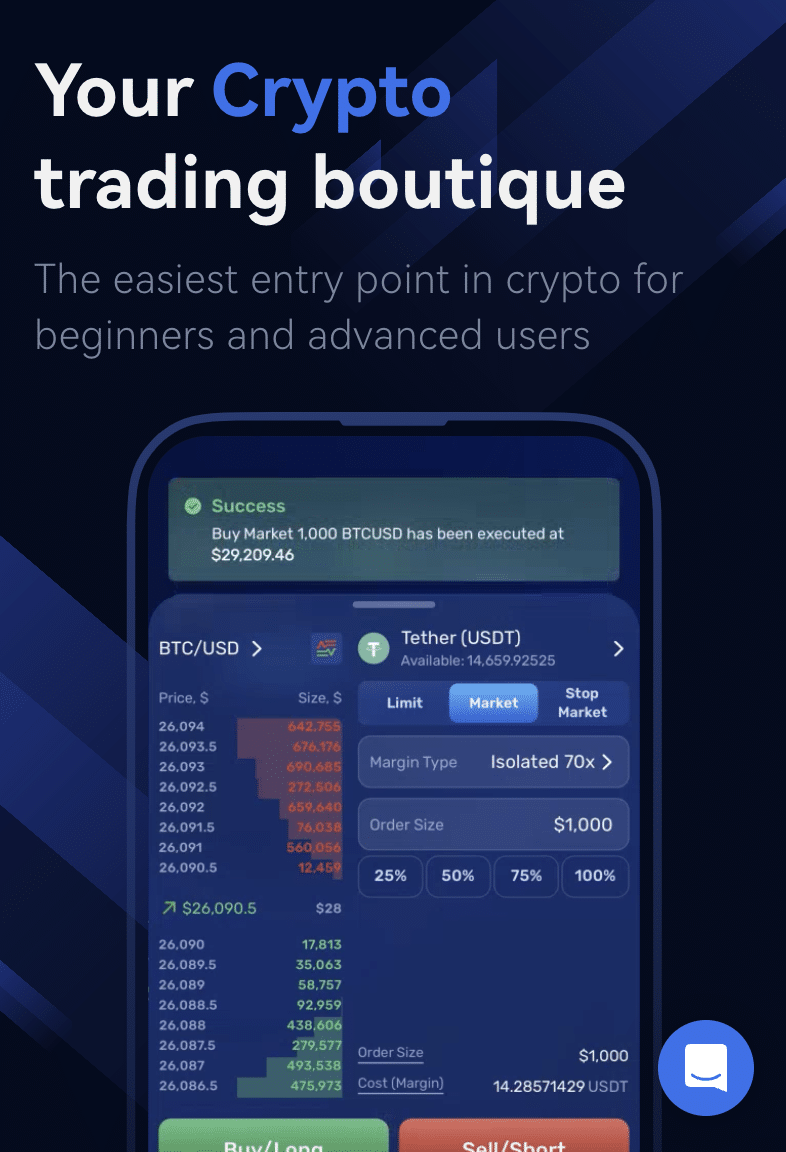

2. Margex – Mobile-Friendly Crypto Derivatives Platform Offering 100x Leverage

Margex is the best crypto app for experienced derivative traders. It offers perpetual futures markets on dozens of coins – each traded against USD. This includes Bitcoin, Cardano, Bitcoin Cash, Solana, Ethereum, Litecoin, and BNB. The benefit of trading perpetual futures is their support for long and short positions.

This enables you to make profits in bullish and bearish cycles. Margex also offers high leverage limits. You’ll get 100x on the largest-cap markets, and 50x or 25x on lower-cap coins. Ensure you understand the risks of leverage trading before proceeding. The Margex app also comes with advanced analysis tools.

For instance, charts and indicators have been optimized for smartphones. The app also offers real-time order books. Trading fees are competitive too; Margex charges commissions of 0.06%. Margex also supports fiat money purchases. Payment methods include Visa, MasterCard, China UnionPay, and SEPA.

Pros

- One of the best apps for crypto trading with leverage

- Pay trading commissions of just 0.06%

- Go long or short on any supported market

- Buy Bitcoin with a credit card

- Also offers staking APYs of up to 5%

Cons

- Only supports perpetual futures

- Doesn’t accept US clients

Be sure to check out our in-depth Margex Review to learn more!

