During a market sell-off in meme coins, Gigachad (GIGA) has been pumping like crazy. It’s a so-called community takeover (CTO) coin and has been up 150% in just five days!

Boasting close to $10 million volume yesterday on Solana, Gigachad has been the light amongst darkness in meme coins lately. What is the reason behind this? We all know the meme from almost every social media, so it was inevitable that it would pop. But just how far can it go?

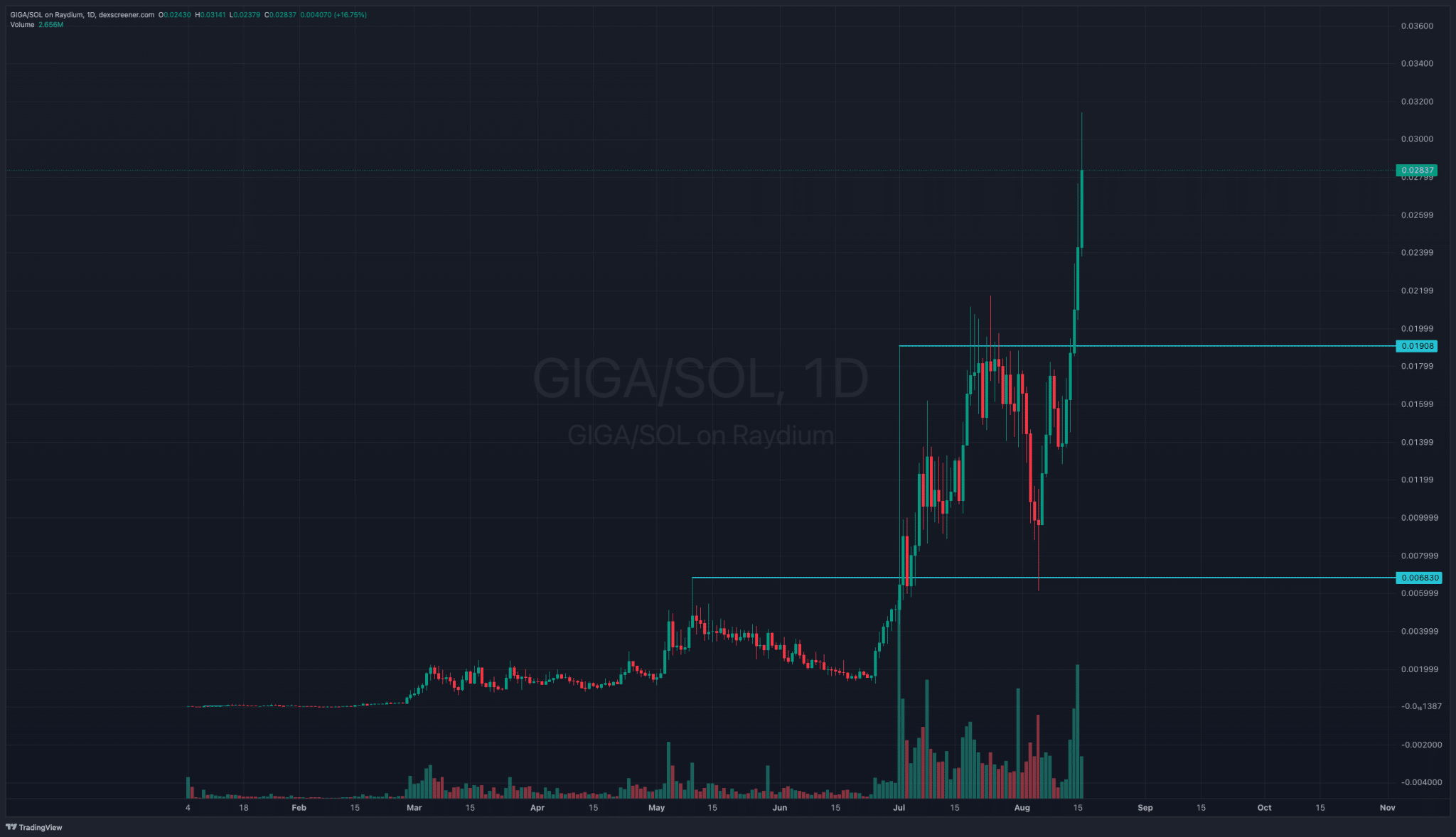

GIGA Price Analysis: GigaChad Smashes $250M Market Cap

$190 million market cap was the resistance for Gigachad since early July. It took nearly 2 months and a lot of attempts to break this area. But holy cow, rarely have I seen as strong a reaction to breaching a level as we’ve seen here.

In a perfect world where everything trades technically well, we would see Gigachad retest the $190-200 million market cap and then bounce.

But something could be brewing here we don’t know about, and it could actually be going straight to a $500 million market cap, which can be hard to predict during price discoveries like this.

