Ripple is partnering with OpenEden to tokenize United States Treasuries on the XRP Ledger (XRPL). The firm is following actions by BlackRock.

Only recently have XRP and Ripple been used interchangeably. Until regulators began asking questions, Ripple and XRP were forced to separate and become independent.

Ripple is a blockchain payments company offering banks and financial institutions efficient solutions riding on decentralized technology.

One of its solutions, the On-Demand Liquidity (ODL), uses XRP, the native currency of the XRP Ledger (XRPL).

The XRPL is one of the oldest platforms, even launching ahead of Ethereum. It allows users and banks adopting the ODL to transact cheaply in a scalable environment.

The XRPL was also improved to support smart contracts. With this, it became yet another competitor of Ethereum and Solana, at least looking at its newfound capabilities.

Ripple Partners With OpenEden To Tokenize US Treasuries

On August 1, Ripple partnered with OpenEden, a tokenization platform, to tokenize United States Treasury bills on the XRPL called TBILL.

Each TBILL in circulation will represent short-dated Treasury bills and complex products called reverse repurchase agreements.

Institutions seeking to mint these tokens will also be subject to mandatory KYC and AML screening.

Ripple also said it is allocating $10 million to TBILL tokens issued by OpenEden to fast-track the process.

The decision to launch tokenized Treasuries on the XRPL is timely.

The Age Of Tokenization: Over $1.8 Billion Worth Of Treasuries Taken On-Chain

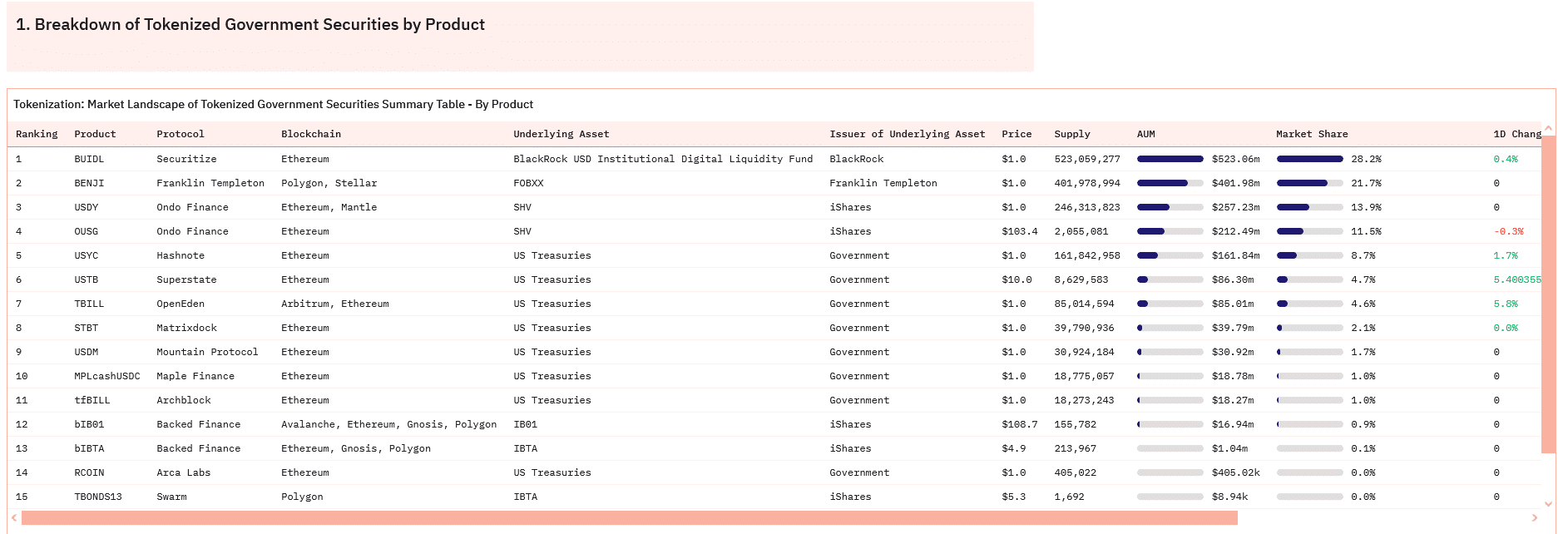

So far, over $1.85 billion worth of Treasuries are circulating on public chains, especially Ethereum.