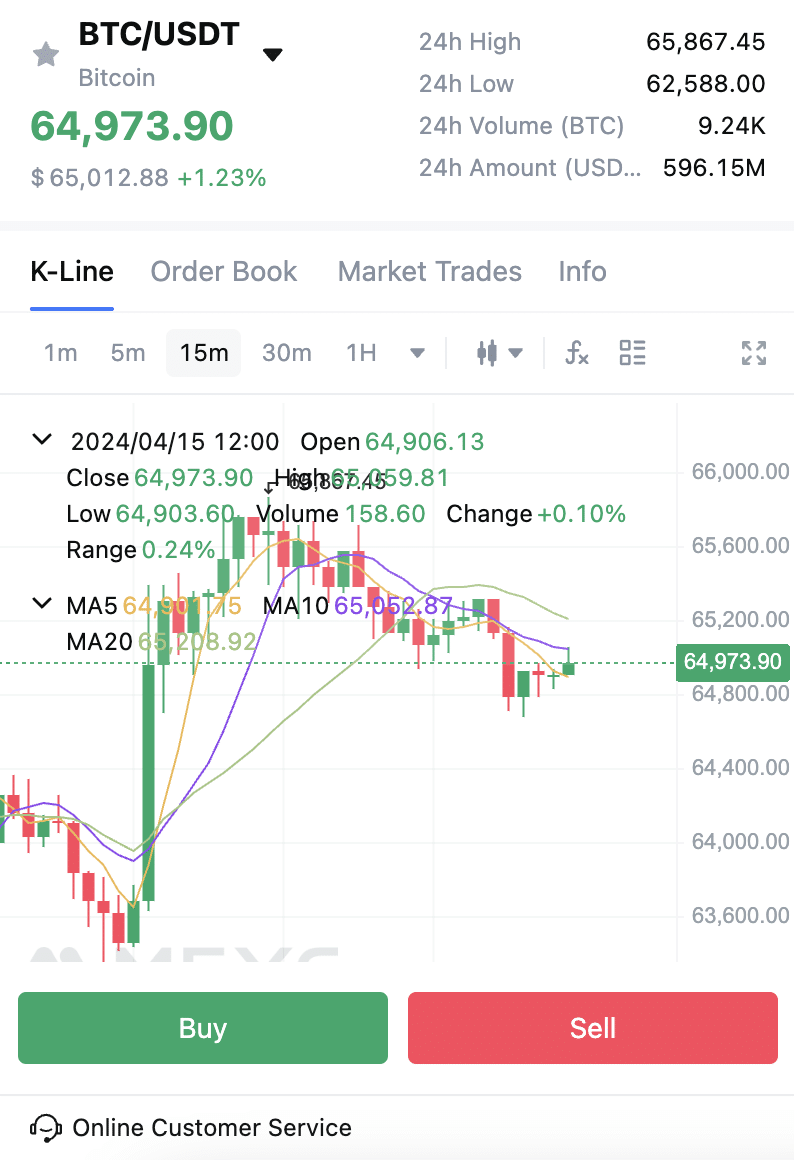

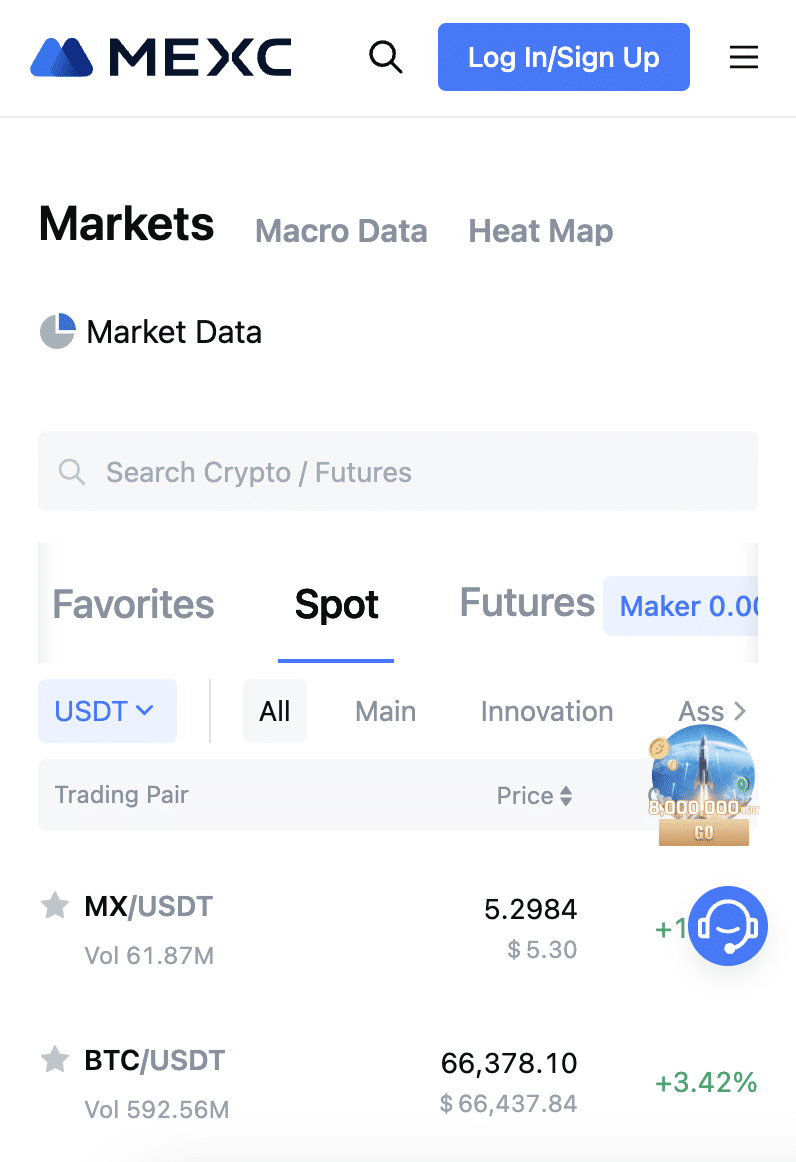

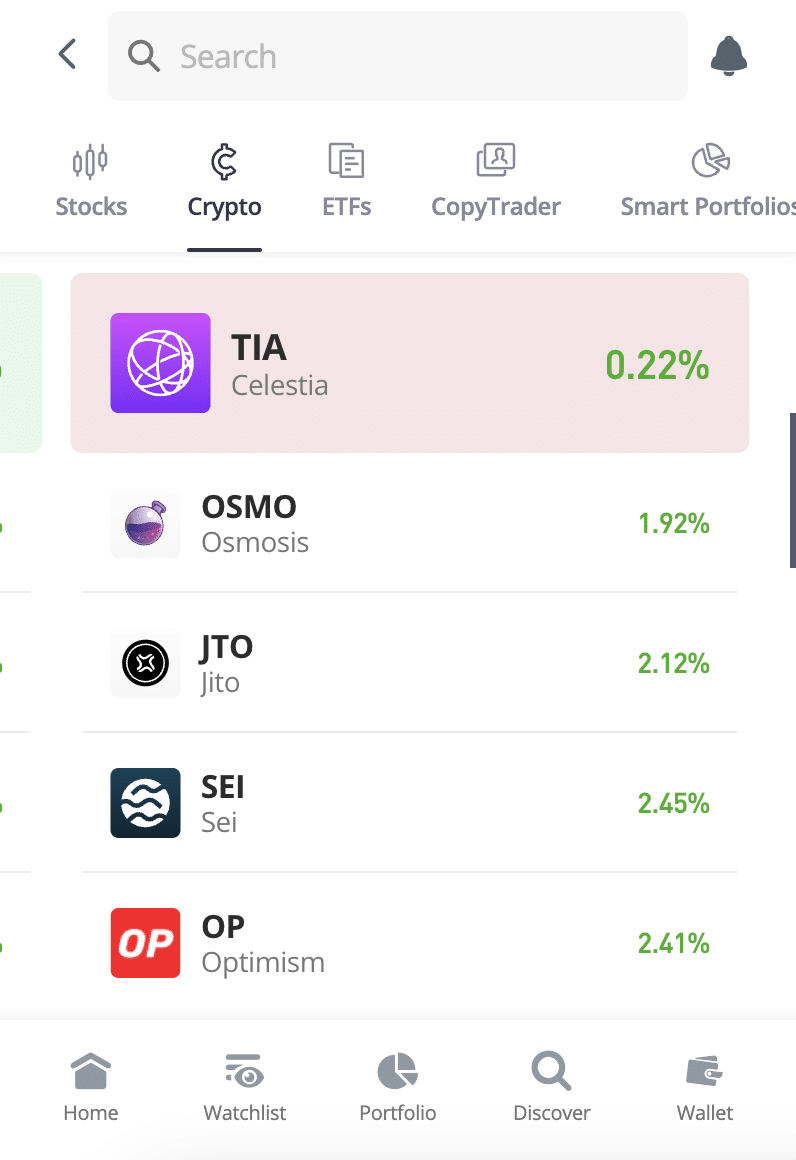

3. MEXC – Trade Thousands of Crypto Pairs at Just 0.1% per Slide

MEXC offers one of the top cryptocurrency apps for market diversity. It lists thousands of tradable pairs, ranging from large-caps like Bitcoin, Ethereum, and Litecoin to new cryptocurrencies with limited trading history. MEXC also benefits from high daily trading volumes and premium liquidity.

The MEXC app is available for iOS and Android. Open an account in seconds by providing an email address or mobile number. You can deposit and withdraw crypto without KYC (limits apply). Each trading market comes with pricing charts, heat maps, order books, and technical indicators. Everything has been optimized for mobile trading.