Certainly, taking a position when something is up 150% in just 5 days is not a smart investment. Buy red, sell green.

DISCOVER: 15 New Coinbase Listings in 2024: Upcoming Listings to Watch!

Bubblemaps Reveals Big Clusters for Gigachad

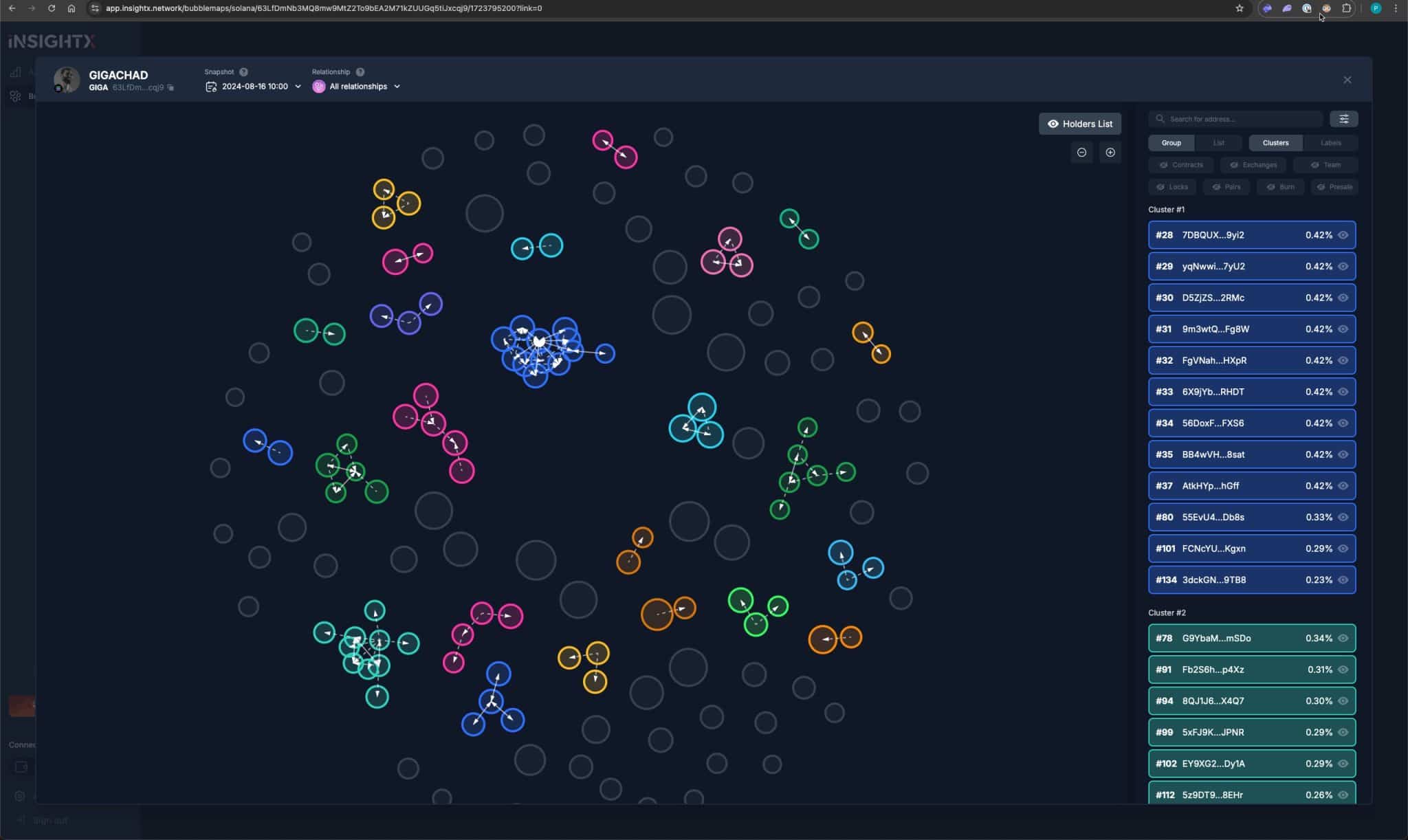

(InsightX – Gigachad bubblemaps)

Using the analytics platform InsightX, which specializes in on-chain analytics, we can try to gain some insight into Gigachad’s distribution. Bubblemaps is a simplified and graphic view of holder distribution and can help immensely if you learn to use it.

The first thing I notice when glancing over this Bubblemaps is that there are indeed some large clusters of holders. 4.6% in the largest one and 2.8% in the second largest one.

It’s not really a huge cause for concern, but having one entity hold close to 5% or nearly $12 million of an asset worth this little could be a problem later on if they decide to offload it.

Another thing to remember with Gigachad is that it has not been listed on any big exchange besides MEXC yet, so some of these clusters could also be exchanges or funds for a market maker for an exchange.

DISCOVER: The Best Bitcoin and Cryptocurrency Exchange Guide

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.