Looking at Dune data, BUIDL, BlackRock’s product allowing institutions to invest in tokenized treasuries via Ethereum, has attracted over $523 million.

(Source)

BENJI by Franklin Templeton has over $401 million in assets under management, allowing investors to get exposure via Polygon and XRPL’s competitor, Stellar.

With the big boys like BlackRock eyeing tokenization, considering projections that the industry would be worth over $16 trillion in the next five years, positioning enabling platforms for mega gains.

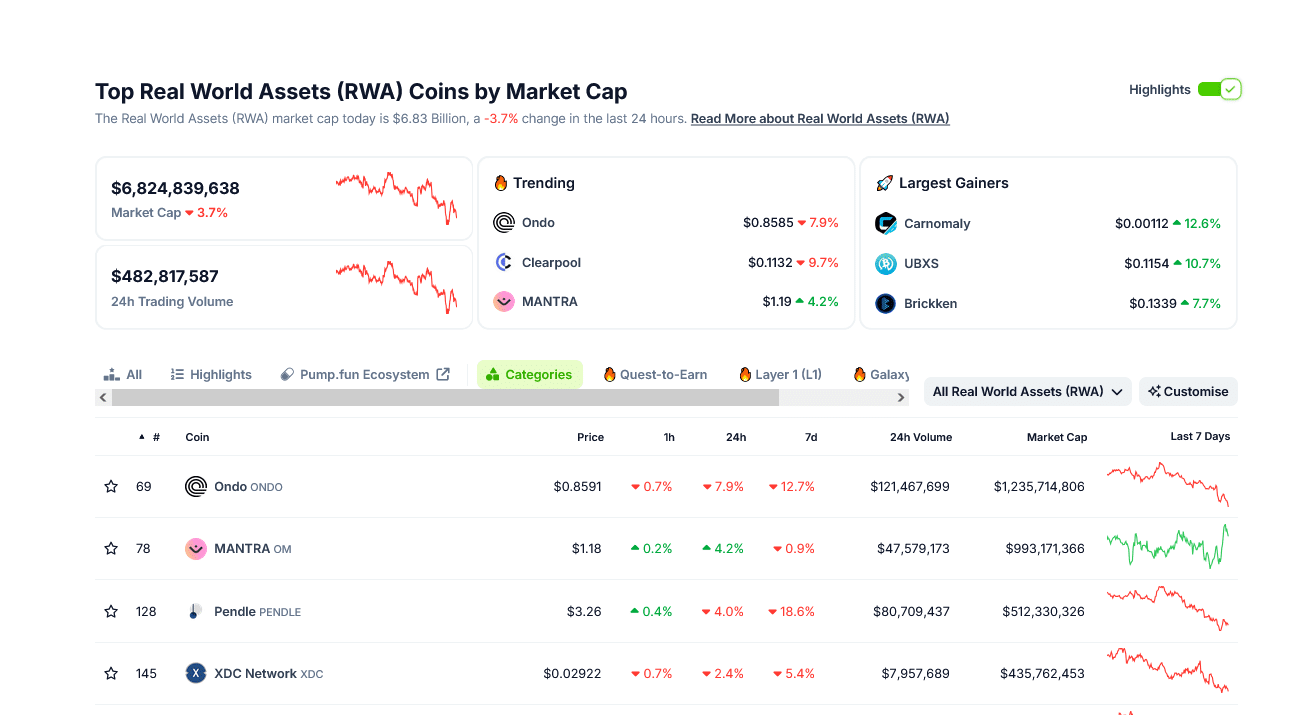

As of August 2, the total market cap for real-world asset coins like ONDO and PENDLE is over $6.8 billion.

These tokens are already some of the biggest performers in 2024, according to Coingecko.

(Source)

In seven months after dropping to fresh all-time lows, ONDO is up 970% at spot rates.

DISCOVER: Best RWA Coins to Buy in 2024

Time For Ripple (XRP) To Shine?

With the XRPL enabling the tokenization of United States Treasuries, XRP could benefit massively.

In July 2024, XRP soared by over 60%, rallying to as high as $0.62 before contracting to spot rates.

(XRPUSDT)

If the United States SEC settles with Ripple and pronounces that XRP is not a security, the coin could rally, even breaking $1.

The resulting regulatory clarity will allow more projects to partner with Ripple and launch more projects on the XRPL.

EXPLORE: Mark Cuban’s Bitcoin Theory: Decoding Silicon Valley’s Support For Trump

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.