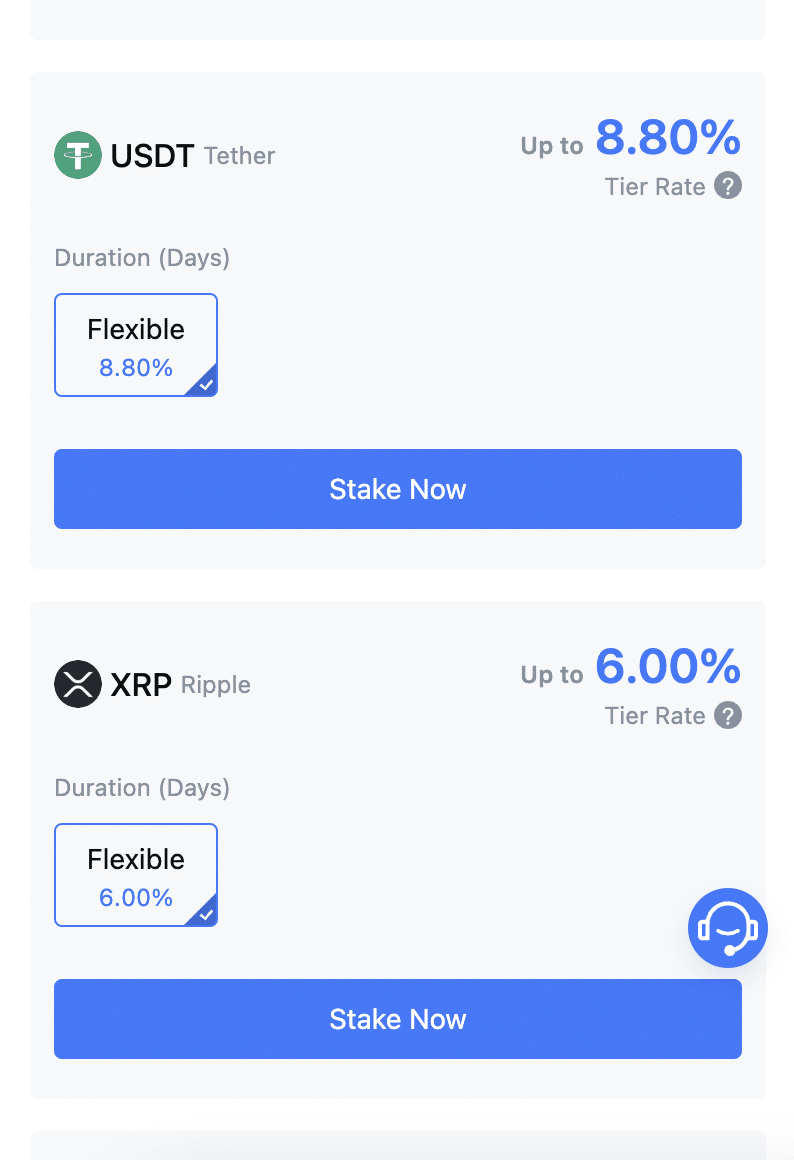

MEXC also offers competitive fees; buy and sell orders are charged just 0.1% per slide. MEXC is also a solid option for trading derivatives. It supports perpetual futures with leverage of up to 200x. If you’re a long-term holder, MEXC offers savings accounts with competitive APYs. For instance, USDT and XRP yield 8.8% and 6%, respectively.

Pros

- Trade thousands of crypto pairs on a mobile device

- Spot trading commissions of just 0.1%

- Also supports perpetual futures with 200x leverage

- A great option for performing chart analysis

- One of the best crypto staking platforms for high yields

Cons

- The Google Play app is rated just 3.8/5

- Limited due diligence is conducted on new listings

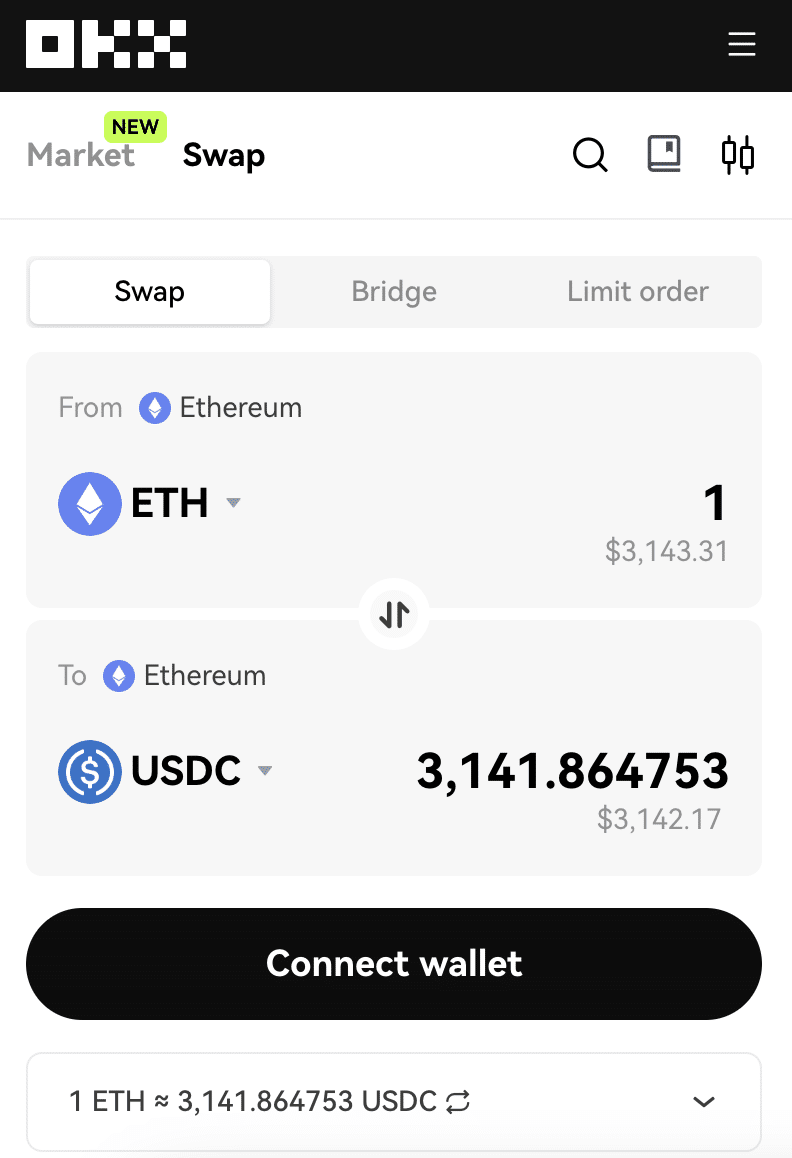

4. OKX – A Great Option for Decentralized Trading With a Self-Custody Wallet

OKX offers one of the best crypto apps for decentralized trading. No account registration is needed; just download the iOS/Android app and search for a preferred market. OKX connects with hundreds of external liquidity pools and supports over 70 networks. This includes Bitcoin, Solana, BNB Chain, Ethereum, and Base.

As a decentralized app, trades are facilitated by automated market makers. Fees are determined by the liquidity pool, but are often just a small fraction of a percent. The OKX app doubles up as a self-custody wallet. This gives you full control of your crypto coins. Security features include biometrics and multi-party computation (MPC).

The OKX app is also great for earning passive income. It connects with staking and liquidity farming pools. Search for a coin and choose a pool with the highest yields. Rewards will be deposited straight into the OKX wallet. OKX also offers a centralized exchange that supports fiat money purchases. However, this requires an account with completed KYC verification. For more details on this popular cryptocurrency wallet, our detailed OKX wallet review is a must-read in 2024.

Pros

- One of the best crypto wallet apps for self-custody storage

- Trade thousands of tokens on the decentralized markets

- Supports over 70 popular network standards

- No account opening requirements

- Earn competitive yields on idle tokens

Cons

- Fees are only displayed when creating an order

- Decentralized trading is more suitable for experienced investors

5. Kraken – Popular Crypto Investment App for First-Time Buyers

Kraken is a user-friendly trading platform with a native mobile app. It’s one of the best options for first-time investors. For a start, the minimum investment requirement is just $10. Beginners can easily deposit funds with a debit/credit card. Banking networks like ACH and SEPA are also supported.

Kraken lists some of the best cryptocurrencies to buy. This includes layer-1 coins like Bitcoin, Solana, Cardano, XRP, and Dogecoin. You’ll also find some of the top ERC-20 tokens, including Axie Infinity, Chainlink, Uniswap, and SushiSwap. The Kraken app also supports recurring buys.

This means you can dollar-cost average your crypto investments. Simply choose your preferred coins, investment size, and purchase frequency. In terms of fees, Kraken charges 0.25% per slide. This decreases if you trade at least $10,000 per month. Kraken has been operating since 2013, so is considered one of the best crypto apps for safety.

Pros

- One of the best apps to buy crypto

- Choose from over 200 coins

- Minimum investment of just $10

- Maximum commissions of 0.25% per slide

- Operating since 2013

Cons

- Debit/credit card fees are expensive

- The app doesn’t offer self-custody storage

My Methodology When Ranking Bitcoin Apps

I focused on crypto trading apps with a proven track record for safety and security. Apps that are licensed by tier-one bodies were awarded the highest rating. I also assessed what markets the app covers, such as spot trading and perpetual futures. I prioritized apps with a wide range of pairs, including large and small-cap coins.

I also tested each app for user-friendliness. For instance, how easy was it to register an account, deposit funds, and begin trading? I also ranked apps based on the availability of trading tools. This included charts, indicators, social metrics, and copy trading. Tools should be optimized for mobile usage. Other metrics included fees, payment types, and customer service.

How to Choose The Top Crypto Apps

Still not sure about the best Bitcoin trading apps for you? I’ll now take a much closer look at my key requirements, such as supported markets, user-friendliness, and account security.

Safety

My main priority was safety, which is why eToro is the overall top pick. Unlike most crypto trading apps, eToro is a regulated brokerage. It holds licenses from multiple tier-one regulators. This includes CySEC (Cyprus) and ASIC (Australia). As a US-approved trading app, eToro is also registered with FINRA and the SEC.

Not only is eToro regulated but it offers institutional-grade security. For instance, all account holders must complete KYC, ensuring the eToro ecosystem is free from crime. Two-factor authentication and biometrics are supported too, and crypto coins are secured in cold storage wallets.

Supported Markets

Depending on your trading goals, you might want access to many crypto markets. For example, most trading apps support the top 10 crypto coins, such as Bitcoin, BNB, Ethereum, Solana, and XRP. However, you might also want to access small-cap coins. These are more risky but present a higher upside potential.

In this instance, MEXC stands out. MEXC lists thousands of trading markets, including brand-new cryptocurrencies, undervalued meme coins, and everything in between. MEXC makes it simple to find a suitable coin. For example, markets can be sorted by the best and worst performers. There’s also a heat map that’s great for discovering real-time market trends.

Experienced investors might want a trading app that supports crypto derivatives. These complex instruments support long and short trading, not to mention leverage. Margex is the best option here. It supports perpetual futures with leverage of up to 100x. This means you can trade $1,000 worth of crypto with just $10.

Non-Trading Fees

Non-trading fees should also be considered when choosing a crypto app. First, explore what fees apply to deposits. Crypto deposits are usually free. However, using fiat money can be costly, depending on the payment method and currency. For example, Coinbase charges 3.99% on Visa and MasterCard payments.

eToro doesn’t charge fees on debit/credit card deposits. However, this is only the case when using US dollars. An FX fee of at least 1.5% will apply to other currencies. Also consider withdrawal fees, such as transferring crypto to a private wallet. Or cashing out fiat money to a bank account.

Trading Fees

Investors should prioritize crypto apps with the lowest trading fees. This is a very competitive market, so plenty of providers offer rock-bottom prices. For example, Margex charges standard commissions of just 0.06%. So, even if you entered a $10,000 order, your commission would amount to just $6.

MEXC is even more competitive. Spot trading fees cost just 0.01%. That’s just $1 for every $10,000 traded. MEXC also charges just 0.02% when trading futures. Not all crypto apps offer low commissions though. For example, while eToro is the best crypto app for safety, it charges a 1% commission. Similarly, Coinbase offers a secure app, but charges commissions of 1.49%.

Most crypto apps offer preferential pricing when trading large volumes. Once you reach the specified minimum, the commission rate will be reduced. Another way to trade with lower fees is to hold the exchange’s native token. That’s BNB at Binance and MX at MEXC.

In-Built Wallet

The best crypto apps not only support trading; but a safe place to store your coins. This removes the need to download a separate wallet app. Instead, whenever you invest in crypto, the coins will automatically be added to your wallet. However, wallets vary considerably when using crypto apps.

Most importantly, you need to assess whether the wallet is ‘self-custody’ or ‘custodial’.

Self-custody wallets give you full control. The app won’t have access to your private keys, so it can’t block, freeze, or prevent transfers. The main drawback is that you’re responsible for keeping the wallet safe. Put otherwise, the app won’t be able to recover your coins if the wallet is hacked. Nonetheless, OKX is a popular option for self-custody storage.

Custodial wallets are often preferred by beginners. Trading apps like eToro and Coinbase offer secure custodial storage, including two-factor authentication. These apps also keep the majority of client coins in cold wallets. This means the coins can’t be hacked remotely. However, the drawback of custodial storage is you don’t control your private keys.

Trading Tools

I also prioritized trading apps that offer adequate tools, such as chart analysis and technical indicators. These tools should be mobile-friendly, ensuring a smooth experience on smartphones. MEXC offers a comprehensive charting dashboard that meets these requirements. This enables traders to perform technical analysis while on the move.

I also rank eToro highly for its copy trading tool. This is ideal for novice traders who aren’t sure which crypto coins to buy. After choosing a trader to copy, future trades will be replicated in your eToro portfolio. eToro also offers smart portfolios. These are diversified portfolios that track a basket of coins. They’re professionally managed, ensuring a passive experience.

Deposit Options

The best crypto apps support a range of deposit options. This often includes debit/credit cards and e-wallets, meaning you can easily deposit funds without leaving the app interface.

These payment methods are instant, too. This ensures you can begin trading crypto coins without delay. That said, some trading apps only accept crypto deposits. This won’t be suitable if you’re new to the market. Don’t forget to check deposit minimums and fees.

In-App Support

The leading crypto apps offer 24/7 support. This should include in-app support via live chat.

Consider sending an in-app message to see how long it takes to receive a reply. If you’re waiting too long, this could indicate inadequate customer service.

Types of Crypto Apps

I’ll now discuss the different types of crypto apps in the market. Each app offers a particular service, such as trading, savings accounts, or crypto analytics. Some apps fall into multiple categories.

Read on to choose the right crypto app for your requirements.

Crypto Trading Apps

The most popular apps support crypto trading. This means you can invest in a range of different coins, whether that’s Bitcoin, Dogecoin, or Ethereum. Trading apps can be split into two sub-categories; brokers and exchanges.

If you simply want to buy coins with fiat money, brokerages are the best option. This is because you’re directly buying coins from the app, rather than needing to trade with other people. eToro, Coinbase, and Robinhood are the top apps in this category. They’re heavily regulated and offer a seamless user experience.

That said, brokerages typically charge higher trading fees. This is because of increased regulatory requirements. Alternatively, if you’re an active trader, consider using an app that’s backed by a crypto exchange. Margex and MEXC are good options. They support a huge range of markets and commissions are super-low.

You might also consider the OKX app when trading crypto. It provides access to the decentralized finance markets. This means you can trade thousands of cryptocurrencies without opening an account. Token swaps are executed in real-time via liquidity pools. The purchased tokens will be deposited in your OKX app instantly.

Crypto Wallet Apps

Crypto wallet apps are also popular. Their primary service is storage – meaning keeping your crypto coins safe. Crypto wallet apps also enable you to send and receive funds. As I mentioned earlier, decentralized crypto wallet apps come in two main forms; self-custody and custodial. The best option will depend on your experience and goals.

- In addition, crypto wallets often support in-app swaps.

- This means you can swap tokens without using an external exchange.

- Swaps are usually supported by decentralized liquidity pools.

- The wallet app will often take a small commission from the swap. Make sure this is clearly displayed before proceeding.

One of my top picks for wallet storage is Best Wallet. This Android/iOS app offers top security, including biometrics. It supports all tokens on BNB Chain, Ethereum, and Polygon. Moreover, Best Wallet offers a decentralized exchange. This enables you to swap tokens directly in the app.

Zengo is another option to explore. While Zengo offers self-custody storage, it doesn’t leverage traditional private keys. Instead, it uses MPC security, which removes a single point of failure. The wallet credentials are split, and stored on several different servers. Account recovery requires multi-factor authentications, such as email and facial ID.

Crypto Analytics Apps

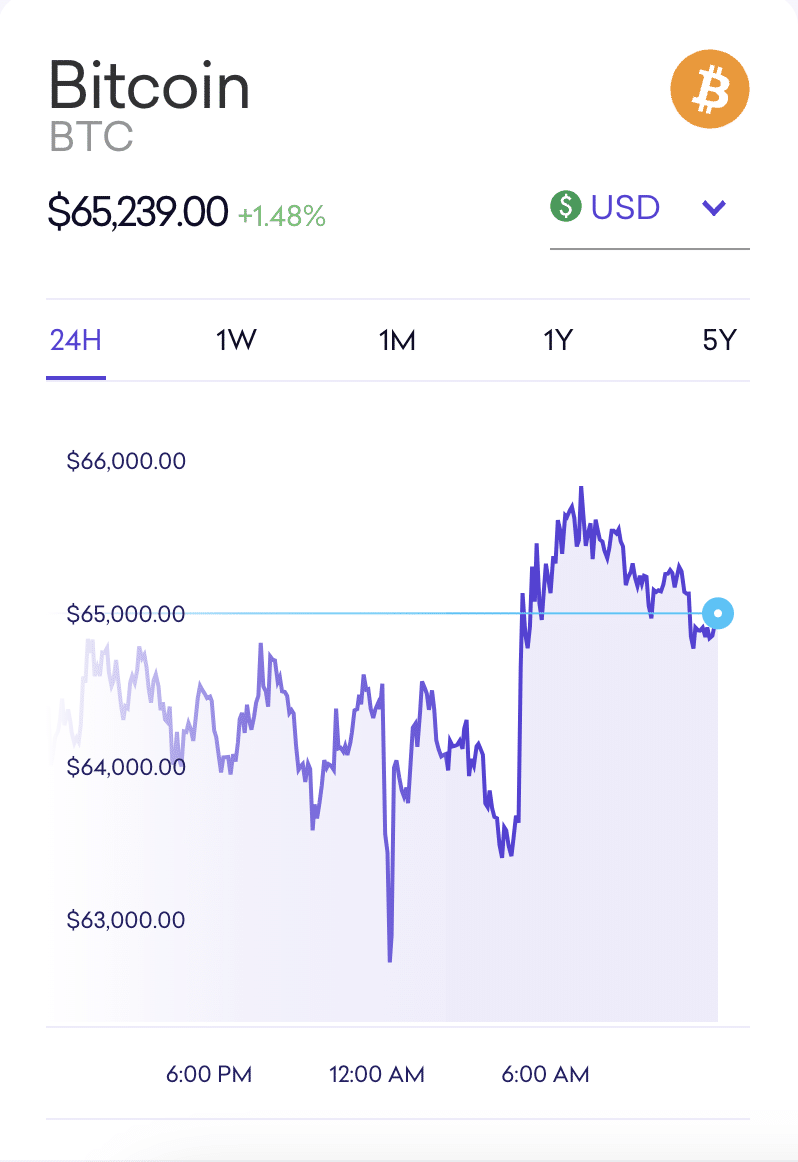

Some crypto apps specialize in analytics. This helps traders stay informed about key market developments – no matter where they’re located. For example, CoinMarketCap is a great option for price-related data. It tracks real-time data from hundreds of exchanges. It aggregates the data to provide uniform pricing on thousands of coins.

The CoinMarketCap app also enables you to track specific cryptocurrencies and set up alerts. For example, you might want to receive an alert whenever Bitcoin rises by more than 20%. CoinMarketCap also lists the most trending coins, plus the best and worst performers.

- Dash 2 Trade is also a top-rated app for crypto analytics.

- It has developed unique indicators that generate trading signals.

- This distributes an alert when a new trading opportunity is flagged.

- Each Dash 2 Trade signal includes the coin and recommended trading orders.

- Users can then place orders with their chosen trading app.

Dash 2 Trade also offers automated trading services. Its proprietary trading bots place buy and sell orders on your behalf. Multiple strategies are supported on the most popular coins. Dash 2 Trade also supports social metrics. This identifies broader market sentiment on specific coins.

Crypto Earning Apps

Free crypto earning apps are increasingly becoming popular. In simple terms, they enable you to earn free Ethereum, Bitcoin, USDT, or another form of passive income on existing crypto holdings. These apps are ideal for long-term investors, as you’ll make money even when the markets are bearish. Many of the crypto trading apps discussed today offer earning tools.

For example, MEXC offers flexible savings accounts with the following yields:

- Tether: 8.8%

- XRP: 6%

- Bitcoin: 1.8%

- Ethereum: 4.8%

- Core DAO: 50%

- Dogecoin: 1%

- TRON: 4%

Flexible accounts are highly sought-after, as they come without withdrawal restrictions.

How to Get Started With a Crypto App

Here’s a quick walkthrough on how to get started with a crypto app:

- Step 1: Choose a Crypto App – First, assess the type of crypto app that’s right for your goals. Most people opt for a trading app that comes with an in-built wallet.

- Step 2: Download App and Register an Account – Next, download the app to your smartphone. Load the app and open an account. This typically requires personal information and KYC documents when using a regulated app. However, some apps only request an email address.

- Step 3: Deposit Funds – Deposit some money into the crypto app. Accepted payment methods will vary depending on the app, but often include debit/credit cards and e-wallets.

- Step 4: Buy Crypto – Finally, you can use the account balance to buy crypto. Simply search for the crypto asset, choose an investment size, and confirm.

Conclusion

Mobile apps simplify the crypto investing process. Simply load the app, choose which coins to trade, and confirm the order. My top pick is eToro, a beginner-friendly app for iOS and Android.

It supports the most popular crypto coins, not to mention a copy trading feature. Plenty of deposit options are available, including Visa, MasterCard, and PayPal. eToro is a regulated crypto app with institutional-grade security.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

FAQs

What is the Best App for Buying Cryptocurrency

What is the Best Crypto Wallet App

What is the Best Crypto Earn App?

References

- Perpetual futures pricing (Wharton School of the University of Pennsylvania)

- You could be leaving your crypto wallet open to hackers—here’s how to protect it (CNBC)

- Decentralized finance market size & trends (Grand View Research)

- Non-custodial wallets vs custodial wallets: Know the difference (BitPay)